What About States Without Income Taxes

Not levying a personal income tax requires tradeoffs that are often detrimental to tax fairness. It is a common misconception that states without personal income taxes are low tax. In reality, to compensate for lack of income tax revenues these state governments often rely more heavily on sales and excise taxes that disproportionately impact lower-income families. As a result, while the nine states without broad-based personal income taxes are universally low tax for households earning large incomes, these states tend to be higher tax for the poor.

FIGURE 8

Note: The nine states without broad-based personal income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Tennessee levies a limited personal income tax that only applies to interest and dividend income it is set to expire in 2021.

How Do I Pay Stamp Duty

Stamp duty is payable once you complete the purchase of the property, and in England and Northern Ireland you must pay HMRC within 14 days. To do this, you need to submit a Stamp Duty Land Tax return.

In Scotland and Wales, buyers have 30 days to make the payment for the equivalent land taxes.

In a lot of cases, your conveyancer will pay HMRC for you and will add the stamp duty charge in with all of the other fees, but it is still your responsibility to pay it on time.

What Is The Top 5 Percent Income In Canada

Recommended Reading: Efstatus.taxact.com 2019

Income Tax Provisions That Benefit Low

A key tool that states have available to enhance income tax fairness and lift individuals up and out of poverty are low-income tax credits. These credits are most effective when they are refundable that is, they allow a taxpayer to have a negative income tax liability which offsets the regressive nature of sales and property taxes and are adjusted for inflation so they do not erode over time.

Twenty-nine states and the District of Columbia have enacted state Earned Income Tax Credits . Most states allow taxpayers to calculate their EITC as a percentage of the federal credit. Doing so makes the credit easy for state taxpayers to claim and straightforward for state tax administrators.

Refundability is a vital component of state EITCs to ensure that workers and their families get the full benefit of the credit. Refundable credits do not depend on the amount of income taxes paid rather, if the credit exceeds income tax liability, the taxpayer receives the excess as a refund. Thus, refundable credits usefully offset regressive sales and property taxes and can provide a much-needed income boost to help families pay for basic necessities. In all but five states , the EITC is fully refundable. The use of low-income tax credits such as the EITC is an important indicator of tax progressivity: only two of the ten most regressive state income taxes have a permanent EITC, while all of the ten relatively progressive state income taxes provide a permanent EITC.

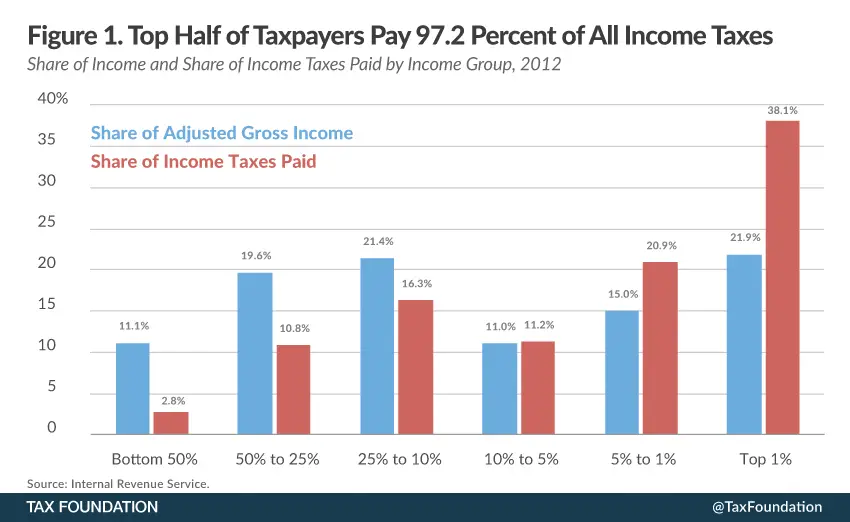

The Tax Burden For Low

Only 1.4% of the $1.45 trillion in taxes paid in 2015 was contributed by taxpayers earning less than $30,000, according to the Pew Research Center.

According to the IRS, $1.6 trillion was collected in total income taxes in 2019, but those in the lower half of the AGI spectrum reported lower incomes. It should also be noted that many taxpayers in this income group received income from the government in the form of those refundable tax creditsthe IRS paid out about $62 million in earned income tax credits in 2020 . The average payment to qualifying taxpayers was $2,461.

