The Net Income Formula

Determining whether taxes are due begins with completing Schedule C as part of your personal Form 1040 tax return if you have a pass-through business. This form determines your net business income what’s left and taxable after you’ve deducted your business expenses. You won’t have to pay taxes if you arrive at a negative number you had a business loss.

Your business expenses might include a home office or work space, allowing you to deduct a percentage of your rent or mortgage interest, utilities and insurance equal to the percentage of your home’s square footage that you use exclusively for business purposes. You can also deduct the cost of tools or supplies, car or truck expenses, advertising costs and even legal costs.

The total remaining after these subtractions is your business income, to be transferred to your Form 1040.

Tax Law Thresholds And Changes

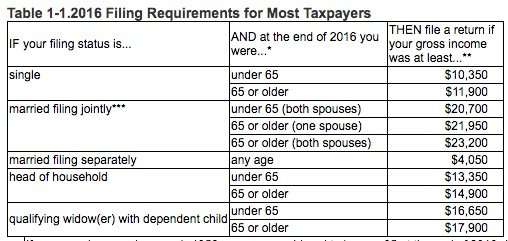

The IRS has not yet announced minimum income requirements to have to file a tax return for 2018, but it’s likely the numbers will be higher than in previous years thanks to the higher standard deduction. Traditionally, the cutoff has been when you make more than the combination of the standard deduction and personal exemption for yourself or, if married, yourself and your spouse.

Personal exemptions are being eliminated for 2018 and standard deductions will be higher than in previous years. The standard deduction amounts for 2018 are $12,000 for single taxpayers, $24,000 for married couples filing jointly and $18,000 for heads of household. It’s likely that if you make below these thresholds you won’t have to file.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Don’t Miss: Do Taxes Get Taken Out Of Doordash

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Negotiate Your Tax Bill

If your tax assessment is too high, you may be able to negotiate a better deal. Penalties may represent 25% of what you owe to the IRS. Getting these removed can make a real difference. File Form 843 to request an abatement of taxes, interest, penalties, fees, and additions to tax.

You might consider a Partial Payment Installment Agreement where the IRS agrees to accept less than the total you owe. The IRS will only agree to a PPIC if it’s clear that the monthly payments you can make will not cover your total taxes due for many years.

Another option to reduce your total tax liability is an offer in compromise . If the IRS accepts an OIC, it acts as an agreement between a taxpayer and the IRS to settle a taxpayer’s tax liabilities for less than the full amount owed. If you can fully pay your liability through an installment agreement or other means, you won’t generally qualify for an OIC.

Don’t Miss: Ein Look Up Number

How Much Can A Retired Person Make Without Filing Taxes On It

Retirement may mean long, relaxing days without a boss breathing down your neck. But it doesnt necessarily mean freedom from the tax man. The good news is, you can live fairly comfortably without a big tax bill. In fact, if your only income is Social Security, you may not need to file a tax return at all. The key is keeping your earnings below a certain level based on your age.

Tips

-

Although a variety of deductions and credits can factor into the income of a retired person, the standard deduction for a senior in 2018 is $13,300.

Who Doesn’t Get A Standard Deduction

It’s important to note that certain taxpayers aren’t entitled to the standard deduction.

This includes a married individual filing as married filing separately whose spouse itemizes deductions.

It also includes an individual who was a nonresident alien or dual status alien during the year.

Individuals who file a return for a period of less than 12 months due to a change in his or her annual accounting period also don’t get one.

Plus, an estate or trust, common trust fund, or partnership won’t get one either.

Read Also: Efstatus Taxact 2016

The Longer You Wait The More Serious The Consequences

Once the IRS determines you should have filed a return and didnt, youll start hearing from them. Youll likely receive a notification letter from the IRS stating you will be penalized for not filing a return.

The IRS may also create a return for you. For example, if your employer reported wages, the IRS may create a tax return showing those wages. The catch? The IRS doesnt know about any deductions or other tax benefits you may deserve. They typically only know about your income, and unless you straighten things out, you could end up paying a lot more in taxes than you should.

If the IRS doesnt hear from you once youve been contacted, things can get more serious. Your bank may send you a notice indicating your money has been seized by the IRS. The agency may also put a lien against your property or garnish your wages. And, during all this time, interest and penalties are piling up, meaning the IRS can take more of your money.

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents while that is not true, the credit amount is greater for eligible low-wage taxpayers with children.

The IRS also says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2021 tax return is Friday, April 15, 2022. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

Read Also: How Do I Get My Pin For My Taxes

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

When Will I Get My Refund

Most taxpayers should see their refund within 21 days of filing, so long as the return is filed electronically with no issues and the taxpayer selects direct deposit. That means, if you file on Monday, you will likely see your refund by Valentines Day, Feb. 14. The IRS even has an online tool so you can check the status of your refund.

Last year, the average tax refund was more than $2,800, according to the IRS. Theres no word yet on what the average may be this year as the agency prepares for more than 160 tax returns this season.

If your refund involves the Earned Income Tax Credit or Additional Child Tax Credit, the IRS legally cannot send you a refund before mid-February. This is to give the IRS time to weed out any fraudulent refunds.

Your refund may take longer if your return needs to be reviewed manually. This happens when the IRS system detects a possible error or missing information or if theres a reason to suspect identity theft or fraud.

How bad can a delay get? Well, the IRS is still working to process some tax returns from previous years. That backlog, however, doesnt include any paper and electronic individual 2020 refund returns that were filed without errors and were received before April 2021. And even if your 2020 tax return is still in IRS purgatory, you generally dont have to wait for it to process before filing your 2021 tax return.

Read Also: How To File Taxes For Doordash

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Also Check: Doordash Driver Tax Deductions

Reasons Why You Might Want To File A Return

Even if youre not required to file an income tax return you still might want to do so. For example, if you have worked and had federal income taxes withheld from wages, the only way to recover the funds is to file a tax return. That way, you can receive a refund for the amount withheld from your pay.

Example. Youre single and earned $2,500 during the year. A total of $300 was withheld for federal income tax. Since the amount you earned is less than your standard deduction, youre likely entitled to a full $300 tax refund.

The IRS does not issue tax refunds automatically. If you wish to claim a refund, you must file a tax return.

These are just some of the situations in which a person might not need to file a tax return. To learn more, visit TurboTax.com.

Haven’t filed your taxes yet? Get closer to your tax refund and file today. We’ll search more than 350 tax deductions and credits to find every tax break you qualify for. Its free to start, and enjoy $10 off TurboTax Deluxe when you file.

Dependents May Have To File

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,200, must file a tax return.

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2019, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2019, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2019 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Related:Where to Get Your Taxes Done

Read Also: Do You Have To Pay Tax On Doordash

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction.

How To Claim An Exemption

The following two criteria must be met in order for you to claim an exemption on your W-4:

- In the prior year, you must have had a refund of ALL federal income tax that was withheld due to the fact that you had no tax liability

- For the current year, you anticipate a refund of all federal income tax that was withheld because you assume to have no tax liability.

Recommended Reading: How Much Does Doordash Take In Taxes

Taxes And Standard Deductions

Beginning in 2018, seniors get a $1,300 standard deduction in addition to a new $12,000 standard deduction provided to all taxpayers. If the taxpayer is not married over 65, and not a surviving spouse, the additional deduction is $1,300 rather than $1,600. Those who are blind and over the age of 65 get an additional $1,300 for an amount of $14,600. Theres even more good news for senior taxpayers in 2019. The IRS is coming out with Form 1040SR, intended to streamline the filing process for seniors.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Also Check: Is Doordash 1099

How Much You Have To Make To File Taxes

Your first consideration is: Does my level of earnings mean I must file taxes? If your gross income for 2021 is above the thresholds for your age and filing status, you must file a federal tax return. See the table below.

Income requirements for filing a tax return| Filing status |

|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, nine states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.