Locations To Pickup Tax Forms

OTR Customer Service Center1101 4th Street, SW, Suite W2708:15 am to 5:30 pm

John A. Wilson Building1350 Pennsylvania Avenue, NW, lobby8 am to 6 pm

Judiciary Square441 4th Street, NW, lobby7 am – 7 pm

901 G Street, NWNote: MLK Library is closed for renovations but can be obtained from libraries across the city

Municipal Center6:30 am to 8 pm

Reeves Center7 am to 7 pm

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Read Also: 1040paytax.com Safe

When Does An Individual Get A 1099 K Form

As per the IRS norms, an individual receives a 1099 K Tax Form if he/she accepts payments from credit/debit cards or third-party networks. Usually, IRS Form 1099 K is used to record payments made through payment cards or third-party network transactions. Specifically, these tax returns are used to report transactions made through a Payment settlement Entity. A PSE is a service that you use to process credit or debit transactions.

Besides, not everyone who uses PSE services will receive the tax form. If the following requirements are met, then youll receive 1099 K:

- Accept payments through credit/debit cards of $600 or more.

- Transactions you receive through third-party networks exceed $20,000 in a tax period.

- The individual payments you receive are more than 200.

What’s In Your Mailbox

From the IRS you should expect little or nothing. If you used TurboTax to file electronically last year, youll receive no tax forms by mail from the IRS. If you filed on paper, youll receive a postcard explaining your options for obtaining the forms. While you can pick them up at a post office or print them from www.irs.gov, TurboTax will ask simple questions and automatically fill in all of the appropriate tax forms you need to file your tax return.

However, you can expect to receive a number of forms reporting your income from your employer, bank or credit union, mutual fund companies and other entities you did business with throughout the year. The most common of these forms are:

Remember, no matter which IRS tax forms you need, TurboTax does the work of selecting and filling in the right formsit can even import W-2 forms from more than 100,000 employers.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Read Also: Is Donating Plasma Taxable Income

Is Filing Electronically Safe

The appeal of electronic filing is obvious, but is it safe? Your tax filing contains some of the most sensitive data about you: where you live, how much you earn, how many dependents you have, your Social Security number, how high your medical expenses were, and how much you gained or lost from selling investments.

Can you trust the tax software companies and the government to have employed best-in-class security to protect your data both as its being transmitted and while its being stored? If you use online tax software, your information is also being stored in the cloud, creating another point of vulnerability.

For this reason, some people prefer to purchase downloadable software so their data is stored only on their own computer. That way, they are vulnerable to one less data breach possibility.

In this era of data breaches and identity theft, security and privacy questions are important to ask. The table below shows what security features online tax services provide as of January 2021 for the 2020 tax return season. Note that the absence of a feature in the table doesnt necessarily mean the software provider doesnt have it, just that the information wasnt available on the companys data security page. Also, while each service describes its encryption practices differently, all appear to be using appropriate methods.

| Security and Fraud Prevention Features in Popular Tax Preparation Software, January 2021 | |

|---|---|

| Software Brand | |

| not advertised | not advertised |

Where Can I Get Tax Forms

- Obtaining tax forms is one of the first steps in completing returns for many people. Find out where you can get tax forms and where you probably can’t.

Older adults may remember when tax forms were readily available in locations such as public libraries and post offices. The IRS also used to automatically mail forms to tax payers. But it’s not as easy to get your hands on a physical copy of these forms today. Find out where you can get tax forms below.

You May Like: How Can I Make Payments For My Taxes

Which Tax Forms To Use

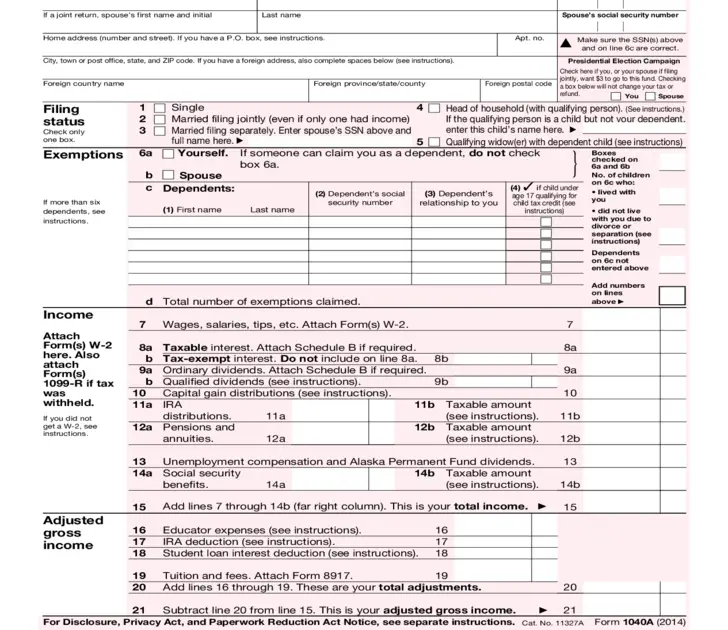

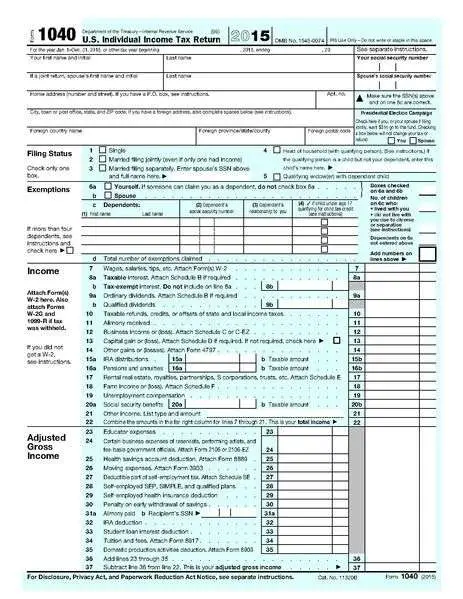

The documents to start with are the 1040 and 1040-SR. For tax years prior to 2018, Forms 1040EZ and 1040A were available but have been phased out beginning with the 2018 tax year by a redesigned Form 1040 and a new 1040-SR for those 65 and older. The 1040 family of forms serves as the center of your tax return.

- Form 1040EZ is the simplest version of this essential tax form. You generally can file it if you:

- Have no dependents

- Earned less than $100,000

- Dont plan to itemize your deductions

- Form 1040A is more comprehensive than 1040EZ, but simpler than the regular 1040. It lets you make certain adjustments to your taxable income, such as child tax credits or the deduction for student-loan interest, but doesnt let you itemize deductions. You typically can use this form if you earn less than $100,000 and dont have self-employment income.

- Form 1040 for tax years prior to tax year 2018 applies if the other two tax forms dont: for example, if you make $100,000 or more, have self-employment income or plan to itemize deductions. Beginning with the 2018 tax year, the redesigned Form 1040 will be used by most taxpayers. The 1040-SR is available as of the 2019 tax year.

Who Issues Form 1099 K

According to the IRS rules and regulations, the Payment Settlement Entity issues Form 1099 K to the business owners. Furthermore, third-party networks like PayPal, Amazon, etc required to report the transactions using 1099 K. For example, if you sell products online and accept payments through PayPal or Amazon or credit/debit cards.

If the individual payments through credit/debit cards exceed $600, then youll receive 1099 K. The credit card processor is responsible to issue the tax form with the due date. Besides, if the individual payments made through third-party networks exceed $20,000 with 200 transactions, youll receive Form 1099 K. The third-party processor will issue the tax returns with the key date.

Recommended Reading: How To Get A Pin To File Taxes

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2021 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2021 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2021 Estimated Tax Payment Voucher for filers of Forms 3M, M-990T and M-990T-62

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: How To Report Ppp Loan Forgiveness On Tax Return

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2020 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Don’t Miss: How To Buy Tax Liens In California

Where To Get Copies Of Tax Forms Due To You

Before you can file, youll need tax forms from the financial institutions with which you have accounts. They should either arrive in the mail, or you’ll receive information on how to access them online. These forms report how much interest youve earned on high-yield savings accounts and certificates of deposit, how much money you made or lost from selling investments, and the amount of any distributions youve taken from retirement accounts.

Youll also need tax forms documenting your earned income and the taxes youve already paid. The most common of these is Form W-2 employees receive it from their employers. Freelancers and independent contractors should receive Form 1099-MISC from each client who has paid them $600 or more . You might also receive a 1099-MISC for certain other types of income, such as prize money.

In addition, you may receive forms documenting any interest youve paid on a student loan or mortgage. This interest may be tax-deductible, depending on your circumstances.

Traditionally, financial institutions, employers, and clients mailed paper copies of these forms to you. Today, you may need to retrieve them yourself by logging into your account online. Sometimes this service is optional, but other times it will be the only way you can get the forms you need.

Electronic Pitfalls To Avoid

If you do file your tax forms electronically, dont complete them on a public computer, and dont transmit your return over public WiFi.

Use a personal computer with antivirus and firewall software and a secure, password-protected private WiFi network, such as your home or work network. Dont transmit your tax returns over an unsecured coffee shop, airplane, or library network.

Also Check: Is Plasma Money Taxable

How Much Tax Do You Pay On A 1099 K Income

Generally, independent contractors pay self-employment taxes and income taxes. Furthermore, there is no withholding of taxes for a contractor from the 1099 income like employees. Thus, contractors owe money to the IRS at the end of the year for the income earned apart from salary. Because the IRS taxes an individual as self-employed. Besides, if you earn more than $400 in a tax year, you need to pay self-employment tax. Self-employment taxes include Medicare and Social taxes of nearly 15.3% on the income earned. Apart from these, you need to keep nearly 30-35% aside for paying taxes if you earn 1099 income. Because you cant estimate how much tax you owe to the IRS. It completely depends on the amount of income earned and the status of an individual.

Agency No Longer Automatically Mails Forms

by IRS| 0

Editors note: This content is provided by the Internal Revenue Service. Consult your financial or tax adviser regarding your individual situation.

The Internal Revenue Service has free tax forms and publications on a wide variety of topics. Because of continued growth in electronic filing, the availability of free options to taxpayers and to reduce costs, the IRS discontinued the automatic mailing of paper tax packages last tax season.

If you need IRS forms and publications, here are four easy methods for getting them.

The Internet: You can access forms and publications on the IRS website 24 hours a day, seven days a week, at IRS.gov.

Taxpayer Assistance Centers: There are 401 TACs across the country where the IRS offers face-to-face assistance to taxpayers, and where taxpayers can pick up many IRS forms and publications. Visit IRS.gov and go to “Contact My Local Office” on the Individuals page to find a list of TAC locations by state. On the “Contact My Local Office” page, you can also select “Office Locator” and enter your ZIP code to find the IRS walk-in office nearest you, as well as a list of the services available at specific offices.

Recommended Reading: Have My Taxes Been Accepted

Who Should Complete This Form

Individuals who:

- have a new employer or payer

- want to change amounts from previous claimed

- want to claim the deduction for living in a prescribed zone

- want to increase the amount of tax deducted at source

have to complete the federal TD1 and, if more than the basic personal amount is claimed, the provincial or territorial TD1.

Individuals do not have to complete a new TD1 every year unless there is a change to their federal, provincial or territorial personal tax credit amounts. If a change happens, they must complete a new form no later than seven days after the change.

How Do You Get Canada Revenue Agency Tax Forms

As of 2015 the website for the Canada Revenue Agency publishes printable tax forms in “.pdf” format. The agency no longer automatically mails printed tax packets to residents but does permit taxpayers to order them on the website or by phone. Postal outlets and Service Canada offices also carry the printed forms, notes About.com. TAXES.CA publishes a list of links to provincial and territorial tax forms for those regions that use documents separate from the Canada Revenue Agency.

The forms and publications page of the Canada Revenue Agency website contains links to forms grouped by topic, cultural group, document type, and form or publication number. Links lead to pages explaining how to get forms in audio, braille or large-print formats, as well as to customized forms for those who file a large number of documents and to the online form for ordering paper forms and publications. The page also provides a top-10 listing of commonly viewed forms and publications.

Some Canada Revenue Agency documents are available only in paper format because of the technology they require, including some payment forms and remittance vouchers. Contact the agency at the toll-free number noted on the agency web page that discusses these documents in order to request them.

Read Also: How Can I Make Payments For My Taxes

Get The Right Irs Tax Forms Automatically

You can find free fillable Federal tax forms at the website of the IRS, or you can use online tax filing to supply the correct tax forms for you automatically.

You can be assured you are preparing and filing the correct tax form by using online tax software. Filing your tax return can be a nerve-wracking feeling, but it doesnt have to be if you let the tax software guide you through the tax filing process.

Updates To Online Form 1 & Form 1

The following is a list of updates made to the online versions of the 2020 printed Form 1 and Form 1-NR/PY booklets:

-

Form 1 instructions page 7 Form 1-NRPY instructions page 9- Veterans Benefits instructions updated to add text for Operation Sinai Peninsula.

-

Form 1 instructions page 8 Form 1-NRPY instructions page 9- Name/Address instructions updated to remove address change language as the fill-in oval is now only for a name change.

-

Form 1 instructions, page 20- Instructions for Schedule X, line 4 updated to change the reference to Schedule FCI-I to Schedule FCI.

Don’t Miss: Buying Tax Liens In California