What Receipts To Keep For Taxes

As much as theyâd love to take your word for it, the IRS requires that you keep documentation that backs up the income, deductions, and credits you report on your tax return.

Here are the main types of records you should hang on to:

- Receipts

- Company health, safety, and any other regulatory documents

- Annual reports

Because the burden of proof is on you to back up every item on your tax return with documentation, the best approach to recordkeeping for small businesses is to try to keep as many records as you can.

Need some help with your bookkeeping and recordkeeping? Check out Bench. Weâll do your bookkeeping for you!

How To Organize Your Tax Records

As youre working on your taxes, its crucial to remember that you may need to access them again in the event of an audit by the IRS. With that in mind, a shoebox with loads of papers or files scattered throughout your hard drive is not a good move.

Instead, start a filing system that organizes all your records by year and by category, such as bank statements, income forms and receipts. Throughout the year, make sure youre maintaining that system so that everything makes sense when you file and if the IRS requests something from the past, youll be able to track it down quickly.

If youre still dealing with a heavy amount of paper, there are plenty of apps to digitize and simplify your life, such as Expensify or CamScanner.

How Long Should You Keep Employment Tax Records

The IRS suggests retaining employment tax records for a minimum of four years after the tax becomes due or has been paid, whichever is later. Employment tax records include:

- employees’ names, addresses, social security numbers, dates of employment, and occupation

- wages, annuities, and pensions paid to employees with dates of payment

- taxes withheld including FICA and Medicare

- records of tips and fringe benefits paid if applicable to your business, and

- 1099 documents for independent contractors.

Read Also: How Can I Pay My Taxes Owed

How Long To Keep Business Documents

If you run a business in France, you must keep all your accounts, invoices, orders, and client details for a minimum of 10 years . You should keep all details of employees contracts, salaries, pay slips, etc, for a minimum of five years .

Crucially, even after you have closed a business in France or ceased working as an auto-entrepeneur, you must keep all your business records for a minimum of five years after closure.

Paper Vs Electronic Records

![[Financial Friday] How long should I keep financial records ... [Financial Friday] How long should I keep financial records ...](https://www.taxestalk.net/wp-content/uploads/financial-friday-how-long-should-i-keep-financial-records.png)

In the digital world, recordkeeping is simplerand takes a lot less physical space! The IRS has determined that electronic records are the same as paper originals. In some cases, electronic is preferred, since paper receipts can fade and become illegible over time. But, if youd prefer to store all your files digitally, feel free to do so.

However, one word of caution: its easy to rely on your financial service provider to access your account information and history. For example, you might log into your online account to view monthly or yearly statements.

Be sure to check the terms of each account to see how long they keep historical records. If its shorter than 7 years, you may need to download and save an annual statement in order to have it on hand for tax recording.

Lastly, keep in mind that youll need to keep originals for important documentation. These are things like articles of incorporation, business licenses, partnership agreements, and any signed contracts.

Many companies store such documentation in a corporate binder. Keep the binder in a safe space . Its one of the first things that will be requested should you want to sell your company or be involved in an audit or lawsuit.

Freshly picked for you

Also Check: Can I File Past Years Taxes Online

How Long Should I Keep Financial Documents

Patrina Dixon, CFEI and owner of P. Dixon Consulting, LLC recommends keeping any important financial documents for up to seven years in case you’re audited.

You can store your paper documents in a locked filing cabinet. Safe deposit boxes may be worth exploring if you have important business documents. However, it’s generally not recommended for documents you want others to have easy access to, like your will or final wishes.

Quick tip: If you are considering getting a safe deposit box, read through our guide first to learn about pricing and how to manage a safe deposit box properly.

Dixon also notes voided checks, in particular, need to be voided and stored properly.

“You should have ‘VOID’ written out across the entire check and with a red marker if possible,” says Dixon.

Dixon adds that you may keep the voided check until you know that any following checks have been processed.

After seven years, you may discard financial papers. However, you’ll need to take precautions to ensure your personal information is safe. Instead of simply throwing away your documents, shred them first and make sure your personal information can’t be deciphered.

Quick tip: If you would prefer to minimize your paper trail, Dixon advises opting for online bank statements. Some financial institutions have a paper statement fee, so you might avoid a monthly bank fee, too.

