Expand Passive Income Opportunities

Investment income represents an important share of overall earnings, so making the most of each opportunity ultimately adds to personal wealth. Professional guidance is suggested for inexperienced investors striving for the best returns. In fact, even savvy participants benefit from sage financial counseling. Building diversified holdings, for example, protects passive returns by balancing risk, so advisors are likely to suggest a blended portfolio comprised of various investment types. Annuities, 401K investments and mutual funds built of stocks and bonds each provide passive income.

Business partnerships and past efforts you’ve made to create residual income furnish passive streams, if everything goes as planned. Royalties and other income-generating publishing rights can also lead to ongoing earnings, protecting authors and composers with compensation.

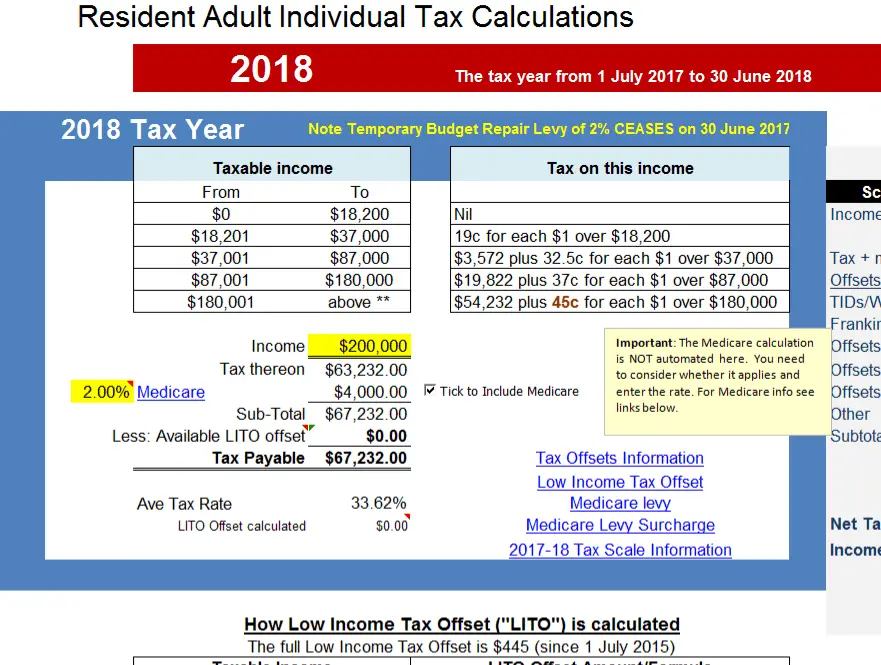

Tax As % Of Income : 000

Did you know that you may not pay the same tax rate onall your income? The higher rates only apply to theupper portions of your income.

TaxAct Costs Less: 20% less or File for less claim based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 10/5/2021. $15 less claim based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 10/5/2021.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Over 80 Million Returns Filed: Based on e-filed federal returns through TaxAct Consumer and TaxAct Professional software since 2000.

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

You May Like: How Much Is Doordash Taxes

Using The Tax Calculator

To start using The Tax Calculator, simply enter your annual salary in the “Salary” field in the left-hand table above. If you know your tax code you can enter it, or else leave it blank.

If you do any overtime, enter the number of hours you do each month and the rate you get paid at – for example, if you did 10 extra hours each month at time-and-a-half, you would enter “10 @ 1.5”. 5 hours double time would be “5 @ 2”. The Fair Labor Standards Act requires that all non-exempt employees are paid overtime rates of at least one and a half times normal wage for any work over 40 hours per week. More information here.

Select your filing status from the drop-down. Choose whether you are filing as an individual , as a married couple filing a joint return, as a married individual filing separately from your spouse, or as the head of household.

Choose the number of dependents you have, excluding yourself and your spouse, who are already included in the default standard deduction. If you have any other deductions enter the monthly amount into the deductions field.

You can read more about the thresholds and rates used by The Tax Calculator on the about page.

Disclaimer: The Tax Calculator is for illustrative purposes only. No guarantee is made for the accuracy of the data provided. Consult a qualified professional financial advisor before making any financial decisions.

Registered in England and Wales no. 8436708 Terms and Conditions and Privacy Policy

What Is The Average Income In Australia

The median monthly household income in Australia is $7,391.25 before tax and other deductions. This works out to a salary of $88,695 per year although it’s important to remember that this counts for households, not individuals. 50% of people also earn less than this figure, and the statistics only include those people who earn enough to pay income tax.

