Which Types Of Retirement Income In Canada Get Taxed

To begin with, taxes work a bit differently in retirement. Like employment income, most retirement income is taxable. In retirement, there are some additional types of income that can be taxed. This can include things like an annuity from a pension plan, an annuity from an insurance company, or an annuity from a mutual fund company.

Once you retire, your tax bill drops dramatically because your income likely drops. But its still a good idea to know how much tax youll pay each year.

When You Retire How Much Taxes Are Taken From Your 401

When you hit retirement and start tapping your 401, you’re not the only one who celebrates. The Internal Revenue Service also gets excited because you finally start paying some taxes on your 401 nest egg. If you’re over 55 when you retire, you won’t owe any early withdrawal penalties. However, you will still owe income taxes. Because tax laws can change from time to time, check with a tax professional to determine how your 401 withdrawals will be taxed.

The Tax Benefits Of Saving For Retirement In A Pre

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

The Balance / Katie Kerpel

Congress established 401 plans to encourage and help workers save for retirement. Traditional 401 plans offer major tax benefits at the time you’re making contributions. You also accumulate the money to achieve financial independence later down the road in retirement.

Don’t Miss: How To Get Tax Preparer License

Borrow Instead Of Withdrawing From A 401

Some 401 plans allow employees to take a loan from their 401 balance before attaining retirement age. The specific terms of the loan depend on the employer and the plan administrator, and an employee may be required to meet certain criteria to qualify for a 401 loan.

The amount borrowed is not subject to ordinary income tax or early-withdrawal penalty as long as it follows the IRS guidelines. The IRS provides that 401 account holders can borrow up to 50% of their vested account balance or a maximum limit of $50,000. This limit applies to the total outstanding loan balances of all loans taken from the 401 account. The loan must be paid within five years, and the borrower must make regular and equal loan payments for the term of the loan.

Your Marginal Tax Bracket

Your tax savings become more significant when you’re in a higher .

Your marginal tax rate is the rate you’ll pay on your highest dollar of income.

Your tax brackets as a single taxpayer as of the 2021 tax year would be:

- 10% on income from $0 to $9,950

- 12% on income from $9,951 to $40,525

- 22% on income from $40,526 to $86,375

- 24% on income from $86,376 to $164,925

- 32% on income from $164,926 to $209,425

- 35% on income from $209,426 to $523,600

- 37% on income over $523,600

Your marginal tax rate would therefore be 22% in 2021 if you earn $80,000, because your top dollar falls within this parameter.

Tax brackets cover different spans of income if you’re married and filing a joint return or if you qualify as head of household because you’re single, have a dependent, and meet other rules.

You should keep making pre-tax contributions to a 401 plan if you enjoy getting those tax savings because you’re in a high tax bracket, and expect to be in a lower marginal tax bracket during your retirement years. You might prefer making contributions to a Roth 401 if you expect to be in a higher tax bracket when you retire, or if you prefer the idea of tax-free growth of earnings.

You May Like: Where’s My Tax Refund Ga

Watch Your Tax Bracket

Since all of your 401 distribution is based on your tax bracket at the time of distribution, only take distributions to the upper limit of your tax bracket.

“One of the best ways to keep taxes to a minimum is to do detailed tax planning each year to keep your taxable income to a minimum,” says Neil Dinndorf, CFP®, a wealth advisor at EnRich Financial Partners in Madison, Wis. Say, for example, you are . For 2020, you can stay in the 12% tax bracket by keeping taxable income under $80,250. For 2021, you can stay in the 12% tax bracket by keeping taxable income under $81,050.

How Could This Impact Your Total Income

50% of your Social Security benefits will become taxable if your income exceeds $25,000 for a single filer or $32,000 for married filers. Income for these purposes includes half of Social Security income plus all taxable income from other sources plus some, but not all, tax-free income.

85% of your Social Security benefits will become taxable if your income exceeds $34,000 for a single person or $44,000 for a married person.

If your modified adjusted gross income goes above $85,000 for single filers or $170,000 for married filers, your Medicare Part B premiums could be anywhere from $53.50 to $294.60 more per month than the standard premium, depending upon income. Part D Premiums could also increase anywhere from $13.30 to $76.20 above plan premiums.

If your benefits weren’t being taxed but will be after you take your 401 distribution, you’ll substantially increase your total tax bill — and your 401 contributions will provide much less additional spendable income since you’ll have to use more of your money to pay the government.

Read Also: Property Tax Protest Harris County

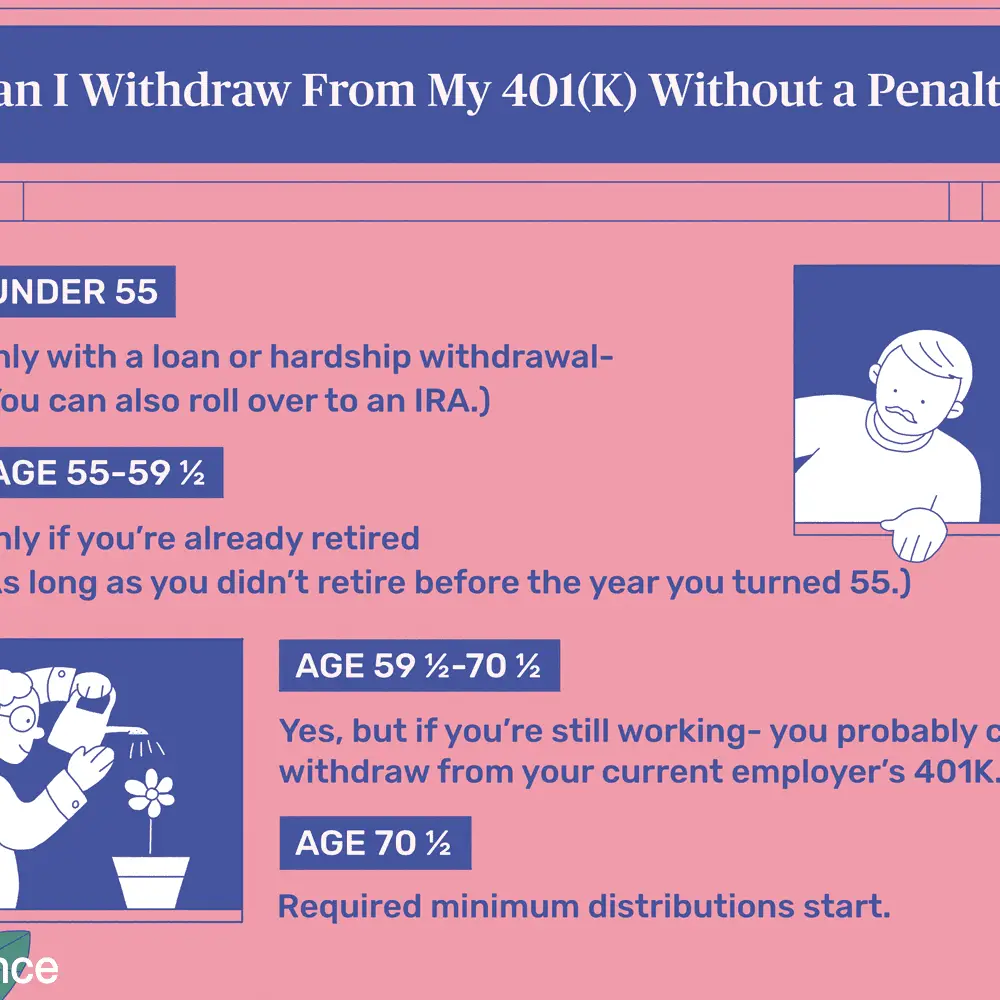

Substantally Equal Period Payments

Substantially equal period payments may be another option for withdrawing funds without paying the early distribution penalty. SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

What Is The Max Ss Payment

The highest amount that a person who submits a claim for pension benefits from social security in 2021 can receive per. month is: $ 3,895 for a person submitting application at age 70. $ 3,148 for a person submitting full retirement age . $ 2,324 for a person filing at 62.

What is the maximum social security benefit at the age of 67? For a person retiring in 2020 at full retirement age , the maximum social security benefit is $ 3,011 per year. month.

You May Like: Www.1040paytax.com

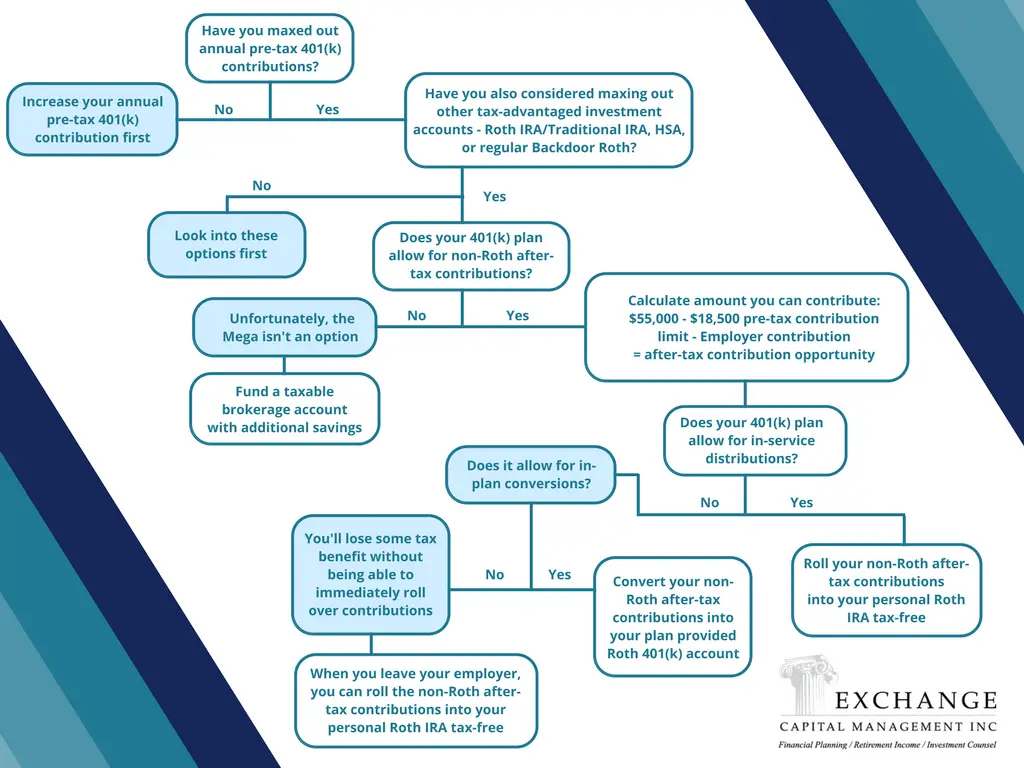

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

How Is Retirement Income Taxed

How is your retirement income taxed by your state?

Sterling Raskie May 18, 2016

Individuals are taxed on a 1040, according to the pertinent tax tables, which set the rates for income taxes. At each income bracket, you are taxed a greater amount. In the lower brackets, that rate is smaller, while in the higher brackets it grows.

For instance, lets take the example of the 2017 tax brackets and rates. A single person making between $0 and $9,325, the tax rate is 10% of taxable income. For a single person making between $9,325 and $37,950, its 15%. The good news is you only pay 10% on all income up to $9,325, then 15% on income up to $37,950, and so on.

