What Can You Deduct As A Small Business Owner

As an independent contractor, youre eligible to make certain business-related deductions as long as theyre considered necessary in the eyes of the IRS. As in, you need those to run your operations. These deductions can lower your overall tax burden aka the amount youll ultimately pay in taxes.

Some of the most common deductions for freelancers include:

- Home office

- Office supplies

- Travel expenses related to work

- Meals and entertainment, within reason, related to client meetings or business travel

- Professional services, like an accountant

- Half of your self-employment taxes

Gather The Required Information

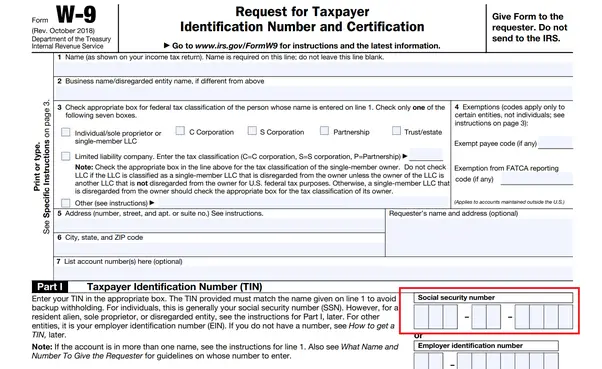

Before you can complete and submit a 1099, youâll need to have the following information on hand for each independent contractor:

- The total amount you paid them during the tax year

- Their legal name

- Their address

- Their taxpayer identification number

The standard method for acquiring this information is to have each contractor fill out a Form W-9. As a best practice, you should have a W-9 on file for each of your independent contractors. Having contractors fill out a W-9 should be one of the first administrative tasks you complete after engaging their services.

Check your bookkeeping records to confirm the total amounts you paid to each contractor during the tax year.

Once you have all of the required information, use it to fill out Form 1099-NEC.

Manage Global Contractors Painlessly With Multiplier

Thereâs no point in wasting time understanding an independent contractor’s form and how it works. Employers should instead focus on how the independent contractors are performing and how their internal collaboration can be better.

But the question is, who will manage this aspect then? How about you automate the whole process?

Multiplier, an automated onboarding tool, can help you with the following activities:

- ~Generating compliant contracts to make collaboration with freelancers smoother

- ~Paying the global freelancers at once without any frictions

- ~Keeping a tab on all freelancers with a single, advanced dashboard

- ~Offering freelancers with various perks and benefits

Want to know how you can get all these benefits at once? Book a demo now!

Don’t Miss: Doordash Filing Taxes

Submit Copy B To The Independent Contractor

Once your Form 1099-NEC is complete, send Copy B to all of your independent contractors no later than January 31.

You can download and print a version of Copy B from the IRS website and send it to your independent contractor. This process is explained in further detail on the first page of Form 1099-NEC.

How To Fill Out And Read Form W

Form W-8BEN is relatively straightforward to fill out, but be prepared with the following information:

- Line 1: Provide your name or your business name.

- Line 2: Provide your country of citizenship.

- Line 3: Enter your permanent residence address.

- Line 5: Enter your U.S. tax identification number.

- Line 6: Enter your foreign tax identifying number.

- Line 7: Provide your Canadian Social Insurance number or your Canadian corporate tax identification number.

- Lines 9 and 10: Specify the tax treaty rules that apply to you. Check the appropriate box if you are operating under a business name.

Also Check: Doordash Paying Taxes

What Are The Tax Deadlines For Form W

Form W-9 is not subject to IRS deadlines, since the IRS does not collect this form. However, since employers must file Form 1099 by Jan. 31, independent contractors who do not provide a W-9 upon starting work with a new client should file the form with their clients as soon as possible. Business owners can also request Form W-9 from contractors as needed between the end of the year and the 1099 filing deadline.

Even though there are no deadlines for Form W-9 submissions, independent contractors should be aware of the quarterly tax deadlines that come with freelancing. While learning about Form W-9, you may want a refresher on self-employed accounting basics as well.

Key takeaway: There is no deadline to complete a W-9. However, you should obtain it prior to filing the Form 1099.

Tax Tips For Independent Contractors

- Consider working with a financial advisor to better manage your independent contractor income. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Develop a good record-keeping system for your business. Make sure you have accurate records of both your income and expenses for the year. Consider using an expense app to keep tabs on receipts, charitable donations and other deductible expenses. When you receive your 1099 forms, be sure to check them for accuracy.

- A financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. This means that you will be able to use your investment losses to reduce taxes on 1099 income.

- Figuring out your taxes can be overwhelming. SmartAssets income tax calculators will help you calculate federal, state, and local taxes.

Don’t Miss: How To Do Taxes With Doordash

Getting Set Up For Success

Running a business means you wear a lot of hats. Managing what you owe to the government can seem like a lot. Here are a few tips to keep you on track with your taxes and to hopefully avoid an IRS audit notice.

Put your system in place and in the beginning especially, and handling your tax obligations becomes simple.

Canadian Subcontractingdo’s And Don’ts

You may interested in an article by Ann Douglas published in the Periodical Writers’ Association of Canadian examining the do’s and don’ts of Canadian subcontracting.

She does say that, “If you’re months behind in your filing and you can’t remember the last time you keyed a cheque into your accounting program, it’s probably time to think about bringing someone in to help you stay on top of your office chores.”

Also Check: Do Doordash Take Out Taxes

How To Pay An Independent Contractor

Unlike employee wages, which youâll handle through your payroll, you pay your independent contractors like you would any other kind of supplier, via your accounts payable system.

Typically an independent contractor will first send you an invoice, which will specify certain payment terms. Depending on your accounts payable process, you might also send them a purchase order back to confirm the invoice before issuing the final payment.

What Was The Cra Auditing

BACKGROUND

In a posting at Omni Management Services Ltd. back in February 2011**, they discussed their conversations with CRA on subcontractor payments and issuing T4As. The blog explained that “the way the rule is written in the tax act, a T4A should be issued for any individual or company that you pay for any fee or service”. This excludes the buying of physical goods and supplies. We are only talking about services here.

In a previous blog, it was noted that CRA wanted “any payments tosub contractors outside the construction industry reported on T4a slips“.

It is recommended you receive an invoice from your subcontractor which contains the following information to keep an auditor happy:

- their personal name and/or their business name if applicable … this means the invoice should state the legal name they are doing business under

- their address … of course

- their GST/HST number if applicable … if there is no GST/HST number, don’t pay any sales tax charged

If you are paying over $500,make sure you get the subcontractor’s SIN if they are operating as a sole proprietor and aren’t a GST/HST registrant … or their BN if they are incorporated and/or a GST/HST registrant.

Better yet, create a form to capture the information you need to gather for subcontractors for CRA … enabling you to prepare the information slip properly. Have each subcontractor complete your form prior to hiring them.

Recommended Reading: Www.efstatus.taxact.com

Tax Deductions For Independent Contractors

As an independent contractor, you can deduct reasonable and necessary expenses related to running your business. Tax deductions reduce net income, lowering your business tax bill.

At your disposal are the same deductions available to any small business. You can scan our guide to small business tax deductions for a more comprehensive list of deductible expenses, but here are a few call-outs for independent contractors.

- Home office deduction: Independent contractors who use a portion of their home for work — and no other purpose — can deduct either $5 per square foot, up to 300 square feet, or the actual expenses of their home office. Dont try to claim your kitchen table or an office you use for your full-time, non-contract job the IRS doesnt look kindly on that.

- Self-employment taxes: Employees pay one-half of Federal Insurance Contribution Act taxes, and their employer picks up the other half. Independent contractors must pay 15.3% of eligible earnings to FICA, but they can deduct the half employers typically pay.

How Else Can An Independent Contractor Be Distinguished From A Full

As a business owner, you should determine whether a person providing services to your company should be offered full-time employment or kept as an independent contractor . If the person in question meets any of these criteria, they should likely be classified as an independent contractor:

Key takeaway: Employers dont have the same control over an independent contractor as they do over a full-time employee. Essentially, the employer can only control what work the contractor produces, not how they produce it.

Also Check: Are Plasma Donations Taxable

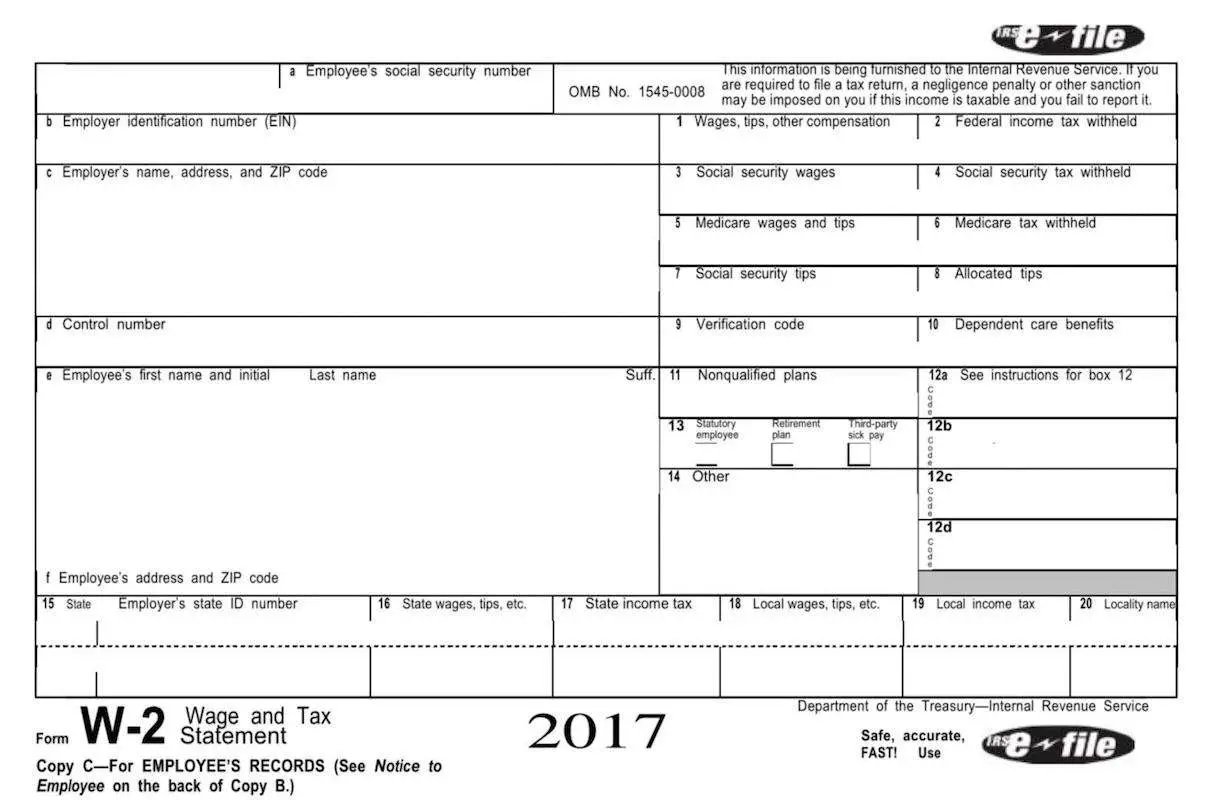

What Is The Difference Between 1099 Employees And W

More and more small businesses are spending money on contractors. In 2018, 8.7% of U.S. sole proprietorship business expenses were spent on contractors, according to the IRS.

Independent contractors have some easy-to-identify benefits for the bottom line. Because you arent paying employment taxes and providing benefits for them, contractors can often cost less than full-time employees.

But with the pros, like lower cost, can come cons, like the lack of control you might have over your contractors schedule.

Heres a breakdown of some of the pros and cons for both independent contractors and employees.

Stay On Top Of A New Address

Whether or not the payer has your correct address, the information will be reported to the IRS based on your Social Security number . As a result, it’s important to update your address directly with payers.

Taxpayers don’t include 1099s with their tax returns when they submit them to the IRS, but its a good idea to keep the forms with your tax records in case of an audit.

Read Also: Www 1040paytax

When Are Quarterly Taxes Due

Quarterly taxes are due around the same time each calendar year and is based on the amount youve earned for each quarter:

- For Sept. 1-Dec. 31 of the previous year

- For income earned from Jan. 1-March 31

- For income earned from April 1-May 31

- For June 1-Aug. 31

To pay these taxes, youll file Form 1040-ES with the IRS on or before the due date. You can file and pay your quarterly taxes online , by phone or mailing in your payment. If you need to pay state taxes, its best to check how much youll need to owe and where exactly to send it off .

How To Keep Tax Records As An Independent Contractor

A benefit of being an employee is that there is likely an HR and Payroll department that ensures all of your requisite tax is paid. However you, my friend, are your own boss! Whether all of your income comes from independent contracting or just a portion of it, itâll be up to you to hold on to your paperwork.

One of the most frustrating aspects of being an independent contractor is having tax season roll around and feeling bewildered by all that must be done. You might feel overwhelmed about possibly being hit with steep penalties and fees .

The goal with this article is to make your tax situation and filing your 1099 taxes as seamless as possible while avoiding any tax penalty

Your records should include a summary of all your business transactions and clearly indicate gross income and total expenses.

If you perform work on a platform, they may provide you with an annual statement of activity which makes things quick and easy. For independent contractors who perform work on multiple platforms or operate as a sole proprietorship, you may want to create an email inbox to hold anything that might be needed when itâs time to organize your tax information. Remember, tips and cash payments also need to be accounted for.

Depending on the kind of work you do, managing expenses may require a little more planning. I get it, itâs easy to forget about the ink cartridge you bought last minute, or the expedited shipping you paid for to make sure an order arrived in time.

Read Also: Doordash Tax Tips

Saving For Retirement As An Independent Contractor

While there has been a surge of people joining the gig economy itâs still a relatively new phenomenon. Whether you got started temporarily to achieve a short term goal or if youâre in it for the long haul, independent contractors retire too. With retirement in mind, there are tax deductions and benefits that come along with any contributions small business owners make. Getting setup with an IRA or 401K may require a little research on your end or working with your tax professional but itâs well worth it.

Do I Need To Issue A 1099 To An Independent Contractor

The basic rule is that you must file a 1099-MISC whenever you pay an unincorporated independent contractor -that is, an independent contractor who is a sole proprietor or member of a partnership or LLC-$600 or more in a year for work done in the course of your trade or business by direct deposit or cash.

You May Like: 1040paytax

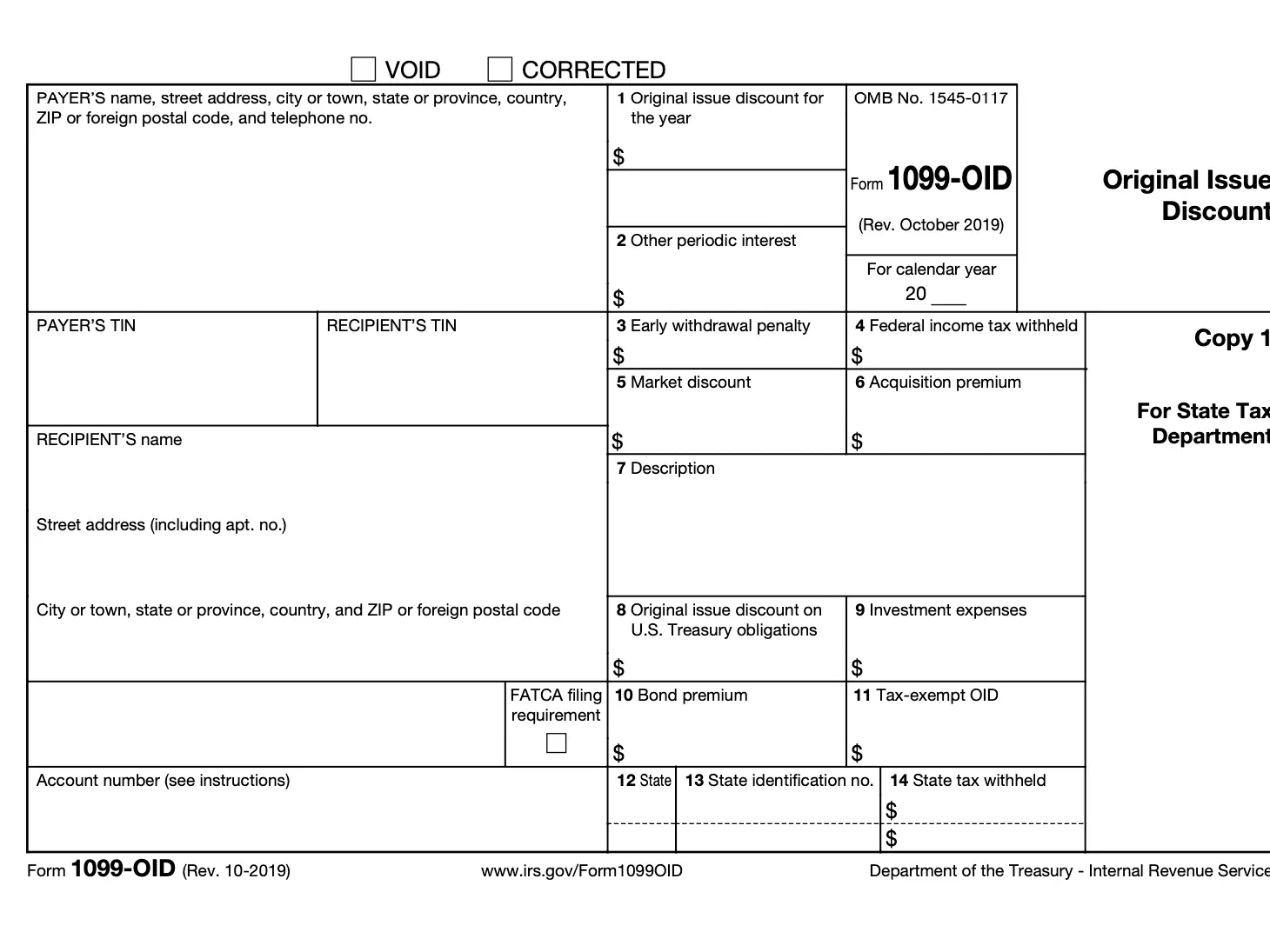

How To File A 1099

Now that you understand the basics on how to fill out a 1099-MISC form, here’s some information on how to file a 1099 misc form:

- To be sent to the IRS: Copy A

- To be sent to the state tax department: Copy 1

- To be sent to the contractor: Copy B and Copy 2

- To keep for your own records: Copy C

The deadline for filing your 1099-MISC form is January 31st. Make sure to send both a copy to the contractor and the IRS before this date. Lastly, as a business you will also need to submit 1096 form to the IRS. This form is a summary of all the 1099 forms you have submitted for each independent contractor. Ensure you display the total amount paid throughout the year on form 1096, which must also be submitted by January 31st.

What Forms Do You Need To Hire An Independent Contractor

This answer lays out the forms and tax documents that companies prepare for Independent Contractors .

No account yet? Register

This answer lays out the forms and tax documents that companies prepare for Independent Contractors , as well as highlighting two best practices: the use of written contracts and tracking of invoices.

If its your first time hiring contractors, be aware that the IRS is aggressive in pursuing abuses of the tax system. So, if a company is unsure whether the individual is a legitimate contractor and not an employee, the first step is figuring that out. The difference is crucial, as misclassification could result in significant fines and penalties.

You May Like: Doordash Tax Write Offs

Filing Your Annual April Tax Return

Even though you file and pay quarterly taxes, youll still need to file a tax return the same as someone working at a full-time job. In general, youll file a personal tax return, where youll indicate your annual income and estimated taxes paid. As youve kept up with your quarterly taxes, it shouldnt be too painful if youve missed payments or neglected the self-employment tax, you may find yourself owing the IRS.

Since youre the one responsible for keeping track of your income, youll want to be diligent about recording every single penny you earn.

Quarterly Estimated Tax Payments

The U.S. tax system is a pay-as-you-go tax system, meaning you need to make tax payments regularly throughout the year. When youre an employee, your employer is responsible for withholding income taxes from your paycheck and sending it to the government.

So, how does an independent contractor pay taxes? When youre an independent contractor, paying the government regularly throughout the year is your responsibility. You do this by making quarterly estimated income tax payments. You can estimate how much you need to pay the government each quarter by guessing what your total income for the year will be or by using the amount youve paid in estimated taxes the previous year.

You wont know exactly how much tax you owe until you file your personal tax return at the end of the year. But youll want to spend time estimating this because if you underpay your estimated taxes, you could be subject to penalties.

And dont forget to pay estimated taxes to your state. Aside from making federal estimated income tax payments, youll be required to pay your state throughout the year as well.

Also Check: Doordash Tips Taxable

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.