You May Like: How To Find Employer Ein Number Without W2

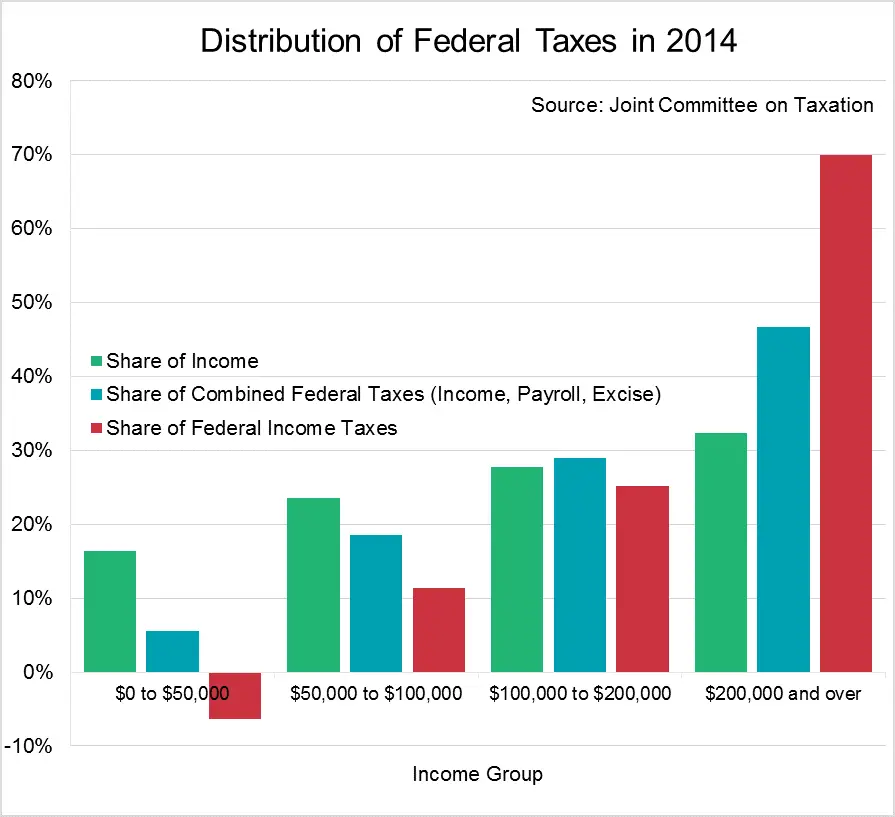

The Us Tax System Is Progressive

As a whole, the U.S. tax code remains progressive with higher-income taxpayers paying a greater share of their income in taxes. That is true despite the fact that high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures.

Major tax expenditures such as lower rates on capital gains and dividends, deductions for charitable contributions, and deductions for state and local taxes tend to benefit higher-income taxpayers more than lower-income groups. CBO estimates that the top quintile of taxpayers receive 51 percent of the value of major tax expenditures, while only 8 percent goes to the bottom quintile. However, even with substantial tax expenditures, the top one percent of American taxpayers still pay an effective tax rate of 29 percent, on average, while the bottom 20 percent of the population pay an average of 3 percent.

TPC estimates that 68 percent of taxes collected for 2019 came from those in the top quintile, or those earning an income above $163,600 annually. Within this group, the top one percent of income earners those earning more than $818,700 per year will contribute over one-quarter of all federal revenues collected.

While the fairness of the tax system is much debated, many economists agree that simplifying the tax code would help the economy. Further tax reform could promote economic growth while also making the code more simple, transparent, and fair.

Taxing Stock Buybacks Like Dividends

Policymakers also should consider reforming the preferential tax treatment of stock buybacks, in which a corporation distributes profits to shareholders by offering to buy back a certain number of shares, raising the stocks price and thereby increasing wealth for all stockholders . This policy would be an incremental step toward taxing unrealized capital gains.

Stock buybacks have tax advantages over dividends, the traditional way in which corporations distribute profits to shareholders. When a corporation pays dividends, shareholders recognize the dividends as income and pay tax on them. In a stock buyback, shareholders who sell their shares to the corporation at a gain recognize capital gain income but shareholders who choose not to sell their shares see the value of their shares rise. The deferral benefit means that their wealth increases, but they do not have to pay tax on that increase.

Moreover, foreign shareholders are generally subject to U.S. tax on dividends but not on most capital gains, including those gains that accrue from stock buybacks. As the Tax Policy Centers Steve Rosenthal recently explained, the share of publicly traded U.S. stocks held by foreign investors has tripled to 30 percent since the late 1990s, so treating buybacks as dividends is more important than ever in ensuring that foreign shareholders pay taxes.

Recommended Reading: Doordash Mileage Taxes

Income Tax Is Only A Part Of The Governments Total Tax Take

Income tax is only a fraction of the total tax take. Over three-quarters of the Governments income comes from other taxes. So Theresa Mays claim is incorrect when considering all government taxes.

There are direct taxes, such as Council Tax, and National Insurance contributions. There are also indirect taxes, such as VAT, Tobacco and Alcohol Duty, and Corporation Tax.

It is much more difficult to say what percentage of these other taxes the top 1% of earners pay. Households earning the top 10% of incomes pay about 27% in total of most direct and indirect taxes, according to Office of National Statistics data. This figure has remained roughly constant since 2009/10.

These numbers at least indicate that the top 1% of households would be paying a smaller fraction of total taxes than 27%, so Mrs Mays claim is unlikely to be correct for the governments total tax take.

The Personal Allowance If You Earn Over 100000

If you earn over £100,000, the figure of £12,570 will be reduced by £1 for every £2 earned over the £100,000 limit. If you earn £125,000, you pay Income Tax on everything and theres no tax-free allowance.

No Income Tax paid at this rate

Calculate your income tax and National Insurance contributions for the current year on GOV.UK website

If you live in Wales, your Income Tax rates are now set by the Welsh Government. At the moment, these are the same as for England and Northern Ireland for the 2021/22 tax year

If you live in Scotland, your Income Tax rates are set by the Scottish Government and are different.

Find out about the different Income Tax rates youll pay if you live in Scotland in our guide Scottish Income Tax and National Insurance

If you think you might have had Income Tax wrongly taken from your earnings, fill in the R38 form from HMRC to have it paid back to you.

Get the R38 form to reclaim tax on the GOV.UK website

If you have questions about Income Tax contact details for HMRC are on the GOV.UK website

Don’t Miss: How To Get Tax Information From Doordash

How Many Americans Do Not Pay Taxes

According to the tax policy center in 2016, there were 76.9 million American that did not pay any tax from their income wages. This would amount to 44.3% of the entire population of the United States. This has been the trend over the past few years. For instance, in 2011, there were 75.1 million individuals that paid no taxes, which is equal to 46% of the total population at the time.

Many Americans are following the rules of the tax system by not pay any income taxes. One reason for this is because they are not earning a very high income, which leads to paying no taxes to the government. When there are deductions made through the year from each paycheck earned, there is a tax refund received when the tax filings are completed.

Also, there are a number of Americans that receive tax credits and breaks, which results in paying no taxes to the government or receiving a tax refund. Some Americans are living in a no-income-tax state, which results in them not having to pay income taxes. A few examples of these no-income-tax states would include Florida, Texas, Alabama, Indiana, Tennessee, and Arizona.

The states listed above charge taxes on interest income, dividend, and capital gains. However, if there are no investments or income earned, there are no taxes paid by the individual.

Measuring The Distribution Of Taxes In Canada: Do The Rich Pay Their Fair Share

There is a common and mistaken impression in Canada that the countrys top earners are getting away with paying relatively little tax. This misperception has been fuelled by governments, especially the current federal government, which has invoked tax fairness to justify recent tax changes such as the creation of a new and higher top personal income tax rate of 33 percentan increase from the previous top federal rate of 29 percent.

The fact is that Canadas top income-earners pay a disproportionateand growingshare of all taxes collected by government.

Measuring the Distribution of Taxes in Canada: Do the Rich Pay Their Fair Share? finds that this year, the top 20 per cent of income earners in Canadafamilies with an annual income greater than $186,875will earn 49.1 per cent of all income in Canada but pay 55.9 per cent of all taxes including not just income taxes, but payroll taxes, sales taxes and property taxes, among others.

The discrepancy is even more pronounced for the top one per cent of earners. While this group will pay 14.7 per cent of all taxes in 2017 , it will earn a smaller percentage of all income.

When looking at income taxes alone, the top one per cent will pay 17.9 per cent of all federal and provincial income taxes, while the bottom 50 per cent will pay nine per cent of all income taxes this year.

