Airbnb Will Report To The Irs

Whether Airbnb sends you a 1099 form or not may depend on how much you make during the year.

If you have over 200 reservations and make over $20,000 per year, Airbnb will send you an IRS Form 1099-K. If you operate multiple Airbnb accounts, you may receive more than one tax form.

These forms are sent to the IRS as well as to you and are likely to be matched against the tax return that you submit. Keep in mind that even if you do not meet this threshold, you still need to report your income on your taxes.

Tax Issues When Operating A Bed And Breakfast Or Hotel

In some cases, renting out all or part of your house or apartment can be classified for tax purposes as the equivalent of running a bed and breakfast or hotel. This will be the case if you dedicate a room or rooms in your home solely for the use of paying customers and never personally live in such rooms. You’ll also be classified as running a hotel business if you provide substantial services that are primarily for your guest’s convenience, such as regular cleaning, changing linen, or maid service during their stay.

In this event, your rental activity will be treated as a business for tax purposes. This means you’ll have to pay both federal income and self-employment taxes on your rental income, which will increase your tax burden. On the other hand, the restrictions on your deductions described above won’t apply, except that there may still be limits on any annual losses you’re allowed to deduct. Ordinarily, you’ll report your rental income and expenses on Schedule C , Profit or Loss from Business.

Obviously, the way to avoid having your rental activity being classified as a bed and breakfast is not to provide substantial services to your guestsâdon’t provide them breakfasts, clean their rooms each day, or do their laundry. Charge renters a cleaning fee at the end of their visit that is separate from their daily rental charge.

Do I Need To Charge Vat On Airbnb Letting

Yes – you have to charge VAT. This is one of the very important distinctions between normal letting and Airbnb letting. The residential rental income is exempt from the VAT in the UK. However, Airbnb is classified similar as hotels rather than typical buy-to-let residential letting. Airbnb falls within the definition of holiday accommodation and so standard rated. This means you need charge VAT at 20% on the rent you charge your lodger.

But, dont worry if your total income does not exceed VAT registration threshold which is £85,000 for tax year 2017/18. However, if your income exceeds the threshold, you need to register for VAT and file regular VAT returns to HMRC. The turnover for VAT includes the full amount you charged to the guest

VAT rules itself are quite detailed and complicated, and so you may get an exemption on a certain type of letting. For example, if the single letting is for more than 28 days, this can be claimed as exempt! So, you need to consult with property tax expert for further advice on this. UK Property Accountants provide a complete VAT solution to Airbnb landlords including VAT registration, VAT returns filing and VAT advice. Contact us if you have any queries on VAT.

You May Like: Do You Pay Taxes With Doordash

Occupancy Hotel Transient And Tourist Impact Taxes

Along with FICA and federal taxes, make sure to check with your state, city and county to see if they want occupancy taxes on short-term rentals. These taxes can apply to not only vacation rental businesses, but also people renting out a room in their personal home.

A survey done by the National Conference of State Legislatures discovered that roughly 20 states have occupancy taxes. The name and terms of this local tax can vary, but the tax usually applies for stays shorter than 30 days in most states. They are most commonly called hotel, transient room, or lodging taxes.

Depending on the location, Airbnb may collect some of these taxes for you from your customers and then send them to the right government authority. However, do not make the mistake of assuming they will. You may have to collect the taxes from your customers and turn them in to your local authority. Learn more about Airbnbâs policies on occupancy tax collection. To off set all these taxes you must discover how to write off all the business expenses you can.

Getting A Mortgage For An Airbnb Rental Property

If you are looking to invest in a property to list on Airbnb, and plan to get a mortgage, there are a few things to consider.

Many people think they can use their Airbnb income just like a normal rental income to qualify for a mortgage. But traditional lenders like banks or credit unions are not eager to provide mortgages for properties that will be rented out for short-term stays.