Most taxpayers tend to be paid an annual salary, and all employees should earn a minimum wage that’s set based on their industry or occupation. The currentAustralian National Minimum Wage is $19.84 per hour. Full-time workers usually work 38 hours or more per week. This means that a full-time worker on minimum wage could expect their pre-tax earnings to total $753.80 per week, $3,266.46 per month, or $39,197.60 per year.

These figures put Australia 3rd in theInternational Labour Organisation’s 2018 ranking of the highest minimum wage by country.

Australia is a large country with six states and a diverse workforce. While its immigration system can be hard to navigate, the country attracts many so-called working holiday makers. Australia’s capital city of Canberra has a thriving construction sector with many jobs also available in the Australian Defence Force. The famous city of Sydney is also a popular destination for workers, and it only ranks as the 66th most expensive global city to live in according to the Mercer 2020 Cost of Living Survey.

Recommended Reading: Do You Have To Pay Taxes On Donating Plasma

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

How To Calculate Federal Tax Based On Your Annual Income

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here..

iCalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. The tax calculator provides a full, step by step, breakdown and analysis of each tax, Medicare and social security calculation. This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated. The online tax calculator makes filing your annual tax return that little bit easier as well as being a great tool for comparing salary after tax calculations when looking for a new job or looking at how your tax return may look after a pay rise.

You May Like: Is Selling Plasma Taxable

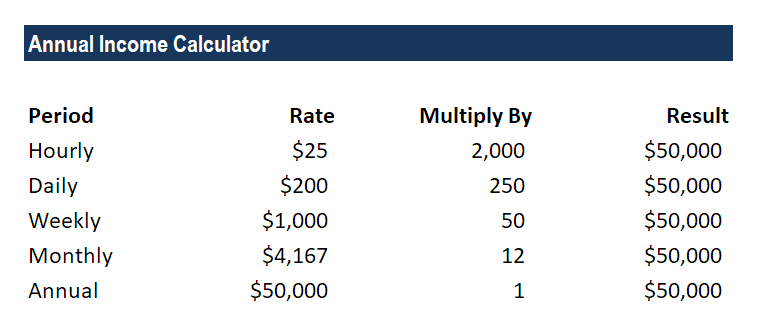

Determine How You’re Paid

The first thing to figure out is whether you receive pay by the hour or by the year. If your pay is the same amount each time you receive a paycheck, then you are a salaried employee. This also applies to things like pension whereby you receive the same amount each time. Figuring out your annual gross income is fairly simple in these scenarios, and the formula is in the below steps.

However, if your income fluctuates based on the hours you worked, or if you’re an independent contractor that charges different amounts for each job, then you’ll need to use a different formula.

Related: How Does a Pension Work?

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

You May Like: Plasma Donation Taxable Income

How To Calculate It

Multiple variables determine your annual net income, including any sources of income. Money earned from retirement contribution funds, grants and scholarship money, Social Security payments, stock market investments, gambling earnings, and the interest you collect from your checking accounts are just some of the forms of payment that constitute your total net income. These are added to your income after deductions.

The following are the four basic steps to follow to compute your annual net income:

Step 1: Determine your annual salary.

If your employer pays you by the hour, multiply your hourly wage by the number of hours your work each week. Then multiply it by 52 for the total number of weeks in a year.

Step 2: Add your additional income to your gross annual salary.

Add any extra payments you receive, like part-time job wages, payments from a trust fund, or royalties to the gross annual salary you determined in step one.

Step 3: Subtract the sum of all the deductions taken from your paycheck from your final gross income.

Don’t be afraid to reach out to your employer or the HR department if you’re unsure what these are.

Step 4: Subtract your daily expenses from your final gross income. The product is your annual net income.

If the number is positive in value, the business is indeed making a profit. This number is important to investors since it indicates the businessâ performance.

Canadian Payroll Calculator 2021

Canadian Payroll Calculator the easiest way to calculate your payroll taxes and estimate your after-tax salary.

If you have a job, you receive your salary through the monthly, bi-weekly or weekly payroll. But do you know what is payroll and how is it calculated? How do you calculate your take-home pay? How do you calculate your payroll deductions? We know, and well show it to you.

Payroll is the process where the employer calculates the wages and distributes it to the employees. The company withholds taxes, CPP and EI contributions from the paycheque, and the remaining amount is paid to the employees.

In Canada there are federal and provincial income taxes paid, while CPP is a contribution to the Canada Pension Plan, and EI is a contribution to the Employment Insurance program.

The federal income tax deduction depends on the level of the annual income, and it ranges between 15% and 33%. The provincial income tax deduction also depends on the annual income, but it has different rates from province to province.

