State And Localtax Grants

A grant is a sum of money given to a person or institution for a specific purpose. Grants do not require repayment to the issuing authority. Most tax grants are really a kind of exemption from tax given by taxing authorities. They are forgiveness of taxes already due to the authority. States, counties and municipalities can issue tax grants, usually on property or capital purchases. Many taxing authorities, for example, issue tax grants to nonprofits, allowing them to forgo paying property tax.

Rules For Self Employment

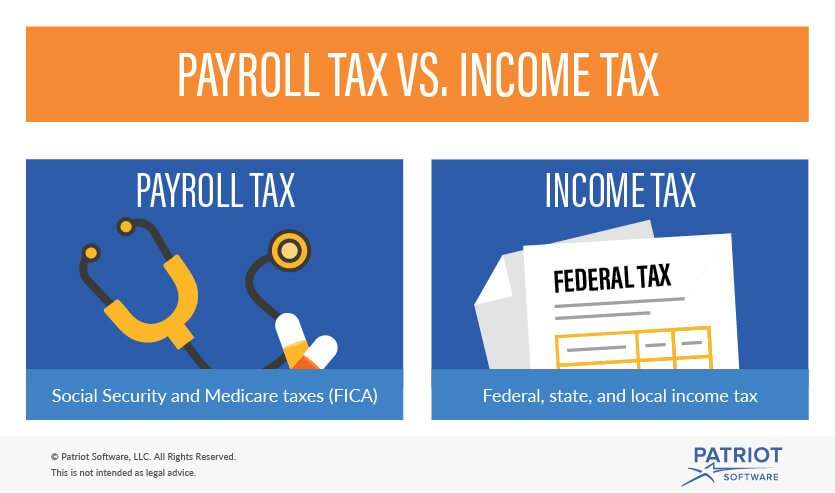

Another exception is self-employment income. Technically speaking, self-employment income is subject to self-employment tax, rather than FICA tax, but the rules are the same except that when youre self-employed, you must pay both the employer and the employee portions of the Social Security tax and the Medicare tax because you dont have an employer with whom to split the taxes.

In addition, because you dont have an employer to withhold the taxes, you must make estimated tax payments, typically quarterly, throughout the year for the amount that you owe rather than paying one lump sum at the end of the year.

What Is Property Tax

Property tax is any tax imposed on different forms of property owned by individuals, corporations or other legal entities. The federal government does not collect property taxes, but states do. However, most property tax rates are determined by local governments within each state, rather than the state itself.

- The tax rate is calculated by the local government where the property is located, which could differ from where the owner primarily resides.

- The current value of the property, usually determined by an appraiser, dictates the amount the owner must pay.

- Typically, property tax refers to land and other structures that do not move, such as homes or buildings.

- However, personal property taxes may be imposed on certain movable items, often vehicles, such as cars, boats and airplanes this could be part of a vehicles license and registration fees.

- Property taxes pay for community services based on the needs of each locality.

At this point, the difference between income tax vs. property tax should be pretty clear. Theyre both taxes you have to pay, but one is for your income, while the other is for the things you own.

Also Check: Where’s My Refund Ga State Taxes

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- Washington

- Wyoming

Let Tax Ease Help You Pay Your Property Taxes

Now that weve compared income tax vs. property tax, you might have a better idea of whats expected of you, especially in Texas. If you have delinquent property taxes to pay, Tax Ease can help. We provide Texas property tax loans that can get you back on track and give you some peace of mind. Contact us today to learn more about what we can do for you!

Also Check: Www.1040paytax.com Official Site

What Are Two Pieces Of Property Besides An Automobile

What are two pieces of property besides an automobilepropertyHouseland

What is one difference between sales tax and excise tax?

There are two basic differences between sales tax and excise tax. While excise tax is levied only on certain goods and services that are considered harmful or linked to specific health issues, sales tax is applied to a broad range of things. Also, sales tax is calculated a percentage of the sale price.

how many types of taxes are there?types of TaxestaxtaxdifferentTaxestypes of taxes

Income Tax Vs Property Tax Whats The Difference

When tax season rears its ugly head again, its easy to get overwhelmed. After all, there are lots of papers to keep track of, many factors to consider and tons of terms you should know. Things get even tougher if youre at risk for delinquency. But you know the old saying: knowledge is power. In reality, taxes are nothing to fear if you know what youre up against and can get the help you need. In this article, were going to answer one of the most common questions people have this time of year: Whats the difference between income tax and property tax? Hopefully, by comparing income tax vs. property tax, you can start to alleviate some of those common anxieties and find out what is relevant to you.

Recommended Reading: How Does H And R Block Charge

What Is Income Tax

Simply put, income tax is any tax on income, whether for an individual or a business. The Internal Revenue Service collects federal income taxes at the behest of the U.S. government, while states and local governments can set their own income tax laws independently.

- Specific tax rates differ, often increasing with income.

- Taxable income refers to the amount of revenue that can be taxed, lowered by certain deductions set by the taxing entity.

