You Can Still Use Your Old Sign

The new ID system will most likely end up affecting how you file taxes online next year, as the tax deadline to submit 2021 returns this year is April 18 for most people. However, if any extensions are made or you need to utilize the agency’s online tools and applications this summer or beyond, you’ll want to take note of the change.

According to the IRS, people can use their credentials from the old system to sign in for most applications until this summer, when ID.me will be fully implemented. Existing accounts only need an email and password for access currently, per UPI. “You won’t be able to log in with your existing IRS username and password starting in summer 2022,” the agency warns, noting that taxpayers are “prompted to create an ID.me account as soon as possible.”

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

You May Like: Pastyeartax.com Reviews

How Can I Do My 2020 Taxes On Turbotax As Of December 2021

Sorry Online is only for 2021 now. It’s too late to start a 2020 online return or use the mobile app, either on Turbo Tax or the IRS.To do a prior year return you have to buy the Desktop program here,You will need a full Windows or Mac to install it on.If you have a simple return and want to file for free you can fill out the forms by hand. Here are some basic forms…..Here is the 2020 1040 returnDont forget your state. And you will have to print and mail your returns. So be sure to attach copies of your W2s and any 1099s that have withholding on them. You have to mail federal and state in separate envelopes because they go to different places. Get a tracking number from the post office when you mail them for proof of filing.Then when you do file 2021 enter 0 for the 2020 AGI since you are filing 2020 late.

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Recommended Reading: Does Doordash Provide W2

Best For Small To Mid

KPMG Spark

-

More expensive than a basic business tax preparation service

-

Offering may be too robust for some businesses

For businesses that want an online tax experience from a well-known name in business tax and accounting, KPMG Spark is a good fit. KPMG is a Big Four accounting and tax firm that handles taxes and auditing for Fortune 500 companies, making it ideal to help smaller companies with big company experience. In other words, smaller businesses can get the same expertise as Fortune 500 companies through an online relationship using the KPMG Spark service.

KPMG Spark offers full-service online bookkeeping and tax account services. Business owners can choose to engage in bookkeeping services to streamline tax prep or choose services a la carte. You’ll need to contact KPMG to get a quote on how much your tax return will be based on its complexity and the number of required forms.

Businesses can use the web to connect to their assigned tax team, who are also available by phone, text, or email. Logging in to the web portal allows business owners to get tax information around the clock. Pricing is monthly with a flat rate starting at $195 per month . Your accounting team pulls in business transaction data right from your bank to its proprietary software. While this service may be more than some businesses need, the expertise provided by KPMG makes it the top choice for growing small and mid-size businesses.

Benefits Of Filing Taxes Online

The IRS expects the number of individuals filing taxes electronically will grow to record numbers this year. E-filing offers:

- Faster refund Electronic filing is faster to process, which means a faster refund.

- Accuracy Although it may not prevent all mistakes, e-filing is software-based, so it’s able to check quickly for errors and scan for missing information. In fact, the IRS has reported that e-file returns are more accurate than paper ones.

- Early filing Taxpayers may e-file early, just as they can with paper returns. The sooner you e-file, the sooner the IRS will send you any refund you are owed. The difference, however, is that with early e-filing, it is not necessary to pay the balance of any taxes you owe until the filing deadline.

- Federal and state filing In most states you can e-file both federal and state tax returns with the IRS at the same time.

- Proof of filing The IRS will send you an acknowledgement when they have received and accepted your return.

Don’t Miss: Doordash Dasher Taxes

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

Documents You Need To File Your Taxes Online

Start by gathering all the required financial paperwork youll need to file. This includes any W-2 forms youve received from employers you worked for in the past year, as well as any Form 1099s you received for work with clients as a self-employed worker or for miscellaneous income you earned.

Other paperwork you may have and would need for your tax return includes interest you earned on bank accounts , investment income , student loan interest paid , mortgage statements of interest paid and information on contributions youve made to an IRA or a health savings account . While you can gather all the required paperwork for your tax return as you move through the e-filing process, collecting this information early can save you time later on.

Read Also: Payable Com Doordash

Who Should Use A Tax Preparation Service

Tax preparation services are best for anyone who doesnt want to do their own taxes for any reason. Whether youre looking to save time, dont know how to handle a complex tax situation, or just dont like doing math or using computers for your finances, a tax preparation service becomes a good choice for you.

