How Tax Revenue Is Spent

In Canada, tax is collected by the different levels of government to pay for the facilities, services, and programs they provide.

Many of the benefits you enjoy today are made possible through tax revenue, such as:

- libraries, parks and playgrounds

- police, ambulance, and fire services

- garbage and recycling collection

- economic development and wildlife conservation

- national defence

Tax revenue also funds social programs such as:

- Old Age Security

Spending Through The Tax Code

The state spends money both directly and indirectly. Direct spending takes the form of annual budgeting for programs and services such as education, public safety, and health care. Direct state spending is covered in the companion publication A Guide to New Mexicos State Budget. The state also spends money indirectly by choosing to forego collecting certain tax revenues. While direct spending is done through the budgeting process, indirect spending is handled by changing the tax code.

Over the years, the Legislature has enacted many tax breaks, which are called tax expenditures. Many tax expenditures are enacted as a form of economic development because they provide a subsidy or incentive for specific businesses. Tax credits for solar panels is an example of this. Other expenditures are intended to help groups of people. The Working Families Tax Credit , which helps low-income working families, is one example.

Cuts in taxes almost always result in the state collecting less revenue. Lower revenue means the state will either have to cut its direct spending or it will have to raise other taxes or fees to make up the difference. Before any legislation to enact a tax break is passed, however, the state tries to estimate how much it will cost. These estimates are contained in a fiscal impact report prepared by the Legislative Finance Committee staff.

Not All Tax Codes Are Created Equal

The characteristics that should be built into a states tax code include: Accountability Stability Transparency

Accountability means that tax credits, exemptions, and deductions are easy to monitor and evaluate. Tax cuts are often enacted in the hopes that they will change behaviors get companies to hire more employees, for example. If the state cannot determine if those goals are met, the tax system is not accountable.

Adequacy means that the tax system meets state spending needs, provides enough revenue to build strong communities, and provides robust opportunities for children and families to thrive. Additionally, adequacy means that state spending keeps pace with inflation and population growth.

Consistency is achieved when tax revenues grow at the same rate as state personal income. Gross receipts and income taxes are the most consistent because they closely follow population growth. This is important because population growth impacts the need for state services.

Efficiency means that the tax code has a broad enough base to avoid excess reliance on one tax. Most states rely on three tax sources: income, sales, and property taxes. New Mexico also collects severance taxes, so the state has four main sources of revenue, giving it a broader base.

Transparency is what makes accountability possible. A tax system is transparent when citizens have enough information about the tax code to hold government accountable.

Tax Facts

Don’t Miss: Protesting Harris County Property Tax

The Us Tax System Is Progressive

As a whole, the U.S. tax code remains progressive with higher-income taxpayers paying a greater share of their income in taxes. That is true despite the fact that high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures.

Major tax expenditures such as lower rates on capital gains and dividends, deductions for charitable contributions, and deductions for state and local taxes tend to benefit higher-income taxpayers more than lower-income groups. CBO estimates that the top quintile of taxpayers receive 51 percent of the value of major tax expenditures, while only 8 percent goes to the bottom quintile. However, even with substantial tax expenditures, the top one percent of American taxpayers still pay an effective tax rate of 29 percent, on average, while the bottom 20 percent of the population pay an average of 3 percent.

TPC estimates that 68 percent of taxes collected for 2019 came from those in the top quintile, or those earning an income above $163,600 annually. Within this group, the top one percent of income earners those earning more than $818,700 per year will contribute over one-quarter of all federal revenues collected.

While the fairness of the tax system is much debated, many economists agree that simplifying the tax code would help the economy. Further tax reform could promote economic growth while also making the code more simple, transparent, and fair.

Reported Income Increased And Taxes Paid Increased In 2017

Taxpayers reported $10.9 trillion in adjusted gross income on 143.3 million tax returns in 2017, the last tax year before the Tax Cuts and Jobs Act took effect. Total AGI grew $780 billion from 2016 levels, significantly more than the $14 billion increase from 2015 to 2016. There were 2.4 million more tax returns filed in 2017 than in 2016, and average AGI rose by $4,232 per return, or 5.8 percent.

