Growing Out Of Control: Property Taxes Put Increasing Burden On Illinois Taxpayers

Property taxes are the single largest tax in Illinois, burdening residents far more than either income or sales taxes.

Illinoisans already know they pay high property taxes.

But what is not as well known is that property taxes are outpacing residents ability to pay for them. Over the past 50 years, whether measured in comparison to household income, economic growth, population or inflation, all classes of property taxes residential, commercial, industrial, etc. have placed an increasingly unaffordable burden on Illinoisans. Since 1963, Illinois property taxes have grown 2.5 times faster than inflation and 14 times faster than the states population.

And looking at residential property taxes alone since 1990 shows:

Residential property taxes in Illinois have grown 3.3 times faster than median household incomes.

Illinoisans residential property-tax burden as a percentage of median household income has risen 76 percent.

If Illinois froze its residential property taxes today, it would take 28 years for residents property-tax burden to return to 1990 levels.1

This long history of growth has resulted in an average effective property-tax rate of 2.32 percent in Illinois the second highest in the nation, behind only New Jersey.2 And with the Chicago City Councils passing a record property-tax hike on Oct. 28, Illinois will be in competition for the highest property taxes in the country.

How Illinois property taxes became the 2nd-highest in the nation

Illinois Pritzker Promised To Lower Property Taxes Hes Only Made Them Worse Wirepoints

Homeowners hate high property taxes. The proof is in New Jerseys recent election results, which you can read about in this piece from Wirepoints.

Here in Illinois, not only has Gov. J.B. Pritzker failed to address what is for many homeowners their biggest issue, but hes made the property tax burden even worse. Under Pritzkers leadership, the legislature has passed a slew of laws that will only increase property tax bills. We list several of the key items below.

Illinoisans are particularly sensitive to the issue given that the average property tax bill per household has far outpaced the growth in median household incomes by nearly three times over the past two decades. Talk to many people, and their property tax bills often exceed their mortgage payments.

Since 2000, property taxes per household have, on average, increased by 113 percent. Compare that to the 41 percent growth in Illinois median household incomes, or to inflation, which rose by 48 percent. Not only are Illinois incomes failing to keep up with inflation, but they are being eaten away by punishing tax bills.

More than two years ago, Pritzker promised a task force that would reform and lower property taxes. And cut Illinois 7,000 units of government.

The commission was a flop. After blowing past their initial due date, the final report ended up as a hodgepodge of half-baked ideas and no firm solutions.

What Is A Property Tax Exemption

A property tax exemption is a type of relief a state provides eligible homeowners to help them reduce the amount of property taxes they owe in a tax year.

When approving an exemption, state tax authorities generally exclude a portion of a homes assessed value from being subject to property taxes. This lower assessed value is one factor that helps determine how much property tax someone owes. And that lower value might translate to a reduced property tax bill.

Don’t Miss: How Does Taxes Work For Doordash

How Can I Avoid Paying Property Taxes

8 ways to lower your property taxes and get some money back Review your property tax card. Get a copy of your property tax card from the local assessors office. Get nosy. Talk to your local tax office. Consider an independent appraisal. Hire an attorney. Ask for tax breaks. Request a Homestead Exemption. Wait it out.

Whos Eligible For A Property Tax Exemption In Illinois

Illinois has quite a few exemptions, so if you own a house in the state, its worth checking to see if you might qualify for one.

Generally, you may be eligible for an Illinois property tax exemption if you own, occupy and pay taxes on your primary residence and meet at least one of the states other qualifications. Exemptions are aimed at helping certain groups of Illinois homeowners who

- Own or lease a house in the state, live in it as their principal residence and are responsible for paying taxes on the property

- Have a disability

- Are disabled veterans who have used federal funds to adapt their home to accommodate their disability

- Are disabled veterans who own or lease a home as their primary residence and are liable for paying property taxes on the home

- Improved a home or rebuilt one after a catastrophe

- Rebuilt a home after a widespread natural disaster

- Are veterans who have returned from a qualified armed conflict

- Are at least 65 and meet income and other qualifications

Each type of exemption has its own rules for who may be eligible to claim it. Be sure to check out the rules for an exemption before you apply for it.

You May Like: How To File Taxes From Doordash

House Bill Would Lower Property Taxes By Trimming Illinois Government Waste

Illinois leads the nation in local government bloat, with over 6,000 taxing bodies. The Citizens Empowerment Act, sponsored by Illinois House Rep. Jonathan Carroll, would make it easier for Illinois taxpayers to dissolve unnecessary layers of government.

Illinois state Rep. Jonathan Carroll has introduced a bill to empower taxpayers to pursue local government consolidation at the ballot box, with the aim of cutting property taxes.

House Bill 5276 would let local voters petition for a ballot referendum to dissolve a unit of government, giving citizens direct control over how many layers of government they want.

Illinois is home to more than 6,000 units of local government, excluding school districts, which is nearly 1,000 more than Indiana, Iowa and Kentucky combined. It is more than any other state. Illinois excessive number of local governments is a major contributor to its second-highest in the nation property taxes.

Removing unnecessary and redundant layers of government could offer residents much needed property tax relief as well as streamline services. While public employee pension reform would offer the greatest relief to property taxpayers, the elimination of unnecessary layers of government is also essential to lightening the burden.

Illinois has more units of local government than any other state

How would the Citizens Empowerment Act help Illinois streamline government and lower property taxes?

DuPage County leads the way in streamlining government

The Morning Rundown: Today’s Top Headlines To Start Your Day

More accurate assessments at the front end should reduce the staggering number of assessment appeals. But the report said higher standards should apply to appeals. Outside data, it said, have indicated that appeals often result in much greater reductions for high-value properties than lower-valued ones, relative to cash value.

And the report takes aim at tax increment financing districts, or TIFs, imposed in supposed blighted areas to encourage redevelopment. Whatever increase in property value results from redevelopment goes back into the project for a set period. The task force recommends reducing TIF lifespans from 23 to as little as ten years and applying a stricter definition to blight.

The task force came about after pressure by lawmakers skeptical of Pritzker’s plan to ask voters this fall whether to adopt a graduated income tax structure. The legislators want to ensure that additional revenue from income taxes helps reduce the property tax load.

Pritzker spokeswoman Jordan Abudayyeh said the governor appreciates the work of the task force and contended that the Democrat has done his part to reduce property taxes by increases state funding for public education and driving a cost-saving consolidation of municipal police and fire pension funds outside of Cook County.

Read Also: Do I Pay Taxes On Plasma Donations

Do Property Taxes Decrease At Age 65

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners. Each taxing unit decides if it will offer the exemption and at what percentage.

Already Been Scammed Donotpay Knows The Way

If you’ve already made the mistake and divulged your personal info to the wrong party or experienced any other kind ofcrime or injustice, you don’t have to sit tight and suffer the consequences. DoNotPay can assist you in taking anyone tosmall claims court!

We’ll help you gather evidencecorrespondence provingstalking or harassment took place,customer service call recordings, deniedchargeback and refund claims,online fax transcripts, or proof ofcopyright violation. Then, we’ll fill out the relevantlegal documents for you and draft a court script that you can use in your hearing.

Don’t Miss: How To Get Doordash 1099

What Is The Deadline

Check with your local board of review about their deadline.

It may be too late to appeal your property tax assessment for this year, which is what you pay next year. So you might not be able to do anything about the property tax youre paying this year.

But, you can still appeal your assessment for next year, which will decide the following years tax.

Your board of review can also give you the form you need to file an appeal. Its short . Theres no filing fee.

Returning Veterans Homestead Exemption

The Returning Veterans Homestead Exemption provides a $5,000 reduction in the equalized assessed value of the veterans principal residence for two consecutive assessment years, the tax year and the following year that the veteran returns from active duty in an armed conflict involving the armed forces of the United States.

Also Check: Paying Taxes On Doordash

Walk The Home With The Assessor

Many people allow the tax assessor to wander about their homes unguided during the evaluation process. This can be a mistake. Some assessors will only see the good points in the home such as the new fireplace or marble-topped counters in the kitchen. They’ll overlook the fact that several appliances are out of date, or that some small cracks are appearing in the ceiling.

To prevent this from happening, be sure to walk the home with the assessor and point out the good points as well as the deficiencies. This will ensure you receive the fairest possible valuation for your home.

How Your Illinois Tax Bill Is Calculated

In Illinois, two factors determine your tax bill: first, the taxable value of your home, and second, the tax rate . You can learn more from the website of the Illinois Department of Revenue, which provides links to county-specific information. Below is an overview of these factors.

The process starts when a local public official determines your home’s taxable value. Depending on where you live in Illinois, this official may be the county assessor, the county supervisor of assessments, or the township assessor. The term “assessor” in this article will cover all of these officials.

Each Illinois county has a slightly different calculation. In most counties, the taxable value of a home is 33-1/3% of the home’s “fair cash value.” The fair cash value is basically the amount for which the home would sell on the open market. In Cook County , for example, the percentage is 10% of the fair cash value. The percentage figures are also known as the assessment ratio.

The taxing authorities multiply the taxable value of your home by the tax rate to arrive at the tax you’ll owe. Let’s say the taxable value of your home is $300,000 and the tax rate is $10 for every $1,000 of taxable value. Your property tax for the year will be $3,000 .

Local officials set the tax rate, so the rate varies depending on where you live. You cannot do much about the tax rate except to vote wisely for the elected officials who determine it, and carefully consider revenue issues that appear on the ballot.

Don’t Miss: License To Do Taxes

Appeal The Taxable Value Of Your Home

You may know that the Illinois authorities compute your property tax by multiplying your home’s taxable value by the tax rate. The taxable value is essentially the fair market value of your home, taking into account its condition, location, and size.

For example, imagine that the state tax assessor has placed a taxable value of $200,000 on the Samsons’ home. If the tax rate is 1%, they will owe $2,000 in property tax.

If you can reduce the taxable value of your home, your property tax bill will be lowered. Imagine that the Samsons decide to appeal the $200,000 taxable value of their home, insisting that the value is actually lower. The appeals board reduces that value to $150,000. Now, the Samsons owe only $1,500 in property tax.

You may check the appraisal value of your home with your county clerk’s office. Be sure that it properly describes your home’s size, and does not overestimate its condition.

If you believe that the Illinois tax assessor has misjudged the value of your home, or if the taxable value is higher than that of similar homes, you might want to pursue an appeal.

Illinois’ High Overall Tax Burden

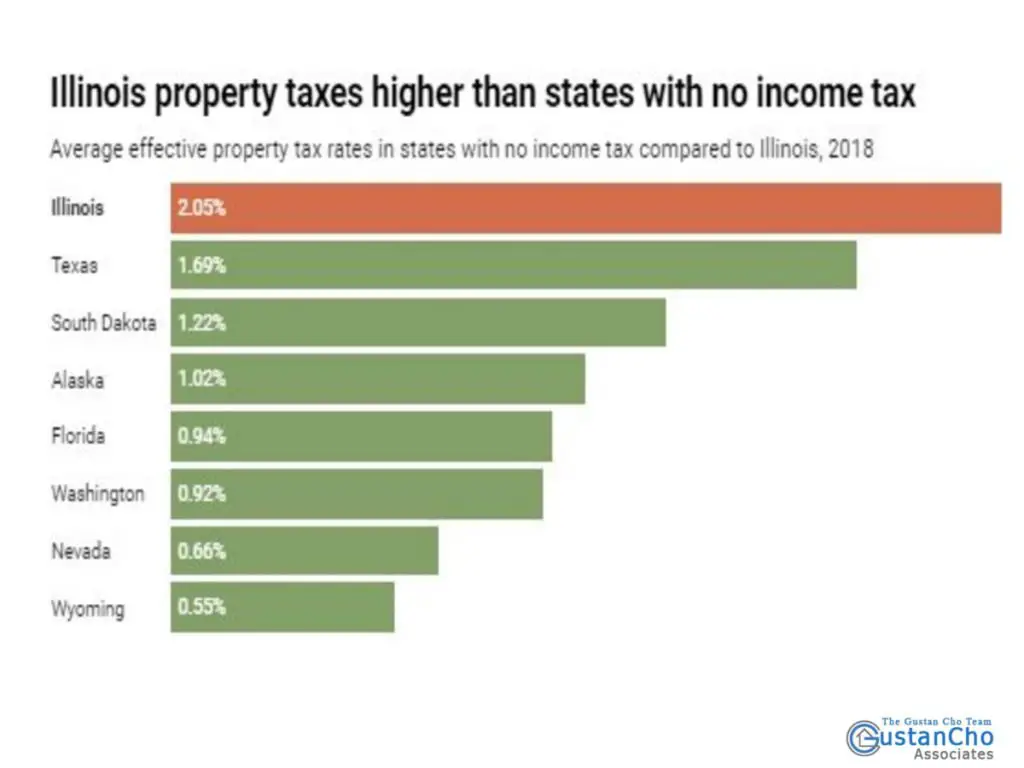

Illinois property taxes are among the highest in the U.S.

In order to better understand how the rapid growth of property taxes has harmed Illinois taxpayers, it is important to determine how Illinois property taxes and total tax burden compare to those in other states.

Not only has the rapid growth in property taxes increased the burden on Illinois taxpayers, it has harmed Illinois economic competitiveness compared to both the states Midwestern neighbors and the rest of the U.S. According to several sets of analyses, Illinois property taxes are among the highest in the nation.

Below is a brief breakdown of several studies from the Urban Institute and the Brookings Institution, the Tax Foundation, and the American Legislative Exchange Council and the Laffer Center, which examined property taxes and overall tax burdens across the 50 states.

Urban Institute-Brookings Institution study

Illinois has the sixth-highest average home-property-tax rate in the country, according to research using U.S. Census data by the Tax Policy Center of the Urban Institute and the Brookings Institution.

However, when examining only counties with populations over 65,000, Illinois has the second-highest property-tax rate in the nation. There are 23 such counties in Illinois and 813 counties nationwide. In 2012, owners of average homes in these 23 Illinois counties paid taxes equal to 2.28 percent of their homes estimated market value.

Tax Foundation study

ALEC-Laffer study

Recommended Reading: Www Aztaxes Net

Disabled Veteran’s Standard Homestead Exemption

This exemption may be claimed in addition to the General Homestead Limited Exemption and the Senior Citizens Homestead Exemptions, if applicable however, it cannot be claimed in addition to the Disabled Veterans Exemption of $70,000, or the Disabled Persons Homestead Exemption. To receive this exemption, you must:

- Be a Williamson County, Illinois resident and have served in the United States Armed Forces, The Illinois National Guard, or U.S. Reserve Forces, and have received an honorable discharge.

- A disabled veteran with at least a 70% service-connected disability will receive a $5,000 reduction in the propertys EAV.

- A disabled veteran with at least 50%, but less than 70% service-connected disability will receive a $2,500 reduction in propertys EAV.

- Have owned and occupied the property as the primary residence on or before January 1st of the tax year.

- Supply documentation as required by the instructions on the back of the form.

- Have a total equalized assessed value of less than $250,000.

- An unmarried surviving spouse of a disabled veteran can continue to receive this exemption on his or her spouses homestead property or transfer the exemption to a new primary residence. To qualify, the surviving spouse must meet the following requirements:

Find Out What Your Neighbors Pay

How much is their property tax? It really is your business.

To win an appeal, you want proof that your neighbors who live in a house comparable to yours pay less in taxes than you do. Search here for homes in your neighborhood that have recently sold, or contact a real estate agent and ask for comps to be pulled. The real estate agent may be kind enough to do it without the promise of a sale. You can also be nosy and just ask your neighbors.

But a word of caution: Be sure youre comparing apples to apples as reasonably as possible, Dowler says.

A tax assessor will be skeptical if you argue that your brand-new, six-bedroom house should be taxed the same amount as a 100-year-old, four-bedroom home down the street. And be aware that any improvements youve made to your home could send your tax bill right back up.

Don’t Miss: Do You Have To Claim Plasma Donation On Taxes

How Property Taxes In Illinois Work

Property tax assessments and collections in Illinois run on a roughly two-year cycle. In year one, local assessing officials appraise real estate to determine a market value for each home in their area. The assessed value of property in most of Illinois is equal to 33.33% of the market value of the residential property, though it may be different in certain counties.

After local officials calculate the assessed values of properties, county boards review these values to determine if they are correct. These county boards may equalize assessed values. If they find, for example, that the property in a certain district was appraised at half of its actual value, they will apply an equalization factor of 2, doubling the assessed value of everything in the district.

Property owners also have the opportunity to protest their assessed value before the county board. If a homeowner is not satisfied with the county boards decision, they can appeal to the State Property Tax Appeal Board or even the circuit court.

The state of Illinois also equalizes values between counties by issuing an equalization factor for each county. This ensures that assessed property values in all counties are comparable.