Minimum Income Requirements Based On Age And Status

There is no set minimum income for filing a return. The amount varies according to both filing status andage. The minimum taxable income level for each group is listed in the following chart. If your income fallsbelow what is listed for your age group and marital status, you are not required to file a return.

| Filing Status | |

|---|---|

| 65 or older 65 or older | $24,800 |

| Qualifying Widow with Dependent Children | Under 65 |

| $400 |

Why Is My Tax Refund Coming In The Mail Instead Of Deposited Into My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Just in case, sign in to your IRS account to check that the agency has your correct banking information. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

Table: 2020 Filing Requirements For Most Taxpayers

| IF your filing status is… | AND at the end of 2020 you were…* | THEN file a return if your gross income was at least…** |

| Single | ||

| * | If you were born before Jan. 2, 1956, you are considered to be older than 65 at the end of 2020. |

| ** | Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States . Do not include social security benefits unless either you are married filing a separate return and you lived with your spouse at any time during 2020 or one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 . |

| *** | If you did not live with your spouse at the end of 2020 and your gross income was at least $5, you must file a return regardless of your age. |

You May Like: Efstatus Taxactcom

Do You Have To File A Return

File a return for 2020 if:

- You have to pay tax for the year

- You want to claim a refund

- You want to claim the Canada workers benefit or you received CWB advance payments in the year

- You or your spouse or common-law partner want to begin or continue receiving the following payments :

Note:

Turbotax Canada Review: How To File Your Taxes

Barry Choi12 **This post may contain affiliate links. I may be compensated if you use them.

**This is a sponsored post written by me on behalf of TurboTax Canada. All opinions are my own.

Tax time has come again after what has been another difficult year for many Canadians. Continued lockdowns and restrictions mean that plenty of Canadians have continued to pivot when it comes to their work. For some, it meant starting a new job, for others working from home, and even more have started a side hustle to bring in some extra income. But, now that tax season is in full swing many Canadians are hesitant and wondering how to file their taxes, and if they will be more complicated with these life changes.

The good news is that despite any changes in your life, your taxes do not have to become overwhelmingly complicated. Not if you use TurboTax. This tax software allows Canadians with all types of tax returns to file their taxes easily online from the comfort of their home. Whether you are a student, a freelancer, or even an investor with an interest in cryptocurrency, TurboTax can work for you. In this TurboTax Canada review, Im sharing everything you need to know. Plus, check out the bottom of this post for the TurboTax Canada giveaway.

Recommended Reading: Tax Preparer Licensing

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Minimum Gross Income Thresholds For Taxes

The IRS defines “gross income” as anything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods. The thresholds cited here apply to income earned in 2020, which you must report when you file your 2020 tax return in 2021.

In a practical sense, the limits are equal to the years standard deduction, because you can deduct this amount from your gross income and only pay income tax on the difference. You would owe no tax and would not be required to file a return if youre single and earned $12,400 in 2020, because the $12,400 deduction would reduce your taxable income to $0. But you would have to file a tax return if you earned $12,401, because youd have to pay income tax on that additional dollar of income unless you had applicable tax credits you could use.

As of the 2020 tax year, these figures are:

| Single under age 65 | |

| Qualifying widow age 65 or older | $26,100 |

Recommended Reading: Is Plasma Donation Taxable Income

Coronavirus Unemployment Benefits And Economic Impact Payments

You may have received unemployment benefits or an EIP in 2020 due to the COVID-19 pandemic.

Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.

If you received the EIP, you do not need to report it as income whether youre required to file a tax return or not. If you did not receive some or all of your stimulus payments, you may claim missing stimulus money that you are owed by filing for a Recovery Rebate Credit on your 2020 return.

Phaseouts And Credit Limits

For 2021, the amount of the credit has been increased and the phaseout income limits have been expanded.