- Individual or personal income taxes paid to the federal government usually come out of a persons paycheck, but those who are self-employed may pay estimated taxes instead.

- Business income tax rates are based on a companys total earnings, reduced by the operating costs and other capital expenses.

- Corporations, small businesses and independent contractors all pay business income taxes.

- Tax returns must be filed yearly.

As you may have guessed, not all states impose income taxes on their citizens, including Texas.

Legal Info & Disclaimer:

Easy Doc Filing, LLC, and its employees, agents, and representatives, are not affiliated with the Internal Revenue Service or any other governmental or regulatory body or agency. Easy Doc Filing, LLC provides paid services to obtain Federal Tax Identification Numbers from the IRS. As a Third Party Designee, pursuant to IRS Form SS-4, Easy Doc Filing, LLC prepares and submits applications for an Employer Identification Number to the IRS on behalf of its clients. Easy Doc Filing, LLC does not verify EIN application submissions and is not responsible for the accuracy of the information provided. Any individual may obtain and submit his or her own EIN application at no cost through the official IRS website at www.irs.gov Easy Doc Filing, LLC may derive revenue from the partnerships we have entered with, and/or our promotional activities may result in compensation paid to Easy Doc Filing, LLC. Fundbox makes capital available to businesses through business loans and lines of credit made by First Electronic Bank, a Utah chartered Industrial Bank, member FDIC, in addition to invoice-clearing advances, business loans and lines of credit made directly by Fundbox.

Easy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLC Easy Doc Filing, LLC

Recommended Reading: Www Aztaxes Net

Withdrawal A Tax Lien

There are several ways you can go about withdrawing a tax lien depending upon your situation. Below are some of the standard methods.

- Direct Debit Installment Agreement: If you qualify for this type of payment plan with the IRS, many times the IRS will withdraw the Notice of Federal Tax Lien from public records.

- IRS didnt follow correct procedures: There are various rules the IRS must follow to file a tax lien, if they didnt follow the guidelines then it is likely the lien can be appealed. The IRS will withdraw the lien if the taxpayer proves they didnt follow procedures.

- Convert a standard installment agreement to a direct debit installment agreement: If you now owe under $25,000 in taxes owed, you can convert to a DDIA. Having a DDIA will allow you to remove the tax lien.

- Prove removing the lien will facilitate IRS collections: You can use form 12277 to state your claim. Like if you need to obtain credit to get a car to secure a job.

- Pay liability in full

How An Inheritance Tax Works

The federal government doesn’t have an inheritance tax, and only six states collect one. Maryland has the dubious distinction of being the only state to collect both an estate and an inheritance tax as of 2021.

The other five states with an inheritance tax are Iowa, Kentucky, Nebraska, New Jersey, and Pennsylvania. Indiana had one, but it’s been repealed.

Transfers to surviving spouses are completely exempt from the inheritance tax in all six states that collect it. Four statesIowa, Kentucky, Maryland, and New Jerseyalso exempt transfers to surviving children and grandchildren, but property passing to children and grandchildren is subject to the state inheritance tax in Nebraska and Pennsylvania.

More distant heirs, such as siblings, nieces, nephews, and friends, must typically pay this tax, and the tax rate tends to escalate as the degree of kinship decreases.

Most states offer exemptions for inheritance taxes as well. Only gifts above a certain value are taxed.

Read Also: Michigan.gov/collectionseservice

What Is An Excise Tax

Excise taxes are type of indirect tax levied on specific goods, services and activities. Products like motor fuel, tobacco, and other heavily regulated goods are subject to excise taxes. Certain activities like highway usage can be subject to excise tax too. Often the cost of the tax is included in the cost of the product, meaning the end consumer doesnt see the excise tax on their receipt.

Excise taxes are applied either as a per unit tax or as a percentage of price. Motor fuel is taxed by the gallon, but air travel is taxed as a percentage of the ticket cost. Federal and state jurisdictions determine the rate for excise taxes.

Tax Lien Filing Process

If you owe back taxes and dont pay them, the IRS may issue a tax lien. Typically, the agency only issues tax liens when your liability is $10,000 or more, but there are some exceptions. Before issuing a tax lien, the IRS must:

- Assess your tax liability. Either by the taxpayer filing a return or the IRS filing a substitute return.

- Send you a demand letter, and give you 10 days to make arrangements.

- The taxpayer does not pay the bill or make an alternative resolution.

Once the IRS meets these criteria, they can file a tax lien with a local county recorder of deeds or the Secretary of State.

