Technical Memorandum Issued By The Department Of Taxation And Finance

Pursuant to the enactment of the 2019-2020 Budget Bill, the Department of Taxation and Finance issued a technical memorandum discussing the sales tax collection requirements for marketplace providers. The memorandum reflects an increase in the sales threshold amount from $300,000 to $500,000, which is retroactive to June 1, 2019. Taxpayers affected by this change must register with the Department at least 20 days before beginning business in the state. This memorandum supersedes TSB-M-19S issued on May 31, 2019. S, 17/10/2019.)

New York Proposes Three New Tax Rates / Tax Brackets Which Would Raise Highest Individual Rate

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include three additional personal income tax brackets for individuals with income over $2.155 million. Each respective proposal includes the same three new tax rates9.85 percent, 10.85 percent and 11.85 percentbut imposes such rates at differing income thresholds. The current maximum individual tax rate in New York is 8.82 percent. The new brackets and rates would be effective for the 2021 tax year.

New York City Sales Tax

On top of the state sales tax, New York City has a sales tax of 4.5%. The city also collects a tax of 0.375% because it is within the MCTD. The total sales tax in New York City is 8.875%. This is the highest rate in the state. With such a high sales tax, its no wonder the cost of living in New York City is so high.

You May Like: 1040paytax Review

New York Issues Guidance On The Application Of Tax Credits On Combined Returns

New Jersey has indicated that with respect to combined returns, tax credits belong to the taxable member that earned them, unless a specific statute authorizes the tax credit to be earned or awarded at the group level. Any credit carryover available for future use belongs to the taxable member that originally earned the credit. If a member leaves the group, that member takes with them any tax credit/carryforward they generated. Any carryforward must be reduced by the amount that is used by the group and/or member. For specific details, please consult New Jersey Division of Taxation Technical Bulletin TB-90 .

New York State Sales Tax

In the state of New York, the sales tax that you pay can range from 7% to 8.875% with most counties and cities charging a sales tax of 8%.

The sales tax rate in New York actually includes two separate taxes: sales tax and use tax. The state groups these together when talking about sales tax and both taxes are the same rate so it doesnt matter where you purchase things. New York sales tax is currently 4%. Each county then charges an additional sales tax between 3% and 4.5%.

Counties in the metropolitan commuter transportation district also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

| Sales Tax in New York Counties |

| County |

| 8% |

Also Check: Claiming Home Improvement On Taxes

Corporation Tax Changes In 2019 Budget

This summary highlights the corporation tax changes that were part of the 2019- 2020 New York State budget. Most notably, several tax law provisions were amended, including the contributions to the capital of a corporation, entire net income for stock life insurance companies, and unrelated business taxable income. Additionally, electronic filing and payment mandates have been extended through December 31, 2024, and the tax shelter penalty and reporting requirements have been extended through July 1, 2024.

Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

Also Check: Doordash Tax Percentage

New York Holds Distributions From An Ira Funded From Federal Thrift Savings Plan Can Be Deducted From Fagi In Determining Nyagi

The New York Department of Taxation and Finance has issued an Advisory Opinion concluding that distributions from an Individual Retirement Account funded from a federal thrift savings plan can be deducted from federal adjusted gross income when determining New York adjusted gross income . To calculate the rollover deduction amount, taxpayers can use a fraction, the numerator of which is the TSP rollover amount, and the denominator of which is the IRAs current value. The product of the fraction is the amount that can be deducted in determining NYAGI. Additionally, while the gain from the rollover IRA may not qualify for that subtraction modification, the amounts may be eligible for the $20,000 subtraction modification.

Nyc Releases Changes For Business Tax Filers

The New York City Department of Finance has released a new issue of its Business Tax Practitioner Newsletter, which discusses the Tax Cuts and Jobs Act as it relates to changes for business tax filers including reporting IRC § 965 income, foreign-derived intangible income , and global intangible low-taxed income . In addition, the newly amended Real Property Income and Expense rules were discussed with respect to the increased penalties for owners of income-producing property who fail to file RPIE statements for three consecutive years. The penalty is increased to 5% of the final actual assessed value for the calendar year in which such statement was to be filed.

Also Check: Plasma Donation Taxable Income

Irs Announces Tax Relief For New York Victims Of Remnants Of Hurricane Ida

Added Dutchess, Orange, Putnam, Rockland, and Ulster counties

Added Suffolk and Sullivan counties

Added Nassau county

NY-2021-01, September 9, 2021

New York Victims of remnants of Hurricane Ida that began September 1, 2021 now have until January 3, 2022, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

Individuals and households affected by Hurricane Ida that reside or have a business in Bronx, Dutchess, Kings, Nassau, New York, Orange, Putnam, Queens, Richmond, Rockland, Suffolk, Sullivan, Ulster, and Westchester counties qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after September 1, 2021, and before January 3, 2022, are postponed through January 3, 2022.

This means that individuals who had a valid extension to file their 2020 returns, due to run out on October 15, will now have until January 3, 2022 to file. The IRS noted, however, that because tax payments related to these 2020 returns were due on May 17, 2021, those payments are not eligible for this relief.

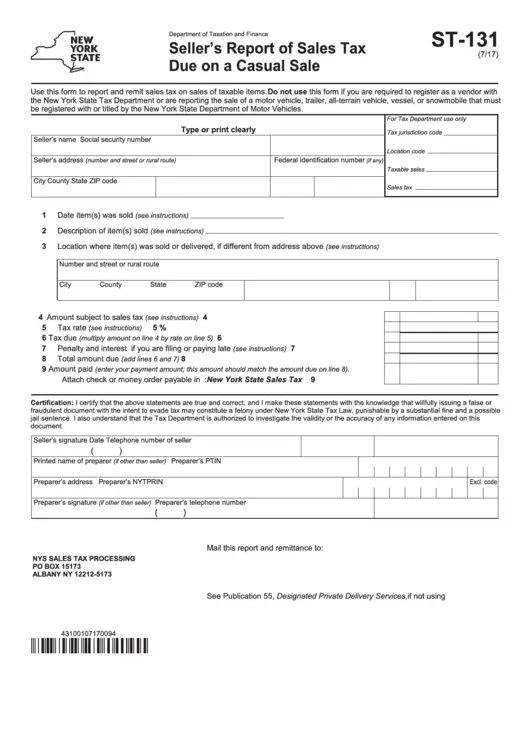

What Is Nys Sales Tax

New York State administers a tax on certain goods and services sold within New York State.

The collection of sales tax is administered through the New York State Department of Taxation and Finance.

For example, if your business sells tangible personal property , performs taxable services ex. , or sells prepared food or sells drinks , you will be subject to sales tax unless there is an exemption or exception that applies.

The types of businesses that are subject to sales tax in New York are extensive and as such, if you have any questions regarding whether your business should be paying NYS sales tax, you should contact the NY Tax Department.

The sales tax you must collect and remit is computed using the combined state and local rate in effect in the county in which you deliver the taxable product or service.

Don’t Miss: When Do You Do Tax Returns

Has New York Extended The Tax Deadline

The New York State Department of Taxation and Finance announced an extension for certain tax filing and payment deadlines for taxpayers who were adversely affected by the flooding during the week of Sept. Tax filing and payment deadlines occurring between Sept. 15, 2021, and Oct. 2, 2021, have been extended to Dec.

Filing When Your Business Has Collected No Sales Tax

Once you have a New York Sales Tax Certificate of Authority, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Don’t Miss: Appeal Cook County Property Taxes

Nyc May Abate Ubt Late Filing/late Payment Penalties But Interest Still Accrues

The New York City Department of Finance, upon request, will waive late filing and late payment penalties for individual unincorporated business tax taxpayers, if such taxpayers complete filing payment on or before May 17, 2021. However, interest will accrue at the underpayment rate for the late payments. UBT taxpayers can request a penalty abatement by using the Departments portal, sending an email, filing a paper return and writing 21 at the top of the page, or request an abatement in writing.

Tax Credit Budget Legislation Enacted In 2019

The New York Department of Taxation and Finance issued technical memorandum TSB-M-19C, I which discusses the individual income and corporate income tax credit budget legislation enacted in 2019. New credits were added to the law, which include the Central Business District Toll credit, Employer-Provided Child Care credit, and the Recovery Tax credit. The Empire State Commercial Production credit and Employee Training Incentive Tax credit provisions were amended. In addition, the Empire State Film Production and Empire State Film Post-Production Tax credit as well as the Workers with Disability Tax credit were extended to 2024 and 2022, respectively.

Read Also: Where Can I Amend My Taxes For Free

New York City Denies Corporate Tax Refund For Service

A New York City-based business provided a subscription service, which gave customers access to expert consultants in a variety of fields. As part of its service package to customers, the taxpayer employed salespeople, IT staff, and consulting managers but the expert consultants were compensated as independent contractors. The taxpayer sought a refund for a large portion of corporate income taxes it had paid during tax years 2003-2010. Alternative rationales were offered for differing methodologies, but ultimately the taxpayer settled on an allocation whereby only the locations and amounts paid to consultants and research managers who provided services directly to clients should be counted IT staff was excluded. The City contended that all of these persons contributed to the performance of the services provided to clients. The New York City Tax Appeals Tribunal found the taxpayer hadnt allocated income correctly because receipts had to include work done by both employees and consultants in New York City, not all of whom the company had included. The Appellate Court agreed , determining all these individuals were all part of the delivery of services for which clients paid an upfront flat subscription fee.

New York Temporarily Suspends Hotel Occupancy Tax

New York City Mayor Bill de Blasio has issued an executive order suspending the 5.875% hotel occupancy tax imposed by NYC Administrative Code Section 11-2502 from June 1, 2021 through August 31, 2021. The daily hotel room tax under NYC Administrative Code § 11-2502 remains in effect. For additional information, please see the executive order released on May 18, 2021.

May 13, 2021

Don’t Miss: Stripe Doordash 1099

Sales Tax Filing Frequency

The New York Department of Taxation and Finance will assign you a filing frequency. Typically, this is determined by the size or sales volume of your business. State governments generally ask larger businesses to file more frequently. See the filing due dates section for more information.

New York sales tax returns and payments must be remitted at the same time both have the same due date.

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

Recommended Reading: Is Plasma Donation Money Taxable

New York Extends Sales Tax Relief

As discussed in our post on , New York State had previously announced that certain businesses that missed the March 20, 2020 due date for filing sales tax returns covering the quarter ended on February 29, 2020 were eligible for relief from penalties and interest, if such businesses missed the due date due to the COVID-19 outbreak.

Under the original provisions of the relief, such businesses were required to file the related return and pay all sales taxes due within 60 days of the due date for the return, which was on or before May 19, 2020.

Notice N-20-6 extends eligibility for this relief until June 22, 2020 for businesses that file the related return and pay all sales taxes due by that date.

Tax Relief For New Yorkers Impacted By Post

The Acting Tax Commissioner has extended certain filing and payment deadlines for taxpayers who were directly affected by Post-Tropical Depression Ida.

For more information, visit N-21-3, Announcement Regarding Relief from Certain Filing and Payment Deadlines due to Post-Tropical Depression Ida.

Sales tax applies to retail sales of certain tangible personal property and services. Use tax applies if you buy tangible personal property and services outside the state and use it within New York State.

- For information on the Oneida Nation Settlement Agreement, see Oneida Nation Settlement Agreement.

- Sales tax rates and identifying the correct local taxing jurisdiction

Read Also: How To Buy Tax Lien Certificates In California

New York Sales Tax Rates

New York State sales tax varies by location. There is a state sales tax as well as by city, county or school district rates. New York Sales Tax Rate: 4% plus any local tax rate imposed by city, county or school district, typically between 3-5%.

New York Sales Tax Rate: 4%Maximum rate for local municipalities: 8.875%

New York Sales Tax varies by county, but a given county may have more than one rate due to local taxes. Therefore, a retailer cannot determine the tax rate simply by knowing the county. Likewise, New York sales tax also cannot be accurately determined by zipcode alone.

New York collects destination based sales tax, that is, local sales tax based on the destination of shipment or delivery within the state by businesses. There is no sales tax charge for deliveries outside the state. Learn more details at their website.

New York Extends Tax Filing And Payment Deadlines

On the heels of the recently enacted federal deadline change, the New York State Department of Taxation and Finance announced important income tax filing and payment extensions related to upcoming deadlines. The extension is designed to provide additional relief for individual taxpayers in light of the ongoing COVID-19 pandemic.

Don’t Miss: Does Doordash Withhold Taxes

Ny Provides Guidance To Tax Professionals Amidst Pandemic

A newsletter was recently issued by The New York Department of Taxation and Finance reminding tax professionals of the information on its website to provide relief during the COVID-19 pandemic. This information includes the extension of the income tax filing and payment due date to July 15, 2020, for individuals, fiduciaries, and corporations. Tax professionals should also have clients contact the Department if they cannot make their regularly scheduled tax payments due to COVID-19. The Department reminds tax professionals that the monthly sales tax return is due on May 20, 2020. For additional information, go to the Q& A section here.

Other Forms You May Have To File

In addition to filing the main return, you may be required to complete one or more schedules that are used to report certain transactions. Schedules A, B, CW, FR, H, N, P, T, and W must be filed with your return under certain conditions, as described below:

See our Sales Tax Web File for more information.

Recommended Reading: 1040paytaxcom

New Jersey And New York Propose Taxes On Financial Transactions

New York has proposed Assembly Bill 5215 and Senate Bill 3980, which would impose a new tax on the purchase of securities having a New York connection. Security would be broadly defined to include shares of stock, partnership interests, bonds, notes and derivative financial instruments, such as options, futures contracts, etc. Varying tax rates would apply to covered transactions, and a hierarchy would apply to determine who pays the tax . Similarly, New Jersey Assembly Bill 4402 and Senate Bill 2902 would impose a tax on persons or entities that process 10,000 or more financial transactions through electronic infrastructure located in New Jersey during the year. The tax rate would be $0.0025 per financial transaction processed through electronic infrastructure in New Jersey. For specific details, each states respective proposals should be reviewed.