Speak With A Professional About Your Estate Plan

The above examples are just two of the types of investment accounts you can open, those for which you can have registered beneficiaries. When you begin to consider any other assets, including property, life insurance, non-registered investments, etc, the picture of your estates tax situation can get blurry. It is crucial to speak with your investment advisor, lawyer, and accountant to make sure all the pieces are working for your beneficiaries, not against them, following your passing. The greatest gift you can leave behind for your family is a well-thought-out plan.

Federal Estate Tax Can Reduce Your Inheritance Before You Get It

But that doesn’t mean that taxes can’t affect the amount you inherit. Estate taxes apply at the federal level. They’re charged directly against the estate, forcing the estate’s personal representative to use cash or sell estate assets to pay the tax.

In the absence of language in a will or trust to the contrary, federal estate-tax liability typically doesn’t affect specific bequests of cash or property to beneficiaries. Instead, those who receive any property remaining after specific bequests are made end up receiving less than they would in the absence of the estate tax.

Fortunately, there is a relatively high exemption from the federal estate tax. Up to $11.58 million can pass to heirs without any federal estate tax, although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal estate tax does not.

If the estate improperly fails to pay any estate tax due, the IRS has the power to collect from heirs. Technically, though, this isn’t a tax on the heirs but rather a collection from inherited assets that should never have been distributed from the estate in the first place.

Plan For Your Estates Future

Now that you know the tax consequences of inherited real estate in Canada, you can set up the future of your estate to make the process simpler for any beneficiaries.

Keep up-to-date and organized appraisals of all real estate, commercial, residential, vacation, or otherwise. Whether you ultimately decide to sell these properties or leave them to your children, a surviving spouse or common law partner or someone else in your will, the documents will help ensure a clear record of taxation requirements at a later date.

Also Check: Doordash Take Out Taxes

Federal State And Inheritance Tax Rules Explained

When a person dies, their assets could be subject to estate taxes and inheritance taxes, depending on where they lived and how much they were worth. While the threat of estate taxes and inheritance taxes does exist, in reality, the vast majority of estates are too small to be charged a federal estate tax, which, as of 2021, applies only if the assets of the deceased person are worth $11.70 million or more. That exemption increases to $12.06 million in 2022.

