The Business Taxes Payable By Your Ohio Llc

Business taxes are a fact of life, and your OH LLC will need to pay a variety of taxes to both the federal and Ohio governments. Well cover all the main taxes in Ohio including self-employment, payroll, federal, Ohio state tax and Ohio sales tax.

If you want help with your taxes, Incfile provides a complete Business Tax Filing service.

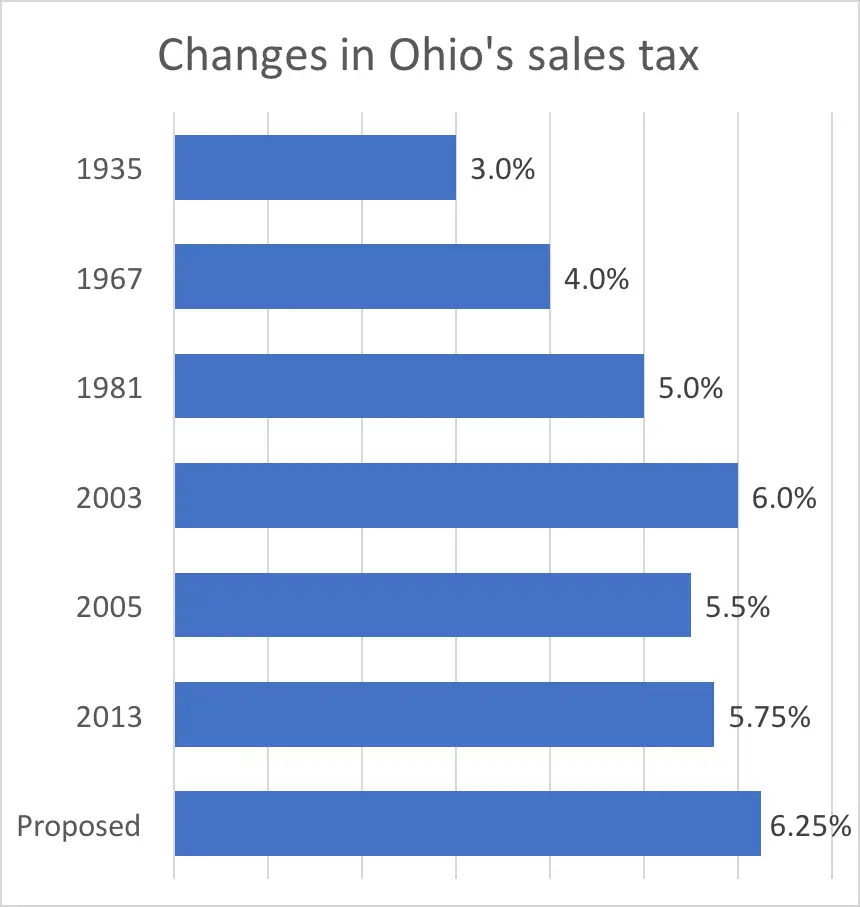

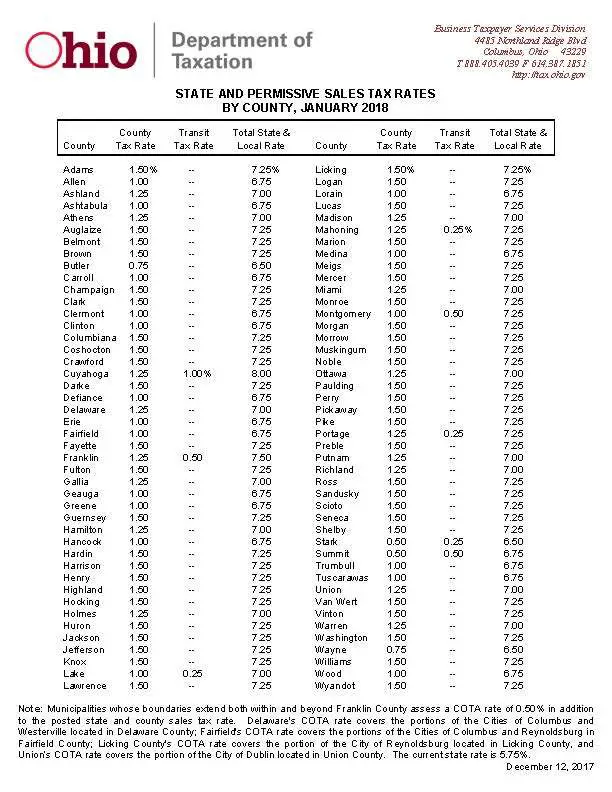

Ohio State And County Sales Tax

The Ohio sales and use taxes apply to the retail sale, lease, and rental of tangible personal property, and there are also a number of select services that are taxable. If sales tax is due, but not collected by the seller, a use tax equal to the amount of sales tax is due from the purchaser. Ohio has a sales tax rate of 5.75%, but each county and regional tax authorities may levy additional rates. For instance, a consumer in Cuyahoga County pays 8% tax, but a consumer in Lorain County pays 6.5%.

Ohio State Sales Tax On Certain Food And Drinks

Do you trust the retailer is complying with sales tax on your receipt?

According to Ohio state law, food is not subject to tax and is considered food if a substance, whether in liquid, concentrated, solid, frozen, dried, dehydrated forms is consumed by humans for nutritional value or taste.”

However, there are still many variations, according to an article.

- Gum – considered food and is not subject to sales tax.

- Coffee with artificial sweeteners – not considered food and is subject to sales tax.

- If you take your coffee black or with a milk product, its considered food and not taxable. If you buy a coffee drink but dont take any milk in it and get caramel syrup added, its not considered food and will be taxed.

Read Also: Is Donating Plasma Taxable Income

Overview Of Ohio Taxes

Ohio has a progressive income tax. While the state rate is relatively low compared to other states with an income tax, many Ohio municipalities charge an additional income tax. Sales tax is also collected at both the state and local level. The states average effective property tax rate is among the highest in the country.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

Failure To Collect Ohio Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

You May Like: Do You Have To Do Taxes For Doordash

Do You Have Nexus In Ohio

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Ohio.

You probably have nexus in Ohio if any of the following points describe your business:

- A physical presence in Ohio: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Online ads or links on an Ohio-based website, which channels potential customers and new business.

- A significant amount of sales in Ohio within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Ohio is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

How To Register For Sales Tax In Ohio

Okay, so you have nexus! Now what?

The next crucial step in complying with Ohio sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Ohio on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Don’t Miss: How To Appeal Property Taxes Cook County

File Your Sales Tax Return

Now that youve registered for your Ohio seller’s permit and know how to charge the right amount of sales tax to all of your customers, you are all set to file your sales tax return. Just be sure to keep up with all filing deadlines to avoid penalties and fines.

Recommended: Hiring a business accountant can help your business file tax returns as well as issue payroll and manage bookkeeping. Schedule a consultation with a business accountant today to save thousands of dollars on your taxes.

How Much Is Sales Tax In Cleveland Ohio

4.5/5sales tax rateClevelandOhiosales tax ratesOhio sales tax ratesales tax rate

Consequently, what is the sales tax in Ohio 2019?

5.750%

Likewise, what is sales tax on 1000 dollars? A tax of 7.5 percent was added to the product to make it equal to 1075.

Likewise, people ask, how much are sales taxes in Ohio?

The state general sales tax rate of Ohio is 5.75%. Ohio cities and/or municipalities don’t have a city sales tax.

Is Ohio a high tax state?

The state of Ohio is No. According to the study, Ohio’s effective total state and local tax rate on the median U.S. household is equivalent to 13.05 percent. Ohio’s income tax is eighth highest in the nation and its real estate tax is 13th highest, while sales and excise taxes rank No. 20.

Recommended Reading: How Can I Make Payments For My Taxes

Ohio Sales Tax Permit

If a seller determines that they should be collecting and remitting sales tax to Ohio, they must apply for a sales tax permit. Sales tax returns can be filed through the Ohio Business Gateway, and the frequency of your filing will be determined during the application process.

There is a discount of 0.75 of 1% for timely filed sales tax returns, and if you file late, theres a penalty equal to the greater of $50 per month or fraction of a month, up to $500, or 5% per month or fraction of a month, up to 50% of the sum of the taxes required to be reported for each month or fraction of a month that occurs between the due date, including extensions, and the date on which the return is filed will be levied.

It is also required that any seller with a sales tax permit file a sales tax return on your due date even if you dont have any sales tax to report or pay.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Recommended Reading: How Can I Make Payments For My Taxes

What Are The Other Taxes And Fees Applicable To Ohio Car Purchases

2020 is a year when you can make smart purchases on vehicles.

Before you make an economical or luxurious purchase on a vehicle in Ohio, look at the sales contract for the ees you may encounter. Remember that these fees differ from the state’s sales tax. The fees go to the Ohio Department of Motor Vehicles .

Here are the fees you need to account for before you agree to buy a vehicle in Ohio:

- A Title Fee .

- A Registration Fee .

- A Plate Transfer Fee .