Taxes paid rose to $1.6 trillion for all taxpayers in 2017, an 11 percent increase from the previous year. The average individual income tax rate for all taxpayers rose from 14.2 percent to 14.6 percent.

The share of income earned by the top 1 percent rose from 19.7 percent in 2016 to 21.0 percent in 2017, and the share of the income tax burden for the top 1 percent rose as well, from 37.3 percent in 2016 to 38.5 percent in 2017.

Table 1. Summary of Federal Income Tax Data, 2017|

Note: Table does not include dependent filers. Income split point is the minimum AGI for tax returns to fall into each percentile. Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares . |

|

| 21.0% | |

| 38.5% | |

| 14.6% |

Read Also: Where Can I File An Amended Tax Return For Free

The Gst And State Taxes

As with most federations around the world, State and Territory governments in Australia spend more than they raise in revenue. The difference is made up by grants from the Australian Government.

The States and Territories receive all revenue raised by the GST. About 23 per cent of total state revenue comes from the GST, with statelevied taxes generating about 31 per cent of total state revenue. The GST is relatively efficient compared to some other taxes because it has a much broader base than many other taxes. However, exemptions reduce its efficiency and introduce significant complexity. In total, around 47 per cent of Australias national consumption is subject to GST.

Legislation requires that changes to the GST base or rate require unanimous agreement by all State and Territory governments, as well as both houses of the Australian Parliament. The Australian Government will not support changes to the GST without a broad political consensus for change, including agreement by all State and Territory governments.

The major sources of state tax revenue are payroll taxes and stamp duties. State governments also impose taxes on land, gambling and motor vehicles. Municipal rates are the sole source of local government tax revenue.

Some studies suggest significant economic gains from state tax reform, particularly reduced stamp duties and greater use of payroll and land taxes.

The State Of The American Tax System In 8 Charts

Congressional Republicans plan to introduce an overhaul of the nation’s tax code on Thursday, a plan President Trump is billing as the biggest tax event in the history of our country.

On the eve of the plan’s scheduled release many of the major details were still being ironed out, particularly the thorny questions of how the plan would be paid for. Republicans have said that among other things, they want to simplify individual income tax brackets, raise the standard deduction, reduce corporate tax rates and eliminate some popular itemized deductions, like the state and local tax break.

Even as details are being worked out, it’s worth taking a look at how federal taxes work in this country. We’ve compiled charts, below, explaining the basics of the U.S. tax system who pays what, and how that’s changed over time.

Read Also: Where’s My Tax Refund Ga

Why Is The Federal Income Tax A Progressive Tax

A progressive tax system is designed to distribute the tax burden more heavily toward those who have more income. Its supporters reason that taxpayers with higher wages have greater means to support government services, and it’s meant to support a thriving middle class. Detractors argue that this discourages people from earning more since they will have to pay a higher tax rate if they do.

Why Do The Rich Pay More

Wealthy households’ share of the federal tax burden is rising because wealthy households are making more money. The richest 20 percent made more than half of all pretax income in 2013, according to the Tax Policy Center. That’s up roughly eight percentage points since 1979.

But there’s a lot of variation in the upper echelons of the household income scale. The top 1 percent of households are on their way to doubling their share of the country’s income pie, from 8.9 percent in 1979 to 15 percent in 2013. That top 1 percent now hauls in more money each year than the bottom 40 percent of households.

The peeling away of the top 1 percent is a big driver of the increase in inequality in the United States in recent years.

Read Also: Efstatus.taxact.com.

Medicare Medicaid Chip And Marketplace Subsidies:

This category consists of the Medicare function , including benefits, administrative costs, and premiums, as well as the Grants to States for Medicaid account, the Childrens health insurance fund account, the Refundable Premium Tax Credit and Cost Sharing Reductions, and two other small accounts supporting the Affordable Care Acts marketplace subsidies .

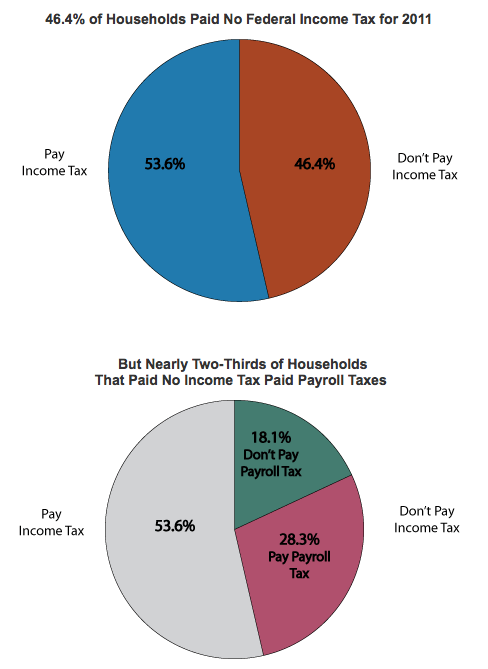

The Tax Burden For Low

Only 1.4% of the $1.45 trillion in taxes paid in 2017 was contributed by taxpayers earning less than $30,000, according to the Pew Research Center.

It should also be noted that many taxpayers in this income group received income from the government in the form of those refundable tax creditsthe IRS paid out about $62 million in earned income tax credits in 2020. The average payment to qualifying taxpayers was $2,461.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Deficits Debt And Interest

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nations gross domestic product . Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount was financed by borrowing. As the chart below shows, three major areas of spending make up the majority of the budget:

Two other categories together account for less than a fifth of spending:

- Interest on debt: The federal government must make regular interest payments on the money it borrowed to finance past deficits that is, on the federal debt held by the public, which reached $16.8 trillion by the end of fiscal year 2019. In 2019, these interest payments claimed $375 billion, or about 8 percent of the budget.

As the chart shows, the remaining fifth of federal spending supports a variety of other public services. These include providing health care and other benefits to veterans and retirement benefits to retired federal employees, ensuring safe food and drugs, protecting the environment, and investing in education, scientific and medical research, and basic infrastructure such as roads, bridges, and airports. A very small slice less than 1 percent of the budget goes to non-security programs that operate internationally, including programs providing humanitarian aid.

New Mexicos Race To The Bottom

In the last two decades, New Mexico has cut personal and corporate taxes by billions of dollars in an attempt to lure companies to the state. Chief among these were personal income tax cuts enacted in 2003. This legislation cut the PIT rate for the top income earners by almost half from 8.2% to 4.9%. New Mexicans earning the median income received a small tax cut. Those earning the least the bottom 40% of tax filers received no benefit at all.

This has made state income taxes considerably less progressive. The tax rate climbs rapidly in the lower-income brackets , then begins to level out at about $70,000, and is completely flat by the time it reaches $250,000. To be truly progressive, tax rates should climb more rapidly in the highest income levels, not at the lowest.

In 2013, without a fiscal impact report and with very little debate, the Legislature passed an omnibus tax bill. Two of the most expensive provisions in the omnibus bill were changes to the states corporate income tax. The bill reduced the overall CIT rate and it also essentially eliminated CIT for the manufacturers operating in the state. Like the PIT cuts before it, the public was told that the 2013 bill would encourage job growth. There is no evidence that these tax cuts produced jobs.

Technical Terms

Don’t Miss: Mcl 206.707

Reported Income Increased And Taxes Paid Decreased In 2016

Taxpayers reported $10.2 trillion in adjusted gross income on 140.9 million tax returns in 2016. Total AGI grew $14 billion from 2015 levels, less than the $434 billion increase from 2014 to 2015. There were 316,000 fewer tax returns filed in 2016 than in 2015, meaning that average AGI rose by $260 per return, or 0.4 percent.

Taxes paid fell slightly to $1.4 trillion for all taxpayers in 2016, a 0.8 percent decrease from the previous year. The average individual income tax rate for all taxpayers fell slightly, from 14.3 percent to 14.2 percent, and the average tax rate fell for all groups.

The share of income earned by the top 1 percent fell slightly from 20.7 percent of AGI in 2015 to 19.7 percent in 2016, and the share of the income tax burden for the top 1 percent fell slightly as well, from 39 percent in 2015 to 37.3 percent in 2016.

|

Note: Table does not include dependent filers. Income split point is the minimum AGI for tax returns to fall into each percentile. Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares . |

|

| 14.20% |

Taxes: Who Pays How Much In Eight Charts

Ideological arguments about whether taxes are too high or too low miss the crucial question of who ends up bearing how much of the burden of financing our public sector.

Theres an inescapable reality surrounding that question: unlike corporations and the ultra-rich, Americas working majority have neither the lobbyists to write loopholes into the tax code, nor the financial planners and high-end tax accountants to exploit them.

The result, as economist Joseph E. Stiglitz tells Bill Moyers, is a system that is fundamentally unfair. Here are eight charts that illustrate how our tax burden has shifted over the years, and why we need to reform our tax code.

The US Is One of the Least Taxed Countries

Heres some important context: Overall, we pay relatively little in taxes today compared to other wealthy countries.

Of the 24 countries that were members of the Organization for Economic Cooperation and Development in 1979, the US paid the 16th highest share of its economic output in taxes.

Fast-forward to 2010, and the US was the third least taxed country, ranking 32nd out of 34 OECD countries in terms of taxes as a percentage of Gross Domestic Product . As the graph below shows, only two countries, Chile and Mexico, paid less in taxes than the US did in 2010. And as the green bar shows, the 24.8 percent we forked over in taxes was significantly less than the average of 33.4 percent that the other 33 countries paid.

Why That Matters

Who Gets the Tax Breaks?

Read Also: When Do You Do Tax Returns

The Tax Burden For High

Wealthy individuals do indeed pay more in taxes than low-income or even middle-income individuals. It’s just basic math.

Even if the tax system were not progressive and everyone paid the same percentage of their incomes, 15% of $30,000 is a great deal less than 15% of $300,000. But we do have a progressive system, so high-income individuals pay higher effective tax rates, even after all those tax credits and deductions are taken into consideration. Those deductions wont reduce $300,000 to $30,000.

The Pew Research Center indicates that taxpayers with AGIs in excess of $200,000 paid more than half of all taxes collected in 201558.9%, to be exact.

Those with incomes over $2 million paid a 27.5% effective tax rate, triple that of taxpayers who earned less than six figures annually, although the effective rate drops to 25.9% for the super-wealthy who earned $10 million a year or more.

The Tax Foundations study concluded that 96.9% of all 2017 income taxes were paid by the higher-earning 50% of taxpayers.

The Pew Research Center study indicates that taxpayers earning between $200,000 and $500,000 annually paid an effective tax rate of 19.4% in 2015. Their income taxes represented 20.6% of the total taken in by the IRS. This decreased to 17.9% of the total taxes paid at an effective tax rate of 26.8%for those with incomes between $500,000 and $2 million.

New Data Highlights Progressivity Of The Income Tax Code Under The Tcja

Each fall the IRSs Statistics of Income division publishes data showing the share of taxes paid by taxpayers across ranges of Adjusted Gross Income . The most recent release covers Tax Year 2018 . This is the first year of reported data under the changes in the TCJA which lowered tax rates, nearly doubled the standard deduction, and expanded the child tax credit.

The new data shows that the top 1 percent of earners paid over 40 percent of all income taxes. Despite the tax rate reductions associated with TCJA, this figure is up slightly from the previous tax years 38.5 percent share. In fact, NTUF has compiled historical IRS data tracking the distribution of the federal income tax burden back to 1980 and this is the highest share recorded over that period, topping 2007s 39.8 percent income tax share for the top 1 percent. The amount of taxes paid in this percentile is nearly twice as much their adjusted gross income share.

The top 10 percent of earners bore responsibility for over 71 percent of all income taxes paid and the top 25 percent paid 87 percent of all income taxes. Both of those figures represent an increased tax share compared to 2017. The top fifty percent of filers earned 88 percent of all income and were responsible for 97 percent of all income taxes paid in 2018.

The other half of earners took home 11.6 percent of total nation-wide income and owed 2.9 percent of all income taxes in 2018, compared to 3.1 percent in 2017.

Recommended Reading: Www.1040paytax.com