Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

Read Also: How Do I Get A Pin To File My Taxes

Before You Check Your Tax Compliance Status

If you file corporate income tax or GST/HST, you are required to upload a Filing and Balance Confirmation letter issued by the Canada Revenue Agency . This letter shows if you have outstanding returns or balances associated with your business number.

Visit My Business Account to obtain the letter before you verify your tax compliance status.

How To Check The Status Of The Payment

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

These letters are sent out within 30 days of a correction being made and will tell you if you’ll get a refund, or if the cash was used to offset debt.

Sadly, you can’t track the cash in the way you can track other tax refunds.

Another way is to check your tax transcript, if you have an online account with the IRS.

This is available under “View Tax Records”, then click the “Get Transcript” button and choose the federal tax option.

After this, you should select the “2020 Account Transcript” and scan the transactions section for any entries as “Refund issued”.

If you don’t have that, it likely means the IRS hasn’t processed your return yet.

This summer, frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans.

Households who’ve filed a tax return and are due a refund get an average of $2,900 back – we explain how to track down the cash.

Read Also: Is Door Dash 1099

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

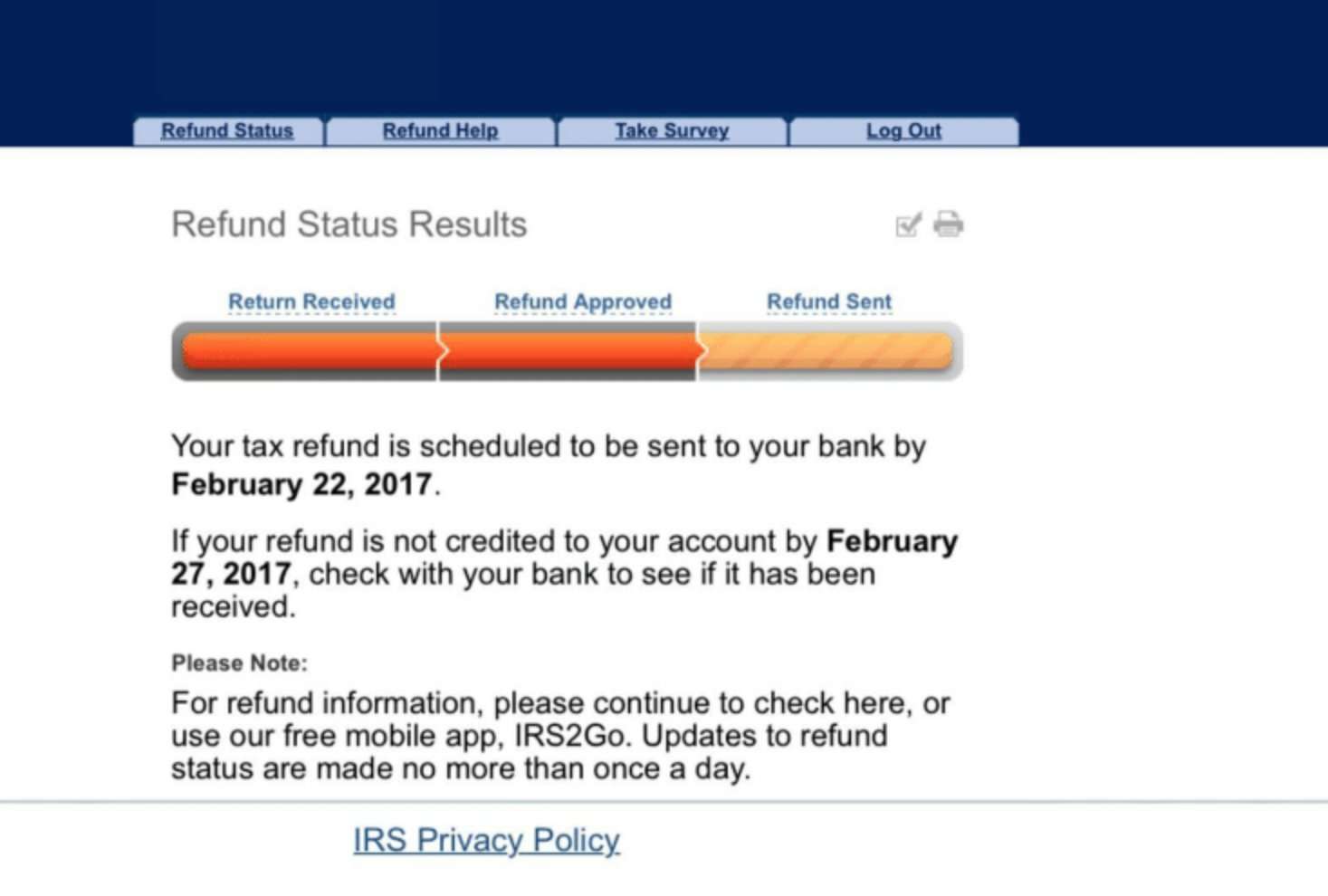

The Tool Displays Progress In Three Phases:

- Return received

- Refund approved

- Refund sent

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their financial institution to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Read Also: Ein Look Up Number

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

How Long Will It Take For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers could have to wait a while longer to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Also Check: Pastyeartax Com Reviews

Why Would My Tax Refund Be Delayed

Here’s a list of reasons your income tax refund might be delayed:

- Your tax return has errors.

- It’s incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes Form 8379 , injured spouse allocation — this could take up to 14 weeks to process.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there’s a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

Cra My Account: How To Check Your Tax Information Online

If youâve ever tried to contact the CRA by phone and received a busy signal, or sat on hold interminably waiting for a service rep, as I did recently trying to change my address, youâll be happy to know about CRA My Account for Individuals.

Online services offered by the banks and other financial institutions have made it easier to manage our financial affairs online and now the CRA My Account portal is no exception. This online account is the gateway to information and activity on your CRA tax account.