Contributions to the Pension Plan guarantees that the contributor or his/her family will receive a partial replacement of earnings in case of retirement, disability or death. Residents of Quebec are contributing to the Quebec Pension Plan , while all other Canadian workers are contributing to the Canada Pension Plan .

Recommended Reading: How Much Tax Do You Pay On Doordash

Financial Facts About Canada

The average monthly net salary in Canada is around 2 997 CAD, with a minimum income of 1 012 CAD per month. This places Canada on the 12th place in the International Labour Organisation statistics for 2012, after France, but before Germany.

In Canada income tax is usually deducted from the gross monthly salary at source, through a pay-as-you-earn system. Self-employed individuals are required to file an income tax return every year. The deduction includes the Federal and Provincial income taxes.

Canada has one of the most stable business climates in the world and is regarded as an attractive investment destination, according to Forbes and Bloomberg. The World Economic Forum declared the country’s banking system to be the most prosperous in the world, for seven years consecutively.

According to the Organisation for Economic Co-operation and Development , Canada is the third best country to live in the world, with the best quality of life, after Australia and Sweden. Canada is often praised for its universal health care system, its clean and friendly cities, its world-class universities, and its multicultural population.

Canada is an immigrant-friendly country with a immigration system that recognizes the importance of immigrants and their potential contribution to the Canadian society. According to official statistics, over 28% of the population was born outside the country, with most immigrants coming from China, India, and the Philippines.

Annual Net Income Calculator

Some money from your salary goes to a pension savings account, insurance, and other taxes. Net income is the money after taxation.

There are two ways to determine your yearly net income:

Set the net hourly rate in thenet salarysection or

Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Then enter the tax rate for both.

Remember to adjust the first two fields of the calculator as necessary. The annual net income calculator will display the result in the last field.

Don’t Miss: Michigan.gov/collectionseservice

Other Ways To Use The Yearly Salary Calculator

The annual income calculator’s main aim is to help you find your yearly salary. However, it can calculate the rest of the variables – it depends on which values you input first.

To calculate the hourly wage:

Reload the yearly income calculator if you’ve been using it already. Use the circular arrow below the calculator.

Fill in the last field of the annual salary calculator first.

Adjust the working hours and working weeks as needed.

You’ll see the hourly wage in the first field of the annual income calculator.

How to calculate working hours

If you’d like to determine how many hours per week you’d have to work to earn a particular amount of money per year:

Reload the calculator. Clear the default number of working hours.

Set the number of weeks you’ll work in a year.

Input your annual income and hourly wage.

To calculate working weeks:

Expect Regular Raises And Performance Reviews

Corporate policies are all over the map, in terms of who gets raises and when. Small scale employers, for example, may rely on informal guidelines to manage human resources, so regularly scheduled reviews and pay incentives may not be in-place. Even multinational organizations are rethinking annual reviews, prompting proactive moves from employees seeking maximum take-home pay.

When annual raises are not a standard part of an employment arrangement, management and staff work together finding added value for workers. Company-provided lunches, paid time off and other coveted perks are used to augment earnings when raises are on hold. And though these feel-good measures do result in savings and increased take-home pay, incremental salary raises should also be included, as part of a reasonable compensation package.

Also Check: Efstatus Taxactcom

Usage Of The Payroll Calculator

Please note that the calculator on this site is for informative purposes only and is not intended to replace professional advice.

If you want to use the tax calculator instead, .

How Much Are Taxes

Social Security and Medicare taxes make up FICA tax. The FICA tax rate is a flat percentage of 7.65% that you hold from each employees wages. Of this 7.65%, 6.2% goes toward Social Security tax and 1.45% goes toward Medicare tax. Keep in mind that there is a Social Security wage base and additional Medicare tax you may need to apply for employees who reach a certain threshold.

The amount of federal income taxes varies based on factors like the employees pay, Form W-4 information, and filing status. When each employee began working for you, they should have filled out Form W-4, Employees Withholding Certificate. Use each employees Form W-4 and the federal income tax withholding tables in IRS Publication 15 to figure out how much the employee owes in federal income taxes.

State and local income taxes vary by state and locality. You will need to check with your state for more information.

Read Also: Do You Have To Pay Taxes On Plasma Donations

What Is Operating Net Income

Operating net incomeâalso referred to as âEarnings Before Interest and Taxesâ or âEBITââis very similar to net income but minus unrelated account income and expenses, such as income tax, interest income and gains or losses from sales of fixed assets.

To calculate operating income, you would use the following formula:Net Income + Interest Expense + Taxes = Operating Net Income

Operating net income is typically the figure lenders and investors will consider before making financial decisions as it shows how profitable the company is.

Related: