Calculate Federal Income Tax Withholding Amount

On emphasis, determining the correct federal tax withheld depends on what the W-4 form you filed with your employer says. The amount you see on your paycheck is based on W-4 information, such as your filing statusthat is, whether youre single or filing jointly with a spouse and also the number of allowances and dependents indicated.

A W-4 form that hasnt been filed correctly can lead to overpayment of withholding tax, leading to a tax refund. However, the overpayment can also occur when you calculate tax refund with the last pay stub, which means you may have overestimated the withholding amount.

Calculate The Gross Pay

A paycheck starts with the gross earnings of an employee. As stated earlier, this is the total amount before any withholding or deductions. To get the gross income in a paycheck for purposes of calculating income tax and other taxesSocial Security and Medicareyou need to include all wages, tips, and salaries earned in a pay period.

-

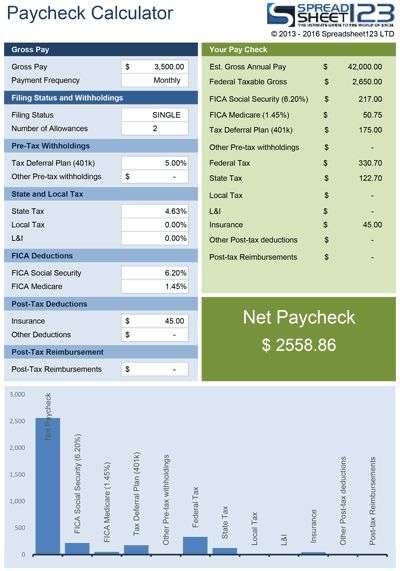

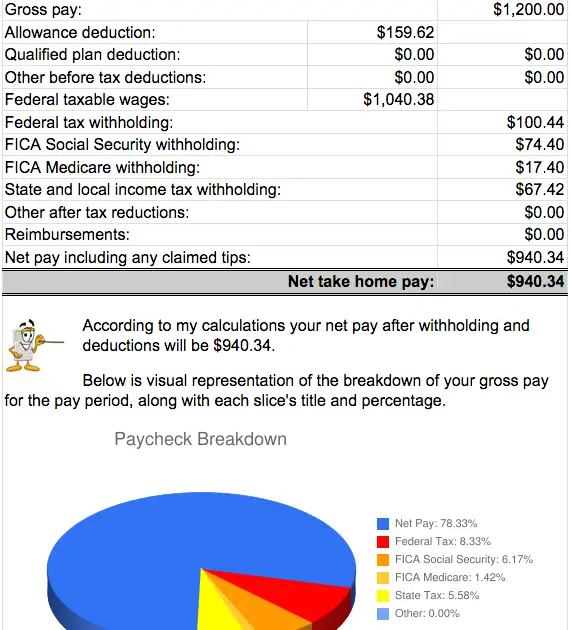

How to determine gross income: Gross pay is calculated for employees on hourly wage by multiplying the number of hours worked, including overtime, by the rate per hour. To get the gross pay for salaried employees, you divide the annual income amount with the number of pay periods. Heres an example of how to calculate gross income for salaried and hourly employees:If your annual salary is USD$42,000, youll divide that by the number of pay periods in the year to determine the gross income for one pay period. The total pay periods will be 24, if the employer pays you twice a month. That will be a gross income of USD$1,750, being USD$42,000 divided by 24. The gross pay of an hourly rate employee whos worked for 40 hours at a rate of USD$15 is USD$600. You also need to add overtime amounts to the regular pay to get the gross earnings in a pay period. Youll see how to calculate overtime in the next step.

What Is The Cpp

The CPP, short for the Canada Pension Plan, is a mandatory public retirement pension plan run by the Government of Canada. All Canadians over the age of 18 with employment income are required to contribute towards the CPP, with the exception of those employed in Quebec. Instead of the Canada Pension Plan, the Province of Quebec administers a similar pension plan, called the Quebec Pension Plan.

Recommended Reading: Do You Claim Plasma Donation On Taxes

How You Can Affect Your Vermont Paycheck

You cant escape your income taxes, but you can take steps to change how much of your income taxes you pay each paycheck. One of the simplest ways to do this is by adjusting your withholdings when you file your W-4. If you want even more control over your tax withholding, you can also specify a dollar amount for your employer to withhold. For example, if you want your employer to withhold an additional $20 from each paycheck, you can write $20 on the appropriate line of your W-4. While that might mean smaller paychecks now, this practice could save you money come tax time.

Besides manually switching up your withholdings, you can also impact your paycheck by lowering your overall taxable income. You can do this by contributing to pre-tax retirement accounts, like a 401, or to a Health Savings Account or Flexible Spending Account . This means smaller paychecks, but because the contributions go in pre-tax, you wind up keeping more of your money.

