When An Employee Leaves

When an employee stops working for you, we suggest you calculate the employees earnings for the year to date and give the employee a T4 slip. Include the information from that T4 slip in your T4 return when you file it on or before the last day of February of the following year.

You must also issue a Record of Employment to each former employee. Generally, if you are issuing an ROE electronically, you have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue it. If you are issuing a paper ROE, you have to issue it within five calendar days of the employees interruption of earnings or the date you become aware of the interruption of earnings. However, special rules may apply.

For more information, or to get the publication called How to Complete the Record of Employment Form, go to Service Canada at The Record of Employment on the Web . You can also call their Employer Contact Centre at 1-800-367-5693 .

If you do not have any employees for a period of time

Inform us by using the Provide a nil remittance service through My Business Account, or through Represent a Client, by calling our TeleReply service, or by sending us your completed remittance form and indicating when you expect to make deductions next. To find out how to use our TeleReply service, see How to use TeleReply.

Impact Of Contribution Errors

If used improperly, some payroll software programs, in-house payroll programs, and bookkeeping methods can calculate unwarranted or incorrect refunds of CPP contributions for both employees and employers. The improper calculations treat all employment as if it were full-year employment, which incorrectly reduces both the employees and employers contributions.

For example, when a part-year employee does not qualify for the full annual exemption, a program may indicate that the employer should report a CPP over deduction in box 22, Income tax deducted, of the T4 slip. This may result in an unwarranted refund of tax to the employee when the employee files their income tax and benefit return.

When employees receive refunds for CPP over deductions, their pensionable service is adversely affected. This could affect their CPP income when they retire. In addition, employers who report such over deductions receive a credit they are not entitled to because the employee worked for them for less than 12 months.

Income And Fica Taxes Deposit Due Dates

The deposit schedule for your employment taxes depends upon the size of your employment tax liability. Generally, toward the end of each year, the IRS tells you which method you should use during the upcoming calendar year. There are four possible options:

- annually

- monthly

- semi-weekly

Annual tax return and deposit. Small businesses may be able to file an annual payroll tax return and remit the taxes with that return.

This is an “opt-in” program and you must request permission from the IRS before filing an annual return.You can request to opt-in to the Form 944 program if you:

- have an estimated annual employment tax liability of $1,000 or less for the entire calendar year

- are not an agricultural employer who is required to file Form 943, Employer’s Annual Federal Tax Return For Agricultural Employees and

- are not a household employer who is required to File Form 1040, Schedule H, Household Employment Taxes.

To file Form 944 for calendar year 2016, you must call the IRS at 1-800-829-4933 or 267-941-1000 by April 1, 2016, or send a written request postmarked by March 15, 2016. The address depends upon where your business is located.

Quarterly deposits for small businesses: If your employment taxes for either the current quarter or the preceding quarter are less than $2,500, you can remit the taxes with your quarterly return. You don’t have to deposit them separately.

Example

You May Like: 1099 From Doordash

Employees Of A Temporary

You may be the proprietor of a temporary-help service firm. Temporary-help service firms are service contractors who provide their employees to clients for assignments. The assignments may be temporary, depending on the clients needs.

Workers of these firms are usually employees of the firms. As a result, you have to deduct CPP contributions, EI premiums, and income tax from the amounts you pay them. You also have to remit these deductions and report the income and the deductions on a T4 slip.

If you or a person working for you is not sure of the workers employment status, either one of you can request a ruling to determine the status. If you are a business owner, you can use the Request a CPP/EI ruling service in My Business Account. For more information, go to My Business Account.

A worker can ask for a ruling by using the My Account service, at My Account for Individuals and selecting Submit documents and then You may be able to submit documents without a case or reference number.

For more information, see Guide RC4110, Employee or Self-Employed?

Calculating Employer Payroll Taxes

In addition to the taxes you withhold from an employees pay, you as the employer are responsible for paying certain payroll taxes as well:

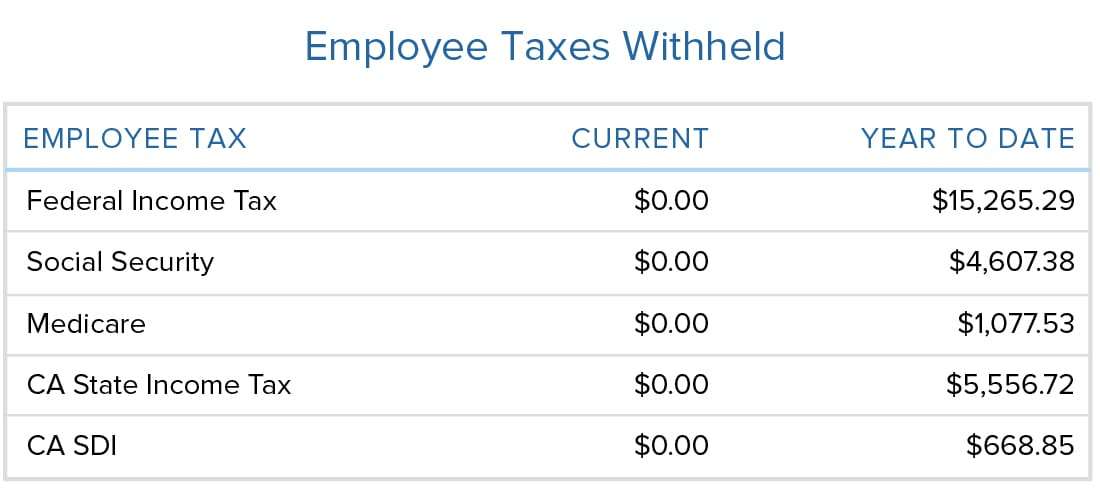

- FICA Matching: You are required to match the employees FICA tax withholding, which means your company will pay 6.2% tax for Social Security and 1.45% tax for Medicare. Using our example employee, you as the employer would pay a matching $129.17 for Social Security and $30.21 in Medicare, resulting in a $159.38 FICA obligation.

- Unemployment Taxes: You will also have to pay federal and state unemployment tax. Unemployment taxes are paid only by the employer, not the employee.

- Federal Unemployment Tax is 6.0% of the first $7,000 in wages you pay each employee each year. If your company is subject to state unemployment, you can receive a federal tax rate credit of up to 5.4%, which makes the effective tax rate 0.6%. Once an employee earns more than $7,000 in a calendar year, you stop paying FUTA for that employee in that tax year. Federal Unemployment: $2,083.33 x 0.6% = $12.50

- State Unemployment Tax varies by state. Consult with your states Department of Labor or Unemployment Revenue for tax rates, wage bases, and filing requirements. For this example, we will assume the employee has not yet been paid $7,000 year-to-date. We will use Floridas unemployment tax rate of 2.7%. State Unemployment: $2,083.33 x 2.7% = $56.25

Recommended Reading: How To Do Your Taxes For Doordash

What Is The Period For Which Employers Can Defer Deposit And Payment Of The Employer’s Share Of Social Security Tax Without Incurring Failure To Deposit And/or Failure To Pay Penalties

Under sections 2302 and of the CARES Act, employers may defer deposits of the employer’s share of Social Security tax due during the “payroll tax deferral period” and payments of the tax imposed on wages paid during that period. The payroll tax deferral period begins on March 27, 2020 and ends December 31, 2020.

Section 2302 of the CARES Act provides that deposits of the employer’s share of Social Security tax that would otherwise be required to be made during the payroll deferral period may be deferred until the “applicable date.” For more information, see What are the applicable dates by which deferred deposits of the employer’s share of Social Security tax must be deposited to be treated as timely ?

Section 2302 of the CARES Act provides that payments of the employer’s share of Social Security tax for the payroll tax deferral period may be deferred until the “applicable date.” For more information, see What are the applicable dates when deferred payment of the employer’s share of Social Security tax must be paid ?

Maintaining Payroll Tax Records And Avoiding Penalties

Once you’ve paid over your payroll taxes and filed any necessary returns and reports, your last significant obligation is to maintain records that substantiate the payroll taxes you paid.

For federal tax purposes, you must retain records for at least four years after the due date of the return or the date the taxes were paid, whichever is later. A similar record-keeping requirement exists in each state, with varying time periods.

Types of records. There is no particular form prescribed for properly retaining records. However, the records must be kept in a manner that will enable the IRS and your state tax authorities to ascertain whether any tax liability has been incurred and, if so, the extent of that liability.

The types of information you should retain include:

- the name, address, and Social Security number of each employee

- the total amount and date of each payment of compensation

- the period of service covered by each payment of compensation

- the portion of each payment of compensation that constituted taxable wages

- copies of each employee’s withholding exemption certificate

- dates and amounts of tax deposits you made

- copies of returns you filed

- copies of any undeliverable Form W-2

IRS inspection. You’re obligated to keep all your required records at convenient and safe locations that are accessible to IRS representatives. And, your records must be available at all times for IRS inspections.

Don’t Miss: Doordash Write Offs

How Much Do Employers Pay In Payroll Taxes

So, how much is payroll tax? The cost of payroll taxes largely depends on the number of employees you have and how much you pay your employees. Why? Because payroll taxes are a percentage of each employees gross taxable wages and not a set dollar amount.

Payroll tax includes two specific taxes: Social Security and Medicare taxes. Both taxes fall under the Federal Insurance Contributions Act , and employers and employees pay these taxes.

Payroll tax is 15.3% of an employees gross taxable wages. In total, Social Security is 12.4%, and Medicare is 2.9%, but the taxes are split evenly between both employee and employer.

So, how much is the employer cost of payroll taxes? Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare.

| Know exactly how much youll pay as the employer without having to do the calculations yourself. Get a FREE trial of Patriots online payroll and skip the calculations! |

If you are self-employed, you must pay the entirety of the 15.3% FICA tax, plus the additional Medicare tax, if applicable .

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

Read Also: Doordash Pay Taxes

Confirm What And When You Need To File

Once youve signed up for e-services, you need to confirm what taxes you need to file and pay for. Youll receive a few reminders that youll see in your Inbox, To Do lists, and Pay Taxes page.

Not sure what taxes you need to pay or file? Learn what you need to pay and file.

Note: You’ll need to make sure sufficient funds are available when your payroll taxes are due and to create the tax payment.

What’s New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

The Ontario income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2022.

You May Like: Does Doordash Give 1099

Overview: What Is The Accruing Payroll Methodology

The accruing payroll methodology tells you to record compensation in the accounting period — a month or year — its earned, even when its not paid until the next period.

Say your business announces annual bonuses in December 2020 but pays them with the first payroll in January 2021. Since employees earned bonuses in 2020, you accrue a payroll expense for the bonus amount before the ball drops at midnight on Jan. 1. The bonuses count as a wage expense on your 2020 income statement.

Accrued payroll is a debt owed to employees. All accrued expenses are liabilities on your balance sheet until theyre paid.

Only businesses that follow the accrual method of accounting need to accrue payroll on their books. Under the cash method of accounting, you record transactions when cash enters or leaves your business. The more precise accrual accounting method has you record transactions when you earn revenue and incur expenses, not necessarily when cash flows.

Making Payroll Tax Payments

Depending on the size of your payroll, you must make periodic payroll tax payments to the IRS and to state taxing entities. For federal payroll taxes, you must make payments on a semi-weekly or monthly basis for:

- The amounts you withheld from employee pay for federal and state income taxes

- The amounts you deducted from employee pay for Social Security and Medicare

- The amounts you owe as an employer for Social Security and Medicare.

You must make your payroll tax deposit payments using the IRS electronic filing system .

