The Progressive Tax System

A progressive tax system is set up in increments. Your overall income is divided into segments, and you pay a different percentage in taxes on each of those segments. The more you earn, the higher the percentage rate becomes.

For example, you’ll pay 10 percent on the first $9,875 you earn if you’re single in 2020. You’ll pay 12 percent from there up to earnings of $40,125, and then 22 percent on income up to $85,525. You’re not paying 22 percent on all your income, even though this is commonly said to be your “tax bracket” because it represents your highest rate.

What Is The Formula Of Rent

The calculation of monthly rent may be done by agents, landlords, or tenants using several different formulas. The most common method for calculating monthly rental amounts is to multiply the weekly rental amount by 52 weeks per year. 14), then multiply by 12 to get the total number of months in the year.

What Is An Effective Tax Rate

Your effective tax rate is the average of all the tax brackets the IRS uses for income tiers. To understand your effective rate, you first have to know the IRS tax brackets.

The IRS assesses a 10% rate for single filers with income up to $9,875 in the 2020 tax year. After that, youll face the following marginal tax rates based on your income:

- 12% for incomes of $9,876$40,125

- 22% for incomes of $40,126$85,525

- 24% for incomes of $85,526$163,300

- 32% for incomes of $163,301$207,350

- 35% for incomes of $207,351$518,400

- 37% for incomes above $518,400

If you are married filing jointly, your marginal tax rates are:

- 12% for incomes of $19,751$80,250

- 22% for incomes of $80,251$171,050

- 24% for incomes of $171,051$326,600

- 32% for incomes of $$326,601$414,700

- 35% for incomes of $414,701$622,050

- 37% for incomes above $622,050

Youd be in the 22% tax bracket if you earn $60,000 in 2020 and youre single, but you wont pay 22% of your total income in taxes. Youd pay 22% on just your top dollarsthe portion over $40,125 as of the 2020 tax year.

The chart below shows the effective tax rate by income for single individuals for the 2020 tax year, the tax return youll file in 2021.

Read Also: How Can I Make Payments For My Taxes

Cra Capital Gains Exemptions

The main CRA capital gains exemption applies in situations where you are selling your primary residence. While recent changes mean that you have to list the details of any property you sell on your taxes, you do not have to pay capital gains when you sell your principal residence.

However, the principal residence CRA capital gains exemption can sometimes get complicated.

A principal residence does not have to be where you live all the time. If you, your spouse, or your children live in a property at some point during the year, you can consider that property to be your principal residence. However, you can only designate one property per year as a primary residence. There is no minimum period for how long you or a family member must live in the home for it to qualify. However, the CRA will look at evidence to determine if a property was truly your primary residence.

This means the agency will look at several factors, including how long you owned the property, how often you buy and sell property, and your profession to determine if you actually lived in the property or if you flipped the home. For instance, if you are a contractor or builder by trade, the CRA is more likely to assume you purchased the property with the intent of flipping it for profit.

Effective Tax Rate Calculation

The formula for a corporation can be derived by using the following steps:

- Step 1: Firstly, determine the total expense of the corporation, which will be easily available as a line item just above the net income in its income statement.

- Step 2: Next, determine the net income of the corporation, which will also be available as a line item in the income statement. The EBT can be calculated by adding the total tax expense to the net income. i.e EBT = Net income + Total tax expense

- Step 3: Finally, the effective tax rate of the corporation is calculated by dividing the total tax expense by its EBT, as shown above.

Tax rate Corporation = Total tax expense /

Also Check: Prontotaxclass

Canadian Income Tax Brackets

Tax Brackets are ranges of income that determine how much tax you will have to pay on the income in that bracket. Each bracket has a lower and upper limit as well as a tax rate.

If you earn more than the lower limit, you will have to pay that tax rate on any additional income up to the upper limit. Any amount beyond the upper limit will be taxed based on the next tax bracket. Each province has their own set of tax brackets, which can differ from the federal tax brackets.

For example, if you earn $80,000, you will be in the $49,020 to $98,040 tax bracket with a tax rate of 20.5%. This means that you are taxed at 20.5% from your income above $49,020 . Any additional income up to $98,040 will be taxed at the same rate. Any income beyond the upper limit will be taxed at the next tax bracket rate of 26%.

At $80,000, you will also have income in the lower two tax brackets: $0 to $13,229 and $13,230 – $49,020. Your income within those brackets will be taxed at their respective tax rates of 0% and 15%.

The basic personal amount of $13,229 has a tax rate of 0%. This means that if you make $13,229 or less, you will not have to pay any federal income tax. Different provinces have different basic personal amounts. The basic personal amount will gradually increase to $15,000 by 2023.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,660 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Also Check: How To File Taxes Without Income To Get Stimulus Check

How To Stay In A Lower Tax Bracket

You can reduce your tax bill with tax deductions and tax credits. Another way to reduce your taxable income, and thus stay in a lower tax bracket, is with pre-tax deductions.

A pre-tax deduction is money your employer deducts from your wages before withholding money for income and payroll taxes. Some common deductions are:

- Contributions to a 401 plan

- Contributions to a Flexible Spending Account

Returning to the example above, lets say you decide to participate in your employers 401 plan and contribute $1,500 per year to your account. Now, your taxable income is $39,000 contribution + $1,700 in other income $12,500 standard deduction). You remain in the 12% tax bracket while saving for retirement. Its a win-win.

For 2020, you can contribute up to $19,500 to a 401 plan. If youre age 50 or above, you can contribute an additional $6,500 in catch-up contributions, for a total of $26,000. In 2021, the contribution limit will remain at $19,500, or $26,000 if youre age 50 or older.

If youre self-employed or dont have access to a 401 plan at work, you can still reduce your taxable income while saving for retirement by contributing to a Traditional IRA or through a broker or robo-advisor like SoFi Invest. These contributions reduce your AGI because they are above-the-line deductions .

For 2020, you can contribute up to $6,000 to a Traditional IRA . The contribution limits are the same for 2021.

How To Get Your Effective Tax Rate

Look at your most recent completed tax return and identify the total tax you owed on line 24 of the 2020 Form 1040.

The IRS has redesigned Form 1040 three times, once for the 2018 tax year, again for the 2019 tax year, and once more for 2020. Your taxes owed are on a different line in 2020 than they were in 2019.

Now, divide the number on line 24 by what appears on line 15 of the 2020 Form 1040. The result of that calculation is your effective tax rate.

Also Check: Michigan.gov/collectionseservice

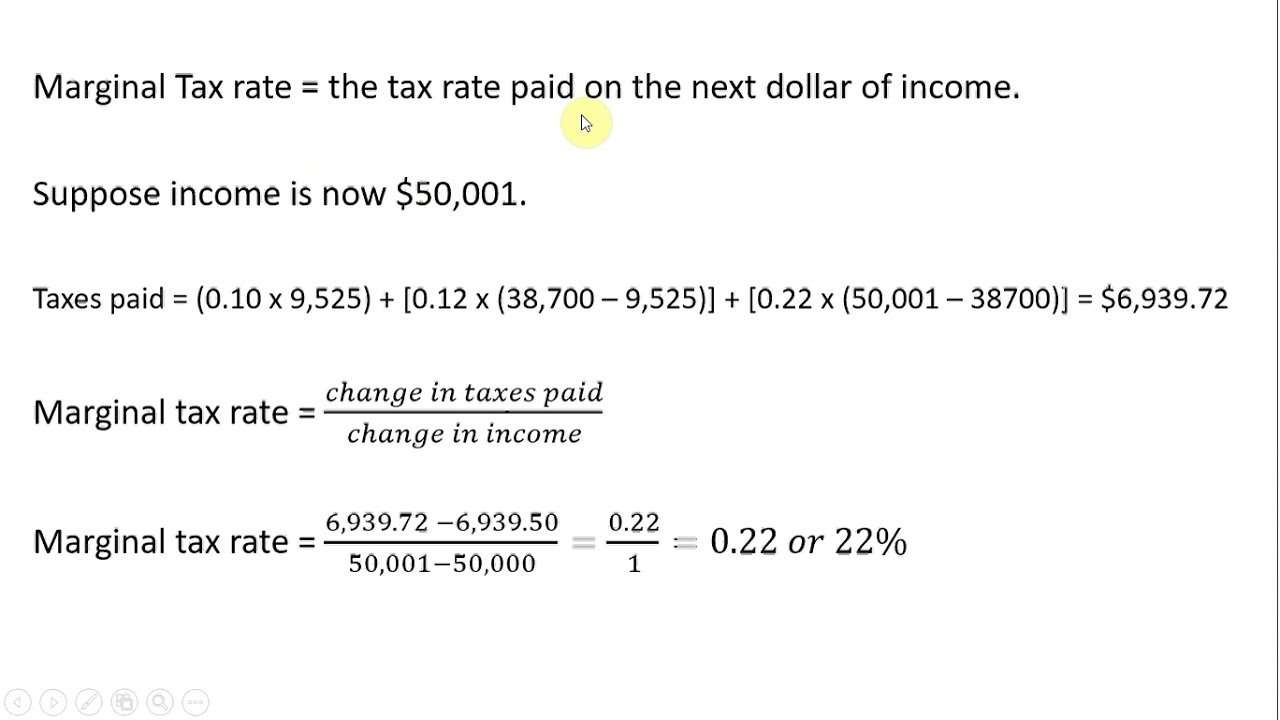

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Recommended Reading: Www.myillinoistax

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Don’t Miss: What Does H& r Block Charge

Effective Tax Rate Formula

Determining ones tax rate is a bit complex. The US tax code is a progressive tax system, so not all of your income will be taxed the same. In fact, depending on your taxable income and tax brackets, if your income spans more than one tax bracket, you may be taxed at two different percentages. But more on that later. To calculate your effective tax rate, you need to know two numbers: your total earnings and total tax bill. To calculate your effective tax rate divide your taxes paid by taxable income and you get the effective tax rate.

ETR = Taxes paid ÷ Earned Income

What Is The Cpp

The CPP, short for the Canada Pension Plan, is a mandatory public retirement pension plan run by the Government of Canada. All Canadians over the age of 18 with employment income are required to contribute towards the CPP, with the exception of those employed in Quebec. Instead of the Canada Pension Plan, the Province of Quebec administers a similar pension plan, called the Quebec Pension Plan.

Also Check: How To Correct State Tax Return

Effective Tax Rate Vs Marginal Tax Rate

The effective tax rate varies from the marginal tax rate, which is the tax rate paid on an additional dollar of income. The effective tax rate is a more accurate representation of a persons or companys overall tax liability than their marginal tax rate, and it is typically lower.

When considering a marginal tax rate versus an effective tax rate, bear in mind that the marginal tax rate refers to the highest tax bracket into which a persons or companys income falls. In the United States, an individuals income is taxed at rates that increase as income hits certain thresholds. This is referred to as a progressive income tax system. Two individuals with income in the same top marginal tax bracket may end up with very different effective tax rates, depending on how much of their income was in the top bracket.

How The Effective Tax Rate Works

To calculate your effective tax rate, you divide your income by the taxes you paid. What makes effective tax tricky is that two people in the same tax bracket could have different effective tax rates.

Heres an example. Someone who earns $80,000 would pay the 22% rate on $39,875 of their income over $40,125 in 2020, whereas you would only have to pay a 22% rate on $19,875 of your income at $60,000 in taxable earnings. Yet you would both have the same marginal tax rate of 22% and fall into the same tax bracket.

You would owe $8,991 in taxes on $60,000 in income:

- $988 on the first $9,875 at 10%

- $3,630 on $9,876 up to $40,125 at 12%

- $4,373 on $40,126 up to $60,000 at 22%

The taxpayer who earned $80,000 in taxable income would owe $13,390 in tax:

- $988 on the first $9,875 at 10%

- $3,630 on $9,876 up to $40,125 at 12%

- $8,772 on $40,126 up to $80,000

The first persons effective tax rate would be 14.99%, while the second persons rate would be 16.74%. The second person has a higher effective tax rate because they made $20,000 more than the first person and therefore paid more taxes.

Your effective tax rate doesnt include taxes you might pay to your state, nor does it factor in property taxes or sales taxes. Its only what you owe the federal government in the way of income tax.

Knowing your effective tax rate can help with tax and budget planning, particularly if youre considering a significant change in life, such as getting married or retiring.

You May Like: How Much Does H& r Block Charge To Do Taxes