Most traditional lenders shy away from seasonal rentals because they cant properly assess or rely on the income for your qualification which may vary seasonally or by location or rely on strong user reviews. Therefore, they see a high risk in getting their money back if you cant make the mortgage payments.

On top of this, commercial mortgage rates are much higher than residential mortgage rates. Currently, a 5-year fixed rate for a residence is around 3%. A commercial 5-year fixed-rate sits closer to 6.5% .

Most homeowners in Canada with Airbnb rental properties will quickly see their capital eroded by the 300 basis points of difference in interest rates. Thats not even accounting for any other expenses such as property taxesor additional insurance costs incurred when owning investment real estate, as opposed to your home!

Also Check: How To Calculate Taxes For Doordash

Use Accelerated Depreciation And Cost Segregation

One deduction many property owners miss is depreciation on a rental property. This allows you to write off the cost of purchasing or improving your rental property. Depreciation and cost segregation is a deduction that is in addition to any other business expenses you might have. This can significantly add to your Airbnb business deductions.

Also, do not forget that you can claim a tax deduction on many major equipment purchases, too. If you purchased a big lawn tractor to maintain the property, then you might be able to take depreciation on it. Are you picking guests up from the airport? If you are, then a portion or all of your vehicle might count for this deduction. Furthermore, you should consult a tax accountant who specializes in Airbnb taxes to ensure youre getting suitable advice.

What Kind Of Expenses Can I Deduct

It is important to keep accurate records of your expenses throughout the process. Here are examples of documents you should keep receipts for

- Receipts for all deductible expenses, including supplies, cleaning services, etc.

- A log of how many days a property is rented, used for personal purposes, or vacant

- Receipts for each repair and improvement including date and amount paid

- A log of travel expenses allocating between rental and non-rental purposes

- If many properties, accurate division of expenses between properties.

- If U.S. mortgage, Form 1098 or other form indicating mortgage interest paid

- Property tax forms and receipts

- Proof of tax preparation fees paid in relation to rental property

In general, if you think you can deduct it on your tax return, keep a record of it.

Also Check: How Do Taxes Work For Doordash

Paying Tax On Airbnb Income

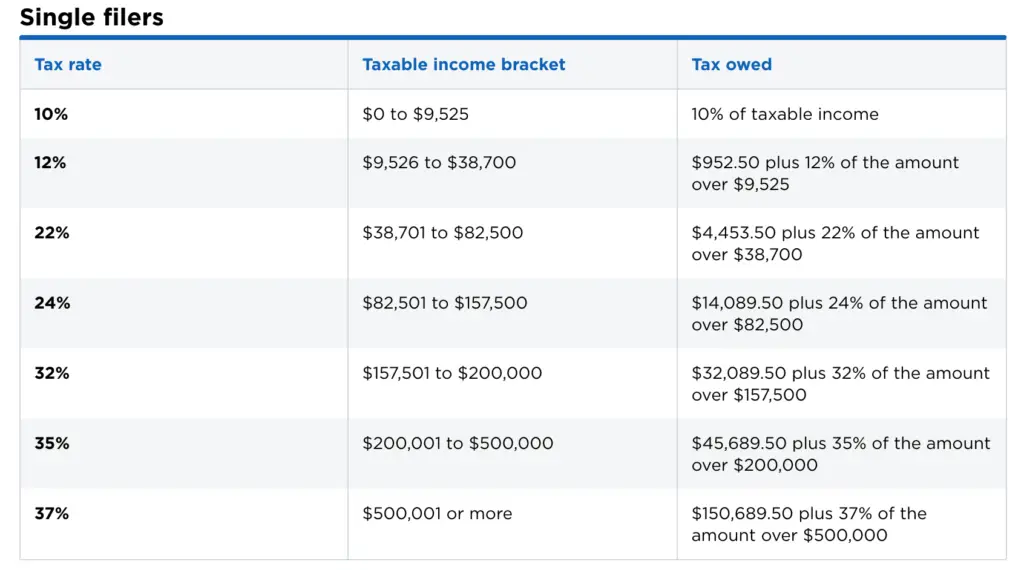

Because we have a progressive income tax system in the US, there are a couple of things to keep in mind.

