Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

How Do I Calculate My State Tax Refund

Where’s My Stimulus Check How To Track The Status Of Your Stimulus Check

Your stimulus check is different than your tax refund. You can track the status of your stimulus check on the IRS website here:

You should be able to see whether a payment has been processed, whether a payment date is available and whether the payment will be issued via direct deposit or mail. The IRS says it updates payment statuses once per day, usually overnight.

You May Like: How To Get Your 1099 From Doordash

How To Get A Faster Tax Refund

Here are four things that can help keep your “Where’s my refund” worries under control.

Avoid filing your tax return on paper. It’s a myth that your IRS refund status will be “pending” for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering “where’s my refund?” by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Don’t let things go too long. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

Can I Check My 2018 Tax Return Online

Taxpayers who have already completed their 2018 taxes can check the status of their refund using online tools offered by the IRS at IRS.gov and through the IRS2Go app. Refund information becomes available within 24 hours after the IRS receives an e-filed return, or four weeks after a paper return submitted by mail.

Read Also: Does Doordash Take Taxes Out Of Your Check

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To the check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Recommended Reading: Do You Have To File Taxes For Doordash

Refunds That Don’t Match The Amount Shown On Your Tax Return

All or part of your refund, including any amount for the Recovery Rebate tax credit, can be diverted to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts . To find out if this happened to your tax refund, or if you have questions about an offset, contact the agency to which you owe the debt.

The IRS can also adjust your tax refund amount if it makes changes to your tax return. The IRS will send you a notice in the mail explaining the changes. The “Where’s My Refund” tool will also note the reasons for a refund offset when it’s related to a change made by the IRS to your tax return.

If the tax refund you receive is not from your tax account, don’t cash the refund check or spend the direct deposit refund. Instead, you should send the refund back to the IRS according to the procedures on the IRS’s website.

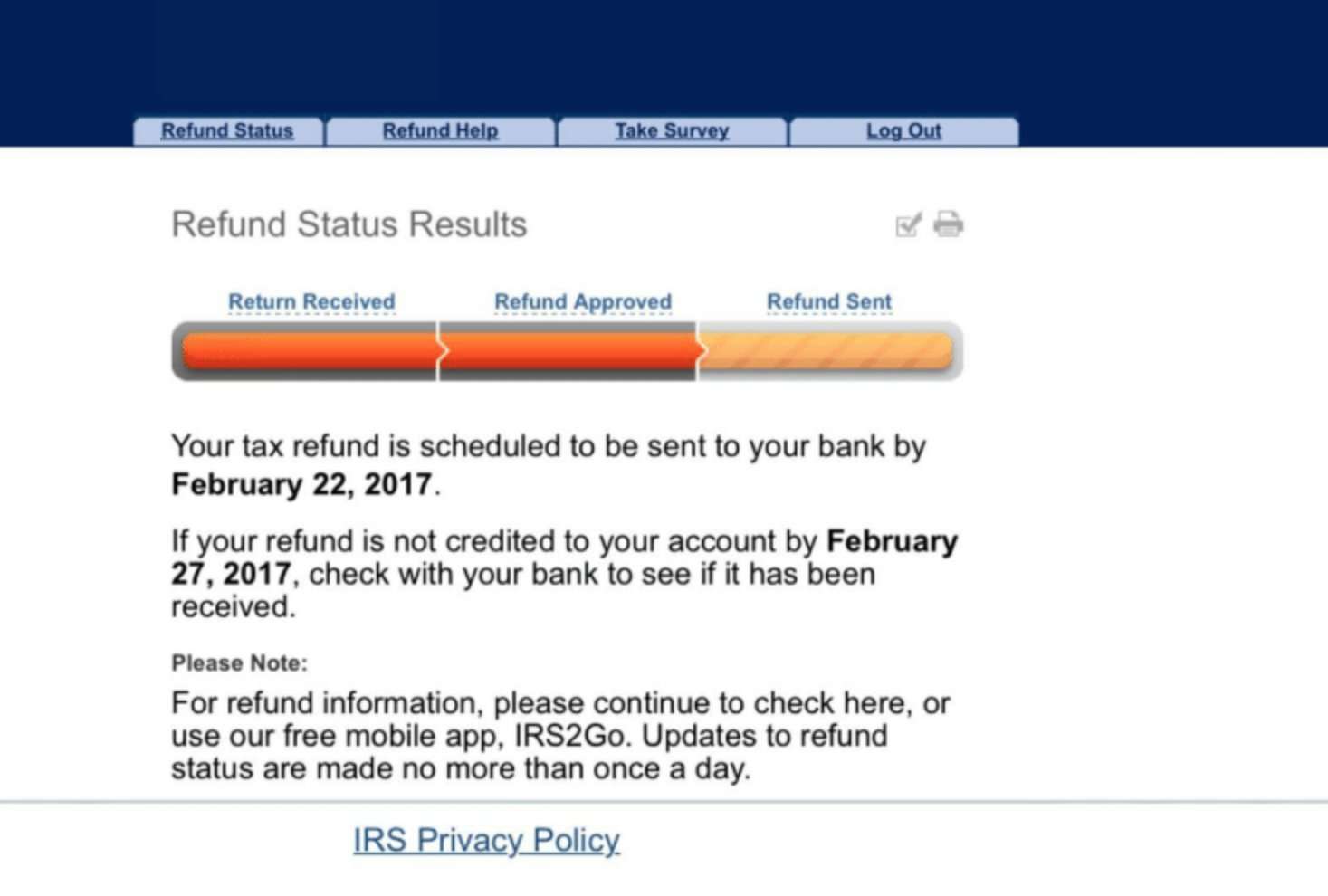

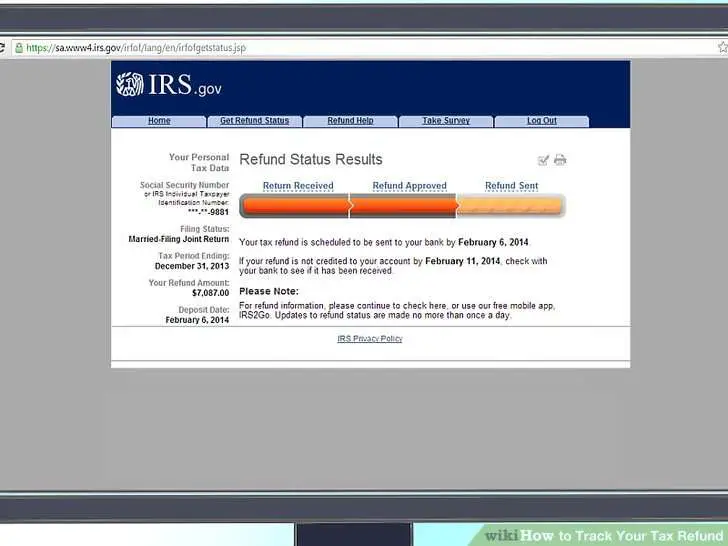

How To Track Your Refund Using The Irs’ Where’s My Refund Tool

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

You May Like: Efstatus.taxactcom

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Wheres My State Tax Refund Ohio

The Department of Taxation for Ohio provides an online form to check your refund status. To see the status, you will need to enter your SSN, date of birth and the type of tax return. You also need to specify if it is an amended return.

According to the Department of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. However, paper returns will take significantly longer. You can expect processing time for a paper return to take eight to 10 weeks. If you are expecting a refund and it doesnt arrive within these time frames, you should use the check status form to make sure there arent any issues.

Read Also: Buying Tax Liens In California

Uncle Sam Expects You To Pay Your Taxes On Time Every Year But If The Federal Government Owes You A Refund Youd Probably Like To Get It Sooner Rather Than Later

Once youve filed your federal income tax return and know youre expecting a refund, you can track it through the Wheres My Refund tool from the IRS.

But before you log in to check on your money, there are some things to know about federal refunds, including how long it can take to get one, what might slow yours down and why the amount you ultimately get can differ from what you expected.

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Also Check: How Do Taxes Work For Doordash

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Can Creditors Take My Check

Can back taxes or child support be taken out of the checks? The stimulus payments are not taxable and are not subject to garnishment by the government for back taxes or student loan defaults. The same is true for past due child support payments or private debtsfor the second and third stimulus checks.

Can my bank take my stimulus check? If your bank account is overdrawn because of overdrafts or outstanding fees, your bank may take part or all of your stimulus check to bring your account even. However, when the second stimulus check came out, many large banks stated that they would bring customers bank balances to zero, temporarily, so that customers could access their stimulus checks. This includes Bank of America, Wells Fargo, Citigroup, and JPMorgan Chase.

Recommended Reading: When Will I Get My Stimulus Check By Mail

Also Check: How Do Taxes For Doordash Work

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldn’t file a second tax return.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

Recommended Reading: Www..1040paytax.com

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Also Check: How To Pay Taxes As A Doordash Driver

How Long Does It Take To Get Tax Return 2018

- If you submit your tax returns electronically, you can check the status of your refund within 24 hours. Meanwhile, you will have to wait at least four weeks before you hear anything about the refund if you choose to submit your returns through the mail. Usually, most taxpayers get their refunds within 21 days or so.

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Also Check: Tax Preparer License Requirements

Let’s Track Your Tax Refund

Within 2 days of e-filing, the IRS may accept your return and begin processing it.

Within approximately 2 days of acceptance, the IRS will process your tax refund.

Refund sent or deposited by IRS

You should receive your tax refund from the IRS within 19 days* after acceptance. If you have not received it by this time, contact the IRS for assistance.

You can also check your refund status directly with the IRS’ Where’s My Refund Tool.

Still waiting on your refund?

What If I Filed My Tax Return On Time But Haven’t Gotten My Refund

There are several reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. You may have made errors on your return that required manual processing, or simply included an uncommon form. Regardless of the reason for the delay, if the IRS does not issue your refund within 45 days after receiving your return, the agency is required to start paying interest on your refund amount.

The 45-day time period starts on either the day that the tax return was due, or when your “processible” tax return was received by the IRS, whichever is later. If you electronically filed on time, the count started on April 18 if you filed a paper return, it began on the day that the IRS marked your return as accepted.

The bad news is that any IRS interest you receive with your refund will be taxable income, much like the interest you would earn from a checking or savings account. The good news is that interest on overpayments to the IRS will rise to 5% starting July 1. The IRS interest rate for overpayment is set at the federal short-term interest rate plus 3 percentage points. With the Federal Reserve raising rates by 0.75% in early June, a full point increase to the IRS interest rate will take effect next month.

Also Check: How Do You Do Taxes With Doordash

Tracking Your Tax Refund By Phone