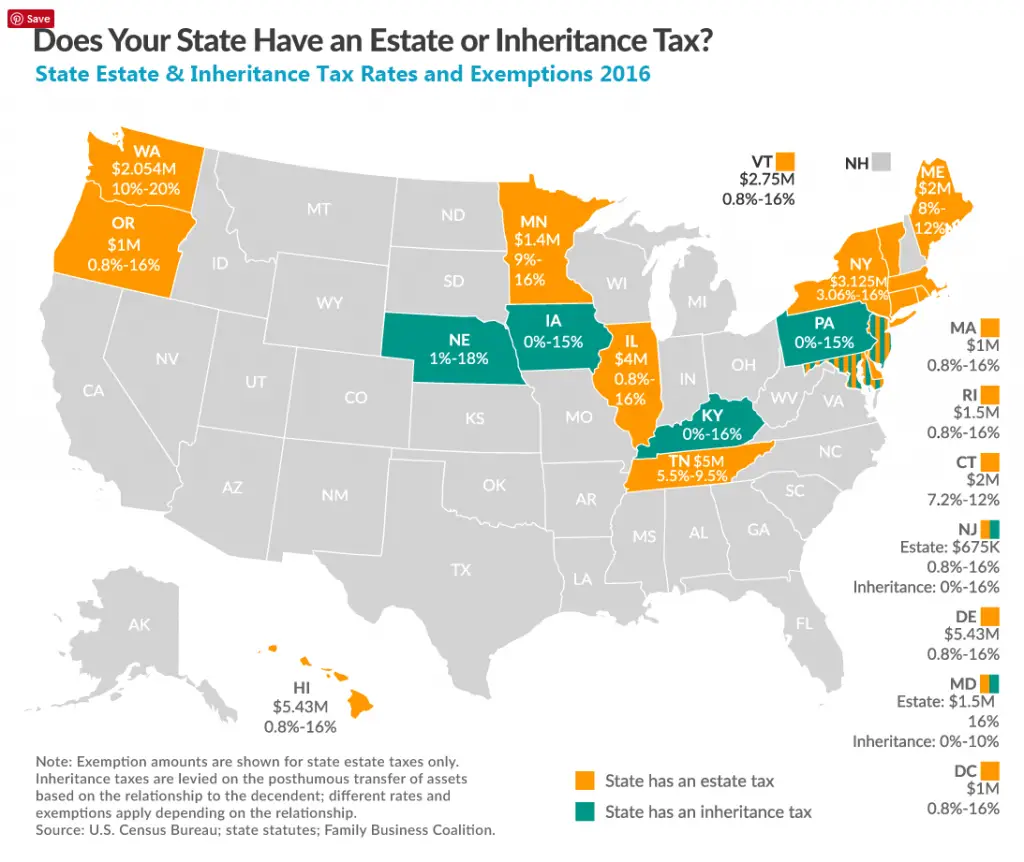

What’s more, most states have neither an estate tax, which is levied on the actual estate, nor an inheritance tax, which is assessed against those who receive an inheritance from an estate.

Indeed, the number of jurisdictions with such levies is dropping, as political opposition has risen to what some criticize as death taxes. That said, a dozen states plus the District of Columbia continue to tax estates, and a half dozen levy inheritance taxes. Maryland collects both.

As with federal estate tax, these state taxes are collected only above certain thresholds. And even at or above those levels, your relationship to the decedentthe person who diedmay spare you from some or all inheritance tax. Notably, surviving spouses and descendants of the deceased rarely, if ever, pay this levy.

Capital Gains Tax On Appreciated Property

If you inherit property that appreciates in value, the amount of the gain is also taxable. To calculate exactly how much the property has gained in value, you’ll need to determine what’s called the “basis” in the property. Typically, for tax purposes, the basis would simply be how much you originally paid for the property. However, when you inherit property, you get the benefit of what’s called a “stepped-up basis,” which means that instead of being taxed on the entire gain from the moment of the deceased person’s purchase, you’re taxed only on the gain from the deceased person’s date of death.

Example: In 2020, Miko inherited her mother’s house, whose fair market value on the date of her mother’s death was $500,000. Miko’s mother had purchased the house in 1990 for $200,000. In 2021, Miko sells the house for $550,000. Because her basis is “stepped up” to $500,000, Miko owes capital gains tax only on a gain of $50,000.

Read Also: Www.michigan.gov/collectionseservice

Can I Give My Son 50000 Uk

Is there a maximum amount of money you can as a gift? As a person, you can spend any amount of money you desire, but as soon as you spend more than the £3000 yearly limit, inheritance tax will apply. Gifts that fall within this threshold will not be subject to inheritance taxes based on their yearly exemption.

State Income Taxes And Federal Income Taxes

You won’t have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. But the type of property you inherit might come with some built-in income tax consequences.

For example, if you inherit a traditional IRA or a 401, you’ll have to include all distributions you take out of the account in your ordinary federal income, and possibly your state income as well.

Read Also: How To File Taxes As A Doordash Driver

Determining Taxable Value Of An Estate

An estate is the estimated net worth of a person, which typically consists of their assets less any liabilities. Assets can be anything of value, such as cash, securities, real estate, insurance, trusts, annuities, and business interests. The value of these items is neither what was paid for them nor what their values were when acquired, but is assessed based on fair market value, which is a “reasonable amount” at which the items can be purchased by interested buyers. The total fair market value of a person’s assets is called a gross estate. After the value of the assets is determined, certain liabilities or reductions may be deducted from the gross estate. Common liabilities include mortgages, unpaid debts, estate administration expenses, and assets that may be passed to surviving spouses or qualified charities. After accounting for liabilities, the value of lifetime taxable gifts is added to this net amount then reduced by the unified tax credit resulting in the taxable value of the estate.