How To Shred Your Documents

When you’re ready to dispose of your bank statements, make sure you actually shred them. Just ripping them in half, isn’t going to stop identity thieves from piecing together your personal information. Shredders are now small, portable, and cheap.

If your paper volume is enormous, shredding services can be bought. Some banks will shred your statements for free on request.

You May Like: Can International Students Get Tax Return For Tuition

How Long To Keep Financial Records

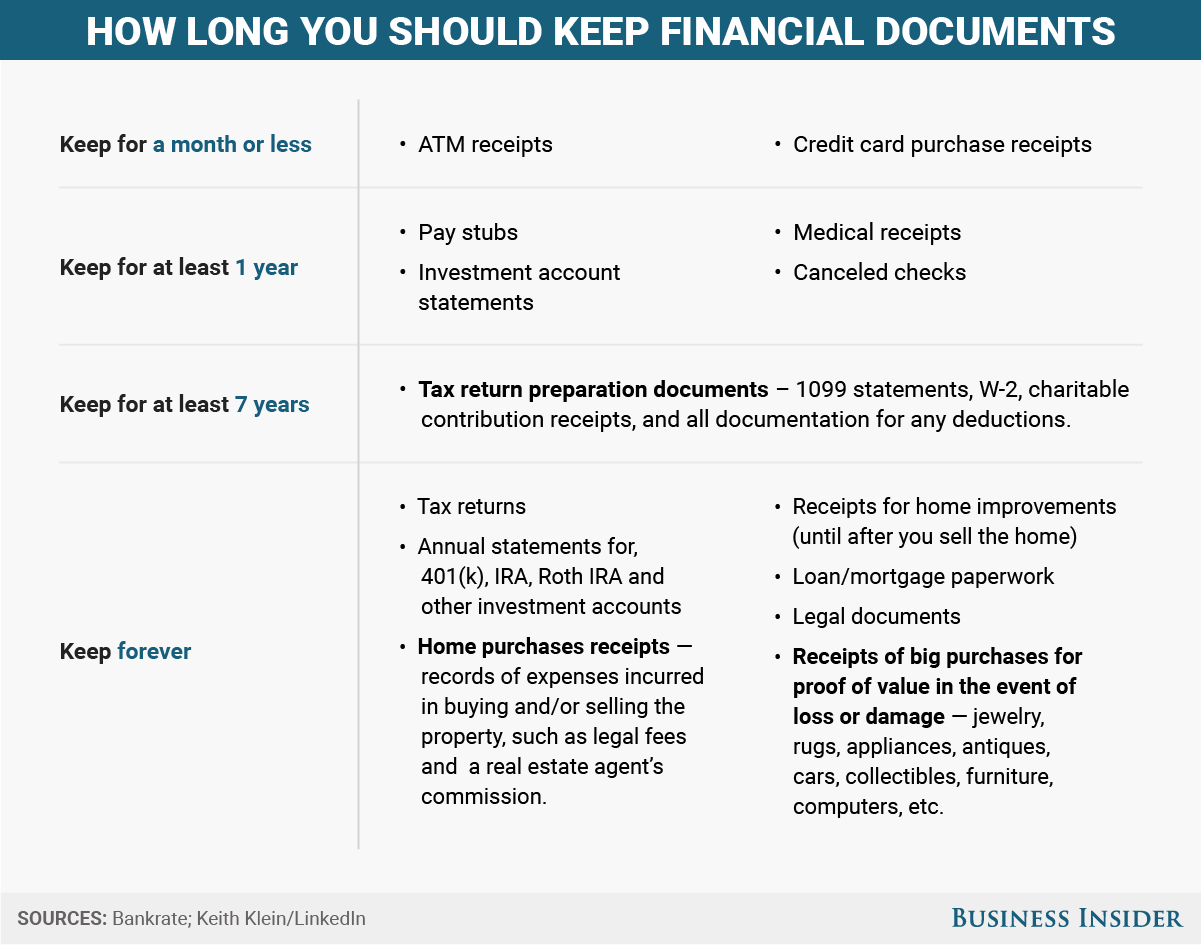

It can be tricky to figure out how long to keep financial records, because the length of time you need to have a document on hand varies according to its contents. For example, you need to save tax documents for several years, but it’s often fine to discard routine utility bills shortly after you’ve paid them.