Local Income Tax Brackets

| City |

|---|

| 1.50% | 7.25% |

While those taxes apply to nearly every product that can be bought, there are some exceptions. For example, there is no sales tax on newspapers, prescription drugs, property used for agricultural production or utilities such as gas, water and electricity. Food is also exempt from sales tax, so long as it is not prepared for on-site consumption .

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Extension Of Temporary Relief For Employee Withholding

Enacted on March 27, 2020, H.B. 197 provides that, for purposes of withholding municipal income tax, any day on which an employee performs personal services at a location, including the employee’s home, to which the employee is required to report for employment duties because of the governors emergency COVID-19 declaration shall be deemed to be a day performing personal services at the employee’s principal place of work. Read our Insight for more detail on the relief.

Relief originally was due to expire 30 days following the end of the governors Executive Order 2020-01D. H.B. 110 extends the relief through December 31, 2021. However, H.B. 110 allows an employer to not follow the H.B. 197 withholding procedure and the employer may begin to withhold at the employees physical location, if the employer so desires.

What Qualifies In The School Supplies Category

As outlined by the Ohio Department of Taxation: School supplies include only the following items: binders book bags calculators cellophane tape blackboard chalk compasses composition books crayons erasers folders glue, paste, and paste sticks highlighters index cards index card boxes legal pads lunch boxes markers notebooks paper loose leaf ruled notebook paper, copy paper, graph paper, tracing paper, manila paper, colored paper, poster board, and construction paper pencil boxes and other school supply boxes pencil sharpeners pencils pens protractors rulers scissors and writing tablets. Items not included in this list are taxable. School supplies does not include any item purchased for use in a trade or business.

Don’t Miss: How To File Taxes Without Income To Get Stimulus Check

How Much Does Your State Collect In Sales Taxes Per Capita

Katherine Loughead

This weeks state tax map examines state sales tax collections per capita. Forty-five states and the District of Columbia have state-levied sales taxes, while five statesAlaska, Delaware, Montana, New Hampshire, and Oregondo not collect sales taxes at the state level.

In fiscal year 2017, the highest state sales tax collections per capita were found in Hawaii , the District of Columbia , Washington , Nevada , South Dakota , and Florida . Hawaii and South Dakota have broad sales tax bases that include many services, contributing to high collections per capita.

The lowest state sales tax collections per capita are found in Virginia , Colorado , Alabama , Georgia , and Missouri . In these states, a combination of low rates and relatively narrow bases contributes to low collections per capita.

In most states, narrow sales tax bases make the sales tax less productive than it could be. Many states exempt certain goods from the sales tax for political reasons, while excluding many consumer services . Since the 1950s, purchases of consumer services have grown, while purchases of consumer goods have declined, as a share of total U.S. personal consumption. This trend has contributed to the erosion of states sales tax bases over time, and the narrowing of sales tax bases puts upward pressure on sales tax rates.

Note: This is part of a map series in which we examine per capita state tax collections

Anderson Ohio Sales Tax Rate

anderson Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Anderson, Ohio?

The minimum combined 2021 sales tax rate for Anderson, Ohio is . This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently %. The County sales tax rate is %. The Anderson sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Ohio?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Ohio, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Anderson?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Anderson. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Ohio and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Don’t Miss: Protesting Property Taxes In Harris County

Business Guide To Sales Tax In Ohio

Website:

So, you need to know about sales tax in The Buckeye State. Look no further!

Whether youâve fully set up shop in Ohio, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

Sales Taxes In The United States

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states do not levy a statewide sales tax.California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the value added tax, a sales tax is imposed only at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.

Read Also: Where Is My State Refund Ga

Governor Signs Repeal Of Ohio Sales Tax On Employment Services

As a follow-up to the VorysState and Local Tax Alert issued June 29, 2021, we now can confirm that Governor DeWine signed the legislation, which officially repeals the sales tax imposed by Ohio on employment services. The tax repeal is set to begin the first full month following the Budget Bills 90-day effective date, which means that starting October 1, 2021 employment services will no longer be a taxable service in Ohio.

In anticipation of the October effective date, businesses should now consider how the tax repeal affects their tax planning, compliance and operations. Purchasers should review their vendor contracts for possible reductions in negotiated purchase prices to ensure tax is no longer charged/paid on employment services starting in October. Purchasers also should review their direct pay permits or use tax accounts to make sure that necessary adjustments are in place for October to avoid overpaying tax and the need to file refund claims related to employment services. On the other hand, vendors should review their service agreements and related tax provisions regarding the collection of sales tax. Vendors should consider making adjustments or revisions to tax terms in these agreements so that Ohio sales tax is no longer collected and remitted for employment services starting in October.