Its important to note that you can likely save money doing your own taxes manually or with tax preparation software. Depending on your income and tax complexity, you may even have an option to do your taxes online for free. It is entirely up to taxpayers to use what gives them the most confidence in sending off IRS-related forms.

Submit Your Tax Return To The Canada Revenue Agency

TurboTax is CRA NETFILE certified software, which means filing taxes online is secure, easy, and most of all, efficient because your tax return and more importantly, your tax information will be securely submitted directly to the CRA, without having to mail it, or send along any supporting documentation . Even better, is that once uploaded to the CRA, you receive a confirmation that your return has been received by the CRA.

No more wondering if it got lost in the mail, or mailed to Cape Columbia, which happens to be the most Northern point in all of Canada, where it was eaten by polar bears, or, ahem Beavers.

Once the CRA processes your return, they then issue you a Notice of Assessment, sent directly to you via email if you are registered for My Account, or via the mail if you are not.

See how easy it is to file your taxes online?!

Also Check: Do You Pay Taxes Working For Doordash

What Was The Big Criticism

Big names, like Intuit’s TurboTax and H& R Block, faced much criticism back in 2019 after a ProPublica investigation detailed how the companies limited the program’s reach by making free options more difficult to find online and instead figuring out a way to steer eligible taxpayers into products that weren’t free.

ProPublica’s reporting included pointing out that Intuit added code to the Free File landing page of TurboTax that hid it from search engines like Google, making it hard to find.

In January 2020, the IRS announced some changes designed to offer more consumer protections.

One such change: Tax preparation firms agreed that they would not exclude “Free File” landing pages from an organic internet search.

The IRS suggested that taxpayers search for standard labeling: “IRS Free File program delivered by .”

As part of IRS Free File, taxpayers cannot be offered bank products that often carry fees, such as high-cost refund anticipation loans.

If you used IRS Free File last year, the company you used is required to send you an email welcoming you back to their official IRS Free File services.

The email must include a link to the companys IRS Free File site and explain how to file with it. If you choose this email link and qualify, you will not be charged for preparation and e-filing of a federal tax return.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: 1040paytax Com Legitimate

