Distribution Rules Change For 2020

In general, the CARES Act provides for expanded retirement plan distribution options and favorable tax treatment on up to $100,000 of coronavirus-related distributions from eligible retirement plans to qualified individuals.

The 20% mandatory federal income tax withholding is waived from qualified retirement plans. Also, distributions from a qualified retirement plan or Traditional IRA that are repaid at any time during the three-year period beginning on the day after the distribution is received will be considered a tax-free rollover.

This years coronavirus relief bill also allows for special rollover rules around distributions. Qualifying taxpayers have been allowed to reinvest or skip required minimum distributions from retirement plans this year.

Exceptions To The Rules

There are exceptions to the rules on early withdrawals from retirement plans. The IRS allows them in certain very specific cases. This is not a break on the income tax owed. It’s a break on the penalty.

For example, first-time homebuyers and people who have huge unreimbursed medical expenses may be eligible, depending on the type of retirement plan they participate in.

You may also be eligible to take a loan from your own account, in certain cases.

Any money you take from a 401 plan must be reported as ordinary income in the same year that you made the withdrawal.

How To Withdraw A Ira And 401k For Returning Canadians

Allan Madan, CA

Are a returning Canadian with an IRA and 401K? The tax man could be around the corner. Learn the best ways for withdrawing your IRA and 401K.

Your Options:1) Keep your IRA and 401K as is. The advantage of this is your investments can continue to grow within these tax-deferred retirement accounts completely tax-free. The disadvantage is that withdrawals from your 401K and IRA would be subject to a 20% withholding tax in the US if you are 59 and a half years old , or 30% if you are younger. Plus the cash withdrawals received would be taxable to you in Canada. However, you can claim a foreign tax credit on your Canadian tax return for the withholding taxes paid to the IRS.

2) Cash out. If you cash out the entire amount of your 401K and IRA upon leaving the US, you will be subject to tax at your US marginal tax rate on the whole amount. This is definitely a bad idea!

3) Transfer your IRA and 401K to your Canadian RRSP. IRAs can be rolled over on a tax-free basis to Canadian RRSPs. While there is a withholding tax imposed by the IRS on the transfer, the withholding tax can be recovered by claiming a foreign tax credit on your Canadian personal tax return. You cannot directly rollover a 401K to an RRSP. To get around this, you should convert your 401K into an IRA, and then make a tax free transfer of the IRA to an RRSP. Withholding taxes, which can be recovered, still apply.

Disclaimer

ABOUT THE AUTHOR

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Taxes On Other Types Of 401 Plans

All of the information above applies to traditional 401 plans. However, there are variations on the traditional 401. Some of these have different rules on taxation.

SIMPLE 401 plans and safe harbor 401 plans function mostly the same as far as employee taxes are concerned. They differ mostly in that employers have to make certain contributions. SIMPLE 401 plans also have a lower contribution limit.

The other type of 401 to note is a Roth 401. These work quite differently from traditional 401 plans. All contributions you make to a Roth 401 come from money that you have already paid payroll and income taxes on. Since you pay taxes before you contribute, you do not need to pay any taxes when you withdraw the money.

Its advantageous to use a Roth 401 if you are in a low income tax bracket and expect that you will find yourself in a higher bracket later in your life. This is very similar to why you might want a Roth IRA.

Tax Rules: Withdrawals Deductions & More

IAMMRFOSTER.COM” alt=”How to report 401k rollover to ira on 1040 > IAMMRFOSTER.COM”>

IAMMRFOSTER.COM” alt=”How to report 401k rollover to ira on 1040 > IAMMRFOSTER.COM”> If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pre-tax money in 2021. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Read Also: How Can I Make Payments For My Taxes

Exceptions For Early Withdrawal

Even though you still have to pay income taxes on any withdrawals, you may qualify for a penalty exemption. The IRS allows some exceptions to the 10 percent penalty for early distribution of 401 funds to help you mitigate financial losses. Some of these exceptions include:

- If you become disabled.

- If you die and your beneficiary inherits your 401 account, the beneficiary does not have to pay the 10 percent penalty.

- If you no longer work for the employer that was your 401 plan administrator , and you are at least 55 years old.

- If you withdraw less than youre allowed as a medical expense deduction.

- If you receive payments to reduce any excess contributions you have made, or which your employer has made in matching fund contributions on your behalf.

- If you are court-ordered to pay in a domestic relations case, such as a divorce.

Although administrators of retirement plans are not required to grant hardship distributions to plan participants, the IRS extends latitude to the administrators for allowing some participants to withdraw funds early. The term the IRS uses to describe the hardships that warrant such a consideration is immediate and heavy financial need.

Withdrawal Taxes: How To Minimize Them

You wont be able to get out of paying taxes on the funds you withdraw from your 401. However, there are a couple of tips and tricks that might help you lower the total tax you pay. Be sure to check with a tax expert or financial advisor if you want to be sure of the best course of action for your specific situation.

