Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Preparing And Filing Form W

At the end of the year, the employer must complete Form W-2, Wage and Tax Statement, to report wages, tips and other compensation paid to an employee. File Copy A of all paper and electronic Forms W-2 with Form W-3, Transmittal of Wage and Tax Statements, to the Social Security Administration . File Copy 1 to an employees state or local tax department.

Calculating Your Total Withholding For The Year

Take your new withholding amount per pay period, and multiply it by the number of pay periods remaining in the year. Next, add in how much federal income tax has already been withheld year-to-date. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Ask yourself whether you can easily write a check to the government plus a little interest if your calculations show that you’re going to owe the IRS $500 in April. Now is the time to adjust if you can’t.

You can now compare your total withholding to your tax liability projection. If your withholding amount is larger than your tax liability, that’s how much of a federal tax refund you can expect to receive. If your withholding is less than your tax liability, that’s how much federal tax you might have to pay when you file your tax return.

Remember, these amountsyour withholding and your tax liabilityare approximate. You’re close to where you need to be if they’re not too far apart. You’re free to change your withholding at any time during the tax year if a change in your circumstances would result in a tax increase or decrease.

Don’t Miss: Doordash Tax Deductions

How Do I Affect Withholding Now

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more open ended. Here youll be able to state other income and list your deductions, which can be used to reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

Don’t Miss: Roth Ira Reduce Taxable Income

Summary Of Payroll Taxes

There are two types of payroll taxes: ones that come out of your own pocket, and ones that you just collect from employee paychecks and remit to the government.

Payroll taxes that come out of your pocket:

-

FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees. Review a CPAâs summary in just a 4 minute read.

-

FUTA tax: covers unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%. Get everything you need to know in a 9 minute read.

Payroll taxes that you just collect and remit:

-

Federal income taxes

-

State and local taxes

Weâll cover each of these in detail, beginning with federal income tax withholding, since itâs the most commonly asked about.

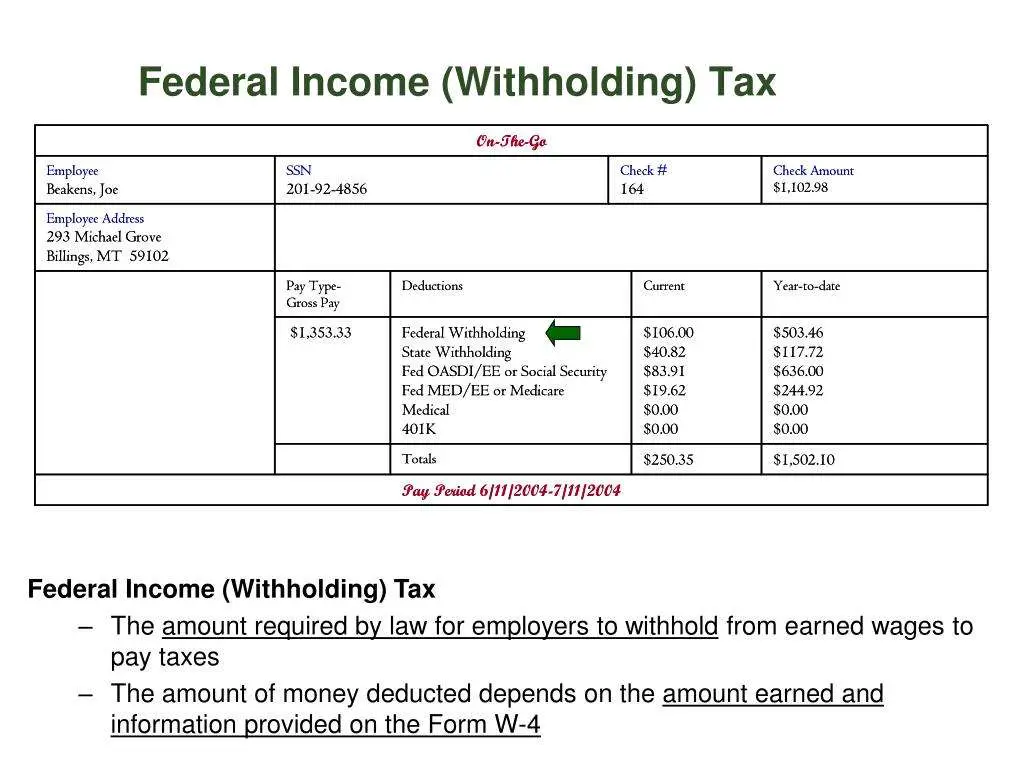

Withholding Income Tax From Your Paycheck

The amount of income tax your employer withholds from your regular pay depends on two things:

- The amount you earn

- The information you give your employer on Form W-4 .

Form W-4 includes three types of information that your employer will use to figure your withholding.

- Whether to withhold at the single rate or married rate.

- How many withholding allowances you claim .

- Whether you want an additional amount withheld.

If your income is low enough that you will not have to pay income tax for the year, you may be exempt from withholding. See Resources below for more information.

Don’t Miss: Home Improvement Cost Basis

Information Needed For The Estimated Tax Calculation

To calculate estimated business taxes from Schedule C you will need to combine this business income with information on other income, tax withholding, deductions, and credits on your personal tax return.

You will also need to calculate self-employment tax and include self-employment taxes in determining estimated taxes due.

When you estimate your taxes for the year, include all sources of income in addition to your business income and self-employment tax, including:

- Salary

- Interest and capital gains

Here is a list of the information you will need:

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.

Read Also: What Home Improvement Expenses Are Tax Deductible

Estimated Taxes For Partnerships Llcs & S Corporations

Owners of partnerships, LLCs, and S corporations are not employees of the business. They receive payments periodically from the business, and these payments are added to their personal tax returns.

These payments are not subject to withholding, so estimated taxes may need to be paid. To calculate estimated tax payments, use the process described above.

The information contained in this article is not tax or legal advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney.

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Recommended Reading: Efstatus.taxact 2013

Why Would A Refund Be A Bad Thing

Receiving a tax refund actually means you gave the IRS more from your paycheck than you had tomoney that you could otherwise have spent on bills, pleasure, retirement savings, or investments. The IRS held onto that extra money for you all year and is now returning it to you when you get a tax refundwithout interest. It would have served you better in a simple savings account.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

Also Check: How Much Does Doordash Take In Taxes

Overview Of Michigan Taxes

Michigan is a flat-tax state that levies a state income tax of 4.25%. A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. Local income tax rates top out at 2.40% in Detroit.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Is Withholding Tax How Does A Withholding Tax Work

A withholding tax is an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

Here’s a breakdown of the taxes that might come out of your paycheck.

-

Social Security tax: 6.2%. Frequently labeled as OASDI , this tax typically is withheld on the first $137,700 of your wages in 2020 . Paying this tax is how you earn credits for Social Security benefits later.

»MORE:See what the maximum monthly Social Security benefit is this year

-

Medicare tax: 1.45%. Sometimes referred to as the hospital insurance tax, this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

-

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4.

-

State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf. The amount depends on where you work, where you live and other factors, such as your W-4 .

-

Local income or wage tax: Your city or county may also have an income tax. This money might go toward such expenses as the bus system or emergency services.

See what else you can do for your business

-

Learn about coronavirus relief options for small businesses and the self-employed.

|

Employer pays |

Read Also: Do You Claim Plasma Donation On Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Don’t Miss: How To Look Up Ein Numbers For Tax Purposes

Total Up Your Tax Withholding

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

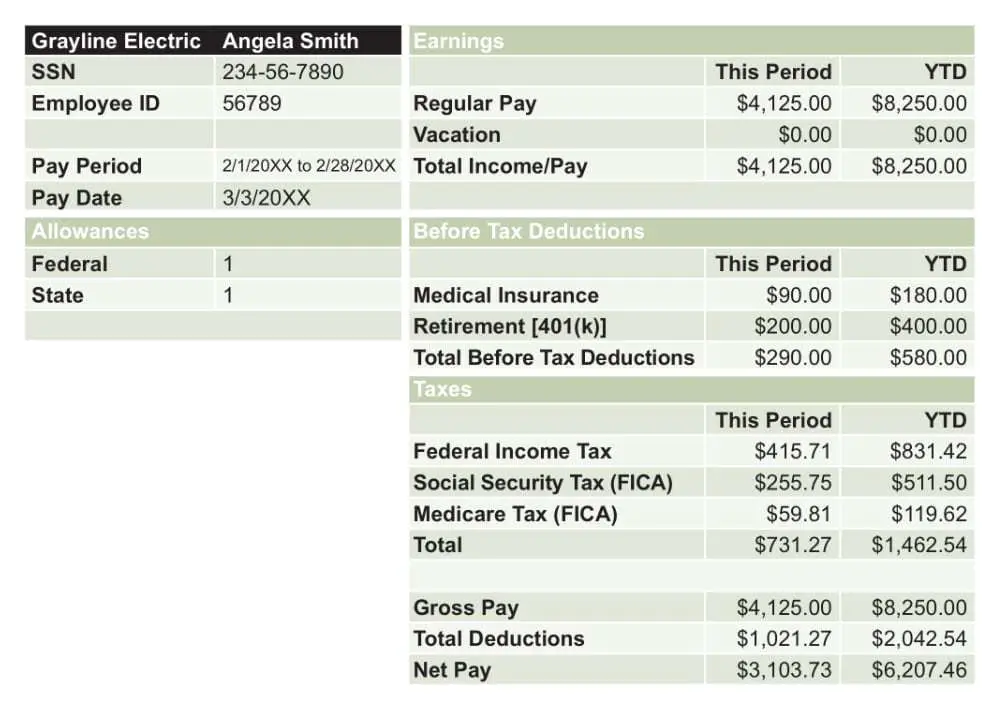

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.

Read Also: How Much Tax For Doordash