Any third-round Economic Impact Payments or child tax credit payments received are not taxable or counted as income for purposes of claiming the EITC. People who are missing a stimulus payment or got less than the full amount may be eligible to claim the recovery rebate credit on their 2021 tax return.

You May Like: Are You Self Employed With Doordash

What If You Do Not Reside In The Netherlands

If you are registered with the Netherlands Chamber of Commerce KVK, either as a resident business or a business with a branch in the Netherlands, you will receive a declaration letter to file for income tax. Generally speaking, the rule is that if you receive income from the Netherlands, you are liable to pay income tax, even if you do not reside in the Netherlands. However, if your business is not in the Netherlands, but you have employees working temporarily in the Netherlands, you are normally not liable for paying income tax in the Netherlands. If you are a self-employed professional working on an assignment in the Netherlands, you may have to file an income tax return, depending on several circumstances. Contact the Tax Administration to find out if you have to file or not. If you are a non-resident taxpayer, you are required to file a tax return in the Netherlands if:

- you have received an invitation to file a return

- you have not received an invitation to file a tax return, but you earned income in or from the Netherlands over which you owe more than 48, or are entitled to 16 or more back from the Tax Administration.

When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer who earns $2,500 during the year, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return, so if you want to claim any tax refund due to you, then you should file one.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: Is Doordash A 1099 Job

How Long Will It Take The Irs To Send My Tax Refund

The IRS usually issues tax refunds within three weeks, but some taxpayers could have to wait a while longer to receive their payments. If there are any errors in your tax return, the wait could be lengthy.

When an issue delays your return, its resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you receive your tax refund also depends on the method you used to file your return. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

If your tax refund goes into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it takes the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your tax refund. Online services like Venmo and Cash App can deliver your tax refund a few days sooner, since there’s no waiting period for the direct deposit.

It’s important to note that tax filers taking advantage of the child tax credit and/or the earned income tax credit will need to wait a bit longer. By law, the IRS can’t issue refunds to taxpayers with those credits until Feb. 15. The IRS has told early filers with those credits to expect a tax refund on March 1.

What If You Didn’t File Taxes In 2019

Normally, taxpayers who fail to file on time face a penalty of 5% of the unpaid tax for each month or part of a month that the return is late, up to 25% of the unpaid tax. … That’s because a minimum penalty of $435 or 100% of the unpaid tax whichever is less applies after a tax return is more than 60 days late.

Also Check: Harris County Property Tax Protest Services

Do Minors Have To File Taxes

Minors will have to file taxes if their earned income is greater than $12,550 . If your child only has unearned income, then the threshold is $1,100 . If they have both earned and unearned income, then it is the greater of $1,100 or their earned income plus $350. If the minor is self-employed, they will have to pay Self-Employment Tax at and above $400.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Recommended Reading: Plasma Donation Taxes

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income.

Here’s an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

How To Correct An Electronic Return

If we have accepted and processed your client’s T1 return, you may be able to amend and retransmit the T1 return using the ReFILE service. Also, your client can use My Account’s Change my return option. Alternatively, if you are an authorized representative for your client and you have a level 2 authorization on their account, you can also use Represent a Clients Change my return option.

We conduct a review on each return transmitted to us. If there are problems which will prevent processing, the system will indicate the fields you will have to correct. This means the electronic tax return was not accepted for processing and your client’s return is not considered to be filed.

Before signing off the system, print the EFILE web service response screen which contains the error messages. Review these messages or codes to determine what problems exist with the return.

For example, you may receive the following:

2037There is an entry on line 30300 on page 5 of the return for the spouse or common-law partner amount and, if applicable, on line 58120 on the provincial or territorial Form 428. Where your client was married or living common law during the year but on December 31st the marital status was other than married or living common law, enter 1 on line 55220.

You can usually get the full text description of each error clue from your tax calculation software package or by accessing chapter 2 of the RC4018 Electronic Filers Manual.