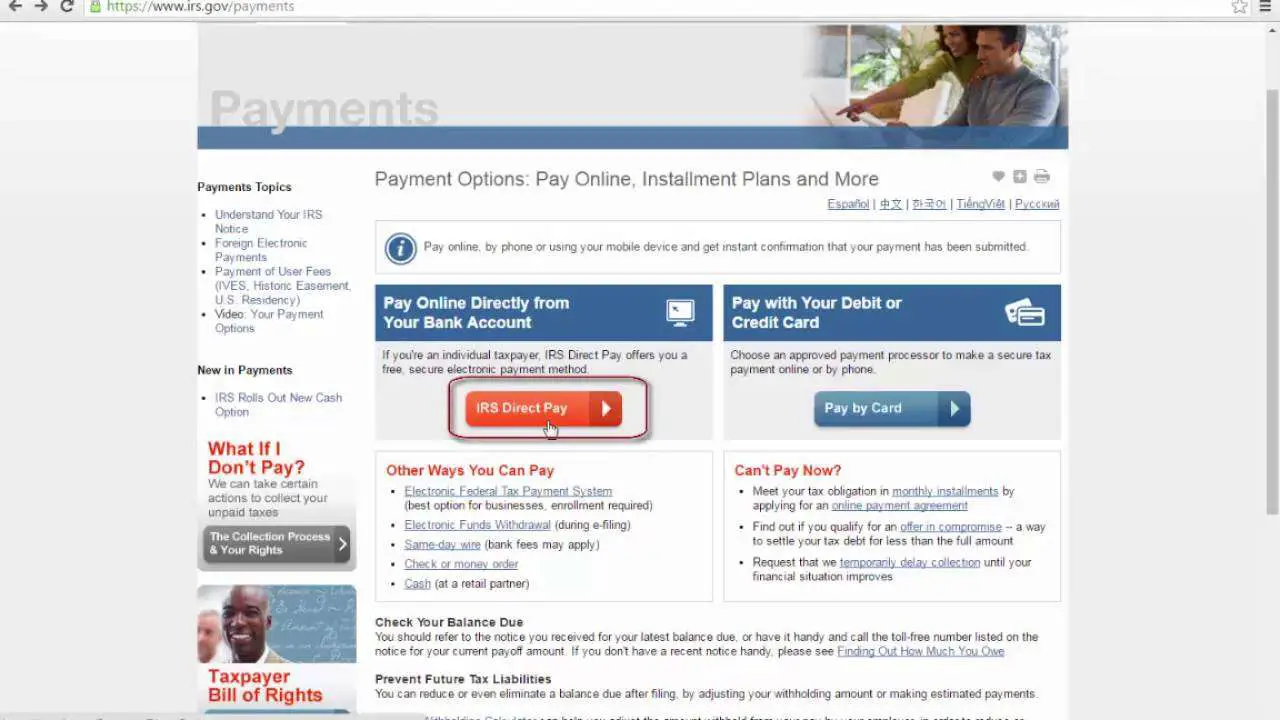

Which Payment Method Is Best For Me

My payment is due today:

Online, telephone or in-person payments made via your financial institution that are completed before your banks cut-off time if it is before your due date will be reflected as payments made on time. Check with your financial institution to find out the cut-off time applicable to you.

Online payments by card through Paymentus made on weekdays do not have a cut-off time until 10PM. This means payments made on a due date before 10PM via Paymentus should be reflected as payments made on time.

I want a payment receipt:

You will receive a physical receipt when paying in-person at one of our Client Service Centres and an electronic confirmation when paying online by card.

I want to pay online:

You can pay your property tax bills online by payment card.

I am house-bound:

You can pay via your financial institution online or by telebanking, online by payment card, through our PAD plan or by mail.

I have no computer:

You can pay via your financial institution in-person or by telebanking, through our PAD plan, by mail or by dropping off a chequeat one of the secure payment drop-boxes located outside the main entrance of the Kanata Client Service Centre at 580 Terry Fox Drive or the Orleans Client Service Centre at 255 Centrum Boulevard.

Tax Receipts And Statements

The City will issue residents a receipt for property tax payment, record of payment or duplicate tax statement upon request.

- Refunds are processed on a first in, first out basis

- Please allow four to six weeks to process

- Should your refund be as a result of an Assessment reduction an application will be sent to you automatically upon processing your reduction. Please do not complete or submit a separate refund form.

Also Check: Doordash Independent Contractor Taxes

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

Why Was The Free File Alliance Formed

In November of 2001, the Office of Management and Budget’s Quicksilver Task Force established 24 e-government initiatives that were a part of the President’s Management Agenda. These initiatives were designed to improve government to government, government to business and government to citizen electronic capabilities.

One initiative, IRS Free File, instructed the IRS to provide free and secure online tax return preparation and filing services to taxpayers. In accordance with this OMB directive, the IRS worked in partnership with the tax software industry to develop a solution. The result was the formation of the Free File Alliance, LLC.

