Compare Online Tax Filing Services

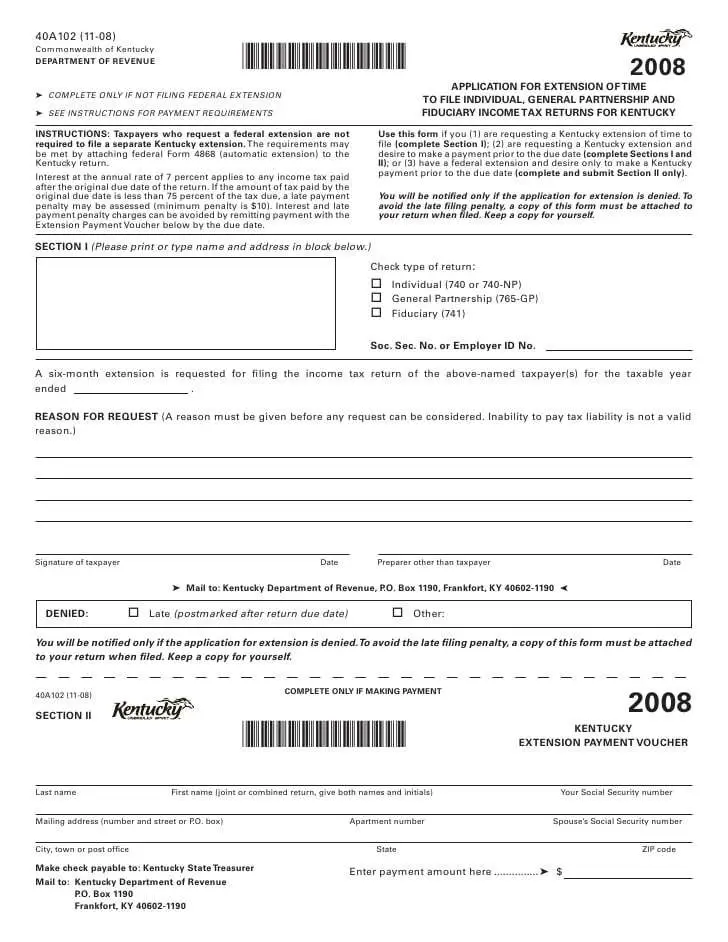

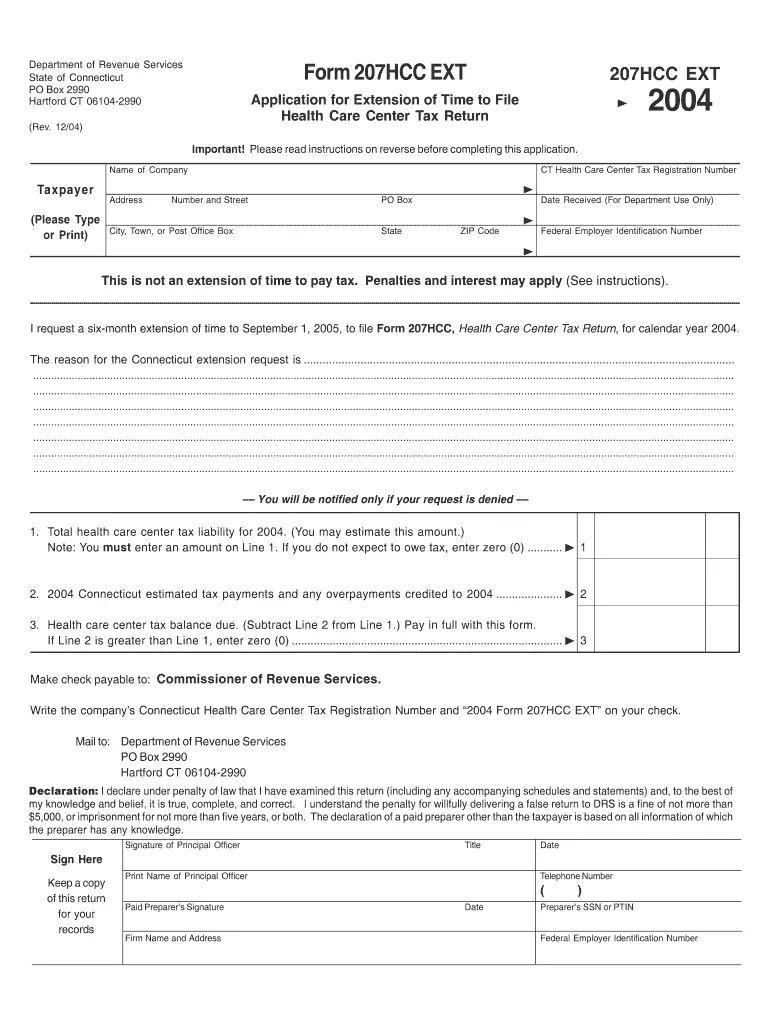

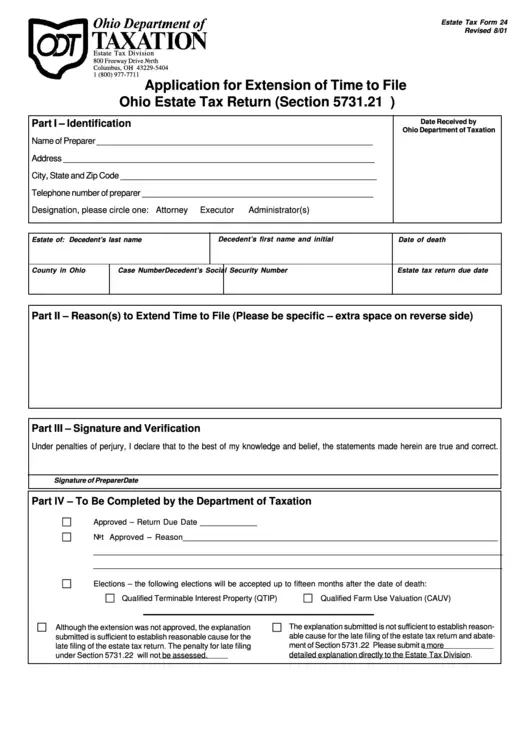

Can I mail my tax extension?

If you prefer to go the snail mail route, you can print and fill out your tax extension form, and drop it in the mail. Make sure you have proof that you mailed it. This way the IRS cant come back and claim they never received it.

Page four of Form 4868 lists several addresses to mail out your extension. The exact address depends on the state you live in and whether youre including a payment with your form.

What Happens When You File For An Income Tax Extension

The question then becomes whether or not you should go ahead and pay the IRS or wait and accrue penalty fees. Lets break it down:

Say youre an individual or an S corporation and youve been granted a tax extension. You have time to estimate the taxes you owe, so you decide to go ahead and pay the IRS what you think you will owe them. In order do that, you will need to use the form 1040ES to work out your estimated tax, as all businesses are different.

Related: Whats the deal with quarterly estimated taxes?

As either an S corp or an individual, if you have been in business for awhile, you can also refer to last years form. Make note of all your income and deductions for this years form and see what the total tax was that you paid last year.

Aim to pay 100 percent to 110 percent of that number to avoid underpayment and the resulting penalties and interest.

If you, as an individual or S corporation, decide to take an extension and not pay at the first due date, be aware that the IRS charges 5 percent a month in penalties or up to 25 percent of the total tax. If your payment is more than 60 days late, you will be charged a minimum penalty of the less of $210 or 100 percent of the taxes owed.