Don’t Miss: Doordash File Taxes

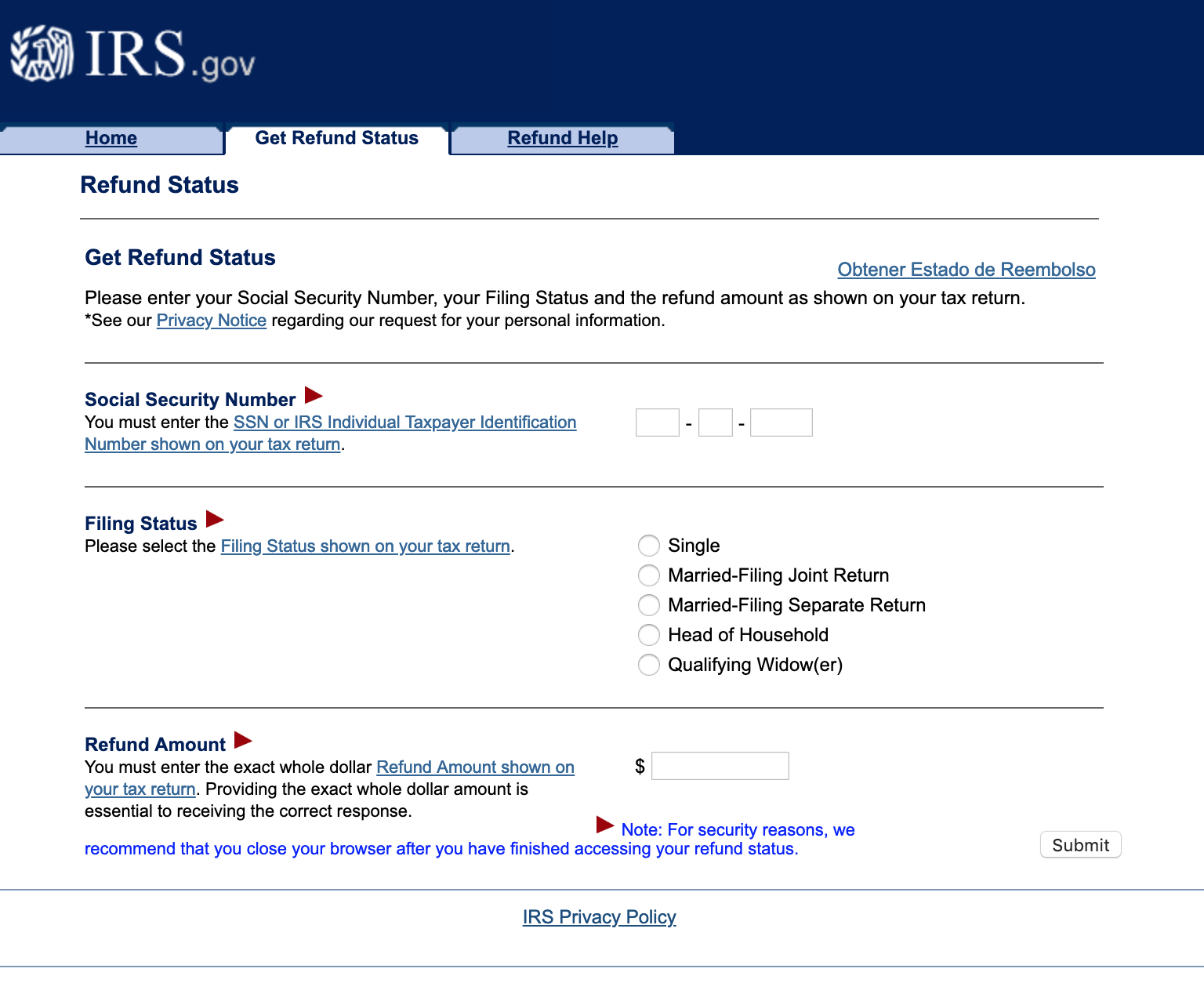

Check Refund Status Online

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option “Tax Refund for Individuals” in the box labeled “Where’s my Refund?”. Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return. If you do not know the refund amount you claimed, you may either use a Letter ID number from a recent income tax correspondence from the Department.

You will receive the Letter ID within 7-10 business days. After we have received and processed your return, we will provide you with an updated status as the refund moves through our system. It may take a few days for an updated status to appear. Please check back often to verify where your return/refund may be in our process.

The information in Revenue Online is the same information available to our Call Center representatives. You can get the information without waiting on hold.

What Are These Irs Tax Refund Statuses

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Read Also: Efstatus Taxact Online

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Verification Through The Use Of The Pin

With the Tax Compliance Status system, a taxpayer is able to authorise any 3rd party to verify its compliance status through the use of an electronic access PIN.

The PIN must be used to verify the taxpayers compliance status online via SARS eFiling.

Top Tip: When the PIN is used for verification, the result reflects the current tax compliance status at the date and time the PIN is used.

Read Also: How To Pay Doordash Taxes

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15.

Are You Entitled To Receive Interest On Your Refund

Yes, the Canada Revenue Agency will pay you compound daily interest on your tax refund. The CRA will start paying refund interest on the latest of the following 3 dates:

- the date of the overpayment

- the 120th day after the end of the tax year if the return for the year is filed on time

- the 30th day after the date the return was filed if it is filed late

Recommended Reading: Pastyeartax Reviews

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Recommended Reading: Plasma Donation Taxable

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

When Will I Get The Refund

Unemployment tax refunds started landing in bank accounts in May and ran through the summer, as the IRS processed the returns.

The first phase included the simplest returns, made by single taxpayers who didn’t claim for children or any refundable tax credits.

More complicated ones took longer to process.

In mid-July, the IRS issued 4million refunds, of which those by direct deposit landed in bank accounts from July 14.

Meanwhile, households who receive the cash refund by paper check could expect this from July 16.

Another batch of payments were then sent out at the end of July, with direct deposits on July 28 and paper checks on July 30.

The IRS didn’t announce payouts in August, September nor October – but on November 1, it noted another 430,000 refunds had been paid out.

These refunds were worth a collective $551million.

The IRS also said it’ll issue another refund batch before the end of the year, but as of December 30, it’s yet to confirm when and how many it applies to you.

It comes as Erin Collins, of the independent Taxpayer Advocate Service within the IRS, in September revealed that 13million accounts had been processed so far.

She added that there were still about 436,000 returns yet to be processed, as they were waiting in the Error Resolution System as of September 11.

This mean they had to be manually reviewed by the IRS, after which the refund was either released or the error confirmed.

Also Check: Doordash Tax Withholding

How To Get The Refund

If you are owed money and you’ve filed a tax return, the IRS will send you the money or use it to pay off other owed taxes automatically.

You typically don’t need to file an amended return in order to get this potential refund.

Instead, the IRS will adjust the tax return you’ve already submitted.

However, if you haven’t yet filed your tax return, you should report this reduction in unemployment income on your Form 1040.

The deadline to file your federal tax return was on May 17.