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Also Check: Are Raffles Tax Deductible

Employers Federal Unemployment Tax Return

Some states may require that you fileunemployment taxes at various timesthroughout the year.

But the federal unemployment tax return is filed annually.

The due date for the Form 940 is January 31.

If you have deposited all of your FUTA taxon time however,you are given until February 10th to file.

As with all due dates, if the date falls on a Saturday,Sunday, or a federal holiday,you can file on the next business day.

As you’ve learned with employment taxes,FUTA tax also has rules on when you must deposit taxes.

If at the end of any calendar quarter you owe,but have not yet deposited, more than $500 in FUTA tax,you must deposit the FUTA tax by the last day of the firstmonth after the quarter ends.

If the accumulated tax at the end of anyof the first three quarters is $500 or less,you do not have to deposit the amount. Instead,you may carry it forward and add it to the liabilitycalculated in the next quarter to seeif you must make a deposit.

Remember all of this information is in IRS Publication 15.

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Recommended Reading: Pastyeartax

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Read Also: Protest Property Taxes Harris County

What’s New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

For 2022, employers can use BPAYT of $14,398 for all employees.

The first three Yukon income thresholds, the Canada Employment Amount and some personal amounts have been indexed for 2022.

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, go to Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

You May Like: How Much Does Doordash Take In Taxes

Conquer Your Payroll Tax Fear

Trust me, we know it can be incredibly daunting when youâre facing filing forms and impending deadlines as you are first navigating how to pay payroll taxes.

But once you get the steps down, those seemingly endless moments of âhow do I pay my payroll taxes?â or âhow do I pay my employees payroll taxes?â will become less frequent.

It takes patience, going through a payroll tax calculation example or two, and just a few cycles to get the hang of things.

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Also Check: Is Plasma Donation Money Taxable

How You Can Affect Your Indiana Paycheck

If you received a large tax refund or were hit with a massive tax bill when you last filed your income taxes, consider changing your withholdings on your W-4. You can fill out a new W-4 , or you can have a dollar amount withheld from every paycheck by entering that amount on the correct line on your W-4. This allows you to get closer to what you need to pay on your income taxes.

While there is nothing wrong with getting a big refund, its nice to have access to that money throughout the year. That way you have the choice to invest that money or at least earn interest from a high-interest savings account. Consistently over-paying your taxes is like giving Uncle Sam a tax-free loan each year.

Pre-tax contributions are another factor that affect your take-home pay. You can actually lower your taxable income by taking advantage of certain benefits that your employer may offer. For example, if you put money into a 401 or 403 retirement account, or a health savings account or flexible spending account, that money will come out of your paycheck before income and FICA taxes are applied. This lowers how much of your income is actually subject to taxation.

Vermont Median Household Income

| 2010 | $49,406 |

Vermonts tax rates are among the highest in the country. There are four tax brackets that vary based on income level and filing status. The states top tax rate is 8.75%, but it only applies to single filers making more than $206,950 and joint filers making more than $251,950 in taxable income. If you’re a single filer with $40,950 or below in annual taxable income, you’ll pay the lowest state income tax rate in Vermont, at 3.35%.

Vermont has no cities that levy a local income tax. This means that whether you live in Burlington, Rutland or anywhere in between, you wont have an additional local withholding.

If you’re planning on relocating to Vermont or thinking about a move within the state and you’re looking to purchase a home, our Vermont mortgage guide is a great place to start learning.

You May Like: How To Report Plasma Donation On Taxes

How To Manually Calculate A Paycheck

Creating a budget is a responsible decision. By calculating your paycheck, you can determine the amount of money you will have and designate it to specific bills and savings. Calculating your paycheck requires the knowledge of your withholdings and withholding allowances. Tax laws change each year, so make sure you have an updated version of IRS Publication 15, Circular E. This publication contains all of the taxing percentages and rules for the current year.

What Is The Income Tax Rate For 2020

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household. You can find your 2019 and 2020 federal income tax rate based on your filing status by using the IRS income tax rates and brackets.

RELATED ARTICLES

Read Also: Louisiana Payroll Calculator

Calculating Your Gross Pay

To determine your gross bi-weekly pay , divide your annual salary by 26.088.

Example: If your annual salary is $50,000, your gross pay is $50,000 ÷ 26.088 = $1,916.59 per pay

To determine your hourly gross rate of pay, divide your annual salary by 52.176 to obtain the weekly rate, and then by the number of hours in your standard work week.

Example: If your annual salary is $50,000 and you work 37.5 hours a week, your pre-tax rate of pay is $50,000 ÷ 52.176 ÷ 37.5 = $25.55 per hour

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Also Check: Efstatus.taxact 2014

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.