Why Is My Tax Transcript Not Available

If you didnt pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

How do I get my transcript from 1120s?

You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on Get a Tax Transcript under Tools or call 1-800-908-9946. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return. There is a fee to get a copy of your return.

When Your Tax Return Goes Missing Or Is Lost

Tax returns can go missing for a variety of reasons, such as moving, a flooded basement, or lost or stolen mail. The CRA may be willing to waive those penalties if you can provide proof that you mailed in your tax return. If you mailed in your tax return by regular mail, you cannot provide proof, but if you sent in your package via courier or registered mail, you can provide a tracking number as proof and check the status of your package.

How Much Does It Cost To Pay Arizona Income Tax With A Credit Card

2.35% convenience fee, minimum of $1.50, to make a tax payment with a credit card. $3.50 convenience fee to make a tax payment with a debit card. Note: To determine if you have a Visa Corporate debit card or a Visa Consumer branded debit card, please contact your financial institution that issued the card.

Read Also: Reverse Ein Lookup Irs

How Do I Pay Sales Tax In Wisconsin

You have a few options for filing and paying your Wisconsin sales tax:

Help Filing Your Past Due Return

For filing help, call 1-800-829-1040 or 1-800-829-4059 for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 1-800-Tax-Form or 1-800-829-4059 for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Don’t Miss: Where’s My Refund Ga State Taxes

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Don’t Miss: How To Correct State Tax Return

Where To Send Your Corporation Income Tax Return

Most corporations with gross revenues in excess of $1 million are required to Internet file their T2 Corporation Income Tax Return using CRA approved commercial software. See Mandatory Internet Filing for more information.

If you are Internet filing, go to Corporation Internet Filing.

Where you file your paper return depends on where the corporation is located.

Can I Claim A Tax Credit For Any Charitable Organization I Choose

A taxpayer can only claim a tax credit for donations made to certified charities from the list for the year in which the donation was made. For example, donations made during 2020 must be to a charity shown on the 2020 QCO or QFCO list. To confirm certified qualifying charities and more information on QCO and QFCO tax credits, visit .

Don’t Miss: How To Appeal Cook County Property Taxes

I Am Having Issues Downloading The Income Tax Forms Online What Is The Issue

The most compatible browsers for this form are Internet Explorer or Mozilla Firefox. If you are using Google Chrome or Safari and see a blank/warning/error message, please view the form within your computer’s Download folder instead of online. For more forms technical help, see .

Do I Have To Enter My Driver’s License Or State

In an ongoing effort to protect taxpayers from identity theft, the IRS, state tax agencies and the tax industry are asking for drivers license numbers or state-issued identification numbers. Providing this information helps verify identity and can prevent unnecessary delays in tax return processing.

Read Also: How Can I Make Payments For My Taxes

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Where To Send Returns Payments And Extensions

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still files a paper or snail-mail tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

Read Also: Appeal Property Tax Cook County

What Is The Due Date For Calendar Corporate Income Tax Returns For Businesses That Received An Extension

The filing extension provides an extension to file the 2020 Arizona corporate returns. The extension due date for calendar year corporate Arizona returns is due October 15, 2021.

The federal calendar year corporate returns are due October 15, 2021.

Corporate income tax payments can also be made on AZTaxes.gov, but registration is required.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

When Can I File My 2020 Wisconsin State Taxes

The 2020 Wisconsin State Income Tax Return for Tax Year 2020 can be e-Filed together with the IRS Income Tax Return by April 15, 2021 May 17, 2021 due date. If you file a tax extension you can e- File your Taxes until October 15, 2021 without a late filing penalty.

What To Do About A Missing Or Lost Tax Return

Finishing your tax return is sometimes a struggle. It feels like a relief when you click the Submit To NETFILE button or pop your taxes into the mailbox. But sometimes things dont go smoothly, and somehow, your tax return gets lost on its way to Canada Revenue Agency . In this post well let you know what to do if your return goes missing, as well as other important information about filing your tax return.

Also Check: How To Get Tax Preparer License

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

Mailing Your Tax Return

Individuals, including small business owners, can mail their individual returnsForm 1040 or 1040 SRto an IRS location thats based on their state. The IRS provides a state-by-state list of these addresses on its website.

Mailing in your tax return takes extra time under normal circumstances, and the IRS indicates that processing times are especially backlogged during the ongoing public health crisis. The IRS strongly urges you to file electronically.

Mailing addresses for partnership Form 1065 partnership returns, Form 1102 corporate returns, and Form 1120 S corporate returns are provided on a .

Recommended Reading: How Much H And R Block Charge For Taxes

Also Check: How To Buy Tax Lien Certificates In California

How To File A California Tax Return By Mail

If you would like to file a paper tax return by mail, youll need to download and print our forms and instructions. 4. . To find out what form you need to use, visit our file page and select your filing situation. 5.

The mailing address for your federal tax return depends on the state or territory that you live in and on the type of Form 1040 that you are filing. However, you can prepare and efile most of the Federal IRS 1040 Forms together with your State Tax Return on efile.com-no need to mail anything when you electronically file your taxes.

Receipts And Proof Of Expenses

The IRS does not require taxpayers to attach receipts or proof of expense payments claimed on tax returns, but you must hold onto receipts and copies of any other items used to prepare your return, and keep them handy. In the event a return you file is selected for an audit, youll need to show proof of your expenses to your examiner, or items you claimed could be disallowed.

Don’t Miss: Efstatus Taxact Online

Is There A Deduction For 529 Plan Payments For 2020

For tax year 2020, you may subtract amounts you contributed directly to 529 college savings plans during the taxable year. You may subtract the amount you contributed during the year up to a total of $2,000 If you are married filing separate returns, either you or your spouse may take the subtraction, or you may divide it between you, but the total subtraction taken by both of you cannot be more than $4,000.

If you contribute more than $2,000 during the year, your total subtraction is still limited to $2,000

You cannot take a subtraction for an amount transferred from one college savings plan to a different college savings plan .

Did Arizona Conform To The American Rescue Plan Of 2021

On April 14, 2021, Governor Ducey signed Senate Bill 1752, which conformed to the definition of federal adjusted gross income , including federal changes made during 2020 as well as through the 2021 American Rescue Plan. The American Rescue Plan of 2021 included a subtraction from federal adjusted gross income of up to $10,200 in unemployment income per person for the 2020 tax year.

Recommended Reading: How Can I Make Payments For My Taxes

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

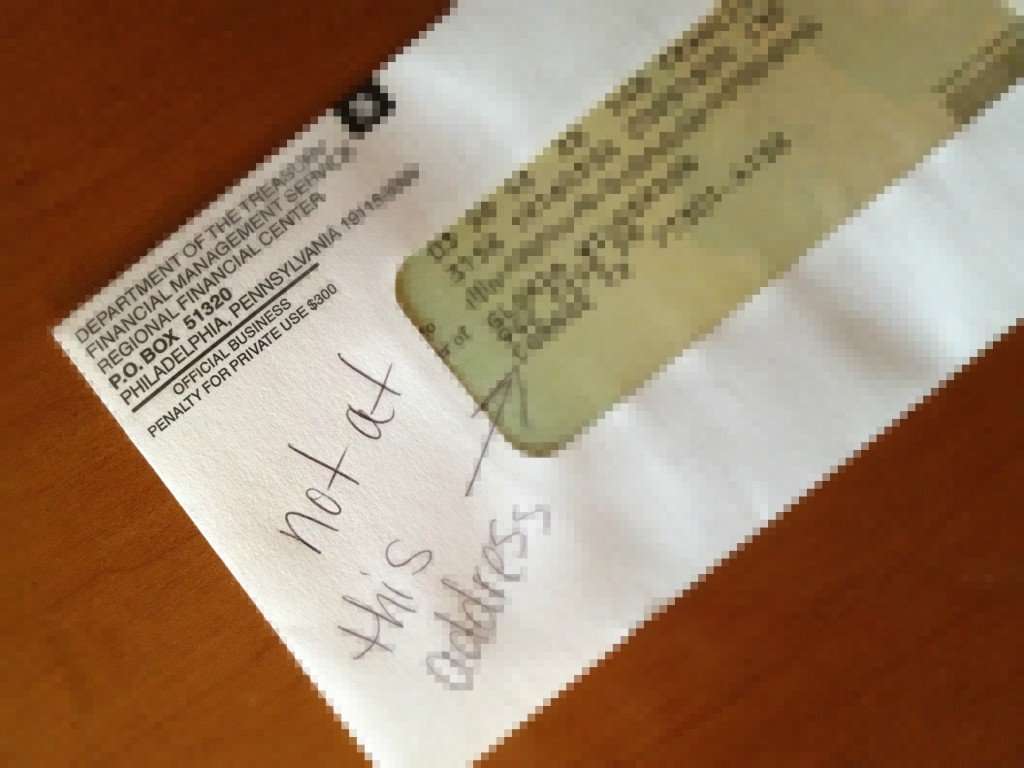

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: Do You Have To Do Taxes For Doordash

What Does It Mean To Be Audited By The Irs

- Banks Editorial Team

Sponsored By

Worried youll be audited by the IRS? The good news is you have a less than 1 percent chance of that happening. But what if the IRS flags your return for further review?

In this guide, youll discover the reasons why you may be selected for an audit, how the IRS conducts audits, how long an audit takes, and what information youll need to provide during the process. Theres also guidance on moving forward after the audit if you need help resolving tax-related matters.

Q& A: Do You Have To Send Your W

No, you dont have to send your W-2 with your tax return. This is true whether you file electronically or through the mail. Instead, you will enter the information found on your W-2 form when our software prompts you or within the appropriate fields on your tax return.

Now, once you submit your tax return, you do need to retain a copy of your W-2, your tax return, and any other related documentation. How long you keep these depends. For most returns, you should keep your tax paperwork for a period of at least three years after your filing date. However, if you file a loss claim or if you dont report all income you may need to keep the paperwork for up to seven years.

Don’t Miss: How To Report Ppp Loan Forgiveness On Tax Return

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Signature Section:

Updates To Online Form 1 & Form 1

The following is a list of updates made to the online versions of the 2020 printed Form 1 and Form 1-NR/PY booklets:

-

Form 1 instructions page 7 Form 1-NRPY instructions page 9- Veterans Benefits instructions updated to add text for Operation Sinai Peninsula.

-

Form 1 instructions page 8 Form 1-NRPY instructions page 9- Name/Address instructions updated to remove address change language as the fill-in oval is now only for a name change.

-

Form 1 instructions, page 20- Instructions for Schedule X, line 4 updated to change the reference to Schedule FCI-I to Schedule FCI.

Recommended Reading: How To Protest Property Taxes In Harris County