How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Can I File For An Extension

Not ready to file your taxes? The deadline to request a tax extension is also today.

You can do so with the “Free File” tool on IRS.gov to electronically request a six-month extension. The extended tax deadline is Oct. 17.

However, there is no extension on payments. Therefore, if you think you’ll owe tax, it’s best to make a payment today to avoid getting hit with interest and other penalties later on.

If you owe any state tax, you must still pay it before midnight tonight to avoid penalty and interest charges.

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

You May Like: Is Doordash Pay Taxed

What Is Irs Free File

The IRS Free File Program provides two ways for taxpayers to prepare and file their federal income tax online for free:

Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. IRS partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose Adjusted Gross Income is $72,000 or less qualify for any IRS Free File partner offers.

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose AGI is greater than $72,000.

How To Request For Refund Reissue

The steps to request for refund issue are given below:

- Click on the link https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html and enter your User ID, Password, date of birth, and the captcha code to login.

- Go to My Account and then click on Service Request.

- A screen will appear which will contain the acknowledgment number for every financial year during which you filed your Income Tax. Click on Submit under the Response section for the year you want the refund.

- Fill in details such as your Bank Account Number, Account Type, IFSC Code, Bank Name, and then click on Submit.

- The amount will then be refunded to your bank account after a few days.

Recommended Reading: Is Plasma Donation Money Taxable

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return up to 12 weeks.

What If You Filed An Amended Return

You might have to amend your tax return if you overlooked a key income statement or forgot to claim a valuable deduction. Amending your return might be necessary to calculate the correct amount of taxes owed or the refund that’s due to you. You can still track the refund’s status through the IRS website if you file an amended return.

Just plug in your Social Security number, your date of birth, and your ZIP code. An amended return can take up to three weeks to show up in the IRS system after you send it. It can take another 16 weeks to process, so you might need to be patient as you wait for the arrival of your refund.

You May Like: Is Plasma Money Taxable

Check Income Tax Refund Status Online Through Income Tax India E

Income Tax Department says : “Checking the online refund status is always good. It’s free and it tells you what’s going on?”

Please Note: Refund Status of income tax return that have been filed this year, must be updated in the Income Tax Department systems. You can check the latest status of tax refund by using this utility. Use the tool & check refund status now!

If you think your friends/network would find this useful, please share it with them We’d really appreciate it.

Why Havent I Received My Tax Refund Yet Canada

You may lose any or all of your tax refund if you dont receive it from the tax office The Canada Revenue Agency may seize any portion of your tax refund if the garnishment order complies with the Family Orders and Agreement Enforcement Assistance Act Take steps to repay any debt before you become Income tax refunds less than $2,000.

Recommended Reading: How To Protest Property Taxes In Harris County

Check Refund Status Online

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option “Tax Refund for Individuals” in the box labeled “Where’s my Refund?”. Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return. If you do not know the refund amount you claimed, you may either use a Letter ID number from a recent income tax correspondence from the Department.

You will receive the Letter ID within 7-10 business days. After we have received and processed your return, we will provide you with an updated status as the refund moves through our system. It may take a few days for an updated status to appear. Please check back often to verify where your return/refund may be in our process.

The information in Revenue Online is the same information available to our Call Center representatives. You can get the information without waiting on hold.

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Recommended Reading: 1040paytax Review

Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

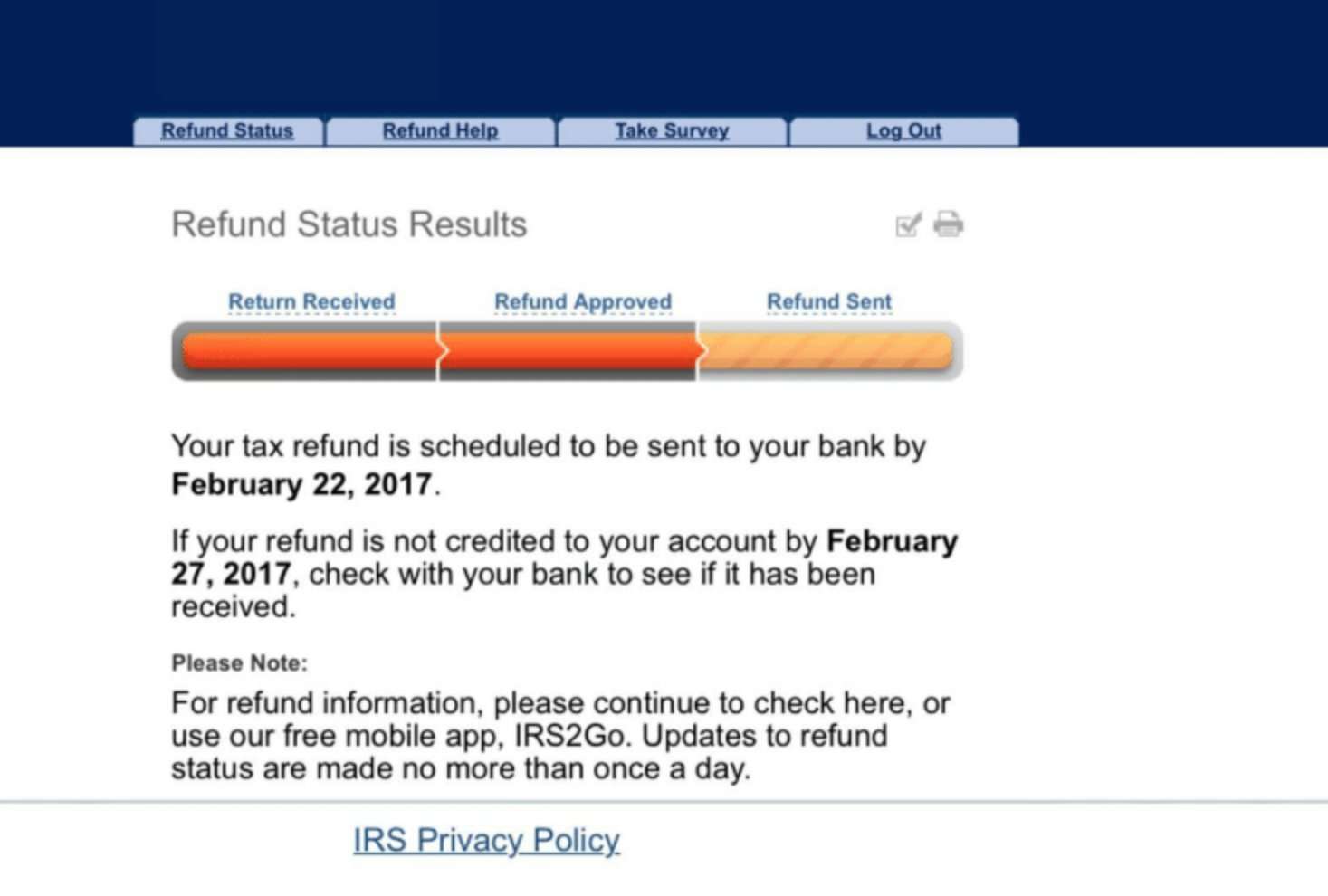

What Do These Irs Tax Return Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Read Also: Does Doordash Take Out Taxes

Should You Call The Irs

Expect delays if you mailed a paper return or responded to an IRS inquiry about your 2020 return. Some returns require special handling such as those that require correction to the Recovery Rebate Credit amount or validation of 2019 income used to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return. If youre due a refund from your tax year 2020 return, you should wait to get it before filing Form 1040X to amend your original tax return.

If Your Tax Refund Check Is Coming In The Mail Here’s How To Track It

You don’t have to check your mailbox every day to see if your refund check has arrived. Do this instead.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

With tax filing season behind us, the next step is waiting for your tax refund to arrive. And if you filed a paper tax return and didn’t set up direct deposit, your refund should come as a paper check in the mail. But when should you expect it to arrive?

The US Postal Service has a tracking tool that lets you know exactly when your tax refund will land in your mailbox. It’s called Informed Delivery, and the free USPS service sends you alerts for all new mail — and transmits images of the front of letters so you know exactly what’s arriving. It doesn’t take pictures of your incoming packages, but it does track them and will also let you add an electronic signature to receive packages when you’re not home.

Also Check: Doordash Independent Contractor Taxes

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Correcting Or Claiming A Credit

Many times, credits are tied to the dependents of the return. However, some people claim credits that they shouldnt have claimed, even if they have the right dependents. Amending the return can help them fix this mistake.

Therefore, they can receive the full amount of refund without getting a tax bill afterward.

Don’t Miss: Efstatus Taxactcom

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

Recommended Reading: 1040paytax Irs

How Long Does It Take To Get A Back Tax Refund

Paper tax returns are often completed and accurate within a few weeks and your refund should arrive from the IRS no later than six to eight weeks after the date of filing. Generally, the refund will arrive in less than three weeks if you file your return electronically rather than by direct deposit if you choose the latter option.

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.

Read Also: How Much Money Should I Save For Taxes Doordash

Usps Informed Delivery: How To Get Notifications

Informed Delivery has some limitations. For example, it will work with many residential and personal post office box addresses — but not businesses. It also won’t work for some residential buildings where USPS hasn’t yet identified each unit.

To check whether Informed Delivery is available in your area, head to the Postal Service’s Informed Delivery page.

1. Tap Sign Up for Free.

2. Enter your mailing address and confirm that it’ll work with the service then accept the terms and conditions and tap Continue.

3. On the next page, choose a username, password and security questions. Enter your contact information and tap Continue.

4. On the next page, you’ll need to verify your identity. Tap Verify identity online if you want to receive a verification code on your phone or tap Request invitation code by mail if you want the USPS to mail you a code. You may also have the option to visit a post office to verify your identity in person.

Fast And Easy Refund Updates

Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return. The tool’s tracker displays progress in three phases:

To use Where’s My Refund?, taxpayers must enter their Social Security number or Individual Taxpayer Identification Number, their filing status and the exact whole dollar amount of their refund. The IRS updates the tool once a day, usually overnight, so there’s no need to check more often.

Also Check: Look Up Employer Ein

Here Are Some Reasons A Tax Refund May Take Longer:

- The return may include errors or be incomplete.

- The return could be affected by identity theft or fraud.

- Many banks do not process payments on weekends or holidays.

Claiming the Recovery Rebate Credit on a 2020 tax return will not delay processing of a tax return. However, it is important that taxpayers claim the correct amount. If a correction is needed, there may be a slight delay in processing the return. If corrections are made, the IRS will send the taxpayer notice explaining any changes. The recovery rebate credit will be included in the tax refund.

The IRS will contact taxpayers by mail if more information is needed to process their tax return.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Also Check: Do I Have To File Taxes For Doordash

Read Also: Do I Pay Taxes On Plasma Donations

How To Verify With The Irs That A Tax Return Was Received

Once youve put in the time and effort required to file your tax return, you want to make sure your work isnt lost in cyberspace or in the mail. If youre due a refund, you want your forms to arrive safely and be processed as quickly as possible. The Internal Revenue Service offers several ways for you to verify that your return has been received and that your IRS refund status is being processed.