You May Know About Ways To File Your Federal Income Tax Return For Free But What About Filing State Taxes For Free

In 43 states and the District of Columbia, Americans have to pay some sort of state-level income tax as well as federal income tax. If you live in a state with a state-level income tax, you may dread the idea of paying someone to complete yet another tax return for you.

If so, youll be happy to know that its possible to file state taxes without paying for it. Heres what you should know about filing your state taxes for free.

When Is This Bill Effective

Senate Bill 113 is effective for the tax year beginning on or after Jan 1, 2022. This allows other state tax credits to be used before the pass through entity tax credit. This bill also ends the temporary suspension of net operating losses, and it also takes away the five million dollar business credit limit enacted under Bill 85.

For taxable years after Jan 1, 2019, Senate Bill 113 excludes gross income any amount received from federal restaurant revitalization adopts and grants. Businesses that consider making a pass through tax entity election could see significant tax benefits.

It is very important to note that making the decision to elect pass through entity requires modeling and analysis of your business. In order to do that, you may want to reach out to a reputable tax advisor to help you sort through this new bill to see if it will benefit you and your business.

Workshop: Intro To California Taxes

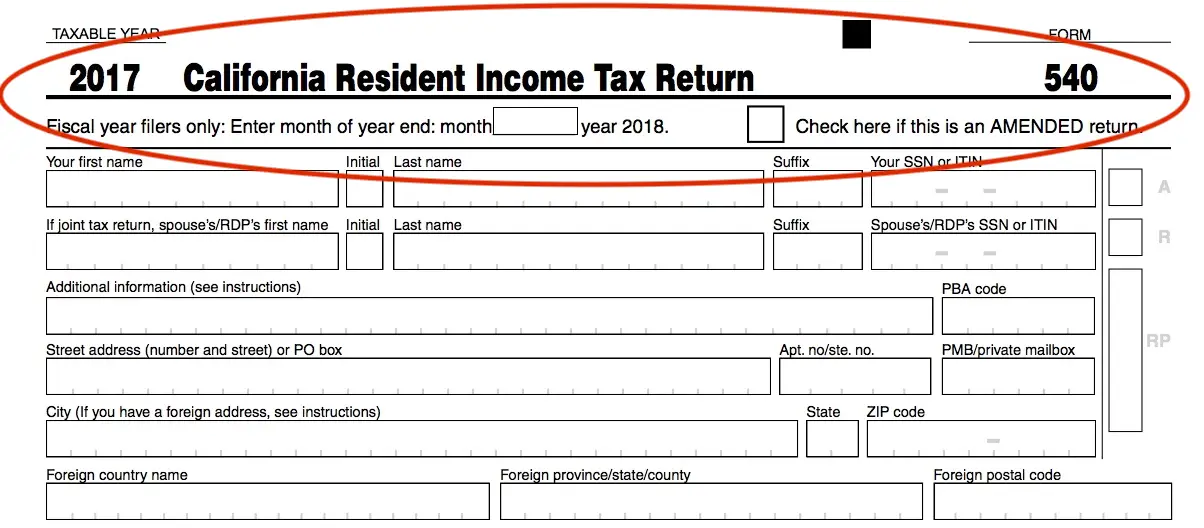

A member of the California Franchise Tax Board will present these workshops to assist you with filing any required state tax forms. We recommend completing your federal tax return before attending one of these workshops. Students or scholars who are considered nonresidents for California state tax filing will complete and file California Tax Form 540NR those who are considered residents for California state tax filing will complete and file California Tax Form 540.

Recommended Reading: How Do You File Doordash On Your Taxes

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

You May Like: Buying Tax Liens In California

Who Pays California Taxes

Just like the federal government, states impose additional income taxes on your income if you have a sufficient connection to the state.

Generally, you must file an income tax return in California if youre a resident, part-year resident, or nonresident and you receive income from a source in California over the threshold for filing. California residents are also taxed on worldwide income

You may also want to file a return with California to get a refund if you qualify for the California Earned Income Tax Credit or you had money withheld from your paycheck for state taxes.