Don’t Miss: How To Pay Quarterly Taxes Doordash

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

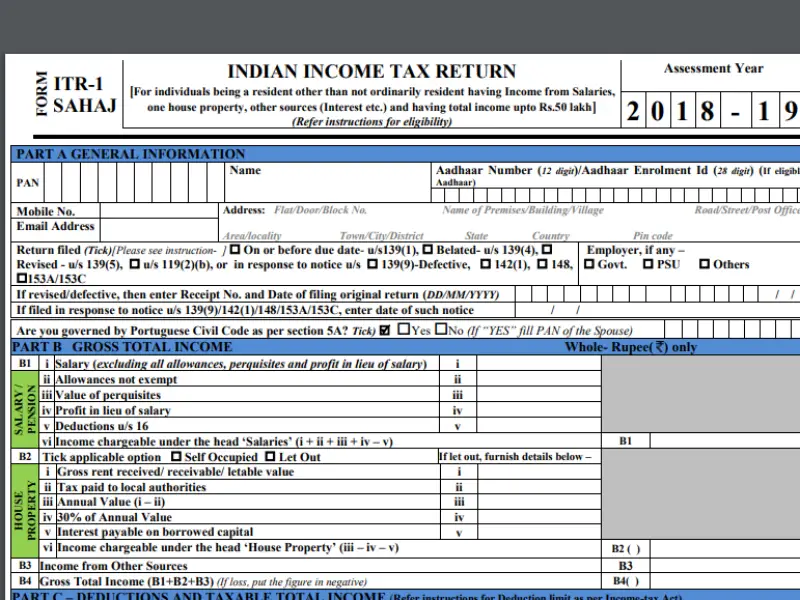

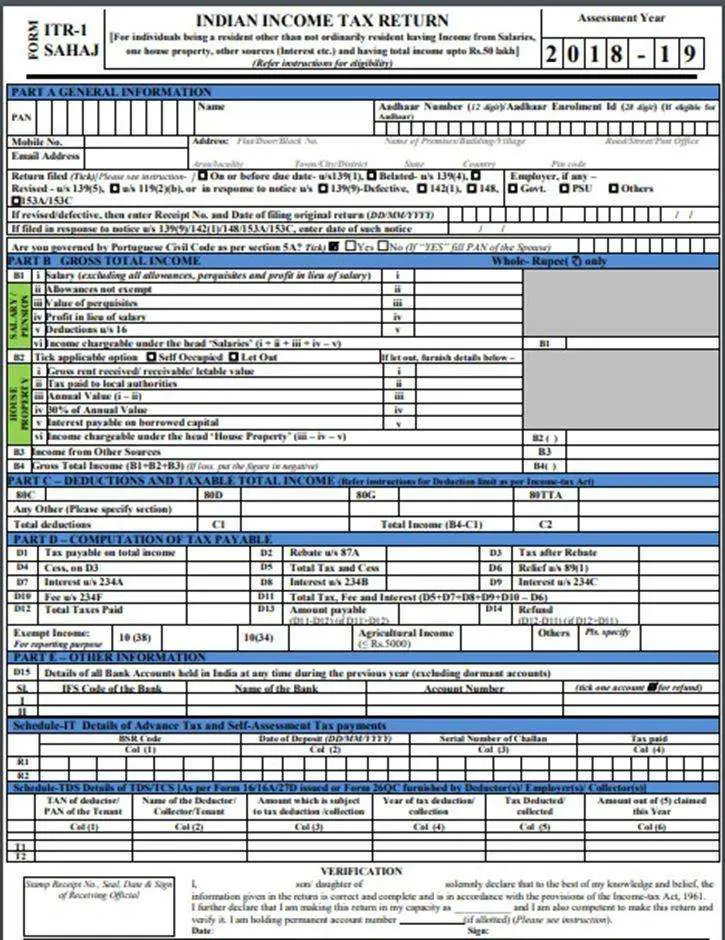

What Qualifies As A Simple Tax Return

A simple federal income tax return is one with almost no options. Prior to the 2018 tax year, the Internal Revenue Service offered two streamlined versions of its 1040 individual income tax return. The simplest was Form 1040-EZ, for taxpayers with very basic tax situations and usually the quickest refunds.