This is the final chapter in a new book on income inequality published by the Fraser Institute.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Making More Of The Income Of The Wealthiest Taxable

Policymakers can change the tax code in several ways to treat some or all of the unrealized capital gains of the wealthiest households as taxable income. One is to make the gains taxable each year, as Senate Finance Committee Chairman Ron Wyden and others have proposed by shifting to a so-called mark-to-market system for taxing capital gains.

President Biden proposes a more modest approach. He would leave deferral in place so that, each year, wealthy people with large unrealized capital gains would continue to pay no tax on the increase in their wealth while they are alive. Instead, Biden would require that the wealthiest people pay income taxes on this untaxed income from unrealized capital gains when they die. Specifically, his proposal would eliminate stepped-up basis at death for unrealized capital gains of more than $1 million for an individual or $2 million for a married couple .

By letting wealthy people avoid paying tax on their unrealized gains during their lifetime, the Biden proposal to tax these gains at death would still result in a lower effective tax rate than if the gains were taxed each year, just as wage earnings are taxed each year. The conservative Tax Foundation has noted the benefit of deferral to wealthy households, explaining in 2019 that deferral matters a great deal. This is because deferral allows a taxpayer to delay paying tax for years even while the asset appreciates and earns income.

The Share Of Income Tax Contributed By The Top 1% Has Generally Been Rising

You might see this kind of claim a lotincluding during last weeks Question Timereferring to how much income tax the top 1% of earners are paying.

This year the top 1% will pay 27% of all the income tax the government takes in. Thats down slightly on last year, but higher than the share in previous years.

But this is only part of the picture. Income tax might be the governments biggest single source of income, but three-quarters of the governments revenue comes from elsewhere.

Also Check: Mcl 206.707

State Local And Territorial Income Taxes

Income tax is also levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income. Some state and local income tax rates are flat and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based on a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax on payment of wages.

Impact Of The Financial Crisis

During the financial crisis from 2007 to 2009, wages fell furthest among the top 0.1% and 1% of earners. In 2020, the top 0.1% had still not yet bounced back to what they earned in 2007.Among the top 5% of earners, wages grew 13.4% since 2007, the year before the Great Recession. Those in the top 10% saw 16.5% growth.

In the decade since the recovery from the Great Recession , the bottom 90% saw annual wage growth of just 1.7%, compared to the top 1.0% and top 0.1%, which experienced 11.2% and 5.8% growth, respectively.

You May Like: Http Efstatus.taxact.com

The Kind Of Tax Matters

State and local governments seeking to fund public services have historically relied on three broad types of taxes: personal income, property, and consumption . States also rely on a range of other tax and non-tax revenue sources such as corporate income taxes, estate and inheritance taxes, user fees, charges, and gambling revenues. A few states rely heavily on non-traditional tax sources, such as severance taxes on the extraction of natural resources, which are not included in this analysis.

FIGURE 6

As ITEPs analysis of the most and least regressive tax states shows, the relative fairness of state tax systems depends primarily on how heavily states rely on these different tax types. Each of these taxes has a distinct distributional impact, as the table on this page illustrates:

Personal Income Tax Rate Structure

Of the states currently levying a broad-based personal income tax, all but nine apply graduated tax rates . Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah tax income at one flat rate. While most of the Terrible 10 states achieve membership in this club by having no income taxes at all, two of them Pennsylvania and Illinois achieve this dubious honor through their use of a flat-rate tax.

However, using a graduated rate structure is not enough to guarantee an overall progressive income tax some graduated-rate income taxes are about as fair as some flat-rate taxes, and some even less fair. The level of graduation in state income tax rates varies widely. As does the level of progressivity. This is illustrated by a look at the income tax structures in the District of Columbia, Pennsylvania, and Virginia, three jurisdictions with income taxes whose wide-ranging structures result in very different distributional impacts.

The District of Columbias income tax is quite progressive. Its six-tier graduated tax rates range from 4 percent to 8.95 percent. Because the top tax rate of 8.95 percent is a millionaires tax, most District residents pay a lower top rate. And most of those at the bottom of the income scale are held harmless by a generous Earned Income Tax Credit provided at 40 percent of the federal credit for workers with children and 100 percent for workers without children in the home.

FIGURE 7

Don’t Miss: Do You Pay Taxes On Doordash