- People who earn more will pay more.

- People fall into tax bracket will not need to pay the tax rate on the entire bracket.

For example, lets pretend youve made $82,500 as a single filer in 2018. This is how much you would pay:

The total taxable Airbnb income for your $82,500 will be $14,089.16.

Is Accommodation Sharing More Work Than Fun

Listing out a property on Airbnb can be creative, empowering, and a great networking opportunity. It will also supplement your income and improve a bit of cash flow, especially if located in a tourist area or on a hot rental market.

But that doesnt mean its easy money!

Like any other business, you will need capital before listing your space on the platform. New furniture, bedding, professional photographers to make your property more appealing, are all costs included in your initial investment. Keep a detailed record of all these expenses, and you will have a much easier time backing up your return claims.

Read Also: Is Doordash Taxable

What Do I Need To Keep Track Of In Order To Prepare An Airbnb Tax Return

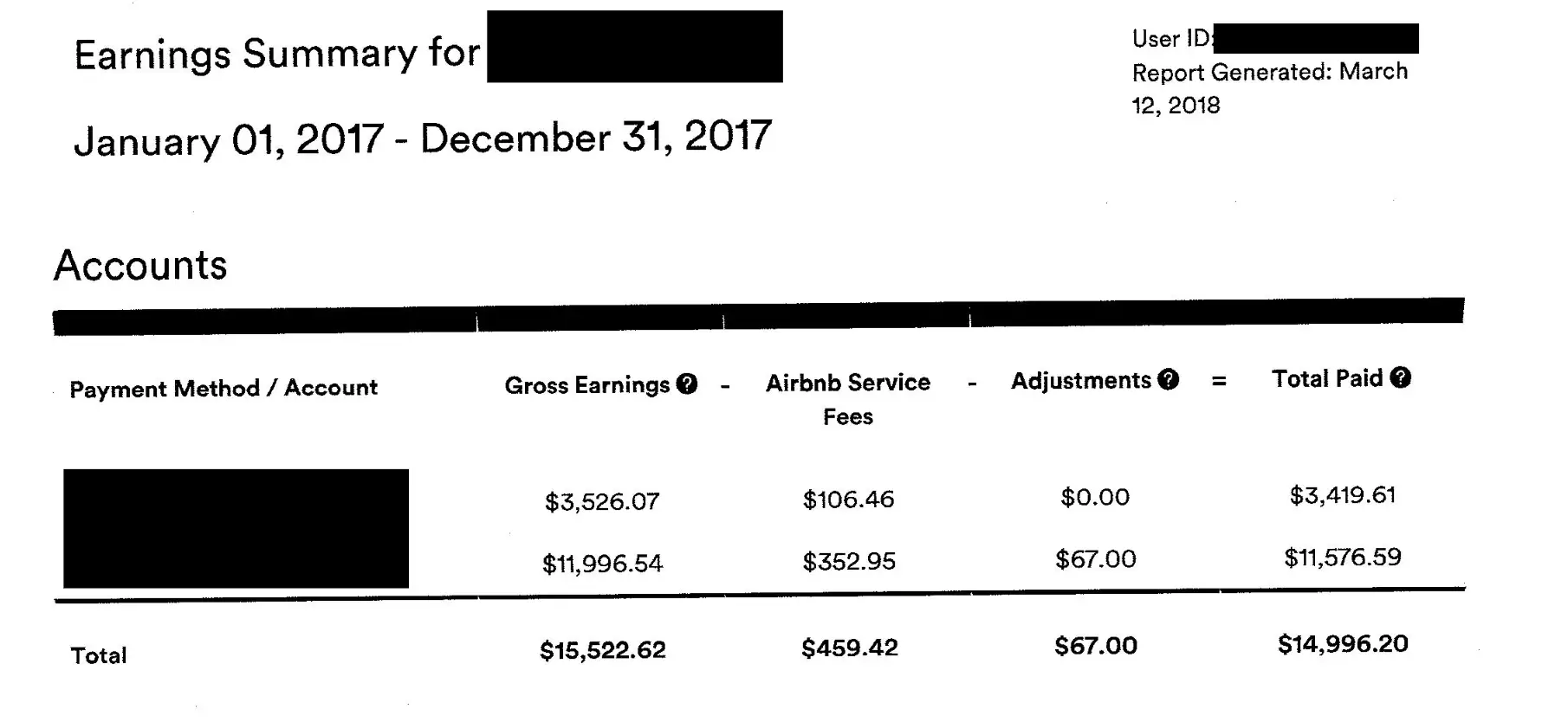

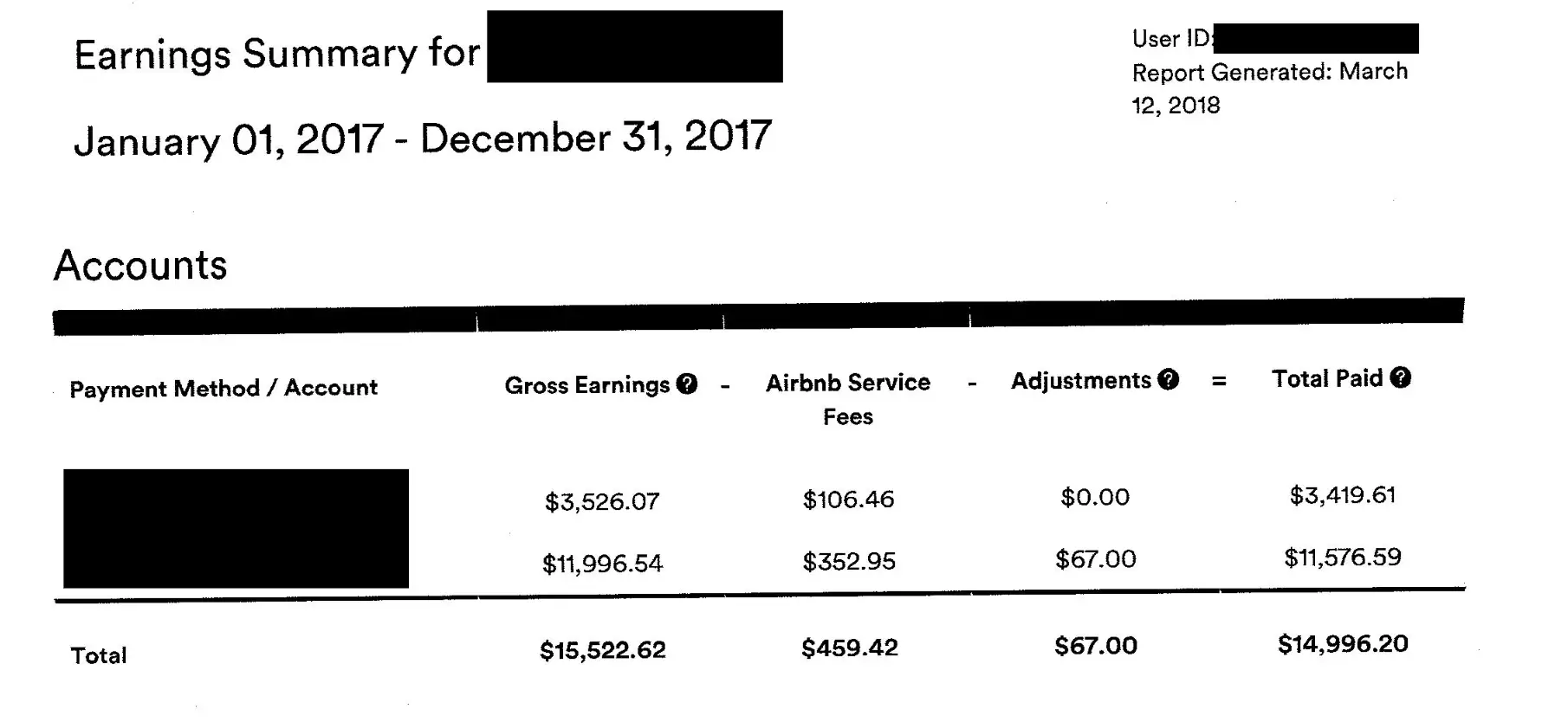

In order to prepare your Airbnb tax return, youll need to make sure to keep track of your Airbnb income, as well as, any expenses related to your Airbnb business. You can obtain records of your Airbnb rental activities simply by exporting this information from your Airbnb host dashboard.

As a business owner, there are likely a number of expenses related to your Airbnb income that youll be able to deduct. Therefore, keep all receipts and invoices related to purchases that youve made for your Airbnb business.