Also Check: How To Calculate Mileage For Doordash

Four Factors That Impact Income Thresholds

Four factors determine whether you must file, and each circumstance has its own gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

- Your age

Some of these factors can overlap, which can change the income thresholds for required filing.

Your Online Efile Account

Use your EFILE number and password to:

- Maintain your account

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Also Check: Does Doordash Take Taxes Out

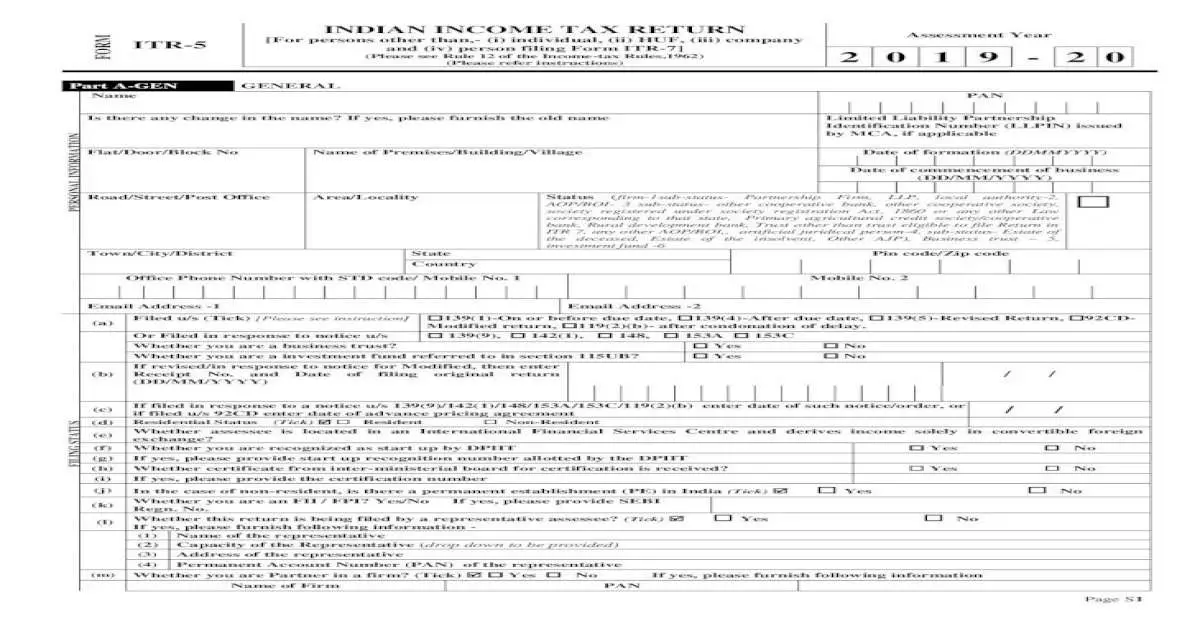

Income Tax Filing Requirements

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are:

- Single or married filing separately and gross income is greater than $12,550

- Head of household and GI is greater than $18,800 or

Note: For non-resident individuals the threshold numbers above are prorated based on the individual’s Arizona gross income to their federal adjusted gross income.

The filing requirements are explained at the beginning of the instructions on all Arizona income tax returns. All tax forms and instructions are available to download under Individual Forms, or by visiting ADOR offices.

To expedite the processing of an income tax return, ADOR strongly encourages taxpayers to use the fillable Arizona tax forms or electronic file . Fillable Forms and e-file information are available. Each year, ADOR provides opportunities for taxpayers to file their individual income tax returns electronically at no cost to those who qualify.