While it is true that you will most likely be given the tax extension, as more than 97 percent f the requests are fulfilled, do not take it for granted that it will happen. Be sure to give yourself plenty of time to figure out what you owe.

Can Anyone Get An Automatic Extension

Fortunately, you can always get an extension to file your return. Some people apply for an extension every year. It doesnt matter how much income you earn or what your filing status is. You also dont have to give any explanation to the IRS as to why you need an extension. Here are 5 good reasons to file a tax extension.

Also Check: Do You Have To Pay Taxes On Plasma Donations

You Still Have To Pay

To avoid state and IRS fines and penalties, you need to estimate the amount and pay taxes by the due date.

The IRS rule is that you must pay at least 90% of income taxes along with self-employment taxes during the year. To get an idea of the taxes due, read this article by The Balance Small Business: How do I calculate estimated taxes for my business?

Tax Year 2020 Deadline Extension

After careful consideration, the Hawaii State Department of Taxation has decided not to extend the Tax Year 2020 filing deadline. Taxpayers must file their returns by April 20, 2021.

While the law requires taxpayers to file by April 20, taxpayers are granted an automatic 6-month extension to file the return through October 20, 2021 if one of these two conditions is met:

You May Like: Reverse Ein Lookup Irs

Youll Get Six Extra Months To File Your Taxes But No Extra Time To Pay Your Bill

If you need more time to file your taxes either because you had a family emergency, couldnt get your papers together in time or were just too busy you have options when it comes to filing a tax extension. But contrary to popular belief, a tax extension doesnt give you extra time to pay your taxes. It just gives you extra time to file. Heres a step-by-step guide on how to do it.

Tax filing and payment deadline

The IRS has extended its 2020 tax filing deadline until May 17, 2021. You have until that date to file and pay any federal taxes you owe.

How To File A Business Tax Extension

Filing for a business tax extension is typically a simple process. It will vary depending on the type of business entity.

Sole proprietors and single-member LLCs must use IRS Form 4868 to apply for a business tax extension. Doing so is free via the IRS Free File tool if your business income is under $72,000. The most recent deadline to file for an extension was April 15, 2021.

Partnerships, multi-member LLCs, and S and C corporations must use IRS Form 7004 to file for an extension. Youll need some basic information about your business structure and fiscal year before filing Form 7004. The most recent deadline for partnerships and S corporations to complete this form was March 15, 2021. C corporations had until April 15, 2021.

Also Check: How To Get Tax Preparer License

Get An Extension When You Make A Payment

You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System , or a . This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

Get An Extension To File Your Federal Return

You do not need to request an extension to file your Georgia return if you receive a Federal extension. The due date for filing your Georgia return will be automatically extended with an approved Federal extension. Attach a copy of Federal Form 4868 or the IRS confirmation letter to the Georgia return when filed. Contact the IRS at 1-800-829-1040 or visit their website at www.irs.gov to obtain Form 4868 and additional extension information.

Recommended Reading: How To Buy Tax Lien Certificates In California

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

% Minimum Tax On Profits Of Large Corporations

The bill would impose a 15% minimum tax on the profits of corporations that report over $1 billion in profits to shareholders. Any corporation that for any three-year period has average annual adjusted financial statement income over $1 billion and, in the case of corporations with foreign parents, has annual adjusted financial statement income in excess of $100 million, would pay a tax of 15% of its adjusted financial statement income for the year over the amount of its corporate AMT foreign tax credit.

You May Like: How To Buy Tax Liens In California

How Do I Know How Much Tax To Pay With My Extension

One problem with not having all your tax information and needing to file an extension is you still have to calculate out how much tax you owe. And to do that, you need to complete your return as best you can. Use estimates for information you dont have yet. Thats better than leaving the information out altogether.

If you are using TaxAct, be sure to click for any information you need to double-check before you officially file your return.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1. However, the filing deadline for 2020 individual income tax returns has been extended to Monday, May 17, 2021. For more information about filing your return this year, see Avoid Pandemic Paper Delays: Tips for Filing Season.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Recommended Reading: How Can I Make Payments For My Taxes

How Does A Tax Extension Work

Tax extension forms for 2020 are due by May 17, 2021. Filing for an extension will give most taxpayers until October 15 to file their returns. But what it doesnt do is give you an extension on your payment. If you owe money to the IRS, those taxes are still due on May 17 if you want to avoid penalty fees and interest.

When is filing an extension a good idea?

The IRS recommends filing your taxes and making payments on time. But it may be worth filing an extension if any of these situations apply to you:

- You ran out of time but want to make sure you take advantage of as many tax deductions and credits as possible.

- You plan on itemizing your taxes but need more time to scrounge up receipts and documentation.

- Youre still waiting on certain tax forms to come in the mail.

If you decide to file an extension, estimate your tax payment first to ensure youre not hit with any late-payment penalty fees. If your tax situation hasnt changed much from the previous year, you can estimate your tax liability based on last years return. Otherwise, use an online calculator to estimate your payment. Many tax software programs have calculators on their website you dont have to sign up to use them.

How do I know if my extension was accepted?

If you filed your tax extension electronically, you should receive confirmation that the IRS has received it. Make sure you keep this for your records. You can also call the IRS customer service number at 800-829-1040 to confirm receipt or approval.

Foreign Tax Credit Limitation

The bill would amend Sec. 904 to apply the foreign tax credit limitation on a country-by-country basis, by taxable unit. Taxable units would include the taxpayer corporation itself, each foreign corporation of which the taxpayer is a shareholder, interests held by the taxpayer in a passthrough entity, and any branch of the taxpayer. The bill would also repeal the carryback of the foreign tax credit. The foreign tax credit changes will apply to tax years beginning after Dec. 31, 2022.