Don’t Miss: How To Do Taxes With Doordash

Protect Yourself From Tax

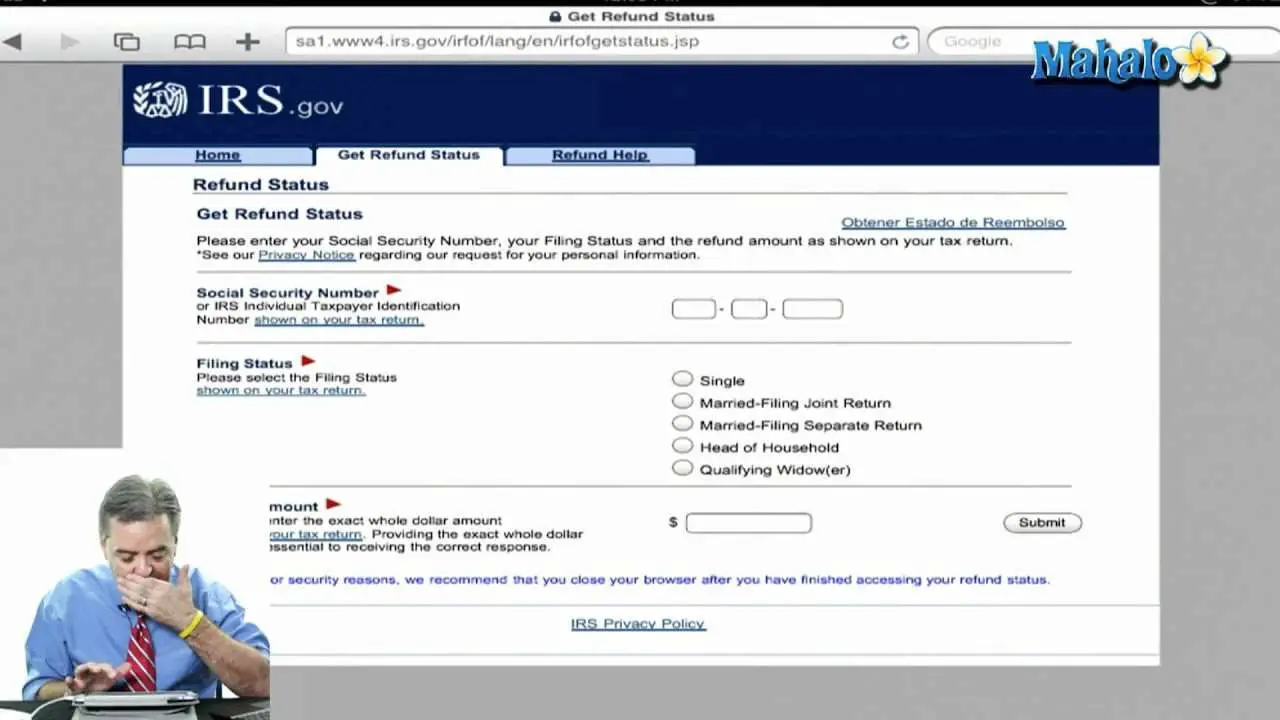

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Will We See Simpler Solutions Ahead

U.S. Sen. Elizabeth Warren, D-Mass., took a shot in July on Twitter at Intuit for exiting the Free File program and said the “IRS can, and should, create its own free tax preparation and filing system.”

Back in early 2020, before the pandemic hit, the IRS said it was no longer promising not to enter the tax return software and e-file services marketplace. The pledge no longer exists for not creating a government-run system.

Then, it seemed there could be a flicker of hope.

The pandemic, though, hit the IRS hard. Shutdowns to stem the spread of COVID-19 in the spring of 2020 triggered delays in processing income tax returns and issuing refunds. The IRS also picked up extra work for rolling out Economic Impact Payments and later the advance Child Tax Credit to shore up the economy. It wasn’t pretty.

Going forward, it only makes sense for the IRS to work harder to give taxpayers even more access to no-cost software options for those willing to do their own tax returns. Getting Congress to really simplify the tax code wouldn’t hurt, either.

Follow Susan Tompor on Twittertompor.

Don’t Miss: Tax Write Off Doordash

States That Dont Allow E

All states that charge a state income tax allow you to e-file your state tax return. However, some states dont allow you to e-file a state-only return they require you to e-file state and federal taxes together.

According to TaxSlayer, states that dont allow state-only filing online include:

- Alabama

What Are The Objectives Of The Free File Agreement

- Provide greater access to free, online tax filing options with trusted partners only through IRS.gov

- Make federal tax preparation and filing easier for and reduce burden on individual taxpayers, and

- Continue to focus free governmental services for those least able to pay for tax preparation services

Also Check: Look Up Employer Ein Number

Find All The Tax Credits And Deductions You Can Claim

Based on experience, its nearly impossible to remember which tax credits and tax deductions apply to you personally, or which apply to your business venture. Understanding that if youre running a business, or have self-employed income, you likely have more on your mind like earning income and are not fixated on tax news to see whats new, whats changed and what no longer counts. Whether you have 70-years of tax experience or 70-hours of tax experience, everyone has come to rely on the expertise that is put into TurboTax. TurboTax searches over 400 credits and deductions automatically for you, so you can be ensured that you are seeing every possible deduction or tax credit that might apply to you. By doing that, you not only maximize your deductions but you also maximize your refund and keep more of that hard-earned money in your pocket.