You May Like: Notice Of Tax Return Change Revised Balance

Whats The Difference Between Federal And State Tax Ids

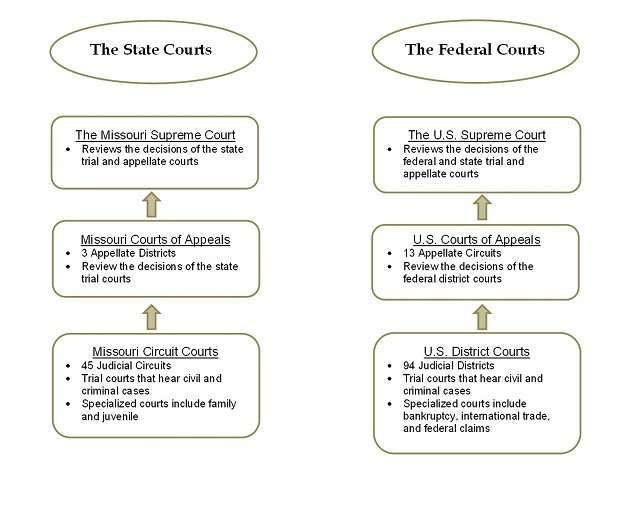

Federal and state governments have separate tax systems and varying laws that determine income tax amounts. For this reason, you will need to obtain a different tax ID from each.

Federal income tax applies to every registered business. Some states have more advantageous tax laws for businesses than others, but nearly every company will have to pay state taxes.

Currently, there are seven states that dont levy any personal income tax:

- Alaska

- Washington

- Wyoming

However, depending on your businesss structure, you might have to pay corporate income tax instead. The only states that dont charge corporate or personal income tax are Wyoming and South Dakota.

The main difference between federal and state tax systems comes down to who you are paying.

Keep this in mind:

Your state has a tax system that is separate from the federal governments. So, you will need to go through the process of registering your business twice once for the state and once for the federal government.

After youve done that, youll receive a separate tax ID from each. Lets take a look at these in greater detail.

State Income Tax Vs Federal Income Tax Example

State income taxes are lower than federal income taxes. Mainly because the states also assess various types of property taxes, sales taxes, and even locality taxes in some states. While the federal income tax is the main source of federal income.

However, when you add the tax bites together you can see a large chunk of change going out to the taxing authorities.

For example, if you take a single 40-year-old taxpayer in Pennsylvania with a taxable federal income of $65,000 and a $5,000 401 contribution making his or her Social Security, Medicare, and PA income $70,000, you can really see the effect.

- Fed income tax $7,368

- Medicare tax $1,015

- Pennsylvania tax $2,149

While this example makes the state taxes look substantially lower than the federal taxes, remember the state can and does collect taxes in many different ways.

Recommended Reading: Turbo Tax 1099q

Whats The Purpose Of Tax Ids

Essentially, tax IDs are social security numbers for businesses. They serve the same function SSNs do for individuals.

Each business receives a unique number from both federal and state governments, which act as their tax IDs. Primarily, you need a tax ID to file your businesss taxes, including income and payroll taxes.

However, other essential business operations require a tax ID, as well. Therefore, once youve determined your businesss legal structure, its a good idea to obtain relevant tax IDs as soon as possible.

Start with making sure you understand the difference between federal and state tax systems.

What Is The Difference Between State & Federal Taxes

In the United States you generally pay taxes twice first to the government, then to the state in which you work. Taxes paid to the government are called “federal” taxes, and the taxes paid to the state are called “state” taxes. Federal taxes are the same for all states, but state taxes vary by state.

You May Like: Can You File Missouri State Taxes Online

Federal Vs State Id Number

When it comes to a federal vs. state ID number, things can sometimes get confusing. A federal ID number is basically the same as an employer ID number, and is a unique set of nine digits that defines your business as a working, tax-paying entity by the Internal Revenue Service within the United States of America. You use your federal ID number to conduct tax-related tasks, such as opening a business bank account, or filing your business taxes in April.

A state tax ID is used solely for state tax reporting. They arent portable, so they are generally not requested by other agencies or third parties. You need to file state payroll returns for each employee that works for your company.

What Tax Rates Apply

Finally, you’ll find a wide range of different ways that states like to set their income tax rates. Some closely resemble the same sort of strategy that the federal government uses, but others make things a lot simpler.

The majority of states that impose income taxes have multiple tax brackets with tax rates that rise as income goes up. For example, California has even more tax brackets than the IRS has, with the lowest imposing a 1% tax rate but the highest coming in at 12.3%. The idea here is the same as it is for the federal government, advocating for a progressive system that collects more taxes from those in a financial position to pay them.

However, there are several states that have a flat income tax. For these states, it’s trivial to come up with how much tax you owe once you know your taxable income. Although some see flat taxes as being relatively regressive, you’ll find that states with flat income taxes sometimes have other ways of collecting revenue that take income and wealth levels into account.

You May Like: What Does Locality Mean On Taxes

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

How To Calculate Excise Tax

Its time to calculate excise tax. Heres an example based on tobacco.

Lets say the tax rate on cigars in Alabama is 4 cents per 10 cigars. So if youre a tobacco distributor and you purchase a case of 1,000 little cigars from the manufacturer. Youll need to collect $4.00 in state tax on that case. Now lets calculate the federal tax. Currently the federal tax rate is $1.01 per 20-pack of cigars. So youll need to collect $50.50 in federal tax on that case. Total tax on your case of 1000 little cigars is $54.50.

Heres the math:

Don’t Miss: Www Michigan Gov Collectionseservice