Who Is Eligible For Irs Free File

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. IRS Free File provides access to free tax preparation software from 10 tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify for IRS Free File . IRS Free File providers include big names such as Intuit , TaxAct, and TaxSlayer.

Recommended Reading: Door Dash Driver Taxes

What Is The Tax Rate In California

For the 2021 tax year, California has nine income tax rates. They are progressive rates and depend on your filing status and income.

- 1 percent: up to $9,325 or $18,650

- 2 percent: $9,325 to $22,107 or $18,650 to $44,214

- 4 percent: $22,107 to $34,892 or $44,214 to $69,784

- 6 percent: $34,892 to $48,435 or $69,784 to $96,870

- 8 percent: $48,435 to $61,214 or $96,870 to $122,428

- 9.3 percent: $61,214 to $312,686 or $122,428 to $625,372

- 10.3 percent: $312,686 to $375,221 or $625,372 to $750,442

- 11.3 percent: $375,221 to $625,369 or $750,442 to $1,250,738

- 12.3 percent: more than $625,369 or more than $1,250,738

Recommended Reading: Doordash Quarterly Taxes

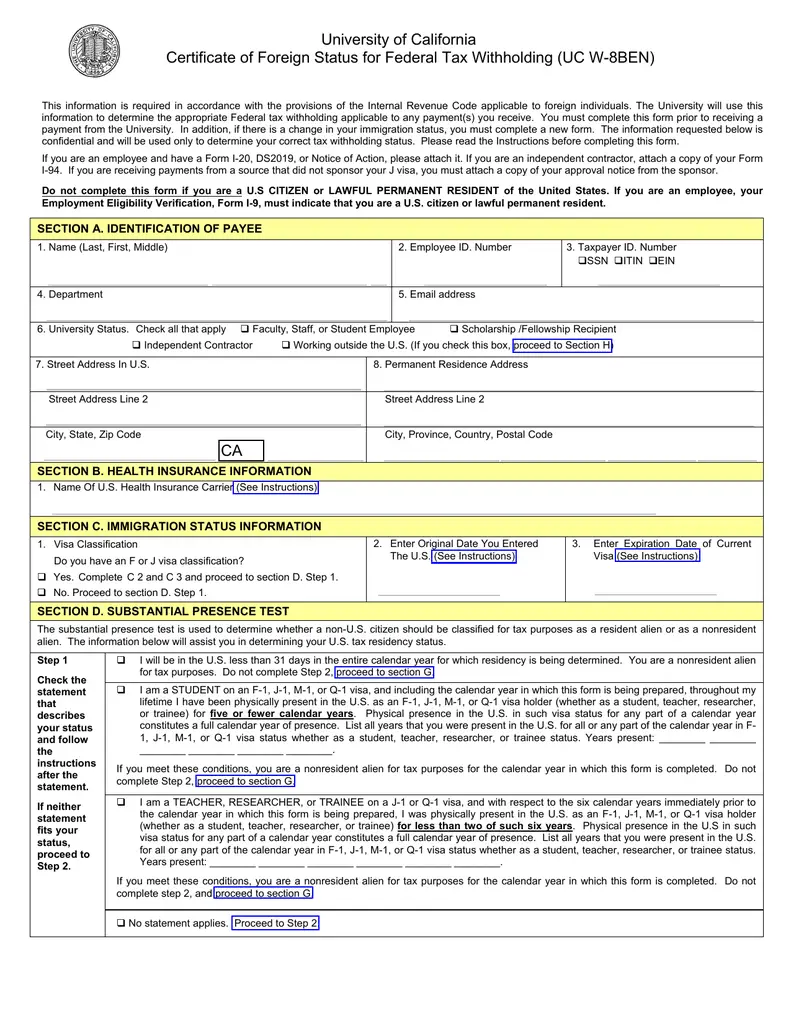

Federal Tax Software Access 2021

To assist UCSF-affiliated internationals with filing their federal taxes, ISSO is pleased that we will be able to offer access to software without charge. This software only assists with filing federal taxes. International students and scholars are responsible for the costs associated with filing their state taxes. To be eligible to use the federal tax software, you must be a UCSF-affiliated international. International students and scholars are responsible for submitting state taxes at their own expense. Unfortunately, the ISSO is unable to provide state tax software access free of charge

Please complete our survery to confirm your eligiblity and access your GPT tax code. You must be a UCSF student, scholar or affiliate to be granted access to the software. ISSO will review your request and respond within 48 business hours. Please do not contact ISSO prior to 48-hours regarding access.

You May Like: Reverse Ein Search

When To Pay For Help

To be sure, some people may still want to pay for help in filing their taxes because they don’t qualify for a free program or don’t want to spend the time to do their own taxes. There are many online software programs that help people file for a fee, and have products serving a wide range of tax scenarios at different price points.

If you have a more complicated return, such as you itemize deductions, are a sole proprietor with income or run a small business, you may want to get help via a software program or hire an accountant or other tax expert to help you file.

This year, filing an accurate return is important to avoid delays in getting any refund you’re owed.

Free California State Tax Filing

Is it possible to fille a free California state tax filing? You can file a California State Tax Return free if you meet the qualifications. This is quite important to know since that is where most of your money goes. If you do not file a return, you may not have to pay back taxes.

More Tips On Free California State Tax Filing:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

The good news is that you can file places online to file your state taxes for free or claim a tax refund.

Most states require you to have a valid drivers license in order to file a tax return. In addition, you must be a US citizen to file for Federal taxes. In California, you need to be a resident in order to file a tax return.

Some other things to keep in mind when youre filing for a California State Tax Return. First, there are usually deductions for interest paid on your loan. Also, you might be able to claim things like the amount you spent on entertainment and the amount you spent on taxes and such.

You may also qualify for a California State Tax Credit if youve received benefits from the US Government. These benefits could include things like unemployment and disability payments. Check to see if you qualify for these.

The best part about filing for a California State Tax filing is that you can do it online. This means you can save time and avoid having to come into the office.

You May Like: Does Doordash Take Taxes Out For You

California Direct Tax Filing

California has an online tax preparation tool called CalFile. For 2021 returns, CalFile is open to taxpayers of all filing statuses with federal adjusted gross incomes of up to $203,341 if you’re single or married and filing a separate return. The limit increases to $305,016 for those filing as head of household, and $406,687 if you’re married and filing a joint return or a qualifying widow.

If you want to use CalFile, you must have lived in California the entire year, and you can claim no more than 10 dependents.

The main sources of qualifying income you can claim with CalFile include:

- Wages, salary, and tips

- Taxable scholarships and grants that weren’t reported on a Form W2.

- Interest and dividends reported on forms 1099-INT or 1099-DIV

- IRA distributions

- Social Security benefits reported on a 1099-R

Educators should remember that you cannot use CaFile if you claim more than $250 in educator expenses .

General Tax Return Information

Due Date Individual ReturnsApril 15, or same as IRS

Extensions California has an automatic six-month extension to file an individual tax return. No form is required to request an extension.

Form FTB 3519, Payment for Automatic Extension for Individuals. Form FTB 3519 is used to make payment only if a return cannot be filed by the return due date and the taxpayer owes tax. To access Form FTB 3519 in the program from the main menu of the CA return, select Personal Information > Other Categories > File CA Extension . Note: This form cannot be electronically filed. Mail Form FTB 3519 with payment to the appropriate mailing address. .

Drivers License/Government Issued Photo Identification: California does not require Drivers License or Government Issued Photo ID information to be included in the tax return in order to electronically file. It is recommended by the state that before preparing returns or accepting returns for electronic transmission, you should review two pieces of identification from each new client and retain a copy of this information in your files for four years from the due date of the return or four years from the date the return is filed, whichever is later.

You May Like: Is Door Dash 1099

How Do You Pay California Taxes

To pay California state taxes, follow these steps:

E-filing your California state return gets you the fastest refund and reduces errors. H& R Block tax software will choose the right state form for you.

Residents should file either:

Part-year residents and non-residents should file Form 540NR.

What To Do If You Made More Than $73000

If your gross annual income was more than $73,000 in 2021, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option.

You May Like: Finding An Ein Number

I Learned That There Was Also A Postdoc Tax Workshop Offered Through The Office For Postdoctoral Scholars Is It Better To Attend The Ops Tax Workshop The Isso Tax Workshops Or Both

The Office for Postdoctoral Scholars tax workshops only apply to those who hold the postdoctoral-paid direct and postdoctoral fellow UC titles. If you hold one of these titles and have not previously participated in an OPS tax workshop, we strongly recommend that you attend. OPS Tax Workshop information can be found on the UCSF Postdoctoral Scholars Association, and OPS general tax information can be found at . Your UC appointment letter will include your UC postdoctoral title. If you are unable to locate your UC appointment letter, you can ask your HR generalist for your UC title. If you missed the OPS workshop, please reach out to for workshop slides. ISSO does not have access to OPS slides.

The ISSO state and tax workshops only apply to those who hold “nonresident” status for taxation purposes. If you are considered a nonresident and have not previously attended an ISSO state or federal tax workshop, we strongly recommend that you participate.

How To File My Taxes

Forms and Publications are available on the federal and state tax websites. Federal Forms and Publications by mail are available by calling 1 829-3676.

In addition, UCSF has purchased Glacier Complete International Tax Preparation an internet-based tax preparation system for nonresidents for federal tax purposes. ISSO makes this program available to international students and scholars at UCSF. Individuals are responsible for filing their state taxes at their own expense.

Those who are taking advantage of their countrys tax treaty with the U.S. will also have the ability to access Glacier via their GLACIER Online Tax Compliance Software account.

Don’t Miss: Is Money From Plasma Donation Taxable

How Can I Get My Tax Transcript Online Immediately

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Select the Tax Return Transcript and use only the Adjusted Gross Income line entry.

Taking Advantage Of Free Filing

Orange County United Ways OC Free Tax Prep has partnered with H& R Block, the IRS, and other local partners to make preparing and filing taxes as easy and affordable as possible in order to promote financial stability. Tax refunds play an integral role in stabilizing low- and moderate-income families and allowing them to better provide for their children. Take advantage of available opportunities to file your taxes for free in California through these services at www.ocfreetaxprep.com.

Don’t Miss: Dasher 1099

If You Owe And Cant Pay

If you cant pay your tax bill and its less than $25,000, you may be able to set up an installment agreement. You can apply online, by phone or mail. Theres a $34 set-up fee, and 60 months is the maximum payment term.

Keep in mind that even with a payment plan, interest and penalties will continue to accrue until you pay your bill in full.

Infreefile Vendors For Tax Season 2021 Are Posted Below Be Sure To:

Notes:

- To ensure you can file both your federal and state return for free, access these free file products from this page.

- Please note that you will need to create a new account each year with the vendor to ensure a no-cost filing.

- Read our Indiana freefile FAQ below.

Recommended Reading: Door Dash 1099

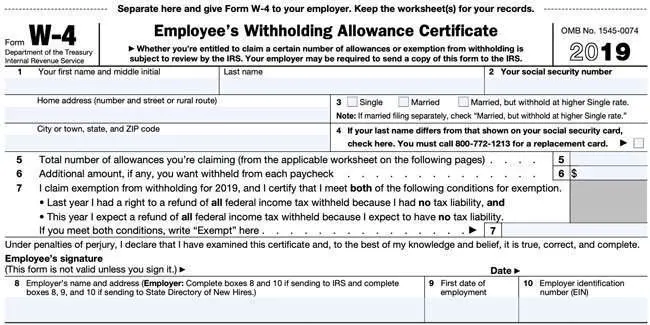

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Identify If You Are Eligible To File For Free

Your income determines whether you qualify to use IRS Free File.

If your adjusted gross income for 2021 is $73,000 or less, you’re eligible for guided tax preparation through the IRS. You can calculate your adjusted gross income by taking your income and subtracting any adjustments . The $73,000 limit for IRS Free File applies to both single taxpayers and married couples who file jointly.

If your adjusted gross income is over $73,000, your only IRS Free File option is Fillable Forms, in which you complete electronic forms yourself without guidance.

Also Check: Does Doordash Send 1099