Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive confirmation for file their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

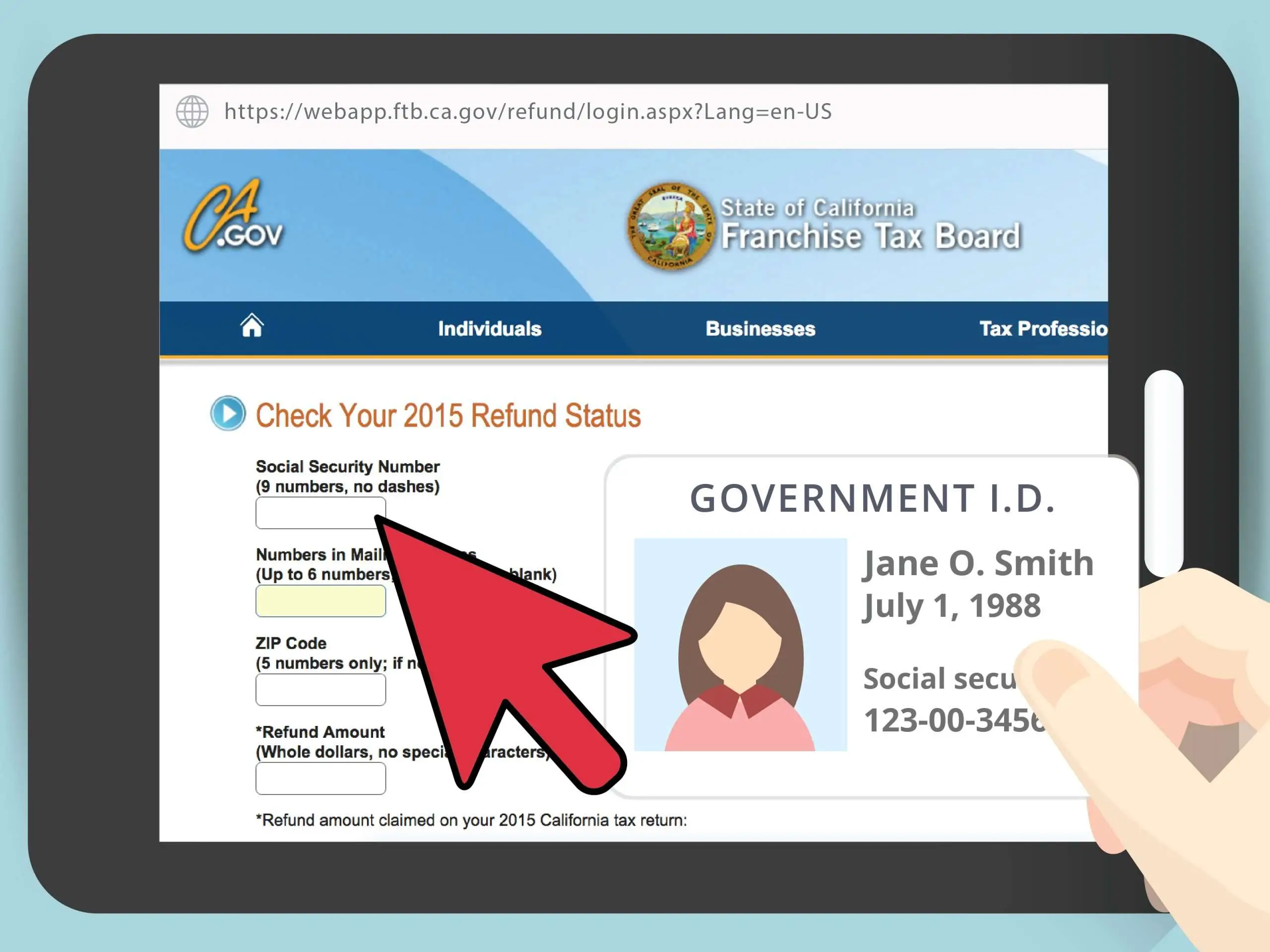

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Needs a correction to the Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation PDF, which could take up to 14 weeks to process

- Needs further review in general

We will contact you by mail when we need more information to process your return. Recovery Rebate Credit corrections and 2019 income validation does not require us to correspond with you but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund and in some cases this work could take 90 to 120 days.

Read Also: Efstatus.taxact

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

See how our return process works:

