What If An Intrastate Fleet Is Suddenly Required To Operate Out Of State

For one-time trips between two or more jurisdictions, fleets can use temporary trip permits. These are only valid for one vehicle on a specific journey into another jurisdiction.

To acquire a single-trip permit, the carrier must define the time period and total distance to be covered. This information will be used to calculate the fuel tax to be paid along with other applicable fees.

Notes For Motor Vehicle Fuel Rates By Period

1. Sales tax does not apply to Aviation Gasoline used to propel aircraft, except for Aircraft Jet Fuel, when the purchaser presents the Exemption Certificate for Motor Vehicle Fuel for Propelling Aircraft, found in Regulation 1598, Motor Vehicle and Aircraft Fuels. The rates for Aircraft Jet Fuel are in the chart below.

2,3. The prepayment of sales tax does not apply to Aviation Gasoline.

Oregon Is The Exception

The State of Oregon never entered into the IFTA agreement. Taxes in Oregon are not charged at the pumps. While this may sound like a way to save money, it is not. Any fuel bought in Oregon that leaves the state is charged the tax rate of the state where the fuel is burned. Like the surcharge states, it is most economical to buy only the fuel you need to run in Oregon.

Read Also: Protesting Property Taxes In Harris County

What Does Base Jurisdiction Mean

- Base Jurisdiction refers to the state or province where your truck and information is registered.

- Operational control and records of the licensees qualified motor vehicle are maintained and available for auditing purposes.

- Some mileage is accrued by qualified motor vehicles within a fleet of vehicles that travel through that jurisdiction.

Information Provided To Other Jurisdictions And Ifta Inc Clearinghouse

Please be aware:

- the information provided to Ontario, as required under IFTA, will be provided to other member jurisdictions and to the International Fuel Tax Association, Inc. Clearinghouse for the purposes of the IFTA program

- the information Ontario provides to other member jurisdictions and IFTA, Inc. may be subject to further mandatory disclosure under the federal, state and provincial laws in that jurisdiction and that the licensee may not be informed of this further disclosure

- the information includes, but is not necessarily limited to, name, addresses, phone number, account number, financial data, and fuel/trip data.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Additional Agencies And Permits That May Apply To Your Business

A retailer of fuel must obtain a Seller’s Permit from CDTFA. A seller’s permit is required because in addition to the use fuel tax, a retailer is also required to collect and submit the sales tax on its fuel sales. You can register for both the seller’s permit and use fuel tax account using CDTFA’s online registration system.

The Governor’s Office of Business and Economic Development offers extensive information on state, local, and federal permit requirements. For a listing of its assistance centers, visit the Governor’s Office of Business and Economic Development website.

Visit the CalGold website for help with permit and licensing requirements for other state, federal, and local authorities .

How Do I Work Out My Fuel Tax Credit Rebate

Step 1: Determine your eligible fuel quantities.

Eligible fuels include liquid fuels like petrol, diesel, kerosene, and heating oil and blended fuels B5, B20, and E10. Work out how much of these fuels you used for each business activity over the reporting period:

- Off-road use including idling, powering auxiliary equipment, and travel off public roads

- On-road use by heavy vehicles only

NOT eligible for FTC claims:

- Liquefied petroleum gas , liquefied natural gas , compressed natural gas , and blended fuels E85 and B100 used on-road by heavy vehicles

- On-road use of any fuel used by a light vehicle

- Aviation fuels

on-road

In the past, businesses had to document all of this manually a laborious process prone to imprecision and error. Because it was so tedious and difficult to track, companies routinely claimed the standard on-road rate, leaving money on the table.

Now, smart tools like EROADs FTC Solution make it easy, automatically pulling telematics data that shows when, where, and how much of each fuel type was consumed, doing what type of activity. By reporting accurately, youll be able to receive the maximum refund youre entitled to, spend way less time on admin, reduce fuel inefficiencies, and grow your bottom line.

You May Like: Will A Roth Ira Reduce My Taxes

Is There An Easy Way To Calculate Taxable Gallons

Next comes the part most drivers dread calculating taxable mileage and fuel use. Drivers use different approaches to meet their IFTA reporting requirements. The 3 methods used most by truckers include:

Fuel Price Calculation In 2021

Crude Oil Prices went to its Historic Lows by even going Negative in April 2020, but went steadily going up to almost at its highs in 2021 with present rates crossed in over 84.15 $ per barrel leading to all time high Petrol and Diesel Fuel Prices in India

With Petrol prices now cost more than Rs 100 a Litre in almost every state and Diesel too now crossing Rs 100 a Litre in some states too. This led to an important announcement of slashing Excise Duty by Rs 5 a Litre on Petrol and Rs 10 a Litre on Diesel by Central Government on 3rd November 2021 as Festive Diwali Season Gift.

Recommended Reading: How To Buy Tax Lien Properties In California

How Do I File Fuel Tax Returns

To maintain fuel tax accountability, the ministry requires registrants to file monthly fuel tax returns. Fines and penalties may apply if returns and payments are not received by the due date, are incomplete or tax is not remitted in full.

Once you register with the Ministry of Finance, the ministry will forward a personalized return each month. You must complete this return, even if you did not have any activity during the reporting period.

Check If Youre Eligible For Fuel Tax Credits

Businesses can claim credits for the fuel tax included in the price of fuel used in their business activities.

You can claim for taxable fuel that you purchase, manufacture or import. Just make sure its used in your business.

Taxable fuels include:

You can claim for activities in:

- machinery

- plant

- equipment

- heavy vehicles over 4.5 tonnes

- light vehicles travelling on private roads .

Don’t Miss: How To Buy Tax Lien Properties In California

Find Out Your Fuel Rates

After youve compiled your eligible fuel purchases youll need to know what rates apply to each different use. Rates vary and change several times each year so its important to check the most up to date information on the Australian Taxation Office website.When calculating your FTC, including fuel used in heavy vehicles, you need to use the rate that applied at the time that you acquired the fuel .

How To Use This Guide

Each section of this guide contains information important to your business.

The Getting Started section provides key resources related to registration, filing returns, account maintenance, other required licenses/permits, and other important information you need.

The Industry Topics tab contains specific topics important to the Users and Vendors for use fuel tax purposes.

The Resources section provides links to useful information, including forms and publications, statutory and regulatory information, and access to live help from our customer service representatives.

Read Also: Turbo Tax 1099q

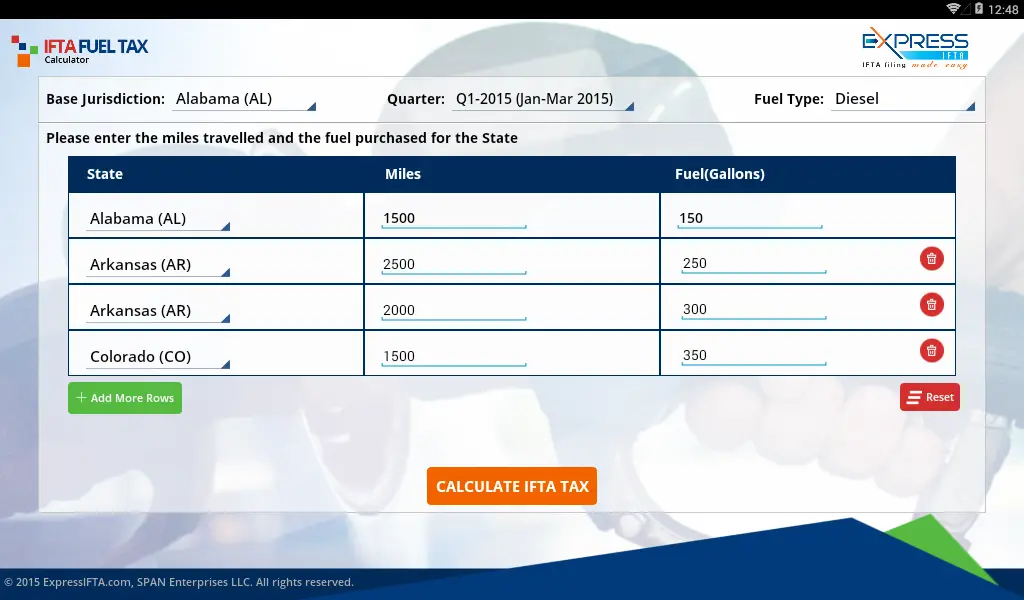

Calculating Fuel Consumed Per State

Once you have the total miles and fuel purchased tallied, its time to calculate the fuel mileage of your vehicles for each jurisdiction. You can use the simple formula below to calculate your fleets overall fuel mileage:

Total Miles Driven ÷ Total Gallons = Overall Fuel Mileage

For example, if you purchased a total of 4,000 gallons of fuel and covered 22,000 miles, then your overall fuel mileage would be:

22,000 ÷ 4,000 = 5.5 miles per gallon

Be sure to round off the MPG value to two decimal places.

To calculate how many gallons your fleet consumed in each jurisdiction, input your overall fuel mileage to the formula below:

Total Miles Driven in State X ÷ Overall Fuel Mileage = Fuel Consumed in State X

Keep in mind that you need to use the second equation for each state or province you operated in during the current reporting period.

How The Revenue Is Used

Use fuel taxes provide revenue for planning, constructing and maintaining California’s publicly funded roadways and public mass transit systems.

The CDTFA transmits all tax money received, to the State Treasurer to be credited to the Motor Vehicle Fuel Account in the Transportation Tax Fund . CDTFA’s fuel tax administration and enforcement functions are supported by the fund.

Recommended Reading: How Can I Make Payments For My Taxes

Why Truckingoffice Is The Right Choice For Your Business

Youll find hundreds of options in your search for trucking management solutions. How will you know which is the right one? Well make it easy for you to decide. Were sure our system will enhance your business, so heres a no-obligation, free trial of our TMS. Youll discover how TruckingOffice can make IFTA reports easier and help you organize your entire operation to save time and money with fewer headaches.

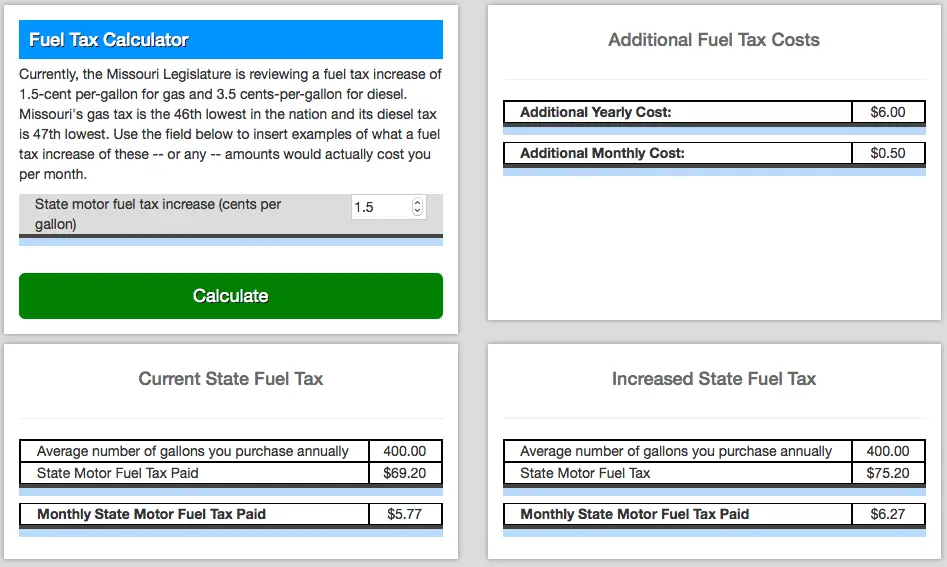

Calculating The Gas Tax

So we gathered together some of these weird people and decided: hey, let’s tax ourselves for every gallon . How much? Well, Europeans pay about $4.50 per gallon. But even we weren’t ready for anything that steep. So we settled on $.50 a gallon

Most of us just keep the receipt slips when we fill up or keep a little ledger in the car and add up the gallons every quarter and multiply by $.50. Then we get together for quarterly or bi-annual gatherings with tea and cookies and pool or revenues. Can you imagine the kind of people who you’re drinking tea with? Selfish, miserly, stingy folks are welcome but so far haven’t shown up!

Also Check: Www.1040paytax.com Official Site

Fuel Used By Railways In Ontario

All railways operating in Ontario as part of a public transportation system must register with the Ministry of Finance as a registered consumer. This includes railways that commercially transport goods or passengers.

Coloured or clear fuel can be used in railway locomotives. Regardless of the fuel used, the tax rate is 4.5 cents per litre and the tax must be remitted by the railway operator with their Fuel Tax Railway Return.

Calculate Ifta Mileage Per State Per Trip

You will need to keep track of how many miles were traveled in each state or province.

Make sure to record your odometer reading when:

- You cross a state/province border

- You refuel

Now, for each corresponding entry and exit for a particular state or province, make sure you subtract the ending odometer reading from the entry reading. This will give you the miles traveled for that state, for that instance.

Miles in = Exit Reading in Entry Reading in

As a result, you will have a mileage number for each time your truck entered a new state.

You May Like: Does Contributing To Roth Ira Reduce Taxes

Flat Rate Fuel Tax Decal Program

Users and bus operators who operate motor vehicles powered by liquefied petroleum gas , dimethyl ether , dimethyl ether-liquefied petroleum gas blends , liquid or compressed natural gas may choose to register for the flat rate fuel tax decal. The flat rate decal allows you to pay an annual flat rate as an alternative to paying the tax to your vendors. The annual flat rate tax is based on the type and weight of the vehicle.

If you qualify for the annual flat rate fuel tax, you must obtain a user use fuel tax permit or exempt bus operator use fuel tax permit from the CDTFA and make payments as an annual flat rate taxpayer. After you have registered online and paid the tax, we will issue a decal that you must affix to your vehicle for which you have prepaid fuel taxes.

As a flat rate fuel tax decal holder, you are required to provide to your fuel vendors a written representation that you have prepaid the annual flat rate fuel tax. Providing the vendor with a copy of the letter we sent to you with your decals will satisfy this requirement.

When you provide written notice to a vendor that you have prepaid the annual flat rate fuel tax, you will be solely responsible for any taxes due and the seller will not be liable for collecting and remitting the use fuel taxes.

Certain annual flat rate taxpayersâfor example those who make bulk purchases of fuelâmay be required to file annual returns with CDTFA.

Tracking Miles Youve Traveled In Each State

Fleet managers and drivers must work together to accurately record the amount of fuel consumed in different jurisdictions. This requires fleets to be extremely organized with how they handle their drivers Records of Duty Status.

Drivers must also do their part and diligently record their odometer readings whenever they cross state lines. To avoid human error, you can leverage route planning or fleet management software to digitally log the miles your drivers cover for each jurisdiction.

Recommended Reading: Www.1040paytax.com.

Seeking Assistance To Get Your Refund

So, now that you are aware of the refund you can get, you need to decide if you want to handle this yourself. For instance, its highly likely operating your business takes most of your time and resources. While you can tackle the subject, you will need to complete all of the paperwork involved in receiving your refund.

Likewise, businesses in your situation have decided to seek the help of a company that specializes in getting your refund. They are fully devoted to monitoring the rulings and tax laws associated with this type of refund.

And, they focus on helping medium and small businesses get back the money that they deserve. One of the great aspects of this type of service is taking their fee out of the refund. So, you dont have to come up with any extra money for their assistance.

Whether you choose to pursue this refund on your own or use a company that specializes in doing all the leg work required to get your money, its good to know you have some extra cash coming to you that will increase your cash flow.

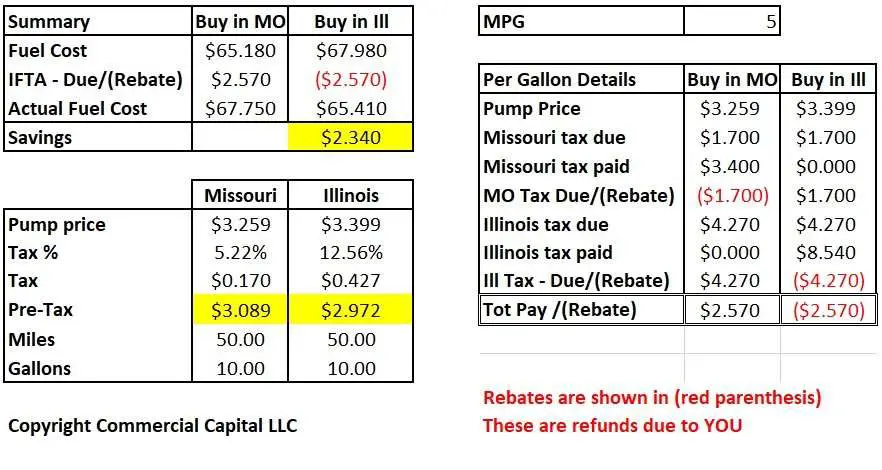

International Fuel Tax Reporting

IFTA reports are calculated by quarter and money owed or money credited will be due. If you purchase fuel in a low cost state, and run that fuel in a high tax state, you may owe taxes at the end of the quarter. Inversely, if you purchase in a high rate state like Connecticut and run that diesel in a low rate region like Vermont, Maine and Massachusetts, you may see a credit at the end of the quarter.

The IFTA program may seem confusing at first, but this system is more efficient and effective in tracking fuel taxes. Owner Operators and Lease Purchasers that are leased with a carrier operates under that carriers IFTA agreement. In this case the carrier is responsible for the filing of the IFTA returns each quarter and paying any liabilities.Owner operators will likely see these taxes debited from their O/O settlement.

You May Like: Oregon Tax Preparer License Renewal

What Ifta Expects From Truckers

Once you have the license and decals, youre ready to roll. But, you have to remember to file the quarterly IFTA fuel taxes by state, usually at the end of the months of January, April, July, and October. If you file late, underpay, or fail to pay, then the fines, penalties, and interest will take a chunk out of your profits. Also, your license may be revoked until the taxes are current.

Using Elds And Fleet Management Software For Ifta Calculation

Traditionally, drivers and fleet managers had to manually track their vehicle miles and fuel purchases when filing quarterly IFTA taxes. Everything, from fuel purchase receipts to a list of miles driven in each jurisdiction, must be accounted for.

Drivers can use the tax reporting worksheet from the Owner-Operator Independent Drivers Association to keep track of their fuel purchases, miles driven, jurisdictions, and routes traveled.

Alternatively, they can turn to cloud-based reporting tools and fleet management software with IFTA reporting features.

We offer an IFTA reporting feature that allows you to automatically monitor and sorts your vehicles fuel purchases, utilization, and costs for each jurisdiction.

There are two ways to import fuel purchase data.

The first method is to upload a CSV file from your fleets fuel card vendor via the KeepTruckin web dashboard. Secondly, drivers can manually submit their fuel purchases as well as upload photos of fuel receipts from the KeepTruckin App.

For more information, read: How to prepare IFTA reports in just a few clicks.

We recently updated our IFTA feature which now makes it easier for drivers to upload fuel purchases at the point of purchase directly to the KeepTruckin dashboard. This allows you to make bulk imports from major fuel cards. In other words, you can import all of your receipts at once.

Try the KeepTruckin ELD solution by clicking the following image and see how KeepTruckin simplifies IFTA reporting.

Also Check: Is Past Year Tax Legit