If you happen to hold stock of your company within your 401 account, you could potentially treat the appreciation of that stock as a capital gain rather than ordinary income. The long-term capital gain tax rate is 0%, 15% or 20%, depending on your tax bracket. For many investors, this means a lower tax rate than their ordinary income tax rate. To actually pull this off, youll need to transfer the stock into a taxable brokerage account. Dont be afraid to consult with an expert if you want to take advantage of this strategy.

The other factor to consider is your tax bracket. If your 401 distributions will put you in the lower end of one tax bracket, see if you can start distributions earlier, spreading things out and potentially dropping you into a lower bracket. As long as you start after age 59.5, you could save on your total tax bill with this method.

Don’t Miss: What Does Agi Mean For Taxes

Taxes If You Withdraw The Money When You Retire

For traditional 401s, the money you withdraw is taxable as regular income like income from a job in the year you take the distribution . For Roth 401s, the money you withdraw is not taxable . You can begin withdrawing money from your traditional 401 without penalty when you turn age 59½.

» MORE: See how retirement age is defined

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

If youve retired, you have to start taking required minimum distributions from your account when you’re 72.

-

If you dont take the required minimum distribution when youre supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

-

You can withdraw more than the minimum.

» MORE:See what tax bracket youre in

Do You Pay State Taxes On 401k Withdrawals

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

Don’t Miss: Where’s My Tax Refund Ga

If You Withdrew Money Under The Covid

By Twila Slesnick, Ph.D., Enrolled Agent

During 2020, “qualified individuals” affected by COVID-19 were permitted to withdraw up to $100,000 from an IRA or an employer plan, like a 401 or 403, without incurring penalties. Those who did withdraw funds under this provision still have to pay income tax on the distribution, but some special rules were enacted to ease the tax burden. Here’s how to report the withdrawals to the IRS and figure out the taxes owed.

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 tax year. There are also income limits above which you cant contribute this full amount.

Read Also: How Much Time To File Taxes

Taxes Withheld From Distributions For Active Employees

When you take a distribution from your deferred compensation accounts, you will pay taxes on the distribution. The amount of tax you pay depends on several factors:

- The amount you withdraw in a calendar year, and your income in that year

- The type of Plan you have 401 or 457

- Your age and employment status

Basically, any amount you withdraw from your 401 account has taxes withheld at 20%, and if you’re under age 59½, you’ll be taxed an additional 10% when you file your return.

Any amount you withdraw from your 457 account has taxes withheld at 20%. However, if you select a periodic distribution over 10 years, then only 10% is withheld for taxes.

Employees Retirement System of Texas

What If I Repay The Covid

If you choose, you are allowed to “recontribute” some or all of the coronavirus-related distribution to your retirement plan or IRA at any time during the three years after you take the distribution. If you do so, you will not owe tax on the portion you repay. This rule applies only to the original participant or owner .

The three-year period for recontributions begins the day after the coronavirus distribution and ends on the third anniversary of Day 1. So if you took a distribution from your retirement plan on June 1, 2020, the three-year period during which you can repay the withdrawal without it being taxed as income begins on June 2, 2020 and ends on June 2, 2023.

You don’t have to pay back the full amount. Any amount you pay back during the three-year repayment period will reduce the amount of the income you must include for the year of the repayment.

You do have to file a new IRS form, Form 8915-E, with your tax return to report the distribution and the repayment.

EXAMPLE 1: Katrina takes a $60,000 coronavirus-related distribution from her IRA on October 19, 2020. She then recontributes the entire $60,000 to her IRA on April 1, 2021, before filing her tax return for 2020. Katrina will not report any of the coronavirus-related contribution on her tax return. However, she must file Form 8915-E with her tax return to report the distribution and the repayment.

If you recontribute part or all of a distribution after paying taxes, you may have to amend your tax returns.

Read Also: Efstatus Taxact Com Login

Do I Have To Pay Tax On The Covid

If you were a qualified individual and you withdrew money from your 401, 403, or IRA, you won’t owe the 10% early distribution tax that would normally apply to distributions for those who are younger than 59 ½.

You will, however, need to pay income tax on the distribution . If the distribution was from a 401 or 403 plan, the distribution was not subject to the mandatory income tax withholding that would normally apply. Either way, you’ll pay all of the income tax for the withdrawal on your tax return.

If you’re worried you’ll owe a lot of tax, you can spread out the distribution over three tax returns so that you’ll owe less tax. You will report one-third of the amount of the distribution as income on each of your tax returns for the years 2020, 2021, and 2022. For example, if you took a coronavirus-related distribution of $30,000 in the year 2020, you would include $10,000 as income in each of the years 2020, 2021, and 2022.

Alternatively, if you are in a very low tax bracket in 2020 , you can make an election to include the entire coronavirus-related distribution in income in 2020 .

For any year in which you took a coronavirus-related distribution , you must file a Form 8915-E with your tax return.

Additional Tax On Early Distributions

Generally, we impose additional taxes on early distributions with some exceptions. Visit Instructions for Form FTB 3805P for more information.

California

- 2.5%

- 6% for distributions made from Savings Incentive Match Plans for Employees plans within the first 2 years of participation

Federal

- 25% for distributions made from SIMPLE plans within the first 2 years of participation

Recommended Reading: Where’s My Tax Refund Ga

Q14 How Do Plans And Iras Report Coronavirus

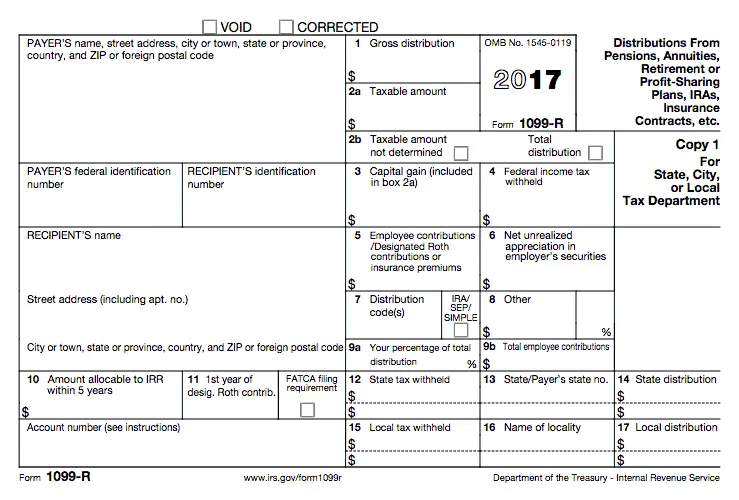

A14. The payment of a coronavirus-related distribution to a qualified individual must be reported by the eligible retirement plan on Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. This reporting is required even if the qualified individual repays the coronavirus-related distribution in the same year. The IRS expects to provide more information on how to report these distributions later this year. See generally section 3 of Notice 2005-92.

Deducting Traditional Ira Contributions

You may be able to deduct certain Traditional IRA contributions from your taxable income. For the income limits associated with deductible contributions, see IRA Contribution Limits. Fidelity issues Form 5498, IRA Contribution Information, showing your contribution amounts and other information about your Fidelity IRAs. For help with this statement, see the IRS Instructions for Form 5498 .

Deduct IRA contributions made up to April 15, 2021

Note that the deadline to make deductible contributions for a given tax year is the tax filing deadline. For 2020 that date is April 15, 2021. Most other deductions are only allowed for transactions completed within the tax year, by December 31.

Enter the deduction amount on line 19 Schedule 1 of your 1040. If you made non-deductible contributions, you will need to file Form 8606 .

When it comes time to withdraw from your Traditional IRA, any contributions you deducted and any earnings will be fully taxable. For any withdrawals of nondeductible contributions, only the earnings will be taxable.

Pre-tax contributions to qualified plans, such as 401s and pensions, are not deductible, as they are already excluded from your taxable income. Post-tax Roth IRA contributions are also not deductible.

Read Also: How To Buy Tax Liens In California

Q3 How Does Section 209 Of The Relief Act Apply To A Plan Year If Only Part Of The Plan Year Falls Within The Period Beginning On March 13 2020 And Ending On March 31 2021

A3. If any part of the plan year falls within the period beginning on March 13, 2020, and ending on March 31, 2021, then Section 209 of the Relief Act applies to any partial termination determination for that entire plan year.

For example, if a plan has a calendar year plan year, the 80% partial termination test in Section 209 of the Relief Act applies to both the January 1 to December 31, 2020, plan year and the January 1 to December 31, 2021, plan year, because both plan years include a part of the statutory determination period of March 13, 2020 to March 31, 2021.

Tips To Help You Plan For Retirement

- Want to create a financial plan that grows your money and provides for a secure retirement? You might benefit from talking to a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Your retirement plan should account for medical expenses. One option to help you plan for medical costs is a health savings account . HSAs are tax-deferred just like 401 plans. However, you dont have to pay any income taxes on withdrawals from an HSA as long as you use the withdrawals for medical expenses. Check out our guide to HSAs and whether you should consider one.

Read Also: File Missouri State Taxes Free

Its Easy To Understand Why People Contribute To 401s And Why You Might Want To As Well

They do it to secure their financial futures and to take advantage of some nifty tax benefits. What might be harder to understand is why anyone would take money out of their 401 before they retire.

Maybe they face a financial crisis like a big, unexpected tax bill and a 401 loan seems like an easy way to get some low-interest money. Or they leave a job and figure its easier to just cash out their old 401 than go through the process of moving it. They may think the amount in the account is small enough that any negative financial impact will be small, too.

But making early withdrawals from a 401 for any reason and in any form can seriously affect your finances. Before you go there, its important to understand the rules for early withdrawals and 401 loans, and how they can affect your taxes.