You May Like: Efstatus.taxact

Social Security And Medicare Taxes

Federal Insurance Contribution Act taxes support the federal Social Security and Medicare programs. The total due every pay period is 15.3% of an individuals wages half of which is paid by the employee and the other half by the employer. This means that each party pays 6.2% for Social Security up to a wage base limit of $147,000 and 1.45% for Medicare with no limit. Employees who earn more than $200,000, however, may be charged an additional 0.9% for Medicare, which employers dont have to match.

Example Of When To Register For Payroll Tax

In the financial year 2018 to 2019, QLD and NSW had a 31-day threshold of $91,666 and $72,192 respectively.

If you employ staff in QLD and NSW and your total Australia-wide wage bill for those 31 days is:

- $95,000 you need to register for payroll tax in both states

- $75,000 you only need to register in NSW

If your total Australian wage bill is under the maximum threshold for your state or territory, you do not have to pay.

You May Like: Doordash Tax Rate

Appendix 2 Calculation Of Cpp Contributions

You can use this calculation to determine the CPP contributions you should deduct for your employee for a single pay period. To determine the CPP contributions for multiple pay periods, or to verify the annual contribution at years end, use Appendix 3.

Note

Before using this calculation, read Starting and stopping CPP deductions.

Step 1 Calculate the employees pensionable earnings for the pay period.

Enter the employees gross pay for the period…………………………………………………………………… $ 1

Enter any taxable benefits and allowances for the period……………………………………………………. $ 2

Line 1 plus line 2…………………………………………………………………………………………………………… $ 3

Enter any income from Employment, benefits, and payments from which you do not deductCPP contributions, described in Chapter 2 of this guide……………………………………………………… $ 4

Pensionable earnings …………………………………………………………………….. $ 5

Step 2 Enter the basic exemption for the pay period. Use the table below, or the following equation:

Annual basic exemption divided by the number of pay periods in the year.. $ 6

Step 3 Line 5 minus line 6…………………………………………………………………………………………… $ 7

For more information, go to E-services for Businesses.

Federal Unemployment Tax Act

The federal government doesn’t pay unemployment benefits but does help states pay them to employees who’ve been involuntarily terminated from their jobs. To fund this assistance to the states, there’s FUTA, which is a tax created by the Federal Unemployment Tax Act. The tax applies only to the first $7,000 of wages of each employee. The basic FUTA rate is 6%, but employers can receive a credit for state unemployment tax of up to 5.4%, bringing the net federal rate down to 0.6%, or a maximum FUTA payment of $42 per employee.

However, the credit is reduced if a state borrows from the federal government to cover its unemployment benefits liability and hasn’t repaid the funds. Then such state becomes a “credit reduction state” and the credit reduction means the employer pays more FUTA than usual.

Don’t Miss: How To File Taxes Working For Doordash

What If I Have Out

The general rule as a business owner is to follow the tax regulations in the state where your employees work.

For instance, if your company is based in a state without income tax, but you employ someone who works from home in a state that does require income tax withholding, you would be responsible for collecting and paying the state taxes for that employee.

Some states have reciprocal agreements that allow out-of-state employees to only pay income tax in their resident state, rather than being taxed in both their resident and nonresident states.

If no reciprocal agreement is offered, you can arrange for a courtesy withholding to deduct both sets of state taxes during regular pay cycles so the employee wont owe it all when they file their annual taxes.

Set Up Direct Deposit For Paychecks

Contact your bank to find out how their direct deposit system works. You’ll also need to get authorization from each employee and information about their checking accounts, such as account numbers and routing numbers.

You might be able to do direct deposit by connecting the service to your bank if you have payroll features through QuickBooks or another accounting system.

You May Like: Efstatus/taxact

How To File Payroll Taxes

According to the IRS, you have to make all federal tax deposits with an electronic funds transfer, or EFT. You can use the Electronic Federal Tax Payment System , a free service from the Department of the Treasury, to make these deposits, or your payroll software provider can make electronic deposits on your behalf.

Heres how to file payroll taxes broken down into steps: