How To Keep Track Of Tax Rates

You’re responsible for collecting the correct and current sales tax rate on all sales that require that you collect sales tax. Sales tax rates can change at virtually any time with different rates in each state, county, and city, so it’s important to keep on top of them. Each state usually has an online database with current sales tax rates.

Most e-commerce platforms look up the customer’s address automatically and charge the applicable tax rate. You’re only responsible for selecting the jurisdictions for which you must collect the taxes.

Make sure that your technology providers update sales tax rates in real time to ensure that your tax rates remain compliant. It’s easier than ever to leverage systems with current accounting technology to make sure you’re current with rates.

How Do I Apply

To submit a request for relief, log in with your username and password and select the account you want to request relief for. The Submit a Relief Request option is located under the I Want To section, More subsection. Simply select the Submit a Relief Request link and follow the prompts.

To submit an Extension of Time in Which to File a Tax/Fee Return, log in with your username and password and select the account you want to request an extension for. The Request a Filing Extension option is located under the I Want To section, select Request a Filing Extension link and follow the prompts.

To review your submitted request, log in in with your username and password, select your account, then select the Submissions tab.

If you do not have a username and password, you can start your request with a CDTFA-735, Request for Relief from Penalty, Collection Cost Recovery Fee, and/or Interest form.

Line 105 Total Gst/hst And Adjustments For Period

Line 105 before RITC reconciliation is calculated automatically based on the information you provided on Schedule A, if applicable.

If Schedule A does not apply, enter the total amount of GST/HST you were required to charge during this reporting period and any adjustments that increase your net tax for the reporting period.

Only include amounts for the current reporting period. Do not include amounts for the fiscal year being reconciled.

Don’t Miss: Www Aztaxes Net

How Sales Tax Applies To Ucla

- As a purchaser, UCLA pays sales tax to California vendors on taxable purchases made in California, unless the item is purchased for resale.

- As a seller, UCLA charges sales tax on sales to California customers external to the UC system. Sales between UCLA departments or between UC campuses are not subject to sales or use tax since the departments and campuses are part of the same legal entity.

How Do I Register To Collect State Sales Tax

You need to register your business with any state for which you’ll be collecting sales tax. To learn how to register, contact the state’s department of revenue or other tax authority. Be sure to have business information available, including your employer identification number, business address, and banking information if you plan to pay sales tax electronically.

You May Like: Louisiana Payroll Calculator

Determining California Sales Tax Naxus

Any business with a physical location in California has nexus, and is therefore required to register to collect sales tax, and to file sales tax returns and pay sales tax to the state.

Other activities that create nexus include someone working for you who lives in the state, having California affiliates who advertise your products in exhange for commission when a sale is made from their affiliate link/marketing activities, or attending a tradeshow and making one or more sales at that show.

Retailers who sell on Amazon and use their Fulfillment by Amazon program, will have a physical presence in California if any of their products are stored within a California FBA warehouse.

What States Don’t Have State Income Tax

States that do not tax income include Alaska, Florida, Nevada, South Dakota, and Texas. Washington and Wyoming are also low-income, Hawaii and Illinois, for example, are leaving some qualified private pensions.

Charitable remainder trustWhat is a Charitable Remainder Trust and how does it work? The remaining charitable trust allows the donor to transfer assets to a separately administered trust that provides the beneficiaries on behalf of the donor with a payment for life or for a period of several years. The settlor determines the amount of the trust fund payment after consultation with the trustees of their choice.What is a charitable trust

Recommended Reading: Do You Claim Plasma Donation On Taxes

Sales Tax And Your Home Business

Just because you do business from home, that doesn’t mean you’re exempt from sales tax. If you have a landscaping business, craft business, antique selling business, or if you have taxable services or products, you’ll need to register your business with your state and start collecting sales taxes.

Vehicles Vessels And Aircraft

If you have questions on how to report and pay use tax on the purchase of vehicles, vessels, and aircraft, see our Tax Guide for Purchasers of Vehicles, Vessels, & Aircraft or refer to Publication 79, Documented Vessels and California Tax, or Publication 79-A, Aircraft and California Tax. The use tax due on these purchases cannot be reported on your California state income tax return.

You May Like: How Do You Do Taxes For Doordash

How Does California Sales Tax Work

Overview of Sales and Use Taxes

Sales taxes are imposed on individuals and businesses which sell goods within the State of California. The amount is calculated by the CDTFA as the total receipt of sales minus any non-taxable sales.

An item is taxable if it is tangible personal property, which includes retail goods of all kinds. Although in general services are excluded, they may be subject to sales tax if they result in the production of a retail good.

A use tax differs in that it applies where a good is purchased from an out-of-state retailer who is selling the good within California but does not have sales nexus within California such that they are required to collect sales tax. The applicable tax rate is the same for both sales and use taxes.

As a business owner, you are responsible for paying the sales tax to be remitted to the CDTFA and you carry the liability for any unpaid amounts. However, you may pass the cost of that sales tax onto the consumer as long as the buyer is made aware that they are paying sales tax as part of the transaction.

Business owners must have a permit in order to collect sales tax and should register for the permit as soon as possible.

Rates of Sales Tax

Sales tax is measured by determining the businesss gross receipts and subtracting any non-taxable sales. The CDTFA may conduct an audit of sales/use tax at their discretion.

Exemptions and exclusions from sales and use taxes

What Sales are Subject to Sales Tax?

How Does Sales Tax Work?

Food

What Is The Highest Tax Bracket In The Us Is

The highest possible taxable category is the 35 percent category, which includes jointly rated couples with incomes greater than $388,350 and individuals with incomes greater than $388,350.

Taxes on lottery winningsHow much tax you will pay on your lottery winnings? Most articles about taxes on lottery winnings emphasize that winners withhold 25% federal income tax. But that’s not really the top federal income tax rate. Instead, large boats are taxed.What percentage of lottery winnings are taxed?Lottery winnings of $600 or less are not reported to the IRS. Income over $5,000 is subject to a 25 percent fe

You May Like: Protesting Harris County Property Tax

Local Sales Tax Reduction Or Repeal Using Proposition 218

Proposition 218 was a 1996 initiative constitutional amendment approved by California voters. Proposition 218 includes a provision constitutionally reserving to local voters the right to use the initiative power to reduce or repeal any local tax, assessment, fee or charge, including provision for a significantly reduced petition signature requirement to qualify a measure on the ballot. A local sales tax, including a sales tax previously approved by local voters, is generally subject to reduction or repeal using the local initiative power under Proposition 218.

Examples where the reduction or repeal of a local sales tax may be appropriate include where there has been significant waste or mismanagement of sales tax proceeds by a local government, when there has been controversial or questionable spending of sales tax proceeds by a local government , when the quality of the programs and services being financed from sales tax proceeds is not at a high level expected by voters, when the local sales tax rate is excessive or unreasonably high , or when promises previously made by local politicians about the spending of local sales tax proceeds are broken after voter approval of the sales tax #General_Tax_Abuses_By_Local_Governments” rel=”nofollow”> legally nonbinding promises concerning the spending of general sales tax proceeds that are not legally restricted for specific purposes).

California Use Tax Overview

Use tax may apply to businesses, individuals, or nonprofits that don’t have an exemption granted by the CDTFA and attempts to level the playing field for purchases that avoid sales tax. Use tax is one of the most overlooked and misunderstood taxes. Two types of use tax exist, sellers use tax and consumers use tax.

Sellers use tax is a transaction tax. It is determined by applying the use tax rate to the purchase price of qualifying goods and services. Generally speaking, a business is required to pay sellers use tax if the following two conditions are satisfied:

To determine the amount of sellers use tax owed, the retailer should apply the sales tax rate where the item is used, stored, or otherwise consumed to the total purchase price.

Sellers use tax may also be referred to as “retailers use tax” or a “vendors use tax”.

Consumers use tax is typically imposed on taxable transactions where sales tax was not collected. A good example is an taxable online purchase where the retailed fails to collect sales tax. The responsibility shifts from the seller to the buyer who can report, file, and remit total use tax on their annual California income tax return.

Also Check: Are Home Improvements Tax Deductible

Register For A Permit License Or Account

You can register online for a permit, license, or account for Sales and Use Tax and most of the Special Tax and Fee programs. See below for additional information.

You will answer questions regarding your business activities and the registration system will identify the permits and licenses required.

The registration process will automatically save the information at each step, allow you to quit at any time and continue at a later time.

Note:Partially completed applications will be deleted after 30 days.

You can also use the registration system to:

- Serial Number of a mobile/manufactured home or aircraft

- Make of a mobile/manufactured home, vehicle, vessel, or aircraft

- Year of a mobile/manufactured home, vehicle, vessel, or aircraft

- Purchase date of the mobile/manufactured home, vehicle, vessel, or aircraft

- Vehicle Identification Number of vehicle

- License plate number of vehicle or undocumented vessel

- Location address of mobile/manufactured home, vehicle, vessel, or aircraft

- Documentation number of US Coast Guard registered vessel

- Hull identification number of the vessel

- Tail number of the aircraft

- Model of the aircraft

If you have any questions, you may contact our Customer Service Center at 1-800-400-7115 , Monday through Friday, 8:00 a.m. 5:00 p.m., Pacific time, excluding state holidays.

File online by logging in to our secure site using your username and password

Local Sales Taxes Subject To Voter Approval Under Proposition 218

All local sales taxes are subject to voter approval under Proposition 218 which California voters approved in November 1996. Whether simple majority voter approval or two-thirds voter approval is required depends upon the type of sales tax levied and the type of local government imposing the sales tax.

Unrestricted general sales taxes are subject to majority vote approval by local voters. General sales taxes can be spent by local politicians for any general governmental purpose, including public employee salaries and benefits. General sales tax spending decisions are made after the tax election by local politicians as part of the regular annual local government budget process. Some local governments may engage in general sales tax abuses in an effort to evade the two-thirds vote requirement applicable to special sales taxes.

Special sales taxes dedicated for one or more specific purposes are subject to two-thirds voter approval by local voters. Any sales tax imposed by a local government other than a city or a county must be a special tax subject to two-thirds voter approval by local voters.

Proposition 218 does not legally authorize any local government to levy a sales tax. The legal authority to levy a local sales tax must come from a state statute. A two-thirds vote of all members of the legislative body of the local government is usually required before a local sales tax measure may be presented to voters at an election.

County transportation sales taxes

You May Like: Do I Have To Report Plasma Donations On Taxes

How To Collect Sales Tax In California

If you have an in-state location in California, you are required to collect both state and district sales taxes. District sales taxes vary between 0.10% and 1.00%, and in some cases more than one district tax will apply to any given location.If you have a single location, in-state buyers who are buying from outside your district will only be charged the state sales tax .If you have multiple locations, you must also collect district sales taxes from any buyer who resides in a district in which you have nexus .

Builders Of New Or Substantially

Certain builders must file their GST/HST returns using GST/HST NETFILE only. Other builders may have to file their GST/HST returns using another electronic method. To find out if you must file electronically and which method you must use, see GST/HST Info Sheet GI-099, Builders and Electronic Filing Requirements.

If you must use GST/HST NETFILE only, follow the instructions in GST/HST Info Sheet GI-118, Builders and GST/HST NETFILE, to complete your return instead of the instructions on this web page.

Don’t Miss: When Do You Do Tax Returns

Business Guide To Sales Tax In California

So, you need to know about sales tax in The Golden State. Look no further!

Whether youâve fully set up shop in California, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

Line 1300 Provincial Transitional New Housing Rebates Assigned To You By Purchasers

Enter on line 1300 the total of all provincial transitional new housing rebates that were assigned to you by purchasers. Do not include on this line any provincial transitional rebates that you are entitled to claim as the builder of new housing. For more information on provincial transitional rebates, see GST/HST Info Sheet GI-096, Harmonized Sales Tax: Provincial Transitional New Housing Rebates for Housing in Ontario and British Columbia or GST/HST Info Sheet GI-151, Harmonized Sales Tax: Provincial Transitional New Housing Rebate for Housing in Prince Edward Island.

Read Also: Prontotaxclass

Looking For More Information On How To Navigate Sales Tax In California

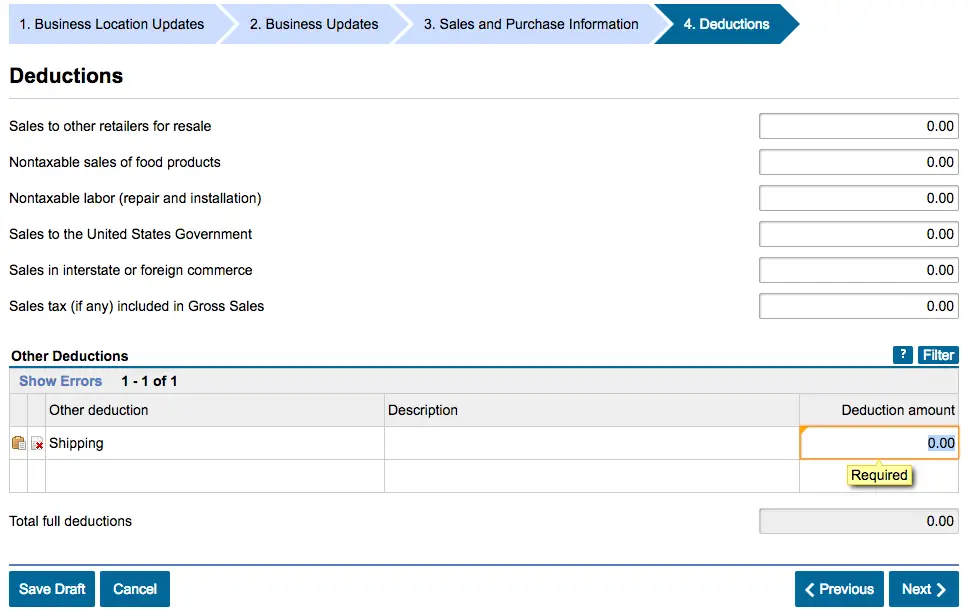

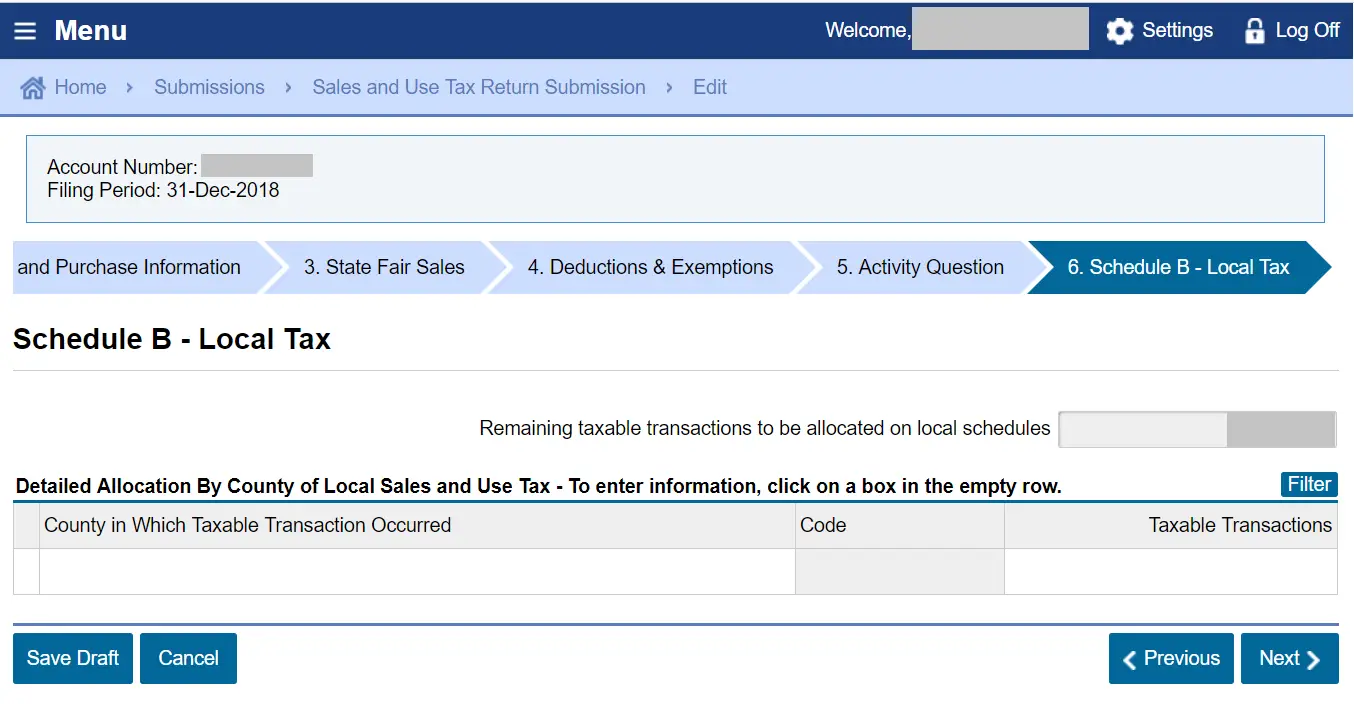

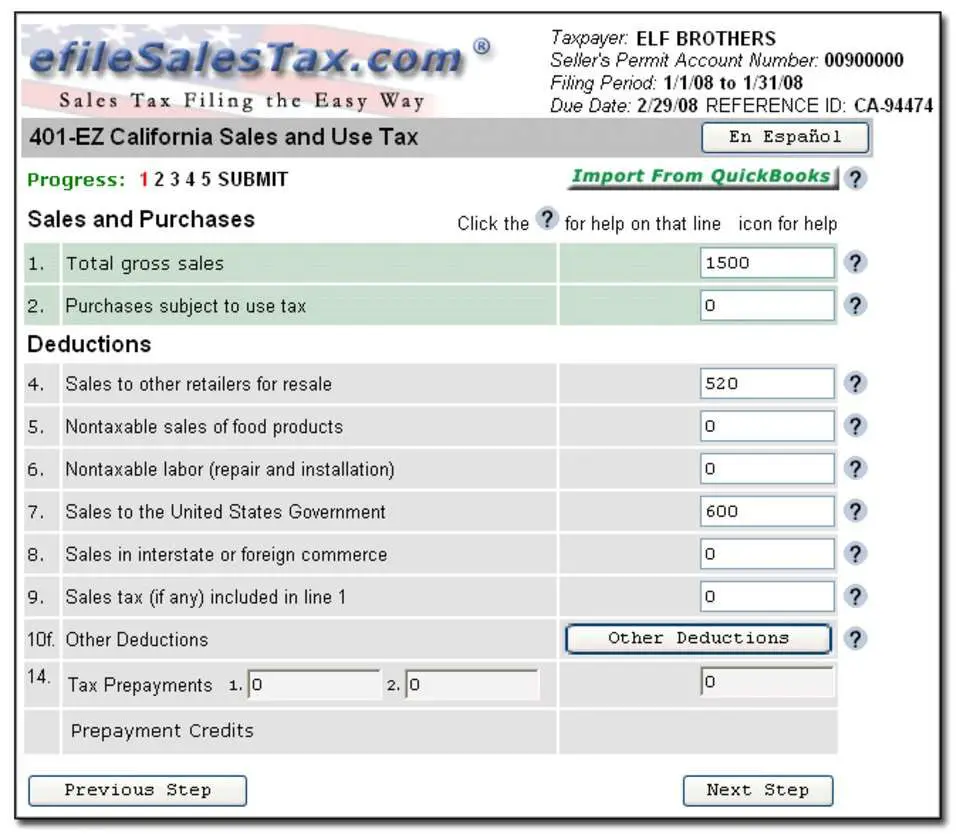

*Please note: California has recently changed their filing process. Here is the updated blog on how to file a quarterly sales tax return in California.

Filing your quarterly California sales tax returns can be challenging, which is why we created TaxJar. TaxJars state reports simplify the process of filing a return and can save you hours spent on managing sales tax. We wrote this post as a step-by-step guide for using TaxJars report to fill in the info you need to file your California sales tax return.

If youd rather not spend time filing a sales tax return ever again, enroll in TaxJar AutoFile and let us handle it. Never worry about missing a due dates or remember your state login and password again! Learn how TaxJar AutoFile can solve your sales tax headaches.

What Is The Current Federal Income Tax

There are currently seven categories of federal income taxes with rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Just because you’re one of the lucky few who earn enough to get into the 37% bracket doesn’t mean that all of your taxable income is taxed at 37%. Instead, 37% is your top marginal tax rate.

Also Check: Efstatus.taxact.com Login

Software And California Sales And Use Tax

Editor: Mark G. Cook, CPA, MBA

State& Local Taxes

The taxability of software for sales and use tax purposes has been a point of persistent debate among states for several years. Many states, including California, have applied sales tax to software based on the form in which it is sold and delivered to consumers. In general, the taxability of software depends on its classification as either canned or custom software, as well as how the program is delivered .

With the downturn in the economy, states have been attempting to revise their tax laws to broaden the overall tax base subject to sales and use tax, thereby increasing revenues to the state. Recently, California courts decided two cases, Microsoft Corp. v. Franchise Tax Board, No. CGC-08-471260 , and Nortel Networks, Inc. v. State Board of Equalization, 119 Cal. Rptr. 3d 905 , that have had and will continue to have an important impact on software transactions. This item addresses the sales and use tax implications of canned software under both cases in light of Californias current statutory scheme. It also comments on the states trend in broadening the tax base with respect to such transactions.

California Sales and Use Taxability of Software

TheMicrosoft Case

Electronically Delivered Software

Historically, California has exempted electronically delivered software from sales and use tax. CA Code Regs. Title 18, Section 1502, provides that

TheNortel Case

EditorNotes