Read Also: How Can I Make Payments For My Taxes

Adoption Of Federal Tax Provisions

We are unable to provide any definitive guidance onconforming to the federalprovisions until the Legislaturesuccessfully passeslegislation.This would include:

- Provisionsfor the exemption of the first $10,200 of unemployment compensation

- Allowing PPP expenditures to be deductible when the PPP loan was forgiven

Any bill passed by the Hawaii State Legislature automatically becomes lawbyJuly 6th with or without the Governors signature, provided the Governor does not veto the bill.

Child Tax Credit 202: How To Receive Your Payments Next Year

Enhancements could be extended

This year has seen big changes for the child tax credit, thanks in part to the American Rescue Plan Act in March, but not all of those changes will continue in 2022.

President Joe Biden and Congressional Democrats have already got the Build Back Better Act passed by the House, which will carry across many of the most important features.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Request Individual State Income Tax Extension

Request an additional six months to file your Georgia income tax return.

There are two ways to request an extension to file your Georgia income tax return. You can either request an extension on your federal return or fill out Georgia Form IT-303 if you only need a state extension and dont need a federal extension. Both methods provide a six month extension to file your state return.

An extension cant exceed six months and only pertains to filing. It doesnt extend the date for paying taxes. Payment is due by the original deadline. An extension request must be submitted no later than the regular due date of your return.

Out Of Country Extension

If you are required to file a North Carolina individual income tax return and you are out of the country on the original due date of the return, you are granted an automatic four-month extension for filing your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date until the tax is paid.

If you are unable to file your income tax return within the automatic four-month extension period, an additional two-month extension may be obtained by filling in the circle at the bottom right of Form D-410 or selecting “Y” at the “Out of country on due date prompt” on the Department’s personalized form creator. To receive the additional two-month extension, Form D-410 must be filed by August 15. Importantly, a taxpayer who is granted an automatic extension to file the corresponding State income tax return if they certify on the State return that the federal extension was granted. Consequently, an “Out of Country” taxpayer granted an automatic six-month extension to file the State income tax return will not be required to file Form D-410 to receive the additional two-month extension.

Also Check: How Do I Protest My Property Taxes In Harris County

California State Tax Extension

Filing an Extension in California

The California Franchise Tax Board only requires that you file for an extension if you owe California taxes. If you are expecting a refund from California there is nothing to be filed, an extension is automatically granted until October 15, 2021 for the filing of your 2019 tax return.

You are automatically allowed an extension of up to six months to file your tax return without filing an extension form. An extension to file your return is not an extension of time to pay your taxes.

If You Owe

If you owe taxes, payment must be made by April 15, 2021 or penalty and interest will be assessed. If you cannot meet the filing deadline, you should apply for an extension. The extension allows additional time to complete and file your income tax return however, the extension does not provide additional time to pay the amount of tax owed.

Find out if you owe using FTBs tax calculator. The tax calculator allows you to figure your tax by using your filing status and taxable income amount.

Pay Online

Pay your taxes online on the Franchise Tax Boards website using Web Pay. After a one-time registration, you can make an immediate payment or schedule payments up to a year in advance. Do not mail form FTB 3519 to the Franchise Tax Board.

There is a convenience fee for this service which is paid directly to the company. The amount of the fee is based on the amount of your payment.

Pay by Phone

Pay by Mail

Penalty and Interest on Tax Owed

If You Do Not Owe

Tax Provisions In The Build Back Better Act

The House of Representatives on Friday morning passed H.R. 5376, the Build Back Better Act, by a vote of 220213. The bill encompasses a wide range of budget and spending provisions and has been the focus of protracted negotiations for the past several weeks. For more on the nontax provisions of the bill, see, “House Passes Build Back Better Act With Universal Paid Leave.”

The vote on the bill was held after the Congressional Budget Office released its cost estimate for the bill. The CBO estimates the bill will cost almost $1.7 trillion and add $367 billion to the federal deficit over 10 years. Adding in $207 billion of nonscored revenue that is estimated to result from increased tax enforcement in the bill, the net total increase to the deficit would be $160 billion.

The bill contains a wide variety of tax provisions, designed to provide incentives to taxpayers and to raise revenue to pay for the spending in the bill. H.R. 5376 now goes to the Senate for consideration its fate there cannot be predicted.

One nontax provision in the bill is the provision for four weeks of paid leave benefits for caregiving leave. These paid leave benefits would not be considered gross income to the recipient for tax purposes under a new Sec. 139J.

Among the many tax provisions in the bill are the following:

Read Also: Turbo Tax 1099q