How To Calculate W4 Exemptions

Each pay period, your employer withholds a part of your wages to cover your income tax bill. The amount of taxes that your employer withholds depends on your filing status, the amount of your paycheck and the number of withholding allowances you claim on Form W-4. The Internal Revenue Service offers two methods to withhold taxes — the wage bracket method and the percentage method. The wage bracket method uses a chart to determine your income tax to determine what percentage of federal taxes is withheld from your paycheck, you must use the percentage method.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

How Do You Calculate Taxes Out Of Your Paycheck

Add the accumulated taxes together to find the total tax withheld on the employee’s check. Divide the result by the gross salary to find the percentage of the salary that is spent on taxes. To find the total percentage of tax withheld for all employees, add the withheld tax to each employee’s check and add the result.

Also Check: Is Donating Plasma Taxable

What Are Federal Taxes

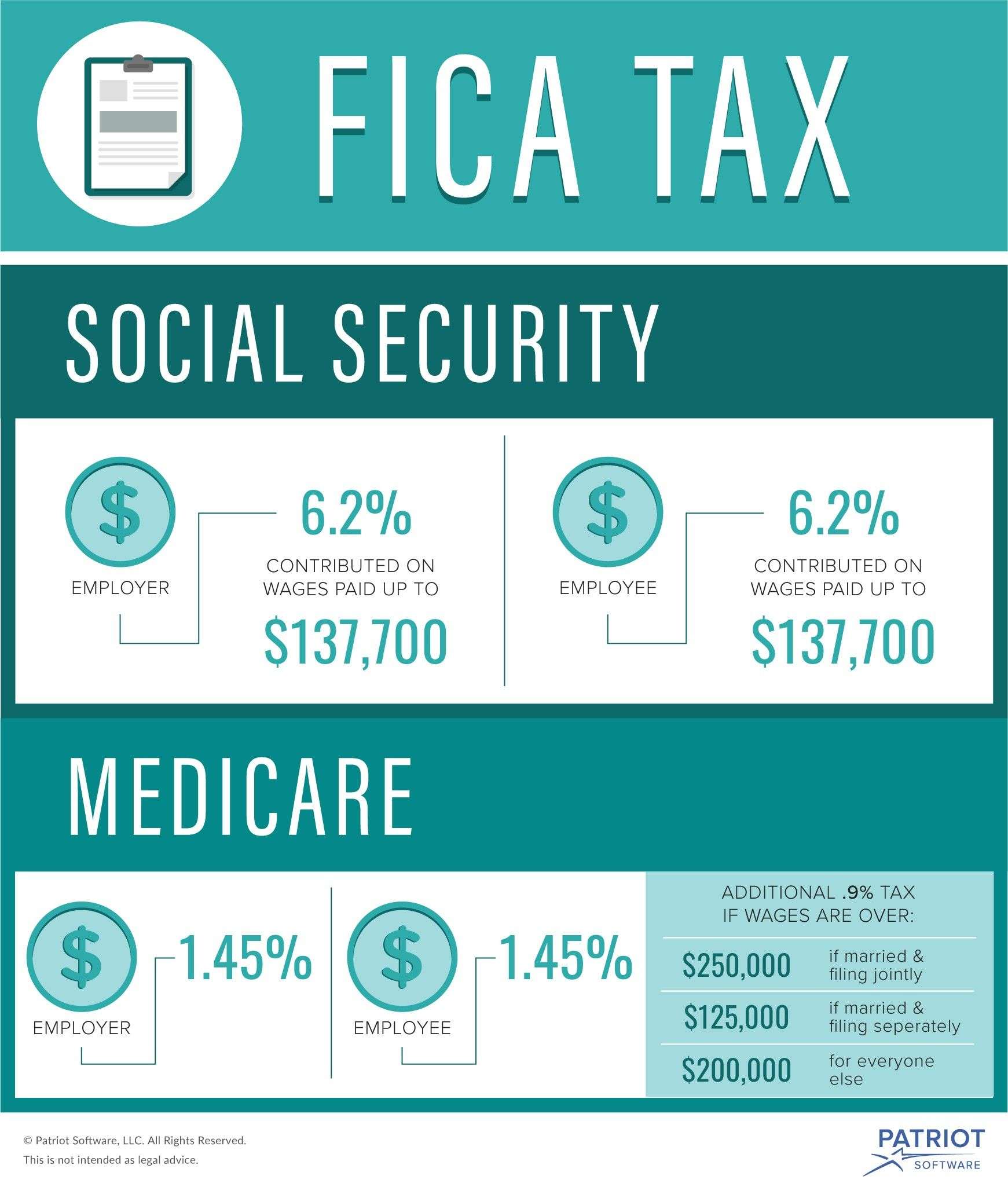

Federal taxes are the taxes that are withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld, however, FUTA is paid solely by employers.

For employees, there, unfortunately, isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck. The amount withheld depends on several factors. However, working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

Housing Takes The Biggest Bite

Housing takes the largest amount out of your income. Common financial advice is to use no more than one-third of your paycheck for rent . After that, what you do with the rest depends on your situation. One popular paycheck allocation formula is:

- 30 to 35 percent for housing

- 10 to 20 percent for food

- 10 to 20 percent for transportation

- 5 to 10 percent for savings

- 5 to 10 percent for debt repayment

- The remainder for discretionary spending

You May Like: Employer Tax Id Lookup

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

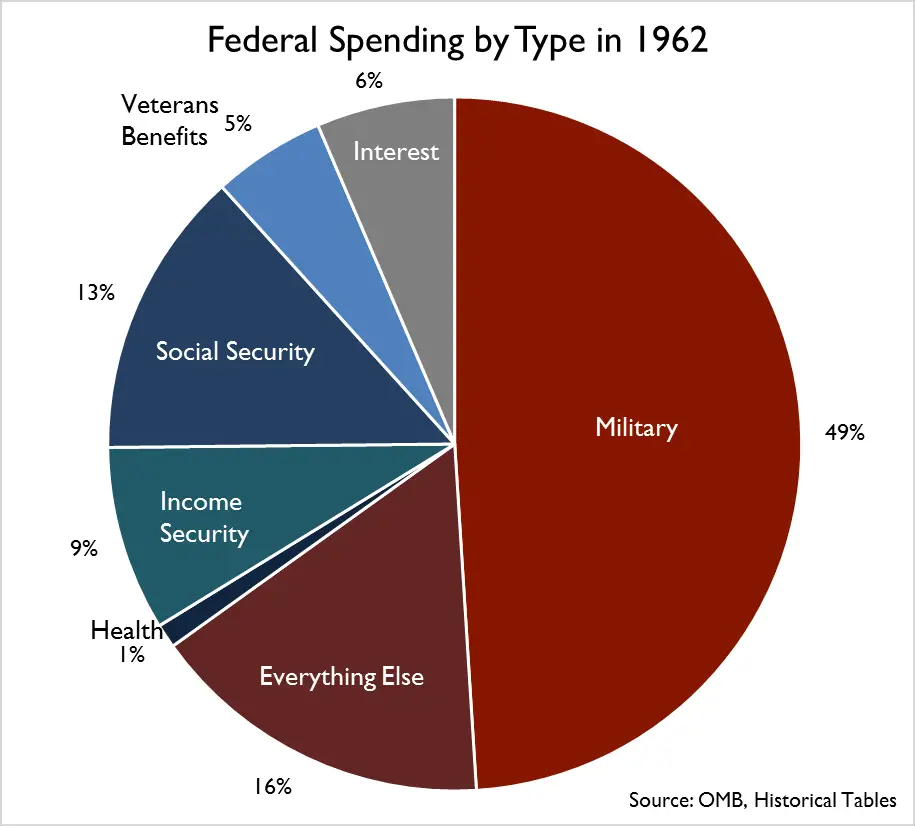

Interest On Government Debt

Lets just say that Uncle Sam is not exactly working the Baby Steps. The U.S. government is currently more than $28 trillion in debtand countingwith a small percentage of your tax dollars going toward paying the interest on that debt.3

The interest on the national debt, which must be paid by the federal government each year, changes based on two factorsthe size of the debt itself and rising and falling interest rates. And since both the national debt and the interest rates on that debt are expected to increase over the next decade, so will the size of our nations interest paymentswhich means more of our taxpayer dollars might be used to make those payments.4

Maybe its time to finally get Washington on the debt snowball . . .

Recommended Reading: Efstatus.taxact 2013

Check State Numbers Twice

Always double-check your employee’s state withholding certificates as allowances and deductions can compute differently using state tax information. In Louisiana, workers claim exemptions and deductions versus allowances. A person claiming one personal exemption and one deduction and earning $800 every two weeks has $18.27 withheld. The tax tables for many states specify a dollar amount of taxation versus a percentage or dollar and percentage combination.

How Much Is Ohio Fica Tax

What is the Ohio FICA Tax? The FICA tax rate is the same as that of the taxable wages. The taxable wage base is the first $118,500 paid in wages to each employee in a calendar year. The FICA tax is split equally between the employee and the employer. The employee has to pay FICA tax on the wages received, while the employer has to pay a premium.

Read Also: How To Buy Tax Liens In California

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Updating Your Personal Information

- To change your name: Contact your department’s payroll/HR administrator.

- To change your address:

- Go to the My Info tab in MyU.

- Note to Foreign Nationals: List your U.S. home address. Do not change it to your home country address until right before you leave to go back to your country. Your final check and tax documents will then be mailed to your home address in your home country.

The Tax Data section of your pay statement shows what you’ve claimed on your Form W-4:

- Your marital status

- Number of tax allowances

- Additional amounts you’ve chosen to have withheld from your paycheck

The state shown on the top line will be Minnesota, unless you’ve completed a MW-R reciprocity agreement form for Michigan or North Dakota, or you live and work in another state where the University is registered to withhold taxCalifornia, Colorado, Illinois, Washington, or Wisconsin. Then that state will be indicated.

Read Also: Irs Federal Returns

Find The Federal Tax Brackets

IRS Publication 15 details various withholding procedures for employers and features tables delineating the percentage tax rate for employees based on their withholdings. Before consulting a percentage tax withholding table, determine the amount of gross pay to remove from the tax calculation.

A single worker with one allowance listed on the W-4 has $155.80 removed. If the worker earns $800, the $155.80 is subtracted and the new total of $644.20 is plugged into the IRS percentage method table. The table reveals the worker is taxed $35.90 plus an additional 15 percent of any earnings in excess of $447.

What Happens To Your Paycheck When Your Tax Brackets Increase

Also, the percentage of federal income tax withheld from your paycheck will increase as your taxable income increases. The tax rate increases in each successive tax bracket until it reaches a maximum.

Where to cash a cashier’s checkHow to verify a cashier’s check is legit? Quick steps to check if you accept a cashier’s check If there are signs of fraud, what to watch out for. Visit or call the bank.Where is the best place to cash a check?The best place to cash a personal check outside of the bank is on the phone. Usually, checks are cashed by deposits at the mobile bank. You can use check cashing apps and have money in your account without having

Read Also: 1040paytax.com Official Site

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

Read Also: Is Freetaxusa A Legitimate Company

How Much Taxes Do They Take Out Of My Check

It depends on how much you earn. The current U.S. Social Security tax rate is, but you pay only half of this amount, or your employer pays the other half.

How much do prison guards makeHow long does it take to become a prison guard? Entry-level prison guards must have a bachelor’s degree or three years of experience in the relevant field by the Federal Bureau of Prisons. You may also need student loans to work for some state and local government agencies.What is the average salary of a prison warden?A young prison guard with 14 years of service earns an average total compe

How Your Federal Income Taxes Are Calculated

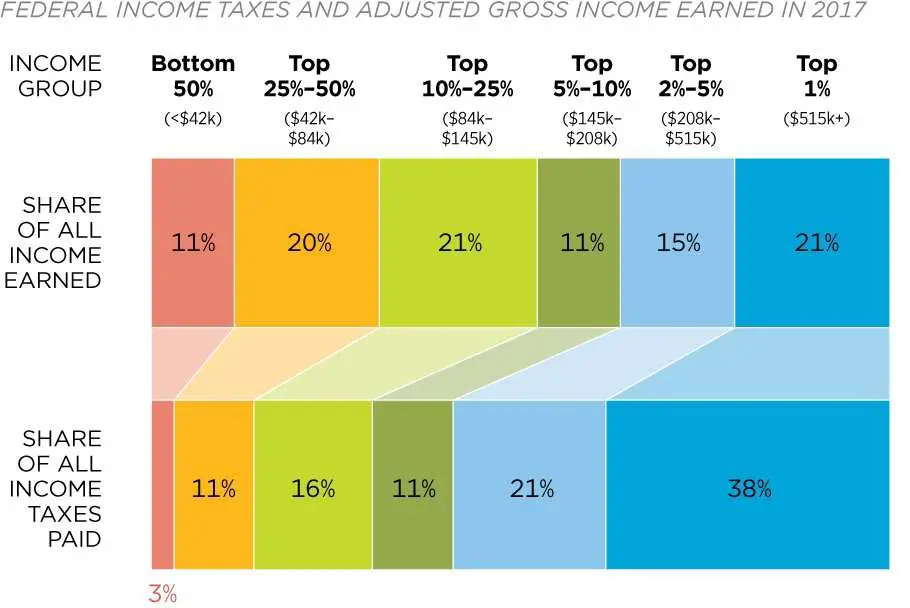

The actual amount of federal income tax thats deducted from your paycheck is based on your income and information from your W-4, such as whether you file as a single person or with your spouse, and whether youre claiming any dependents.

The calculation also takes into account the tax brackets your income falls into. Under Americas progressive tax system, chunks of your income are taxed at different rates.

These are the federal tax brackets for the taxes youre filing in 2020, on the money you made in 2019:

Income amounts up to $9,700 / $19,400 : 10% Income amounts over $9,700 / $19,400: 12% Income amounts over $39,475 / $78,950: 22% Income amounts over $84,200 / $168,400: 24% Income amounts over $160,725 / $321,450: 32% Income amounts over $204,100 / $408,200: 35% Income amounts over $510,300 / $612,350: 37%

You May Like: Efstatus.taxactcom

Social Security Payroll Tax

Funds paid to Social Security taxes go into two trust funds: the Old-Age and Survivors Insurance Trust Fund, which pays retirement and survivor benefits, and the Disability Insurance Trust Fund, for disability benefits. The Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, the Commissioner of Social Security, and two public trustees manage these trust funds.

President Franklin D. Roosevelt signed the Social Security Act into law on Aug. 14, 1935, to provide a safety net for the disabled and retirees. When the program was conceived, high-wage earners were exempt from paying into the fund and receiving Social Security benefits. However, the U.S. Congress replaced the exemption with a cap that usually increases at the same rate as wages.

What Is Federal Income Tax Withholding

Every time you get a paycheck, your employer withholds, or sets aside, taxes based on the information you provided on your Form W-4 when you first started your job.

Your Form W-4, also known as your Employees Withholding Certificate, provides financial details that allow your employer to deduct the correct amount of federal income tax from your pay.

If not enough federal tax is withheld, youll owe the IRS money and may have to pay a penalty, depending on the size of the shortfall. If too much is deducted, youll be owed a tax refund.

When any big changes happen in your life you get married, have a child, or get a big raise, for example you will need to update and resubmit your W-4 to your employer so your paychecks can be adjusted accordingly.

The IRS recently redesigned Form W-4, and the changes could mean that your refund will be smaller than expected this year. Even if your financial situation stayed the same in 2019, H& R Block recommends that you review your W-4 to see how youve been affected.

Some of the changes to Form W-4 include the elimination of withholding allowances, one new blank for you to include income that doesnt come from jobs, and another that allows you to factor in likely deductions.

Don’t Miss: Does Doordash Withhold Taxes

How Does The Federal Income Tax Work In 2019

The federal income tax is a Payasyougo tax. Taxpayers pay taxes when they generate or receive income during the year. Taxpayers can avoid a tax surprise by verifying the amount of tax withheld. The IRS is calling on everyone to write down their wages in 2019, even though they did in 2018. This also applies to anyone who receives a pension or annuity.

How To Calculate Taxes For My Paycheck

To calculate federal income tax, see Employee Tax Certificates and Current Tax Brackets. Calculate taxes to comply with the Federal Insurance Contributions Act using the most recent health and Social Security data. All applicable taxes are based on the employee’s gross salary. The result is the percentage of withheld taxes on the salary.

Severance pay calculatorHow do you calculate severance payment? The court calculates the amount of the severance pay according to the following formula: S × R. The S factor takes into account the duration of the employment and the R factor, the amount of the compensation.How do you calculate separation pay?Determine the reason for the dismissal. Suppose you are eligible for severance pay.Latest base salary and years of service. The las

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

How State Taxes Work

States that levy an income tax may set a flat rate or rates based on the amount of income you earn, as do local governments that levy an income tax. For both local and state income taxes, you generally pay tax on your compensation income based on the state and locality where you work, rather than where you live.

To avoid double taxation, you are generally given a credit for the state and/or local government where you paid the tax so you do not have to pay extra taxes where you live in addition to those you paid in the locality and state where you work.

What Percentage Of Your Paycheck Should You Spend Each Week

Managing finances looked so easy in grade school with those cute pie charts sliced into brightly colored wedges. But, out in the real world, dividing up your paycheck into spending and saving requires some additional calculating and a bit of shuffling. While you won’t find a magic formula that sets out hard-and-fast rules for divvying up , financial planners offer several possible ways to budget.

You May Like: Www.1040paytax.com.

What Happens If Too Little Is Withheld From Your Paycheck

If you or your employer fails to have sufficient funds withheld from your paycheck, the IRS could hold you personally liable for the shortfall.

Generally, there are penalties and interest for failing to have enough funds withheld from your check to either meet your tax liability or to pay enough to cover your previous year’s tax liability.

You must also pay taxes on any bonuses, non-cash gifts, and benefits such as life insurance that are subject to federal tax.