How To Calculate Lottery Lump Sum Payout And Annuity Payout By Using Lottery Payout Calculator

A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings basedon the advertised jackpot amount, multiplier, and the total number of winners in each state. A lotterypayout calculator can also calculate how much tax you’ll pay on your lottery winnings using current tax lawsin each state. Calculate your lottery lump sum or annuity payout using an online lottery payout calculatoror manually calculate it yourself at home.

Lottery Payout Calculator is a tool for calculating lump sum payout and annuity payout by choosing yourlottery numbers in each state. Lottery Payout Calculator provides Lump-Sum and Annuity Payout forMegamillions, Powerball, Lotto.

How To Use The Lottery Tax Calculator For Your Home Country Taxes

After checking the tax applicable to your country, indicate the total prize on the lottery tax calculator. Calculate the taxes in the country of the lottery first if you are playing overseas, and use the after taxes amount to eliminate your home taxes as well.

If you opt for an annuity prize, make sure to specify the number of years, or leave it as 1 if you opt for a lump sum. Write the percentage tax and press Calculate.

It Can Cost Your Neighbors Too

A 2016 study of lottery winners in Canada found that the neighbors of lottery winners were more likely to declare bankruptcy. Youre not responsible for how your neighbors spend their money, but its certainly an interesting outcome to think about and a potential lesson to learn from.

Winning the lottery can free up your finances and allow you to spend money on discretionary expenses that were once out of reach. Your neighbors may notice and increase their spending as well. The keeping up with the Joneses effect is in full force here and youre the Joneses in this case.

Keep in mind, lottery winners themselves arent immune from financial ruin. Stories of lottery winners declaring bankruptcy, ruining relationships, and winding up worse off than before make for tantalizing headlines. You dont want to find yourself among one of those listicles in the future.

Don’t Miss: How Can I Track My Tax Return

How To Minimize Your Tax Burden After You Win The Lottery

Taxes on lottery winnings are unavoidable, but there are steps you can take to minimize the hit. As mentioned earlier, if your award is small enough, taking it in installments over 30 years could lower your tax liability by keeping you in a lower bracket.

Also, you could donate to your favorite non-profit organizations. This move allows you to take advantage of certain itemized deductions, which, depending on your situation, could bring you into a lower tax bracket.

Additionally, if you are sharing your good fortune with family and friends, youll want to avoid paying a gift tax. You can gift up to $15,000 in 2021 per person without owing a gift tax. If you go over the limit, you probably still wont owe tax. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exclusion in 2021 to $11.7 million for single filers . Any amounts over the $15,000 per year per individual will count toward the lifetime exclusion.

If you anticipate coming close to the limit, though, remember that direct payments to colleges and universities dont count as gifts neither do direct payments to medical institutions. Also, if you are married, each of you can contribute $15,000 to a person, so that is $30,000 per year that is gift-tax free. And, if the recipient is married, you and your spouse can give the spouse $15,000 each, which means you can give a total $60,000 to a couple, gift-tax free.

How Are Lottery Winnings Taxed

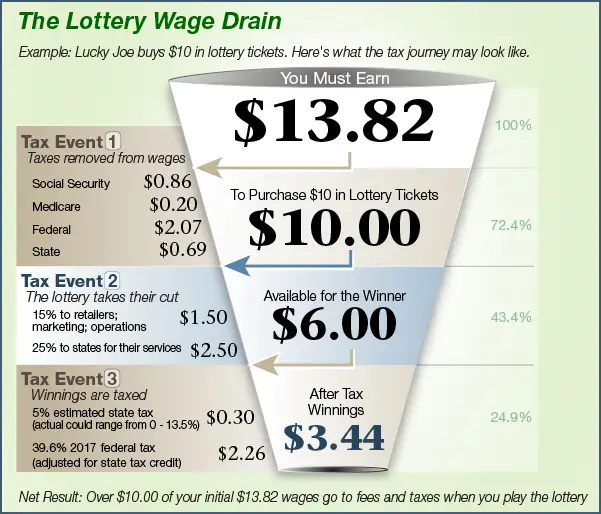

The IRS considers net lottery winnings ordinary taxable income. So after subtracting the cost of your ticket, you will owe federal income taxes on what remains. How much exactly depends on your tax bracket, which is based on your winnings and other sources of income, so the IRS withholds only 25%. Youll owe the rest when you file your taxes in April.

You can find your bracket on the table below:

| Federal Income Tax Brackets for 2021 |

| Rate |

The tax rates for 2022 are here:

| Federal Income Tax Bracket for 2022 | |

| Single | |

| $539,901+ | $539,901+ |

On the bright side, if youre in the top bracket, you dont actually pay 37% on all your income. Federal income tax is progressive. As a single filer in 2021, and after deductions, you pay:

- 10% on the first $9,950 you earn

- 12% on the next $30,574

- 22% on the next $45,849

- 24% on the next $78,549

- 32% on the next $44,499

- 35% on the next $314,174

- 37% on any amount more than $523,601

In other words, say you make $45,000 a year and you won $100,000 in the lottery. That raises your total ordinary taxable income to $145,000, with $25,000 withheld from your winnings for federal taxes. As you can see from the table above, your winning lottery ticket bumped you up from the 22% marginal tax rate to the 24% rate .

Of course, if you were already in the 37% tax bracket when you win the lottery, you would have to pay the top marginal rate on all your prize money.

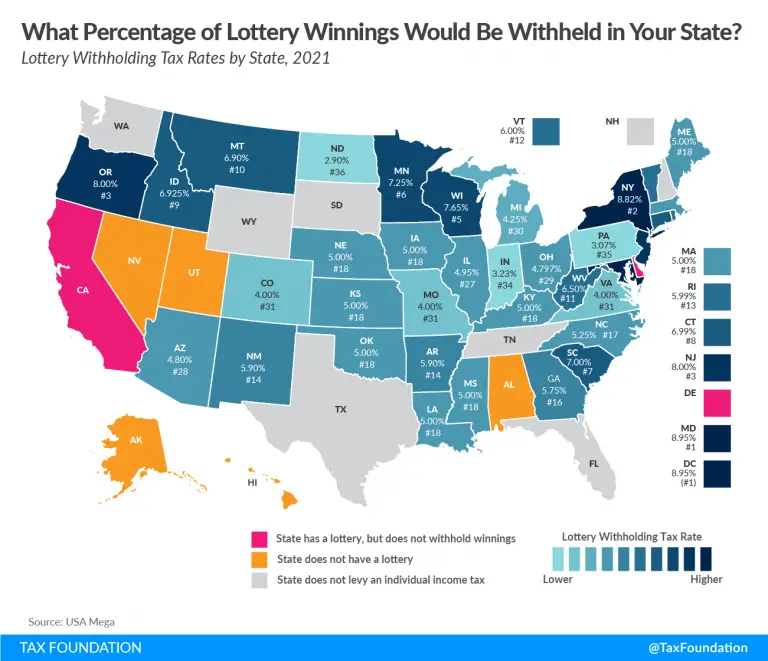

But these rules apply only to federal income tax. Your city and state may want a cut, too.

Read Also: How To Appeal Property Taxes

Prizes Valued At $599 Or Less

A lottery prize of less than $600 is the easiest to claim.

Most lottery retailers in Texas are willing to pay out smaller prizes straight from the cash register. For larger prizes within this range, your options are to go to a local claim center, pay a visit to the lottery commission in Texas, or send a claim form via mail.

How Much Do Lottery Winnings Get Taxed

The federal government and all but a few state governments will immediately have their hands out for a bit of your prize. The top federal tax rate is 37% for income over $500,000. The first thing that happens when you turn in that winning ticket is that the federal government takes 24% of the winnings off the top.

Don’t Miss: How To File Taxes Online Step By Step

What Are The Lump Sum Lottery Winnings After Taxes

The federal tax on the lottery is determined by the federal marginal rates, which is 37 percent in the highest bracket. In practice, there is a 24 percent federal withholding of the gross prize, plus the remaining tax, based on your filing status.

For example, if your gross prize is $1,000,000, you need to pay $334,072 in total taxes .

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agency’s General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Don’t Miss: How To Stop Unemployment From Taking Tax Return

Minimizing Lottery Jackpot Taxes

Obviously, winning the lottery is a tad different, and most of the above options don’t quite apply. But you do have choices in handling the windfall.

The biggest one concerns how you’ll actually get the money. As mentioned above, you’ll have to decide whether to take the payment as a single lump sum or as an annuity . Each choice has financial implications, and you may want to consult with a tax attorney, certified public accountant , or certified financial planner to discuss them before deciding.

Strictly from a tax viewpoint, the annuity has some advantages. Let’s say you win a jackpot with a $1 million lump-sum payout.

If you took the lump sum, you would owe $370,000 in federal income tax based on the top marginal tax rate of 37%. If you opted instead for an annuity paying $50,000 a year, you might only be taxed at a 22% marginal rate, paying $11,000 per year or $220,000 cumulatively over 20 years on the first $1 million of annuity payments.

| Gross Winnings |

| $780,000 |

Is It Better To Take Your Mega Millions Payment As A Lump Sum Or An Annuity

There are benefits and downsides to both methods. The lump sum affords more control over winnings and investments, but higher taxes overall. The annuity payment option means less initial control but lower taxes because it allows people to take advantage of yearly tax deductions. This decision is why some winners seek out a financial advisor after hitting the jackpot.

The math doesn’t end there. Lottery winnings are taxed the same as wages or salary on both federal and state levels, so you’ll pay more taxes come spring 2023.

Federal tax brackets still apply, so portions of the winnings will be taxed at different rates and could be as high as 37%. State and local tax rates vary by location, but Ohio’s highest tax rate is about 4%.

More on Mega Millions:From blimps to Galley Boys for life: What can you buy with $1 billion Mega Millions jackpot?

After all taxes have been taken out, you’re left with about $427,775,000, according to TaxAct’s lottery tax calculator.

That leaves the next important question: What would you buy with that money? The Beacon Journal wants to know, email reporter Tawney Beans at [email protected] with your million-dollar wish list.

Also Check: Are Raffle Tickets Tax Deductible

Prizes Valued Above $2500000

As you can see, winning a larger jackpot means you have fewer options for claiming your prize.

When your win is between $2,500,000 and $5,000,000, youll either have to go to one of four claim centers , complete a claim form via mail, or go to the lottery commission in Austin.

All prizes valued at over $5,000,000 and all types of annuity payouts will require you to make an appointment with the lottery commission first.

The Cost Of Winning A House

After winning a home, you’ll be responsible for paying the federal income tax based on the home’s value. You may also be liable for state income tax, depending on your state of residence. As with any prize, the home’s fair market value must be reported on Form 1040 as other income, and will be taxed at your .

Unless they already own a home they plan to sell, many people couldn’t afford to pay such a significant sum all at once, even with several months’ notice. Furthermore, consider that homes given away as prizes are worth more than $500,000 and located in expensive areas.

Of course, if you could afford the tax bill, you’d be getting a home for the price of a generous down payment. But your costs wouldn’t end there. On top of income taxes, you would also have higher recurring expenses such as property taxes, homeowner’s insurance, and utility bills, not to mention the cost of general maintenance and upkeep. Despite striking it rich in the sweepstakes, you could end up house poor in the end.

You must report any and all of your winnings to the IRS regardless of their value.

Don’t Miss: When Do Child Tax Credits Start

Taxes On Lottery Winnings In The United States

Understanding how taxes are applied in the United States is useful for both residents and non-residents of the American country. There are different levels for each situation and prize, and the impact on the total winnings can be meaningful, especially when it is not a large amount.

| Tax Type |

|---|

| From 24% and up to 37% |

Federal Personal Income Tax

The catch for residents of the U.S. is the fact that their winnings should be informed when they file their income tax returns. Therefore, on top of the 24% loss for federal taxes, they might have to pay up to 37% if they win a jackpot prize. That occurs because prizes above $600 are also considered income and are added up to your total income that year.

A similar condition might apply in your country of residence, which is why we recommend taking a look at the local legislation in that regard.

Lottery Tax Calculator Disclaimer

You should consider this after tax lottery calculator as a model for financial approximation. All payment figures, balances, and tax figures are estimates based on the data you provided in the specifications that are, despite our best effort, not exhaustive.

Without claiming completeness, please also note the following:

- The federal taxes approximated based on the 2021 marginal tax tables published by the IRS without taking account of possible deductions

- All state taxes are estimated with fixed-rate calculation applicable in 2021

- Potential additional local taxes are not considered

- If you are not a U.S. resident, you will typically have a flat 30% federal withholding, and state taxes may differ from what is listed above.

For this reason, we created the calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice.

Don’t Miss: Are Adult Diapers Tax Deductible

How Much Is Lottery Tax Tax On Lump Sum Vs Annuity Lottery

While the same type of taxes are levied on lump sum and annuity payouts, the final amounts you may receive can diverge considerably. First of all, the lump sum payment is typically lower than the advertised lottery prize and is subject to an automatic 24 percent federal withholding tax.

The remainder of the amount is also reduced by the additional Federal tax depending on your filing status, lottery purchase, and place of residence.

In the case of lottery annuity payments, the same taxes are levied however, they are paid annually and are always based on the actual tax rates of the given year.

A Ticket Purchase Transaction By A Player By Way Of Subscription In Accordance With This Section 52 Is Referred To As A Future Game Transaction

all before such draw is held.

OLG does not undertake any obligation or responsibility for notifying a Player:

provided that the foregoing will not restrict OLG’s ability to so notify a Player.

Also Check: How To Order Tax Forms From Irs

How Does A Winner Receive A Lump Sum Payout After Lottery Winning

Most jackpot winners choose a lump sum payment, usually paid over several years. If you select a lump sumpayment, you will receive an estimated $1 million as cash and have to decide how to invest it. Otherwise,the lottery company will pay out your winnings in installments over 29 years. This chart explains whatpercentage of your prize each installment is, so you can see how much of each check goes toward state andfederal taxes.

The federal tax withholdings are taken out before receiving your lump sum. Still, you can pay less tax byclaiming a more oversized tax bracket. For example, if you take $1 million as a lump sum and put it in aninvestment account, it will earn interest, which means you’ll have more money. Unfortunately, you’ll have topay taxes on that interest annually and will likely end up paying more in taxes over 29 years than if you’dtaken an annuity payout. However, choosing a lump sum may make sense if you want complete control over howyour money is invested and aren’t afraid of losing some of it.

How Much Money Will You Get After Taxes If You Win The Mega Millions Jackpot

How much will you really take home after winning the lottery?

The Mega Millions lottery drawing stands at $1.1 billion as of Thursday, an amount of money most of us have trouble even imagining.

Images of grand homes, yachts and airplanes are surely tempting, but with the taxes a lottery winner has to pay, the amount you net in the end may not be what you were expecting.

Mega Millions and other lotteries generally allow a winner to decide how they want to take possession of the jackpot either by choosing an annuity where the jackpot is paid out over a 30-year period or by taking it in one lump sum. According to lottery officials, most winners opt for the lump sum, or cash option, as Mega Millions calls the payout.

In the case of the next Mega Millions jackpot of $1.28 billion, that amount would be $747.2 million. Its a staggering pile of money, but its not exactly what you would pocket following your win.

The federal government and all but a few state governments will immediately have their hands out for a bit of your prize.

The top federal tax rate is 37% for income over $500,000. The first thing that happens when you turn in that winning ticket is that the federal government takes 24% of the winnings off the top.

But the payments dont end there. You will owe the rest of the tax the difference between 24% and 37% at tax time next year.

So, when you take the cash option, you will end up with $470,773,045 after federal taxes.

You May Like: Who Pays The Most Taxes Pie Chart