As Per Current Income Tax Laws The Sum Of Money Received By You By The Way Of Inheritance After The Death Of The Elder Son Is Exempt From Tax

I am 82. I recently lost my eldest son, who was single. I want to give the money that I have inherited from his estate to my three grandchildren from my daughter and younger son. They are 21, 20 and 14 years old. What will be the tax implications for me or my two surviving children in this case?Amit Maheshwari, Partner, AKM Global says,I regularly invest in the stock market. My trades are invariably delivery based. I am a member of a stock advisory. The firm charges a fee every quarter. Please let me know whether this fee paid is deductible as an expense from the profit and gains I make from my investments? I am not engaged in the share trading business.Raj Khosla, Founder and Managing Director, MyMoneyMantra.com says, Capital Gains

Read More News on

How to save tax for FY 2020-21.)

You May Like: Doordash 1099

Do You Have To Pay Taxes On An Estate In South Carolina

There are many types of taxes that the estate may owe, but the primary tax obligations tend to be state and federal income taxes and federal estate taxes. South Carolina imposes income taxes on income earned during the course of estate administration, and there may be income and/or estate or death taxes imposed by other states or nations.

Inheritance Tax Vs Estate Tax

Inheritance taxes and estate taxes are often lumped together as “death taxes.” However, they are two distinct forms of taxation.

Both levies are based on the fair market value of a deceased person’s property, usually as of the date of death. But an estate tax is levied on the valueand comes outof the decedent’s estate. In contrast, an inheritance tax is levied on the value of the inheritance received by the beneficiary, and it is the beneficiary who pays it.

Of course, if you were the sole beneficiary of an estate, that might seem like the same thingthe amount the estate is worth, and the amount you inherit. But technically, they are subject to different taxes. And in some situations, an inheritance could be subject to both estate and inheritance taxes.

According to the Internal Revenue Service , the federal estate tax is only applied to estates with values exceeding $11.58 million in 2020 and 11.70 million in 2021. If the estate passes to the spouse of the deceased person, no estate tax is assessed.

If a person inherits an estate that is large enough to trigger the federal estate tax, and the decedent lived or owned property in a state with an inheritance tax, the beneficiary faces both taxes. The estate is taxed before it is distributed, and the inheritance is then taxed at the state level.

Also Check: How Do I Get My Doordash 1099

Is The Interest Earned On Inherited Money Taxable

Inherited money received by you and your mother is totally tax exempt. However, interest earned on that money is taxable. You can show inherited money in your ITR under exempt income section. Considering that you have income from legal gambling, its considered as speculative business income and you should file ITR 3.

What Is The Maximum Amount You Can Inherit Tax Free

Those who receive estates will be exempt from gift taxes up to $12 each. Over the next 12 years, $6.8 million will be spent each on an individual per death, an increase of $ 11 million. In 2021, the number is expected to be $7 million, according to new Internal Revenue Service inflation forecasts. The gift tax annual exclusion is raised from $15,000 to $16,000, which stands at $15,000 this year, but would rise to $16,000 in 2022.

Don’t Miss: How To Calculate Taxes For Doordash

Serving Clients In The Gilbert Arizona Area

- Estate Administration, Estate Planning, Estate Tax, Probate, Trust Administration, Wills & Trusts

Unfortunately, unless the person you love has an estate plan and has spoken with you about it, the time you are grieving will also be the time you have to get up to speed about both death and taxes. The tax questions are explored in an article from the Delaware Bulletin Review titled What Taxes Do You Have to Pay on an Inheritance?

First, there is no federal estate tax on property. Federal law does not impose inheritance taxes on the heir directly. This is similar to gifts, as gift recipients dont pay federal gift taxes either. However, that does not mean heirs dont pay taxes. It is actually the opposite. Thats why its good to have these conversations before a loved one passes.

Estate taxes apply at the federal level, and they are paid by the estate. The executor uses cash from the estate or sells estate assets to pay the tax.

Unless there is specific language in the will or trust staying otherwise, federal estate tax liability does not usually impact specific bequests of cash or property to beneficiaries. The heirs may receive less of an inheritance because taxes are being paid by the estate. As of this writing, the federal tax exemption is very high$11.7 millionso very few Americans actually pay federal estate tax.

Note: if the estate fails to pay any estate taxes, the IRS is empowered to collect taxes from heirs.