A good rule of thumb is that documents you might need later for legal or tax purposes should be kept on file.

How Long Should You Keep Your Tax Records

You should keep your tax records for at least 3 years from the due date of the return or the date the return was filed, whichever is later . If the IRS requires you to keep your federal records for a longer period, you should keep your state records for the same period of time. More information on federal recordkeeping.

Recommended Reading: How To Pay My Indiana State Taxes

What About Electronic Records

In today’s digital age, both paper and electronic records are acceptable forms of documentation. Make sure that records you have scanned into your computer files are legible, however.

The IRS recommends you back up your paper documents electronically in case of flood, fire, or other disaster. Choose a method of electronic storage–whether on your computer, in the cloud, or on a thumb drive or external hard drivethat offers the most safety and security against identity theft. Make sure your computer is password protected, and consider using an encryption program like Microsoft BitLocker, Apple FileVault, or a third-party program. Choose a well-protected cloud storage program, and use a unique and complex password with two-factor authentication.

How Long To Keep Tax Records And Other Documents

You’ll also want to safely keep other documents for the right amount of time

Many Americans find the tax season stressful, but this years filing process could be worse than ever.

As a result of the pandemic, the IRS faces a huge processing backlog, according to a January 2022 National Taxpayer Advocate report, while a shortage of staff means that many taxpayer queries remain unanswered. A more recent report found that the backlog had ballooned to nearly 24 million returns for the 2021 tax year.

Given the difficulties of dealing with the IRS, this is not a good time to throw away any tax-related paperwork, says Dan Herron, a CPA and financial planner in San Luis Obispo, Calif.

So its crucial that you keep track of tax forms and other documents that come in. Many Americans, for example, should keep an eye out for a new IRS form, Letter 6419, which details how much you received in expanded Child Tax Credit payments in 2021.

You should also be sure that your tax documents are well-organized. Greg McBride, chief financial analyst at Bankrate, suggests that you put all your W-2 forms together in one place, and do the same for your 1099 forms and brokerage account statements.

If you havent yet started on your taxes, getting your paperwork in order will reduce stress and make you more efficient, McBride says.

Recommended Reading: How Old Do You Have To Be To File Taxes

Why Should You Maintain Tax Records

- To help you prepare an accurate tax return and pay the correct tax

- To ensure you can prove all items on your return with adequate records or sufficient evidence

- To address any questions that come up if Virginia Tax selects your return for review

- To have any necessary supporting documentation in case you need to file an amended return

How Long Should I Keep Tax Records Medical Bills Financial And Bank Statements

Like me I am sure you get tons of bills and statements in the mail or delivered electronically. Most times you just action and then toss them. But you may in fact be creating legal or tax issues by not keeping certain documents. Where possible you should try and retain a hard copy and electronic version of all the relevant documents listed below.

Tax Records Business and Personal

The IRS only requires 3 years of tax records if you are audited. But if they find you are under-reporting your income they can request up to 7 years of tax records. However, where the IRS suspects fraudulent or missing returns, there is no limit on how far they can go back.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

So to play it safe, and assuming most people are not tax fraudsters, keep all your tax related records for 7 years. I use old shoe boxes stored in my basement to keep tax records related to a certain year. Since I also have business related taxes, I keep an extra shoebox for business related tax records. I also keep electronic copies of the actual tax returns and key W2 documents.

Legal and Identification Documents Birth Certificates, Passports, Social Security cards etc

Home Improvement Records

Utility Bills

Recommended Reading: Why Have I Still Not Gotten My Tax Return

Where Should I Store My Tax Documents

You can organize your tax documents in any number of ways, ranging from a digital solution to a shoebox. What matters most is that your documents are in one location and are classified in a way that lends itself to easy access.

That said, a digital solution is far superior to hard-copy filing. You dont have to worry about losing or destroying documents. With a cloud solution, you can access them from your phone, computer, or tablet. You can organize everything neatly into folders and sort by date.

Regular Statements Pay Stubs

Keep either a digital or hard copy of your monthly bank and credit card statements for the last year. Its a good idea to keep your digital copies stored online if you choose to go paperless. You should also hold on to pay stubs so that you can use them to verify the accuracy of your Form W-2 when tax season arrives.

