How To Determine The Calculation Basis

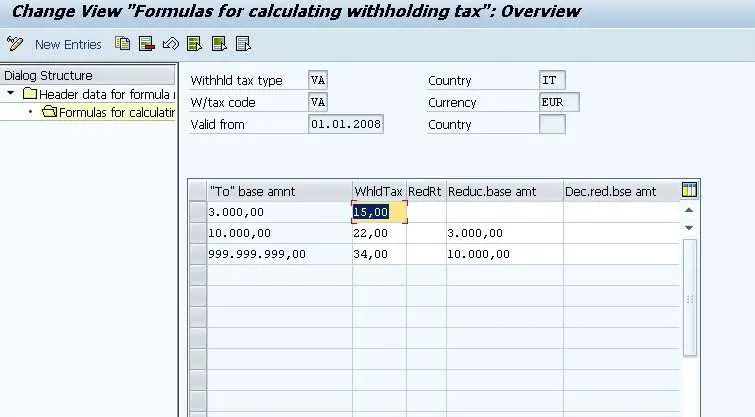

In order to determine the correct withholding tax, you must first calculate the basis for the deduction and then apply the employee’s tax deduction card to this. This is called the calculation basis. The calculation basis is the sum of all benefits that the employee has received from you, determined according to established valuation rules and, where applicable, after the deduction of certain statutory deductions. Benefits that you pay to your employees can be divided into three categories: cash benefits, payments in kind and expense allowances. The general rule is that you must deduct withholding tax from all taxable benefits that you pay to your employees. However, this is only a general rule and there are exceptions. The obligation to withhold tax which you have as an employer doesn’t always correspond with what is taxable for your employees. This could mean that you have to deduct withholding tax from benefits which are tax-free for the employee, or that you shouldn’t deduct withholding tax from benefits which are taxable for the employee.

Calculate A Sales Order

Click Sales and marketing> Common> Sales orders> All sales orders. To open an existing sales order, double-click the sales order. To create a new sales order, on the Action Pane, on the Sales order tab, click Sales order.

âorâ

Click Accounts receivable> Common> Sales orders> All sales orders. To open an existing sales order, double-click the sales order. To create a new sales order, on the Action Pane, on the Sales order tab, click Sales order.

In the Create sales order form, select a customer account that is updated with the withholding tax setup. For more information, see Create or edit a sales order.

In the Sales order lines grid, click Add line or press CTRL+N to create a new sales order line. Select the service that is updated with the withholding tax details in the Released product details field.

Note

On the Line details FastTab, click the Setup tab to view the Withholding tax group and Item withholding tax group fields, which are selected for a service.

On the Sell tab, in the Generate group, click Confirm to confirm the sales order.

On the Invoice tab, click Invoice to post the customer invoice. For more information, see Sales posting and Key tasks: Customer invoices.

Special Treatment: Eu Directives

The CIT law provisions and certain EU Directives provide special treatment for dividends, interest, and royalties paid to numerous European countries.

In general, the transitional rules on interest and royalty payments paid by Polish corporate residents to associated EU or EEA companies, as well as the full exemption after 1 July 2013, only apply to interest and royalty payments between associated companies in which capital involvements are significant, i.e. the paying company owns or is owned at least 25% by the company receiving interest or the company that pays interest and the company that receives interest are owned at least 25% by the same parent company. Shareholding should be kept for a minimum of two consecutive years.

Dividends paid to corporate residents of EU and EEA countries are exempt from WHT, subject to certain conditions specified in the CIT law. The basic requirement is that the foreign beneficiary holds at least 10% of the shares in the Polish company for a minimum of two consecutive years.

In relation to all given payments , the condition regarding holding shares is also fulfilled if two years passes after the day of the dividend/interest/royalty payment. If the period is interrupted afterwards, the company is obligated to pay the tax at the standard rate with interest.

Note that several additional conditions have to be met for the reduced rate/exemption from the WHT based on the Directive to be applied .

Read Also: Protest Property Taxes In Harris County

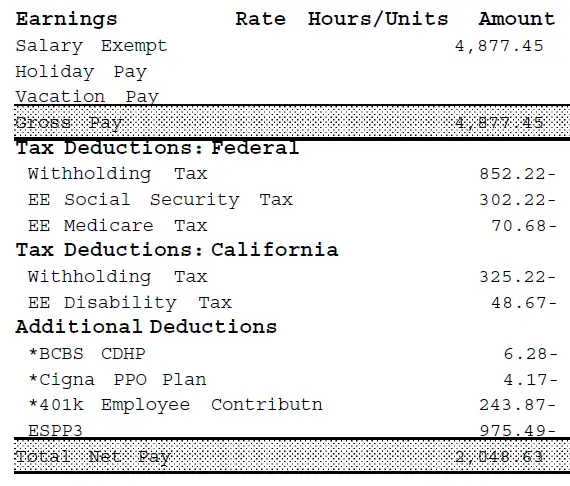

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

How Can I Calculate Percentage

1. How to calculate percentage of a number. Use the percentage formula: P% * X = Y

Also Check: Is Donating Plasma Taxable Income

Withholding Tax On Employment Income 2021

The 2021 withholding tax reform comes into force on 1 January 2021. One of the main objectives of this revision is to eliminate unequal treatment between people who are subject to withholding tax and those who are subject to regular taxation. In addition, the cantons will be obliged to standardize the calculation of withholding taxes throughout Switzerland. The respective circular letter no. 45 was elaborated by the Federal Tax Administration and the cantons.

To determine the withholding tax rate for a person subject to withholding tax, the total gross income from all employment, including supplementary income , must be included in the calculation. In situations where part-time employees have more than one job or receive an additional pay supplement, the income that determines the rate has to be extrapolated.In order for Human Resources at ETH Zurich to be able to correctly implement the withholding tax reform 2021, all employees subject to withholding tax are required by law to cooperate.

Find The Best Gic Rates In Canada

Watch your savings grow faster, when you invest your money in the GIC products with the best interest rates

If you live in Quebec, thereâs an additional 16% provincial tax thatâll be withheld. In all provinces and territories, youâll also have to report any amount you withdraw as income so you may have to pay additional taxes on top of the withholding tax.

The effect of the withholding tax is that you donât really get all the money you take out of your RRSP. For example, if you live in Ontario and withdraw $25,000 from your RRSP, you only end up with $17,500 after the withholding tax of 30% is applied. Depending on your income, you may need to pay additional taxes on top of the withholding tax.

Don’t Miss: Tsc-ind Ct

Specific Rates Have Been Set For The Value Of:

- board and lodging paid by an employer for its employees

- private use of an employers car

- benefit of low-interest loans from employers

- benefit of cost savings in the home

- private use of electronic communication paid by the employer

Rules have been established concerning the valuation of residential property owned or leased by the employer which are made available for use by the employees

How To Calculate Your Social Security/medicare Withholding

The following guidance pertains to wagespaid on and after January 1, 2021.

To calculate the amount of Social Security and/or Medicare withheld from your paycheck, calculate your Taxable Gross: Gross Pay minus any Pre-TaxReductions for Social Security/Medicare.*

Then, determine your tax:

- Social Security is calculated at 6.2% of Taxable Gross up to $142,800.00. The maximum tax possible is $8,853.60.

- Medicare is calculated at 1.45% of Taxable Gross up to $200,000. Then, Medicare is calculated at 2.35% of Taxable Gross over $200,000 .

*Pre-Tax Reductions for Social Security/Medicare include pre-tax medical insurance, pre-tax dependent care , pre-tax Health Savings Account , pre-tax Flexible Spending Account/Arrangement , and pre-tax parking.

Don’t Miss: How To Protest Property Taxes Harris County

Six: Calculate Social Security And Medicare Deductions

You must withhold FICA taxes from employee paychecks.

Be sure you are using the correct amount of gross pay for this calculation. This article on Social Security wages explains what wages to take out for this calculation.

The calculation for FICA withholding is simple.

| FICA Taxes – Who Pays What? | |

|---|---|

| FICA Taxes | Employee Pays |

| 0.9% on gross pay over $200,000 | 0% |

Withhold half of the total from the employee’s paycheck.

For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% for a total of $114.75.

Be careful not to deduct too much Social Security tax from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social Security Administration.

You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year. The additional tax is 0.9% of the gross pay based on the employee’s W-4 status. No additional tax is due from the employer.

Most states impose income taxes on employee salaries and wages. You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority.

Your responsibilities as an employer for deducting, paying, and reporting these taxes are discussed in this article.

What Can I Do If My Withholding Is Not Correct

If you go to the IRS website and determine from the Tax Withholding Estimator that what your employer is withholding is not correct you should contact your employer. You will most likely need to complete a new form W-4 and return it to your employer. Be sure to follow up once you have returned the updated form W-4.

Also Check: License To Do Taxes

How To Calculate Federal Tax Withholding

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 121,264 times.

Calculating federal tax withholding can be surprisingly frustrating even though it’s something the majority of people have to do regularly. Luckily, with the right guidance, this yearly ritual doesn’t have to be a source of stress: each tax has its own set of laws and regulations associated with it, which are clearly outlined by the IRS. Learn how to calculate your federal tax withholding today to save yourself time and energy for years to come.

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 – $18,200 | $0 |

| 19c for every dollar between $18,201 – | 0 |

| 32.5c for every dollar between – | 0 |

| 37c for every dollar between – $180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

Don’t Miss: Tax Deductions Doordash

You Must Make Deductions From The Calculation Basis For:

- pension contributions you deduct from salary for which the employee will be entitled to a deduction in connection with their tax assessment

- trade union fees you deduct from salary for which the employee will be entitled to a deduction in connection with their tax assessment

- special allowance for seafarers resident in Norway

Calculate Income Tax On Salary With An Example

Your salary is inclusive of Transport Allowance, Special Allowance, House Rent Allowance , and Basic Salary. In the old regime, certain salary components such as leave travel allowance, telephone bill reimbursement, and a part of the HRA were exempt from tax. However, if you choose the new regime, these exemptions are not available.

Given below is an example of how tax calculation works under the New regime when compared to the old regime:

Also Check: Protesting Harris County Property Tax

Claim Dependents Source: Irs

Add the number of dependents you can claim on your tax return. To qualify, your income must be less than $200,000 . The child must be under age 17 as of Dec. 31 and live with you for more than half the year.

Each of these children should qualify for the child tax credit so calculating these credits into your withholding amount will reduce the amount of tax withheld. These tax credits are also refundable tax credits, meaning, you could get back money above what was withheld by your employer.

If you have other dependents living with you, you can claim a $500 tax credit for each of them.

Quick Tip: If you have two jobs, be careful only to claim dependents on one Form W-4.

What Are The Different Kinds Of Withholding Tax In The Philippines

Many Filipinos receive huge help from tax calculators in the Philippines. These tools allow them to correctly compute the taxes they owe the government. But only a few people are aware of the fact that there are two groups of taxes in the country: national taxes and local taxes.

National taxes are fees or charges imposed by local government units . Local taxes, on the other hand, are what the registered taxpayer pays to the government through the Bureau of Internal Revenue . Under these are several types of taxes that are applicable to different entities, individuals, products, and services.

In this article, were going to focus more on a specific kind of national taxes which is the withholding tax. In the Philippines, it is the most basic type of tax that individuals and entities engaged in trade, business, or practice of profession must understand.

The withholding tax comes in three sub-classifications: withholding tax on compensation, expanded withholding tax, and final withholding tax. Lets discuss them one by one below.

Also Check: Doordash Accounting Method

Get Tax Help However You Need It

Know the price of tax prep before you begin as part of our No Surprise Guarantee. Go to disclaimer for more details15

Important Terms And Definitions In Tax Calculation

- Assessment Year: When your income for a certain financial year is assessed in the coming financial year, it is referred to as an assessment year.

- Financial Year: The period between the current years April 1st and the following years March 31st. This is the time period wherein you are required to collate all your documents and submit your investment proofs.

- Previous Year: The financial year that acts as a precursor to the following assessment year. Your income for the current year is assessed in the next year .

- Deduction: It is a reduction in the total taxable income based on Section 80 and Chapter VI-A. Specific kinds of spending such as investment in life insurance policies and payment of childrens tuition fee help you avail a tax deduction.

- Exemption: It is a specific amount that is excluded from the gross total income before calculating tax. Exemptions are available under Sections 10 and 54. Interest earned from tax-free bonds and salary components like LTA are examples of exemptions.

Read Also: Do You Have To Pay Taxes On Donating Plasma