Do You Have To Pay Taxes On 30k Inheritance

do not have to worry about paying inheritance taxes to the beneficiary of their estate since there is no state inheritance tax, because there is no inheritance tax at a state level here in the Golden State. State inheritance taxes in California do not apply to most families, and the estate tax is not applicable for estates above $5 million.

Read Also: How Can I Get My 1099 From Doordash

Working Out Income Tax Up To The Date Of Death

When a loved one has died, they might have paid too much or too little Income Tax. From now on well refer to the one who has died as the deceased as this is the legal term youre most likely to see.

As a result, the deceaseds estate might owe tax to the government, or it might be owed a tax refund.

The estate is a word that describes everything a person owned and owed when they died.

To make sure that the correct amount of Income Tax is paid, its important to contact HM Revenue & Customs as soon as possible so that they can adjust the deceaseds tax calculation.

If the deceased lived in England, Scotland or Wales, you can use the Tell Us Once service to do this. HMRC and the Department for Work and Pensions should then contact you about the deceaseds tax, benefits and entitlements automatically.

If they lived in Northern Ireland, you can do this using the Bereavement Service on

Tax On Life Insurance Proceeds

Whether a beneficiary has to pay tax on the proceeds of a life insurance policy depends on whether the proceeds are paid in a lump sum or in installments with interest. If they are paid in a lump sum, they are not taxed. If they are paid in installments over several years, the part of each installment that constitutes interest is taxable income each year.

Don’t Miss: Freetaxusa Legit

What Are Canadas Inheritance Tax Rates

As there is no inheritance tax in Canada, all income earned by the deceased is taxed on a final return.

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death. Any resulting capital gains are 50% taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. They are taxed at the applicable capital gains tax rates.

The fair market value of a Registered Retirement Savings Plan or a Registered Retirement Income Fund is included in the deceased persons income and taxed at the regular applicable personal income tax rates with no special treatment for any capital gains earned within the RRSP or RRIF.

Can I Gift My Daughter 100000

As of 2018, IRS tax law allows you to give up to $15,000 each year per person as a tax-free gift, regardless of how many people you gift. Lifetime Gift Tax Exclusion. For example, if you give your daughter $100,000 to buy a house, $15,000 of that gift fulfills your annual per-person exclusion for her alone.

Read Also: Doordash Taxes Calculator

What Is The Best Method For Avoiding Inheritance Tax

No Inheritance Tax In Nc

There is no inheritance tax in NC. However there are sometimes taxes for other reasons. These are some of the taxes you may have to think about as an heir.

- If you live in a state that does have an estate tax, you may be expected to pay the death tax on the money you inherit from a death in NC

- IRAs that distribute large amounts of income each year according to the new 10 year payout rule may cause you to pay taxes on the distributions

- Capital gains taxes might be accrued on some types of trusts

Also Check: Taxes Grieved

Amount Of Inheritance Tax

Part of the inheritance is exempt from tax. The precise amount depends on your relationship to the deceased person.

The Tax and Customs Administration lists the exemptions on its website. You pay inheritance tax on the amount exceeding the exemption. Inheritance tax rates are also available on the Administrations website.

You can use the Tax and Customs Administrations inheritance tax calculator to work out how much tax you have to pay.

Who Has To Pay An Inheritance Tax

As you can see, there are only six states with inheritance taxes. Overall, inheritance tax rates vary based on the beneficiarys relationship to the deceased person.

Spouses are automatically exempt from inheritance taxes. That means that if your husband or wife passes away and leaves you a condo, you wont have to pay an inheritance tax at all even if the property is located in one of the states mentioned above. Since the Supreme Courts ruling, the same rule applies to same-sex spouses.

Children and grandchildren who receive an inheritance arent taxed either if the deceased person lived in any of these four states: New Jersey, Kentucky, Iowa or Maryland. The bad news then is that all other relatives and kids and grandkids receiving property from Pennsylvania and Nebraska may have to pay up.

Also Check: Wheres My Refund Ga State

Exemptions From Inheritance Tax

You do not pay inheritance tax on a surviving dependants pension or state pension. The surviving dependants pension, however, is deducted from the partners exemption. In certain special situations you pay less or no inheritance tax. Contact the Tax and Customs Administration for more information.