Also Check: When Can We File Taxes 2021

Personal Accounts And Records

You should keep documents relating to your work and salary, bank statements and other banking documents , and details of insurance claims for up to five years. You should also keep rent reciepts and contracts, insurance certificates, electricity and gas bills, and loan repayments for the same amount of time.

Its a good idea to hang onto invoices and recipts for work or repairs carried out on your home or car, as well as any sales receipts, at least for the period of the guarantee.

The information in this article is provided for informational purposes and does not constitute legal, professional or financial advice. We encourage you seek the advice of a relevant professional before acting on any of this information. Any links to other resources are provided as sources and assistance, and are not intended as endorsement.

What Records Should You Keep

You should keep copies of your tax returns, and all supporting documentation. The list below includes some of the tax records you should maintain.

- Income: Keep forms W-2 , Forms 1099, financial statements, bank statements, contacts, and other documents to verify income reported on your returns.

- Deductions and credits: Keep cancelled checks, bank statements, paid invoices, sales receipts, Forms 1098 , loan documents, financial and legal documents, mileage logs, appointment books, credit card statements, tax credit certificates, and other documents to verify expenses and credits claimed on your returns.

Recommended Reading: How Much Is Federal Payroll Tax

Keep Bank And Credit Card Statements For One Year

Having all of your statements available when you prepare your taxes will help you confirm income and track deductible expenses accurately.

This holds true whether you receive statements by mail or electronically. If you choose paperless statements, you can access them online, possibly going back months or years if your bank or credit card issuer keeps them available. Alternatively, you may download and store your statements in a password-protected file or print them out. Either way, you’ll be able to access them for as long as you decide to keep them.

If you’ve used any statements to help calculate your taxes, save themalong with your tax returnfor at least seven years, in case the IRS has any questions. See Experian’s guide to storing financial documents for tips on how to maintain them safely and securely.

Other Reasons To Hold On To Bank Statements

Keep bank statements for future lenders, landlords, and others with whom youd like to start a financial relationship. When determining if you can afford the payments for a loan, a rental home, or something else, they may request to see your bank statements to verify your income.

Bank statements can also come in handy to show proof of purchases made by debit card, check, or bank transfer should someone claim you owe them money. And if you need to use a product warranty or file an insurance claim, a bank statement could help by confirming you made the connected purchases.

Read Also: Where Can I Mail My Tax Return

How To Dispose Of Old Financial Documents

Clearing your home of piles of old, useless paperwork is a wonderful feeling, but dont scrap it with your weekly garbage collection. Most of these documents contain personal information you dont want to have exposed.

According to a Federal Trade Commission report, over 3.2 million consumer reports were filed with the Consumer Sentinel Network in 2019, and 20% of them involved identity theft. Throwing away documents with your trash exposes your information to anyone willing to do a little dirty work to steal your identity. You might not realize how much information is present on your old bills, statements, voided and canceled checks and other financial documents.

Heres what could be present on the documents you want to throw away:

- Full names

Business Checking And Savings Account Statements

Business checking and savings accounts have a greater significance than personal statements. Businesses are often tied to employees, partners, contractors, and other entities. And, businesses are open to stricter tax laws under the IRS and are more likely to face auditing.

Keeping track of business account statements is key until all affairs are in order. Making sure everythings settled could take months or years, and you might still want to keep a copy just in case. This is especially true if the business is now under someone elses control.

You May Like: How To Pay My Federal Taxes Online

Secure Your Loved Ones Documents

Nobody wants to think about paperwork after losing a loved one. However, youre the only one able to make sure these documents stay safe and secure. Its easy to focus on the funeral and other arrangements, but dont overlook these documents above.

Keeping track of your loved ones forms protects them from fraud and helps with legal recordkeeping. This is a difficult time. Make sure youre following the right steps to ease the burden of the entire family.

If you’re looking for more, read our guide on how long to keep tax records after a death.

Post-planning tip: If you are the executor for a deceased loved one, handling the details of their unfinished business such as dealing with bank statements can be overwhelming without a way to organize your process. We have a post-loss checklist that will help you ensure that your loved one’s family, estate, and other affairs are taken care of.

Categories: