Llc Electing S Corp Tax Status: An Option You May Not Know You Have

If you think you can benefit from the combined features of using an LLC to own and operate your small business and then having it be taxed like an S corporation, the possibility exists to establish your business as an LLC, but then make the election to have it treated as an S corporation by the IRS for tax purposes.

If you decide to form an LLC to own and operate your small business, you have a couple of choices for how you want your LLC to be taxed. For federal income tax purposes, there is no such thing as being taxed as an LLC. Instead, an LLC can be taxed like a sole proprietorship, a partnership, a C corporation orif it qualifiesan S corporation.

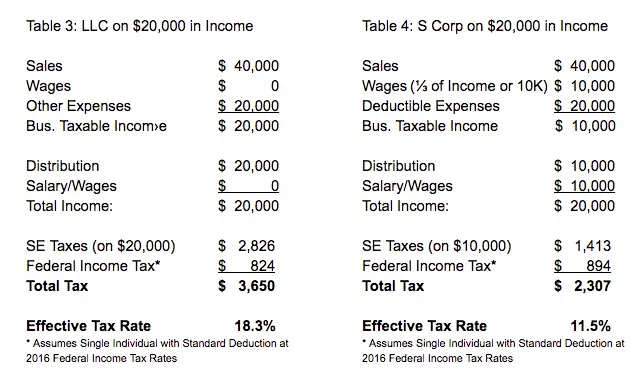

Although being taxed like an S corporation is probably chosen the least often by small business owners, it is an option. For some LLCs and their owners, this can actually provide a tax savings, particularly if the LLC operates an active trade or business and the payroll taxes on the owner or owners is high.

Difference Between Llc And S Corp

Perhaps the most fundamental difference between an S Corp and an LLC is the way the entity is treated for tax purposes. While LLCs are often treated as pass-through entities, meaning the income of the LLC flows through to its members, S Corps are accounting entities, meaning the S Corp itself calculates income and deductions at the corporate level before income is allocated to individual shareholders.

Another primary difference between S Corps and LLCs relates to who is permitted to own the entity. While most states allow individuals, corporations, partnerships, and other entities to be members, or owners, of an LLC, only U.S. citizens and permanent residents may be shareholders of an S Corp. Additionally, for an S Corp, only limited types of entities may be shareholders and the total number of shareholders must not be greater than one hundred.

In terms of day-to-day operations, perhaps no difference between the two entity types is more significant than the lack of corporate formalities associated with LLCs. In Indiana, for instance, both S Corps and C Corps are required to hold annual meetings of shareholders and directors. By contrast, there is no such requirement that members or managers of an LLC hold such meetings. In addition, while Indiana S Corps and C Corps must have at least one corporate officer, LLCs need not have officers at all.

Irs Form 1120s And Other S

An S-Corporation is a pass through tax entity in that it doesnt pay federal taxes at the corporate level. The profits, losses, credits, and deductions from the S-Corporation flow through to the individual shareholders personal tax return and they are responsible for paying the tax.

However, the S-Corporation still needs to file whats known as an informational return. That includes filing Form 1120S as well as issue K-1s to each of the S-Corp shareholders.

For 90+% of LLCs which operate on the calendar year , the S-Corp tax return will be due by March 15th each year. And like personal tax returns, if your S-Corporation needs an extension, you can file Form 7004.

There are also additional tax forms your S-Corporation must file in order to report taxes paid from payroll . This is filed on Form 941. And Form 940 will be used for federal unemployment tax.

The IRS is very strict about due dates and has the right to impose penalties if your S-Corp tax return is late . If no tax is due and you need to file an informational return only the IRS can charge $195 per month per person. If there is a tax due, its $195 per month per person plus 5% of the unpaid tax for each month its late. This is just an overview though. For more info please see the Interest and Penalties section of Form 1120S instructions.

Also Check: Do Churches Pay Property Taxes

How To Elect An Llc To Be Taxed As An S

A limited liability company or LLC is formed under state law and is not considered a taxable entity by the Internal Revenue Service. All 50 states allow LLCs and specifics vary, but the IRS classifies them for taxes according to the number of individuals or members in the LLC. A single-member LLC is essentially treated as a sole proprietorship. A multiple-member LLC is considered a partnership unless it opts to be taxed as a C or S corporation. Make sure your state recognizes an S corporation.

1.

Prepare an IRS Form 2553, listing the name, address and employer identification number of the business. Include the name, address and Social Security number of each owner or member of the LLC, with the percentage of ownership. Have each member, if it is not a single-member LLC, sign a consent area in the 2553 or submit a separate consent form.

2.

Submit Form 2553 to the IRS by the 15th day of the third month of the tax year, March if the LLC elects to be taxed on a calendar year. Establish a tax year with the beginning date of the LLC if it is a new entity filing for the first time. Attach a statement showing relevant facts and circumstances to request that a fiscal year be used as a tax year.

References

- Check your state laws on both LLCs and S corporations as these steps may vary.

Writer Bio

Complete And File Form 2553 With The Irs

When you submit your completed IRS Form 2553, youre officially letting them know you want your LLC to be taxed as an S-corporation.

The form is only four pages long. Youll need to provide company contact information, tax year, and ownership information. But it gets tricky in two places.

You can expect it to take the IRS at least six to eight weeks to process your election request. But while you wait, continue to operate your company as if it were already an S-corp.

Once approved, your S-corp election will remain in effect until the IRS revokes it or you withdraw it.

Choosing S-corp tax status for your LLC is a complex decision that can have impacts beyond taxation. So be sure to consult with your tax and legal advisors.

Also Check: How Do I File Federal Taxes For Previous Years

How To Form An S Corporation

Llc As An S Corp: Everything You Need To Know

To classify your LLC as an S-corp for tax purposes, you need to file IRS Form 8832. 3 min read

To classify your LLC as an S-corp for tax purposes, you need to file IRS Form 8832. This special tax treatment allows your LLC to be taxed as a corporation, but all else remains the same in your LLC. An LLC is not a taxed entity, so the form is used to tax a Limited Liability Corporation as a corporation.

Read Also: Are Uber Rides Tax Deductible

Management Structure Of S Corporations

In contrast, S corporations are required to have a board of directors and corporate officers. The board of directors oversees the management and is in charge of major corporate decisions, while the corporate officers, such as the chief executive officer and chief financial officer , manage the company’s business operations on a day-to-day basis.

Other differences include the fact that an S corporations existence, once established, is usually perpetual, while this is not typically the case with an LLC, where events such as the departure of a member/owner may result in the dissolution of the LLC.

LLCs and S corporations are business structures that impact a company’s exposure to liability and how the business and business owner are taxed.

How Much Does It Cost To Change From Llc To S

Its free. If you want to convert your LLC into an S-corp for tax purposes, youll need to file Form 2553 with the IRS.

There are no filing fees. But making the switch to an S-corp can have impacts beyond tax matters, so its wise to involve your tax and legal professionals in the process. And this will cost money.

Recommended Reading: What Form Do I Give An Independent Contractor For Taxes

Llc Tax Classification With The Irs

LLCs have a default tax status with the IRS, depending on how many members there are:

- If you have a Single-Member LLC , then the IRS will tax it as a Disregarded Entity/Sole Proprietorship.

- If you have a Multi-Member LLC , then the IRS will tax it as a Partnership instead.

Alternatively, you can tell the IRS to tax you as a Corporation by filing an additional form after getting an EIN for your LLC. There are two different ways you can have your LLC taxed as a Corporation:

- You can have your LLC taxed as an S-Corporation by filing Form 2553 .

- You can have your LLC taxed as a C-Corporation by filing Form 8832.

S-Corporations are becoming very popular for small business owners , but S-Corporations are also the least understood .

Lets now discuss the S-Corporation advantages and disadvantages.

Why Would You Choose An S Corporation

An S corporation provides limited liability protection so that personal assets cannot be taken to satisfy business debts by creditors. S corporations also can help the owner save money on corporate taxes since it allows the owner to report the income that’s passed through the business to the owner to be taxed at the personal income tax rate. If there will be multiple people involved in running the company, an S Corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

Also Check: How Do You Report Bitcoin On Taxes

Llc Taxed As S Corp: How To Make The Election + One Big Mistake To Avoid

We may receive a commission if you sign up or purchase through links on this page. Here’s more information.

Electing for your business to be taxed as an S corporation may offer you tax savings on Social Security and Medicare taxes.

Perhaps the easiest way for a new business to be taxed as an S corporation is for the owner to form an LLC for their business with their states secretary of state and then for this LLC to file Form 2553 with the Internal Revenue Service as well as, if required by their state, any state S corporation paperwork with their states revenue department.

However, if business owners go this route for electing S corporation status for their business, they should be aware of a major pitfall that could completely invalidate their S corporation election.

Learn how an LLC can be taxed as an S corporation and what business owners considering this move should watch out for.

Want to learn more basics about S corporations? Watch the video below or read this article!

The Difference Between An S Corp And A C Corp

LLC members can also choose to have their LLC taxed as a C corp. The legal status of the company wont be changed to a corporation, but you can choose to have it taxed as one for various reasons.

If LLC members choose this option, they have to pay corporate taxes on their earnings at the current flat rate of 21%. All remaining profits are distributed among the members from the after-tax funds.

S Corp vs C corp tax advantages are evident in the fact that S corps dont have to pay federal taxes on the majority of their earnings, and they can freely distribute company gains among shareholders. If S corps want to use these tax advantages to their benefit, though, they have to comply with strict regulations imposed by the IRS no more than 100 shareholders, domestically based, no individual investors, and offer only one class of stock.

C corporations dont have to comply with these rules and they can expand their base of operations, meaning they are usually larger than S Corps.

Also Check: Will Irs Extend Tax Deadline

What Certificates Are Required For An Llc And An S

To understand LLCs and S-corps, it helps to understand C corporations. Taxed under Subchapter C, C-corps are separate taxable entities that file Form 1120. An LLC or C-corp may be converted into an S-corp by filing the Form 2553 with the IRS, as long as it meets all Subchapter S guidelines.

LLCs require business owners to file with the state the LLC was formed in, and these requirements may vary by state, according to Brian Cairns, CEO of ProStrategix Consulting.

Most states require some public notification, which can be costly depending on the jurisdiction, Cairns said. For example, in New York state, you have to advertise in the county in which the LLC is formed. If you form in one of the five boroughs of NYC, this can cost upward of $1,000.

For S-corps, youll need to file articles of incorporation in the state where you want to incorporate. An annual shareholders meeting and additional state reporting are also required.

How An Llc Taxed As An S Corp Works

Like a partnership, an S corporation is a pass-through entityincome and losses pass through the corporation to its owners’ personal tax returns. S corporations also report their income and deductions much like partnerships.

An S corporation files an information return reporting the corporation’s income, deductions, profits, losses, and tax credits for the year. S Corp owners must provide shareholders a Schedule K-1 listing their shares of the items on the corporation’s Form 1120S. The shareholders file Schedule E with their personal tax returns showing their share of corporate income or losses.

Read Also: Do You File Unemployment On Your Taxes

Should I File My Llc As An S Corp

Before filing for an S corp status, you should carefully consider if that is the best course of action for your business. You should only file for this type of status if:

- Your business is well-established and produces stable profits

- You are familiar with bookkeeping and payroll taxes

- You can afford to pay the reasonable salary

- You need to have at least $10.000 in annual distributions

Before reaching a final decision regarding the status of your company, you should also be aware of LLC taxed as S corp disadvantages. The rules for filing company taxes are stricter if the company is taxed as an S corp LLC owners need to adopt a calendar year as the companys tax year, unless they can list a reason for having a fiscal year. There is less flexibility in allocating income and losses, and the IRS pays more attention to these entities, meaning the chances of an audit are significantly higher. Another disadvantage is that 1099 forms arent available for an LLC taxed as S Corp LLCs taxed as S corps arent entitled to non-employment compensation.

If youre still uncertain as to whether you should file for an S corp status, you can always consult a financial advisor that can help you reach the right decision.

| DID YOU KNOW? A multi-member LLC is, by default, treated as a general partnership the amount of taxable income they have to pay depends on their share in the company. Even if they dont have any profits, they still have to report taxes. |

Important Facts About S Corps

There are obviously some pretty great benefits to electing S Corp taxation. So, why doesnt everyone pick this path? Like any business election, there are some limits to this structure.

- To change your LLC to S Corp taxation, you must file paperwork. Its not granted automatically.

- You cannot have more than 100 shareholders.

- Each shareholder must be a person, not a business. Can an LLC own an S Corp? Nope, your S Corp must be owned by an individual.

- The shareholders must be U.S.-based nonresident aliens cannot be owners.

- All issued stock must be of one class preferred stock cant be made available to a portion of shareholders.

If you cant fulfill all of the above requirements, you may consider a C Corp status for taxes.

You May Like: How To File Sales Tax In California