Recommended Reading: How To Buy Tax Lien Properties In California

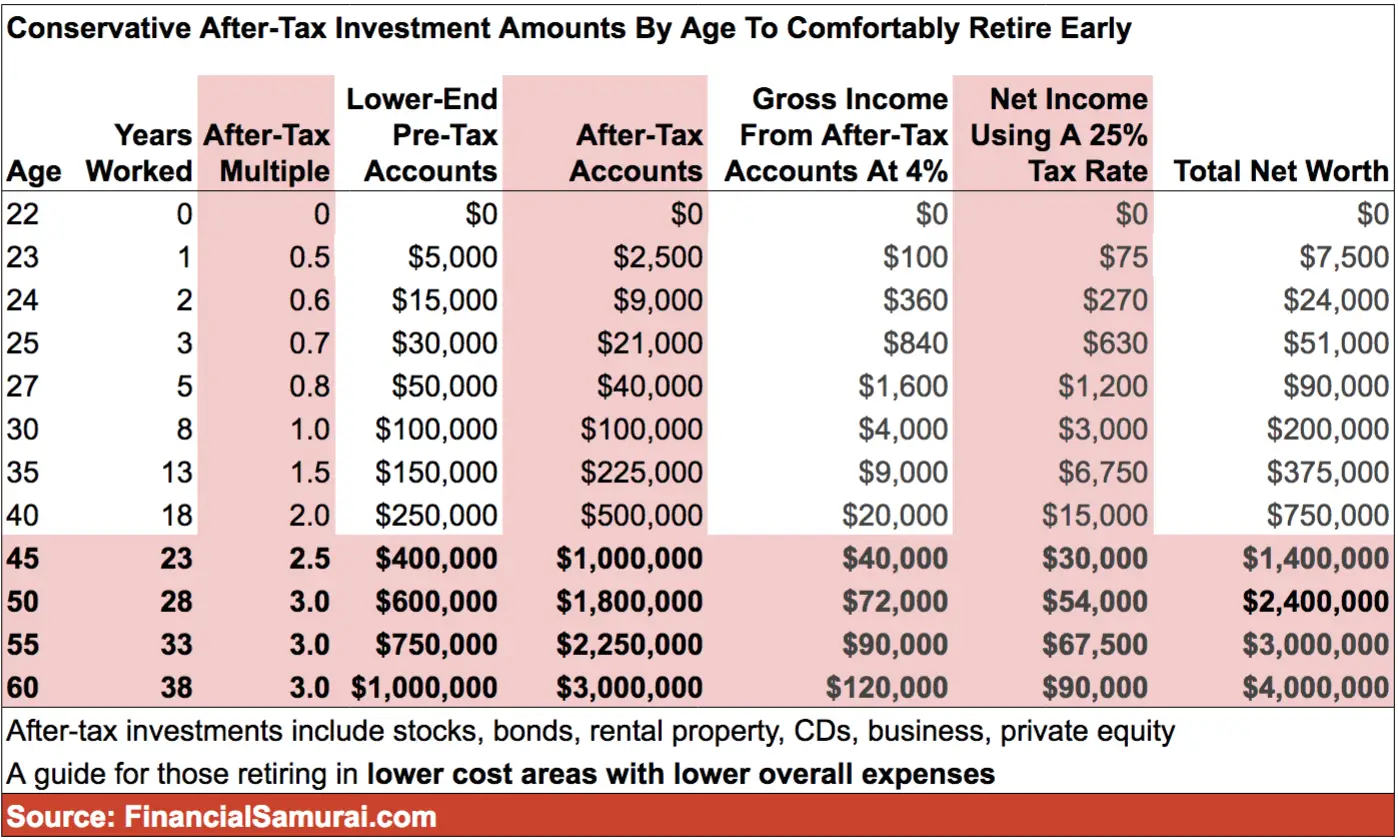

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

How Rmds Are Calculated

RMDs are calculated via some easy math just kidding! This is the IRS were talking about.

To calculate your retired minimum distribution for the current year, divide your account balance at the end of the last year by a distribution period that is based on your age. Those periods are available in two tables:

-

If youre married, the sole beneficiary of your account is your spouse, and he or she is more than 10 years younger than you, you will use the Joint and Last Survivor Table.

-

All other original IRA owners will use the Uniform Lifetime Table to calculate their withdrawals.

You could also skip that song and dance and use our RMD calculator below.

You May Like: Harris County Property Tax Protest Services

Calculate Your Gross Income

Add up all sources of taxable income, such as wages from a job, income from a side hustle, investment returns, etc.

To illustrate, say your income for 2021 includes the following:

- $75,000 in wages

- $1,000 in taxable interest and dividends

- $10,000 from a side hustle

- $5,000 in gifts from your grandparents

Of those sources, only the gift is non-taxable. So for tax purposes, your gross income is $86,000.

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

Read Also: Efstatus Taxact Online

Take A 401 Loan Versus A Hardship Withdrawal

No matter how prepared you may be, financial hardships do occur. During tough times, many people turn to the money they have saved in their 401 accounts. Unfortunately, withdrawing money from your 401 before you are age 59 ½ has some expensive consequences.

In order to take a hardship withdrawal from your 401, your financial situation must first meet a specific set of criteria as specified by the IRS. If your request for withdrawal is approved, you must then pay federal and state income tax on the amount taken out of your account. Also, you must pay a 10 percent penalty fee for early withdrawal.

Instead of withdrawing money from your retirement account, you can consider taking a 401 loan instead. Unlike hardship withdrawals, loans have to be paid back. 401 loans are not taxable, so they arent as damaging to your finances as a hardship withdrawal. Not all employer plans allow 401 loans, so be sure to check with your companys 401 administrator for all of the details.

Taxes On Iras And 401s

Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular income tax rate. If you deducted any portion of your contributions, you’ll owe tax at the same rate on the full amount of each withdrawal. You can find instructions for calculating what you owe in IRS Publication 590, Individual Retirement Arrangements.

If you have a Roth IRA, you’ll pay no tax at all on your earnings as they accumulate or when you withdraw following the rules. But you must have the account for at least five years before you qualify for tax-free provisions on earnings and interest.

When you receive income from your traditional 401, 403 or 457 salary reduction plans, you’ll owe income tax on those amounts. This income, which is produced by the combination of your contributions, any employer contributions and earnings on the contributions, is taxed at your regular ordinary rate. Keep in mind that withdrawals of contributions and earnings from Roth 401 accounts are not taxed provided the withdrawal meets IRS requirements.

You May Like: How To Get Tax Preparer License

Case : You Have An Outstanding 401 Loan

There are many reasons why it doesnt make sense to take a loan from your 401. Heres one more: You cant deduct the interest payments that you make on your 401 loan. This means you wont receive an interest statement like the one you receive when paying mortgage interest .

As long as you keep up with your agreed payment schedule and you pay your loan in full within five years , you wont have to do anything special on your taxes. However, defaulting on your loan turns the remaining unpaid balance into a taxable distribution and triggers the same rules described under case 2b above. Even worse, you are no longer eligible to do an indirect rollover and are likely to trigger additional penalties from your plan and state government.

Realize You’re Not As Rich As You Think

Millions of Americans have watched their retirement accounts balloon in value in recent years. But if a good chunk of your assets are held in traditional Individual Retirement Accounts or workplace 401-style plans, you eventually will have to pay taxes on the balances. Hence, you’re not as wealthy as you might assume.

Kitces provided this simple example: Suppose you hold $750,000 in unsheltered brokerage accounts and $750,000 in a traditional IRA. When you withdraw money from the IRA, you will pay ordinary income tax on it. If you figure a middle-range 24% federal tax rate, you really have $570,000 in the IRA and $180,000 in deferred tax liabilities, he said. Corporations have to account for this on their balance sheets, but individuals typically don’t think about it in this manner.

“Really, you wouldn’t have a $1.5 million portfolio,” he said.

In fact, assets in the brokerage account likely would incur taxes, too. Even a relatively low capital-gain rate of 15% on withdrawals would put a further dent in your wealth.

Also Check: Where’s My Tax Refund Ga

Taxes When You Make Withdrawals

In a traditional 401, your contributions and your investment growth are tax-deferred. However, you have to pay taxes when you start making withdrawals from the account. In the case of a Roth 401, since you already pay taxes upfront while making the contributions, you dont owe any taxes when you withdraw from the account.

Your Retirement, Your Way!

It Depends On Whether Your Funds Are In A Traditional Or Roth 401

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you withdraw funds from your 401or “take distributions,” in IRS lingoyou begin to enjoy the income from this retirement mainstay and face its tax consequences. For most people, and with most 401s, distributions are taxed as ordinary income. However, the tax burden youll incur varies by the type of account you have: traditional or Roth 401, and by how and when you withdraw funds from it.

Don’t Miss: Louisiana Payroll Calculator

What Types Of Income Arent Taxable

The good news is, several types of income arent taxable. You wont owe federal income taxes on:

- Child support payments

- Interest from municipal bonds

- Life insurance proceeds

- Disability benefits

- Capital gains from the sale of your primary residence

- Gifts and inheritances

Note that gifts arent taxable to the recipient, but they do have special tax rules. Gift givers may have to file a gift tax return if they give gifts worth more than the annual gift tax exclusion to any one person during the year.

However, generally gifts made to your spouse for any amount are not taxable. Also, inheritances arent taxable at the federal level, but some states levy inheritance taxes.

IRS Publication 525 has a more expansive list of the types of income that are and arent taxable.