Keep a log of the dates in which your property was rented and was not rented out. These dates are important for determining how often your property was used for rental activities for the purposes of calculating your deductions.

Finally, youll also need to keep any tax documents that youve received from Airbnb for reconciliation purposes.

Will I Receive Any Tax Documents From Airbnb

If you earn more than $20,000 and you also successfully complete 200 or more Airbnb transactions in a calendar year, youll receive a Form 1099-K from Airbnb. Airbnb will also directly report your rental income to the IRS.

Make sure that you reconcile your Form 1099-K against the earnings reported in your Airbnb dashboard. This way you can ensure that your Airbnb tax return matches what Airbnb has reported to the IRS.

You May Like: Highest Paying Plasma Donation Center Near Me

Does Airbnb Report Hmrc

Those receiving income from any source , must declare this income to HMRC. Individuals whose Personal Allowance exceeds those of the year will have their taxes due on any amount above that amount. All you have to do is add the income from Airbnb to your total taxable income to calculate all your taxes.

Deductible Expenses For Airbnb Hosts

Here are the expenses you can deduct from your activity as an Airbnb host. This is a brief overview of these expenses. Some of them may be limited or may not be applicable to your situation.

You must be able to prove that your expenses are both ordinary and necessary to run your business. This means keeping excellent records in case of a tax audit.

Recommended Reading: Pastyeartax.com Review

How Do I Claim Airbnb On My Taxes

âItâs really important for Canadians to know that they can still prepare their own tax returns easily,â says Caroline Corbeil, Tax Expert for SimpleTax. âIf itâs a new income source for them, they donât need to go to an accountant and spend hundreds of dollars to claim Airbnb.â

SimpleTax is a Canadian tax software company looking to make the complicated tax process, simple.

What Kind Of Expenses Can I Claim If Im Renting Out A Room In My Home

If you rent out a furnished space in your home and you earn less than £7,500 a year then your income is automatically covered by a rent a room allowance so you pay no tax on it.

The limit is halved if you share the income with a partner and there are a couple of limitations:

If you have more than £7,500 of income from renting out space in your own home, then there are further options to reduce the tax you pay. And, of course, untied helps you select the options that are relevant to you.

Don’t Miss: Door Dash 1099

Now Is The Time To Fess Up

If youre a landlord or rental host via Airbnb or elsewhere and youre concerned about underpayment of tax, then now is time to come clean. HMRC take a dim view of those whove simply kept quiet, and if you do owe tax there are a number of ways forward. Remember that HMRC has the power to look back over the last twenty years of records if it needs to!

HMRC also now has full information on how much landlords have received through the Airbnb booking system. There really is nowhere to hide.

Its absolutely vital that landlords and short-term hosts understand their tax obligations and keep accurate records of their income and expenditure.

Gst/hst For Airbnb Hosts

Owners renting their home in Canada on a short-term basis will need to start collecting and submitting provincial sales taxes to the CRA once theyve passed the $30K earnings cap over four consecutive calendar quarters. Short-term rentals are defined as guests who stay in your property for less than a month at a time.

When renting their home long-term, owners should know their income is not subjected to Canadian sales tax.

Note that if you are self-employed or a business owner and already GST/HST registrant, you will need to charge sales taxes on vacation rentals regardless of your income. Unfortunately, the Airbnb platform doesnt allow hosts living in Canada to add sales taxes to their listings.

Some hosts choose to bill their guests for sales taxes as soon as they arrive. To avoid inconveniences, Airbnb recommends including any extra taxes in the nightly price. You can explain in your listing that the total price includes local sales tax. That way, your guests will know upfront how much theyre paying.

Also Check: Michigan Gov Collectionseservice

Airbnb To Collect And Send Taxes On Behalf Of Hosts

Effective October 15, 2015, Airbnb will collect and send the following taxes to the Department of Revenue on behalf of Airbnb hosts who use the website for short-term lodging sales:

- state and local retail sales tax

- special hotel/motel taxes

- convention and trade center taxes

If a host made lodging sales before October 15, 2015, the host needs to collect and send all taxes to the department for that time period.

A host still needs to register with DOR to report their rental income on an excise tax return:

- The host reports all of their Airbnb rental income under all appropriate tax classifications Retailing and Retail Sales Tax.

- The host can then claim a deduction for Gross Sales Collected by Facilitator under the RetailSales Tax classification. This deduction is equal to the rentals made through Airbnb as of October 15, 2015.

The host needs to pay any Retailing B& O tax due after taking the small business B& O tax credit, if applicable. The credit calculates automatically when the host electronically files.

A host cannot take deductions for Airbnb charges such as a service fee or commission service fees and commissions are considered a hosts cost of doing business with Airbnb.

What if I have more questions?

- Visit Airbnbs website:

Where Do I Find My Airbnb Earnings For Tax Purposes

Whether youre looking for detailed information on a specific transaction or a static report, you can view your earnings at any time from your Airbnb account.

It’s your responsibility to determine what, from your total amount earned, to report as taxable income on your tax return. We encourage you to consult a tax advisor if you need assistance deducting any non-taxable income.

Don’t Miss: How Much Should I Set Aside For Taxes Doordash

Will Airbnb Send Me Any Forms For My Taxes

Airbnb is required to send you an annual tax report on IRS Form 1099-K if you meet the following criteria:

- You are a U.S citizen, U.S. resident alien, or operating as a U.S. entity

- Your gross payments for the year were over $20,000

- You had more than 200 transactions for the year

You may also receive a 1099-K if you had taxes withheld from your payments or if you operate in Massachusetts or Vermont.

Form 1099-K reports the total amount of payments for the year, month-by-month, and any federal income tax withheld.

What Expenses Can I Deduct From My Income Taxes

It is possible that not all of your earnings as a host are taxable as income. You may be able to deduct the cost of your supplies, amounts you paid to other service providers like restaurants or entertainment venues, insurance costs, and other expenses.

We encourage you to speak to a tax advisor for more details, as there are many special rules in this area and we aren’t able to provide tax advice.

*Airbnb is not responsible for the reliability or correctness of the information contained in any links to third party sites .

Recommended Reading: Csl Plasma Taxable

Tax Tip For Occasional Hosts: The 14

Many people avoid renting out rooms in their home because they donât want to report their rental income wrong to the Internal Revenue Service. This is understandable but there is a 14 day exception rule that many donât know about.

You donât have to report your income if you:

There is a small catch, of course. If you donât report your income then you canât write off any associated expenses, but you usually can still use mortgage interest and property tax deductions to lower your tax payment. More on writing off business expenses later.

This may sound too good to be true, but itâs not. If you are skeptical, read more information from the IRS on renting residential and vacation property. You have to keep a detailed record of your rental days, personal residence and business expenses in case you get audited.

Christian Davis

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes.

Find write-offs.