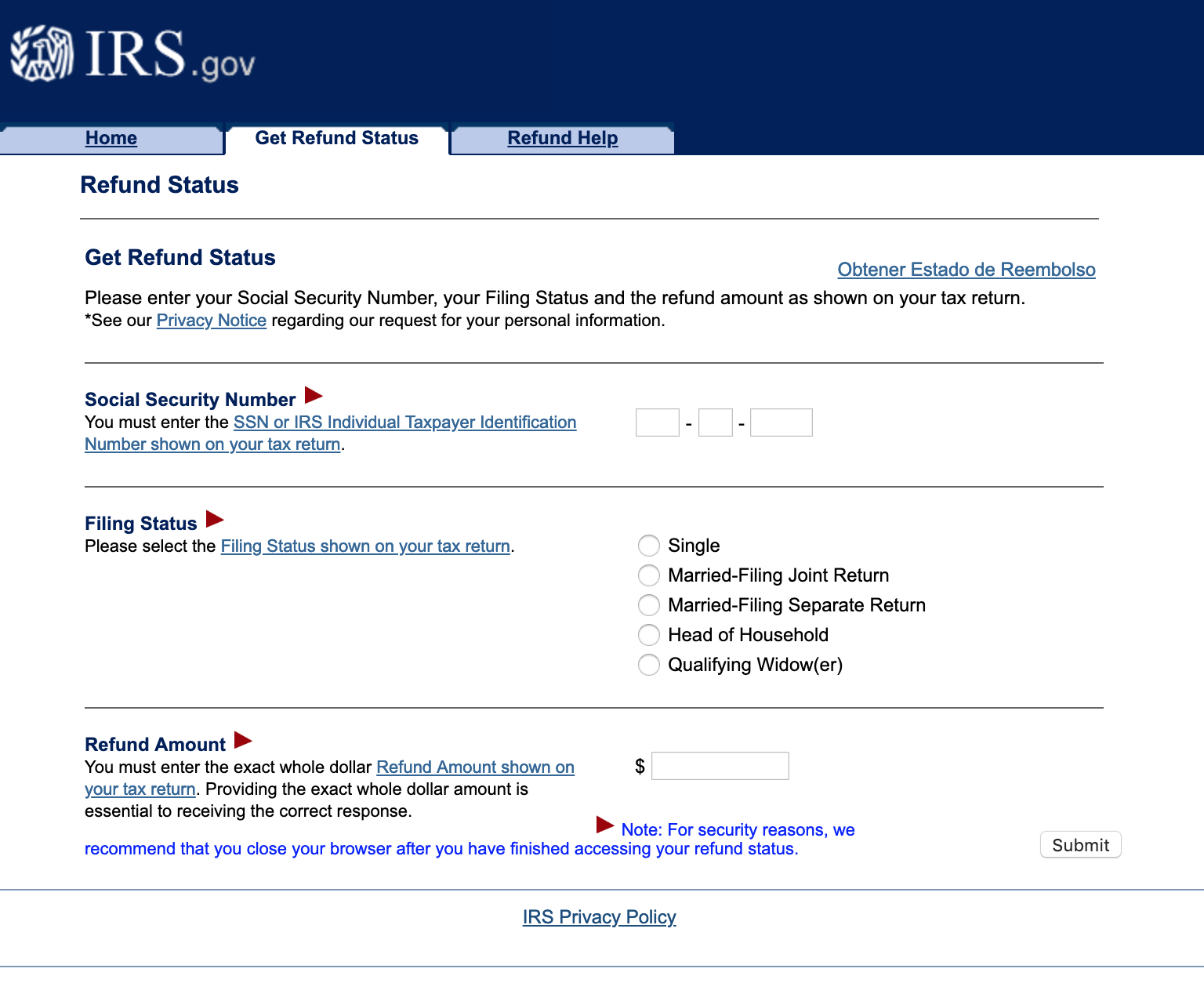

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: Will A Roth Ira Reduce My Taxes

What Is A State Tax Lien

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Read Also: How To Calculate Doordash Taxes

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

How Do I Calculate My State Tax Refund

You May Like: How Much Taxes Does Doordash Take Out

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Read Also: Do I Have To Claim Plasma Donation On Taxes

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Wheres My State Tax Refund North Carolina

Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. If 12 weeks have gone by and you still havent gotten your refund, you should contact the Department of Revenue.

Recommended Reading: Do I Have To File Taxes For Doordash

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, youre refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns are available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

You May Like: Doordash Driver Tax Deductions

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

I See An Irs Treas 310 Transaction Listed On My Bank Statement Why

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Recommended Reading: Have My Taxes Been Accepted

Why Did I Not Receive A State Tax Refund

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Read Also: Is Plasma Donation Taxable Income

Why Do I See A Tax Topic 152 Tax Topic 151 Or Irs Error Message

Although the IRS’ Where’s My Refund tool will generally show one of the three main statuses — Received, Approved or Sent — for your refund, there are a wide variety of messages and notices that some users may see.

One of the most common is Tax Topic 152, a generic message indicating that you’re likely getting a refund, but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

During the 2022 tax season, many Reddit tax filers who filed early received the Tax Topic 152 notice from the Where’s My Refund tool accompanied by a worrisome message: “We apologize, but your return processing has been delayed beyond the normal time frame. You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.”

The purported delay could be an automated message designed for taxpayers claiming the child tax credit or earned income tax credit. Due to additional fraud protection steps, the earliest filers with those credits can receive their refunds will be March 1. Several Reddit users commented that the message eventually cleared and they received notifications their refunds were sent.

Wheres My State Tax Refund Nebraska

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

Read Also: Doordash Take Out Taxes

How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Read Also: How To Find A Companys Ein

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

Also Check: How Does Taxes Work For Doordash