The Premium Tax Credit

If your income is between 100% and 400% of the federal poverty line, the PTC will reimburse the amount you spent on monthly premiums for health insurance purchased through the Health Insurance Marketplace. These federal poverty line thresholds are actually higher than the minimum amount needed to file a tax return. However, if you received unemployment compensation for any week beginning during 2021, your household income is automatically considered to be 133% of the federal poverty line and therefore qualifies you for the credit.

To claim it, you must file a federal income tax return and attach Form 8962. More information about claiming this credit can be found here.

When To Expect Your Refund

Remember, patience is a virtue. According to the CRA website, as long as you filed your return by the deadline, it aims to send you your refund within two weeks if you filed online or up to eight weeks if you filed a paper tax return. However, it can take as long as 16 weeks if you live outside the country. The CRA further notes that the fastest way to get your refund is by signing up for direct deposit.

You can check the status of your refund by either phoning the CRA or accessing your CRA account online. The CRA also posts standard processing times on its site.

Health Coverage Tax Credit

The health coverage tax credit helps certain displaced workers and pre-retirees pay for health insurance. Specifically, it is available to people eligible for Trade Adjustment Assistance allowances because of a qualifying job loss, and people between 55 and 64 years old whose pension plans were taken over by the Pension Benefit Guaranty Corporation. The credit is worth up to 72.5% of payments for qualified health insurance coverage.

As with the other credits we’ve mentioned, the health coverage credit is refundable. So, if you can claim the credit, you’ll want to file a tax return just to claim the credit, even if you’re not required to file a return. By doing so, you can get a federal income tax refund check sent to you.

As with the premiums tax credit, the health coverage credit can be paid in advance. That also means that your refund will be smaller if the advance credit payments are greater than your actual allowable credit. There’s no suspension of 2020 excess payments of the health coverage credit like there is for the premium tax credit.

Also note that the health coverage credit was set to expire at the end of 2020, but it was extended to December 31, 2021.

9 of 9

Read Also: Does Doordash 1099

Is It Necessary For International Students To Pay Income Tax

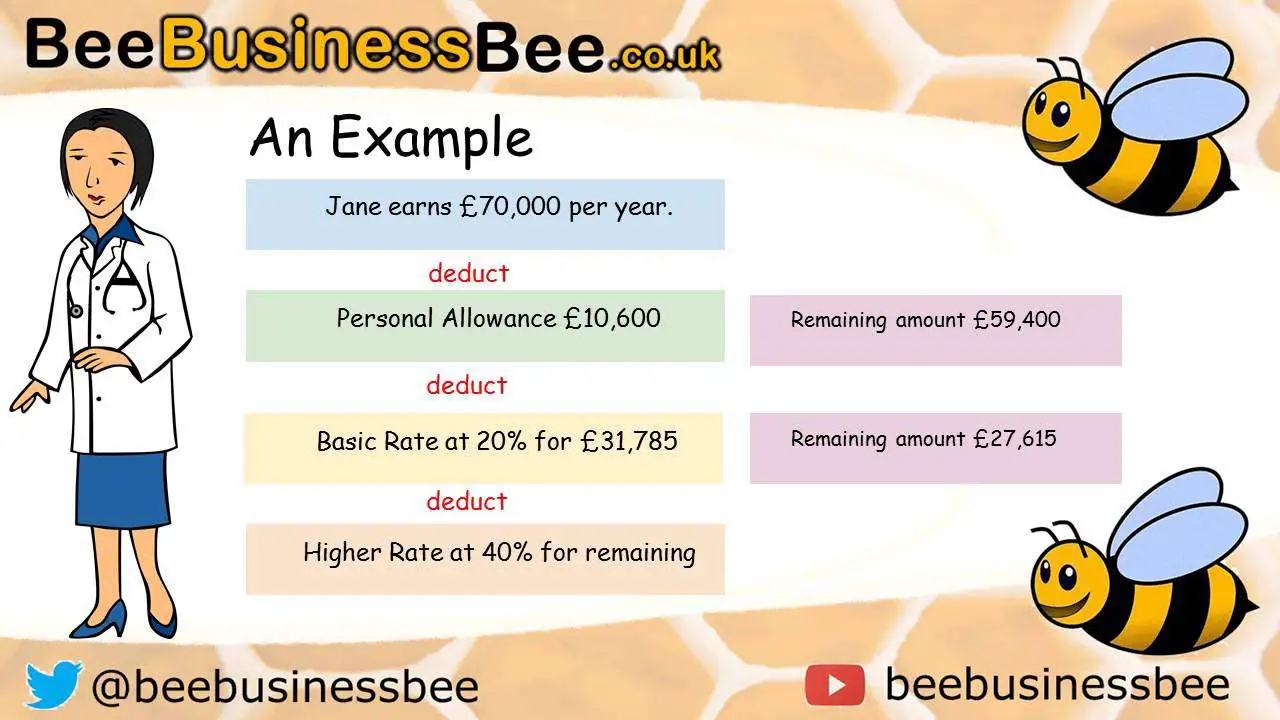

You need to pay income tax and national insurance contributions in most situations. While studying in the UK, you must pay income tax on any earnings from work you do while a resident in the UK. Additionally, as an international student, you need not pay income tax on funds brought into the UK to fund your education. Furthermore, any assistance you get from a student loan company, bursaries, scholarships, or grants will not be subject to income tax.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Recommended Reading: 1099 Form Doordash

What Should You Do With Your Tax Refund

Obviously, what you do with your refund is up to you. It can be very tempting to see it as a windfall and go on a shopping spree. A far wiser use for a tax refund would be to see it as a welcome opportunity to pay down some debt, start an emergency fund or invest it in a TFSA or RRSP.

If you are self-employed and pay taxes in quarterly installments, you can use your refund to make your payments more manageable. You can do this by electing to have the CRA transfer your refund to the amount owing on your next future installment payment.

Two Other Factors That Could Influence Your Refund Are:

- Canada Pension Plan contributions on self-employed earnings: If you have self-employed income and have to pay a pension contribution, your refund is reduced by that amount.

- The Canada Workers Benefit : The CWB is a refundable tax credit available for low-income individuals in the workforce and if you qualify will be shown on Line 45300 Canada Workers Benefit.

References & Resources

Don’t Miss: Do I Have To Pay Taxes For Doordash

Tax Return Vs Tax Refund

Your tax return is a calculation of what you owe the IRSor what the IRS owes you. Your tax refund is a payment made to you by the IRS because you overpaid over the course of the year or were eligible for one or more refundable tax credits. Youll receive a tax refund if the amount on line 33 of Form 1040 is greater than the total tax you owe on line 24. Youll have to make a tax payment to the IRS if line 24 is more than what appears on line 33.

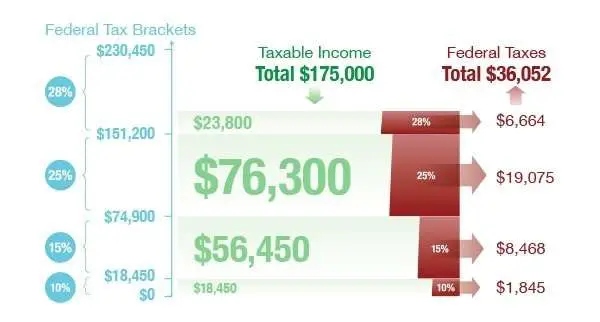

For example, suppose you are an unmarried individual who falls into the single filing status, and you work for an employer. Your gross income before any deductions was $35,000 for 2021. You had $3,500 withheld from your paychecks throughout the course of the year. If you had no adjustments to your income and only took the standard deduction of $12,550, your taxable income would be $22,450. Based on this taxable income, your taxes owed would be $3,570, but since you already paid $3,500 in taxes throughout the year, you would owe just $70 and would not get a tax refund.

However, if everything were the same, but you had $4,000 withheld from your paychecks throughout the year for taxes, youd get a tax refund of $430 from the IRS.

How Tax Refunds Work For The Self

In contrast, self-employed individuals are responsible for their own cash flow throughout the year. Ideally, they should estimate their average tax rate at the beginning of the year, and transfer that percentage from each paid invoice to a separate bank account.

At the end of the fiscal year, the self-employed add up all their income, subtract expenses, deductions, determine their average tax rate and then subtract credits. Because no taxes have yet been collected, they must send the full amount to the CRA.

The self-employed require the time to do bookkeeping, plus the willpower not to spend the accumulated cash.

Those who pay taxes annually like this rarely receive a refund. The vigilance this approach requires usually results in the taxpayer paying the correct or nearly correct amount in taxes.

Its also possible for this group to pay taxes throughout the year, in quarterly installments. Theres several different ways to calculate how much these installments are, but its unlikely it will add up to the exact amount owed. If you overpay, you will get a refund. This group generally has until April 30th to pay any taxes owed and until June 30th to actually file a return.

You May Like: Taxes With Doordash

What Are Tax Returns What Are Tax Refunds

Many consumers confuse and conflate the terms tax return and tax refund. A tax return is a form, or series of forms, that compose a statement of your income, expenses, liability, and taxes youve already paid to the IRS throughout the year. If you are a salaried or hourly employee, youve no doubt noticed that your employer withholds a percentage of your pay every period for taxes. When you file your tax return, you send the IRS a statement of how much money youve already paid in taxes for salaried or hourly employees, you will most likely use Form 1040 to file your federal return.On the other hand, a tax refund is the difference between what you actually owed in taxes and what you paid. Most Americans pay more than they truly owe in taxes through their employer. This is because, when an employer withholds pay, the tax money is usually divided between Social Security, Medicare, and also state income tax . When you receive a tax refund, the money is the difference between what you owed in federal tax and what you actually paid in taxes . To learn more about income tax and how it is calculated, check out this video:

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Also Check: Protest Property Taxes Harris County

Refunds From Tax Credits

While taxpayers usually forfeit their tax credits when they owe nothing, you may qualify for a tax refund through these exceptions:

- The Child Tax Credit in 2021 pays a maximum of $3,600 for every child that qualifies as a dependent. The credit was $2,000 per dependent in years past but was expanded as part of the American Rescue Plan, signed into law by President Biden in response to the COVID-19 pandemic. For 2021, the CTC is fully refundable. This is different from past years when it was only refundable up to $1,400. In other words, if you qualify for the CTC for tax year 2021 and it brings your tax liability below zero, the IRS will send you the remaining amount.

- Taxpayers who earn low-to-moderate income may qualify for the Earned Income Tax Credit , which reduces the tax amount that you owe and could entitle you to a refund.

- The American Opportunity Tax Credit helps taxpayers offset higher education costs paid on behalf of eligible students. The annual credit is worth $2,500 per student. If the credit drops your tax liability to zero, the IRS will refund up to 40% of any remaining amount of the credit .

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How To Find A Companys Ein

You Need To Account For Support Your Received

Living in Germany has been a blessing during Corona times. The country has had a healthy budget in order to support freelancers, companies & employees with support packages. Many of us have received support with public money in one way or another.

The money you have received from the German authorities need to be accounted for in the tax return made for 2020 and 2021. This could come under different forms. Some examples:

- Kurzarbeit Geld: if your employer reduced your hours, the German state has compensated for your lost income in the form of Kurzarbeit Geld.

- Corona grants/aid/support money for freelancers: This has taken different names like Corona Zuschuss, Überbrückungshilfe, Neustarthilfe or Härtefallhilfe. In some cases, the application had to be done by your Steuerberater, so they would know where/how to include it for you. For this you use the new Corona Hilfen form. Those aids are also to be accounted in your general profit statement .

- Compensation due to legal restrictions: you could not work because of restrictions measure

- Krankengeld: if you were infected by the Corona virus and werent able to work because of it. You probably have received support money in this case too.

Basically anytime you received public money, it should appear in your tax declaration for that time window.

You May Like: How Do Taxes Work For Doordash

How Does Getting A Tax Loan Work

A Tax Refund Anticipation Loan is a loan made by a lender that is based on an anticipated federal income tax refund. Taxpayers are generally charged fees and interest to obtain a tax refund loan. The full amount of the tax refund loan must be repaid even if the refund is lower than the amount anticipated.

You May Like: Efstatus.taxact.com.

How Long It Takes To Get Tax Back In Canada

The CRA typically sends your tax refund within two weeks when you file online, or within eight weeks when you file a paper return. If you live outside of Canada returns may take up to 16 weeks. If your tax return is flagged for an in-depth review it may take longer.

The CRA recommends signing up for direct deposit with your online bank to get your return faster.

If the CRA takes longer then about a month to deliver your refund then they will pay you a compound daily interest of between 2 and 6%.

How Can I File My Tax Return

Before you can even start thinking about your tax refund, youll need to make sure that your return is properly filed on time. You have two options when it comes to filing your return: you may file a paper return or you can use tax prep software to assist you in filing electronically. If youve chosen to file with a paper return, visitIRS.gov to locate and download the forms to submit. If youre going to use software to help you file your return, youll first need to choose a tax software manufacturer. No clue where to start? Check out our list of thebest tax software programs available for the 2019 tax season.Its important to note that your federal taxes cannot be filed at the same time as your states income tax . If you live in a state that requires you to pay income tax, you cannot pay this directly to the IRS. Instead, youll need to locate your states tax address and send your return there if you are filing on paper. If youre still trying to figure outhow to file state taxes, check out our easy-to-follow guide.

You May Like: How To Do Taxes On Doordash

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Heres Something New: You Can Now Claim Your Rats

One small gift from the ATO this year is the ability to claim black those very expensive rapid antigen tests. If, of course, you were swabbing yourself for work-related purposes.

They have to be specifically work-related RATs you have to be taking them in a circumstance that will either allow you or not allow you to go to work, says Francis. So it cant be one that youve purchased to go out on a Saturday night. Its got to be work-related and not already reimbursed by your employer. And yes, you need receipts.

Similarly, if you had to buy your own PPE, masks or hand sanitiser to go to work, you can claim those expenses as well.

You May Like: How Much Is Doordash Taxes

Although You Might Not Be Required To File A Tax Return It Might Be Wise To File One Today Anyway Here Are A Few Reasons Why

Filling out tax forms is a pain in the you-know-what. So why on earth would anyone file a tax return if they don’t have to? Well, actually, there’s one very important reason why you might get a big, fat check from the government.

People with income under a certain amount aren’t required to file a tax return because they won’t owe any tax. But if you qualify for certain tax credits or already paid some federal income tax, Uncle Sam might owe you a refund that you can only get by filing a return. Think about that for a minute!

If you want to know more, here are 9 reasons why you might want to file a tax return even if you don’t have to. Even though dealing with taxes can be a real drag, it’s probably worth it if you wind up with a much fatter wallet in the end.

Federal Tax Return Filing Requirements :

|

Filing Status and Age at End of 2020 |

Income Required to File 2020 Return |

|

Single Under 65 |