How To Negotiate A Fair Price

Call various tax preparation firms and get a feel for their price ranges if you’re searching for the lowest price. The business might not be able to give you an exact price quote, but they should be able to quote you either an average price or a price range for your tax situation.

Some firms might charge additional fees during their busiest days, like the weeks right after W-2 forms are mailed out or just before the April tax filing deadline. You might be able to obtain a lower price quote during a less hectic time of the tax season.

H& r Block Plans And Prices

H& R Block online tax filing software comes in four different editions:

- Free Online: $0 plus $0 per state filed

- Deluxe Online: $29.99 plus $36.99 per state filed

- Premium Online: $49.99 plus $36.99 per state filed

- Self-Employed Online: $79.99 plus $36.99 per state filed

Heres a basic rundown of what each of these plans offers and why you might want to sign up.

To Itemize Or Not To Itemize

You might not have to torture yourself over the decision between itemizing and claiming the standard deduction. The Tax Cuts and Jobs Act effectively doubled the standard deduction for all filing statuses when it went into effect in 2018.

As of 2021, you’d need more than $25,100 in itemized deductions to make itemizing worthwhile if you’re married and you file a joint tax return . You’d be taxed on $5,100 more in income if you itemized and have only $20,000 in itemized deductions. That’s not even to mention the additional tax prep fee.

The standard deductions for other filing statuses are $12,550 if you’re single or if you’re married and filing separately , and $18,800 if you qualify as head of household .

Also Check: Is Selling Plasma Taxable

Does H & R Block Charge Up Front

This is sometimes a point of confusion. The RAC is not an option for how you can receive your refund. If you select H& R Blocks refund anticipation check, you will not have to pay the fee for tax preparation services up front. Instead, H& R Block will deduct those fees from your refund after the IRS issues it.

Also Check: Where Can I Get My Taxes Done By Aarp

How Much Does H& r Blocks Tax Service Cost

H& R Block offers a free online tax-filing program that includes simple federal and state tax returns. If you need to upgrade based on your tax situation, youll pay $49.99 to $109.99 to complete a federal return, and $36.99 for each state tax return.

At the time of publishing, the company is offering a temporary discount. Filing a federal return costs just $29.99 to $84.99 during the promotion, which brings the pricing more in line with TaxSlayer, the lowest-cost provider we reviewed.

H& R Block also offers in-person tax filing starting at $69 per federal return plus an additional fee for state returns. Its desktop software, which downloads to your computer, ranges from $29.95 to $89.95 for federal returns, and $19.95 for each state return. The in-person and downloadable software options arent included in our review.

Also Check: Doordash Tax Deductions

What It Looks Like

H& R Blocks interface is visually simple, straightforward and easy to use, and it steps up to explain concepts as you go. Skipping around to specific spots can be a little tricky, but a banner across the top keeps track of where you stand in the filing process.

Embedded “learn more” links provide more information without having to wander around, the help menu updates according to where you are and you can click to access the chat support portal throughout.

A Price Preview button up top tells you which package youre buying, whether youve also selected add-ons and how much your total software bill is so far.

Is H& r Block Or Turbotax Better

When it comes to costs, H& R Block‘s pricing is slightly lower than TurboTax‘s. Both offer solid customer service, an easy-to-use interface, and clear instructions and guidance, though there are some variations between packages.

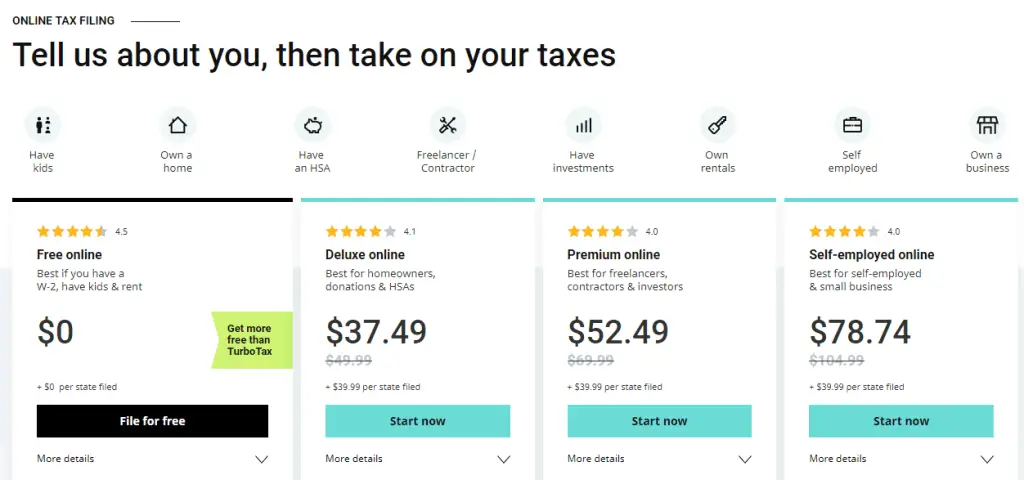

Beyond the free version, here’s how they stack up on cost for the DIY online filing option, not considering discounts:

| $44.99 |

Read Also: Taxes For Doordash

How Much Does It Cost To File Your Taxes With H& r Block

Tax prep companies frequently offer discounts on products early in the season. The prices listed in this article do not include any discounts. You can check the company’s website to see current offers. Check the site »

You can pay as little as $0 or as much as $231.98 to prepare and file your own federal and state returns online. The more options you need to add on, including multiple streams of income and/or deductions and you qualify for, the more expensive it will be to prepare your return with H& R Block. Similarly, the more expert help you enlist, the more you’ll pay.

H& R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist , downloadable computer software, and full service from a tax preparer. Each of these categories offers different price points, which are determined by which tax forms you need and how much help you want.

The DIY packages without expert help are the cheapest, since you’re filling out every form yourself. If you don’t qualify for the free version, these cost either $49.99, $69.99, or $109.99, plus $36.99 for a state return, not including discounts.

Tax Season Nightmare: Couple Pays When H& r Block Makes Mistake

After red tape struggle, tax Preparer eventually paid out nearly $10K.

H& R Block’s Mistake Guarantee May Not Be Foolproof

THE ABC NEWS FIXER — Steven and Adriana Rahal of Florida wanted a stress-free tax season, so they signed up for their tax preparers money-back guarantee. But when the IRS found a mistake, Steven and Adriana had a hard time invoking that guarantee. After months of wrangling, they still hadnt gotten their refund.

Read their original letter to the ABC News Fixer below, and see how The Fixer helped get this resolved. Also, check out the Fixers tips for hiring a tax preparer.

Do YOU have a consumer problem? Maybe The Fixer can help! Submit your problems at ABCNews.com/Fixer. Letters are edited for length and clarity.

Dear ABC News Fixer: We have used H& R Block to do our taxes for about 10 years. They offer a guarantee, and we also bought their extra Peace of Mind plan because we were told it would protect us financially if we were to ever get audited.

Well, lo and behold, we ended up getting audited.

We submitted two claims under their guarantees. It has been an absolute nightmare. We have gotten the runaround for several months. We have given them every document they have asked for. I have even called their corporate office and spoke with two people who wouldnt give their last names. One man in the local office assisted us for a while but he couldnt resolve it.

Please, we need your help. About $10,000 is owed to us — that is a lot of money.

Read Also: How Much Does Doordash Take In Taxes

How Much Does It Cost

The course is marketed as free but you are required to purchase course materials, which are $149 in most states. For my class, if you wanted printed course materials, there was an additional charge. We also received a Study Guide book that included reference materials, key points, and areas to take notes.

You Have Other Options

You can save considerably by purchasing tax preparation software instead if your tax situation isn’t very complicated. These programs have evolved considerably over the years and are set up to ask you specific questions, then prepare your return based on your answers and the data you input.

As of Dec, 2021, prices start as low as $19.95 for the H& R Block basic tax software. You can file a simple tax return for free with TurboTax, but any returns looking to maximize deductions would require its programs starting $39. There might be an extra cost for preparing state returns, however.

You can have your return prepared and filed for free through IRS Free File if your tax situation is very simple and basic, subject to some income limits. You can’t have more than $72,000 income, and some of the participating providers’ limits are even less than this. The Free File website can guide you to what’s available.

The IRS Volunteer Income Tax Assistance Program also provides free tax preparation for low-income taxpayers, as well as for the elderly, disabled, Native Americans, rural citizens, and those for whom English is a second language. There were more than 7,350 volunteer program sites across the U.S. as of March 2021.

Read Also: Tax Write Off For Doordash

Reliable Quick And Easy Tax Consultant Support

I enjoy using H& R Block to file my taxes. I have used H& R Block software for several years and before that their TaxCut software. Being able to do your tax return and home is a major plus. Much better than gathering all your documents together and going to an account or tax prep office. The app or software guide you through in a quick and easy process. I use the Deluxe edition to itemize my taxes and Im typically finished within two hours. I also like the H& R Block app or software maximizing the amount I receive in my tax return by providing yes or no questions and, select all that apply check boxes. After answering the question, you are taken directly to the sections that apply specific to your situation. As you move quickly along, the app or software show you a real-time total of the return or owe amount. I also like the option to have a live tax consultant available to me 7/24 and a representative with me if I were to be audited. Thank you H& R Block for making a typical stress for task quick and easy from start to e-file with a tax refund in my bank account with around a week to ten days!

H& r Block Vs Turbotax: Cost

Cost is always a consideration when you choose a tax filing service. H& R Block and TurboTax are the two most comprehensive online services available and likewise they are also some of the most expensive. However, while H& R Block was once cheaper than TurboTax, the companies are now nearly perfectly aligned when it comes to cost.

As mentioned, both services offer a free option, covering simple returns. You can also file some additional schedules and forms with this option. However, H& R Block does cover more forms and schedules with its free option. It also allows you to file multiple state returns for free. By contrast, the free plan from TurboTax includes only one free state return. This all gives H& R Block a slight advantage if you qualify for the free option.

Its great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat.

There are a couple of big differences between the options in the forms that they support. TurboTaxs Deluxe option supports Schedule SE, which allows you to file self-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

Don’t Miss: Do I Have To File Taxes For Doordash If I Made Less Than $600

How Much Does It Really Cost To File Your Taxes Online At H& r Block

There are ways to file your taxes online for free. But, many of us will end up paying something to get through tax season. To take the guessing out of doing your taxes, weve made a complete guide to exactly what youll end up paying to file your taxes this year with H& R Block.

From basic packages to add-ons, we break down the costs so you dont get a surprise bill when youre finally ready to file. Bonus: Dont miss out on all the savings available to you on the Groupon Coupons H& R Block coupons page.

Read Also: How To Get Tax Exempt Status

Are There Other Fees I Should Know About

Like most companies, H& R Block allows you to pay for tax prep and other related fees right from your federal or state refund payment, but youâll be charged a $39 Refund Transfer fee.

That means that H& R Block wonât charge you when you file, but will take the amount you owe from your refund plus the additional fee. So, for example, if you went with the Deluxe option for $49.99 and added on the additional $39 Refund Transfer fee, H& R Block wonât charge you on the spot but will deduct the added charges from your final refund. If you donât have the cash available to pay now and you expect to get a large refund, it might be worth the extra fee.

Read Also: Efstatus Taxactcom

Yeah Yeah Yeah But Is It Worth It To Take The Course

Honestly, that depends on what you are hoping to get out of it. Lets take a look at some of the Pros and Cons and see if it might be worth it for you.

Pros:

- Opportunity to earn commissions after the first year

- You can do your own tax return for free

- Access to advanced tax classes year-round

- Social interaction a lot of tax preparers that have been around a while see the same clients year after year and enjoy catching up with them

Cons:

- Costs $150 for course materials

- Big time commitment

- Not guaranteed to be hired by H& R Block

- Required to sign an agreement that you will not work for a competitor after taking the class

- If you work at H& R Block:

- Pays minimum wage for the first year

- In subsequent years, can take tests to increase certification level, which increases commissions. Total compensation is the greater of hourly pay or commissions. Excluding people who have worked there for 10+ years, many people I spoke with had compensation very close to their hourly pay rate.

- Unpaid 18 hours continuing education requirement each year $35 Annual Fee to access H& R Blocks continuing education classes

For all of those reasons, I wouldnt recommend the course if:

Read Also: How Much Can You Get Back In Taxes

Advantages Of Online Tax Preparation

Those who prefer to do their own taxes are in the minority, but itâs a sizable minority â about 40%. Many prefer to do taxes themselves because itâs faster, cheaper, and private. The advantages to online tax preparation are:

- Affordability

You can prepare and file your taxes for free or at very low cost with many highly rated, online subscription services or downloadable software products.

- Speed

Eight in 10 taxpayers get their tax refunds faster by opting to e-file and have their refunds directly deposited into their bank accounts, according to the IRS.

In addition, you donât have to gather up your documents, make an appointment, drive to an office, go through an interview, and then return to the office to review and pay for your return. You just download your software, complete your return, and file online.

- Privacy

Most online services allow you to complete the forms directly or work through an interview format, answering questions and allowing the program to populate the return. So you donât have to talk to a human about your money if you donât want to.

Also Check: Prontotaxclass

What Is The H& r Block Fee Structure

If youre using H& R Blocks service to file with a professional, whether thats with their drop-off service or online, then youre looking at a couple of different payment options, including just allowing H& R Block to deduct its fee from your refund. H& R Blocks fees comply with those stipulated by the government: 15% on the first $300 and 5% on the rest.

In addition to filing options, H& R Block also offers a prepaid debit card called the Advantage Prepaid Mastercard. You can use this card as a destination for your tax refund, and then use the card like you would any other debit card. You can also reload it with further funds if or once your refund runs out. Note: Withdrawals are free at DCBank ATMs.

How Much Does H& r Block Cost To Amend A Tax Return

Form 5498 is an IRA contribution tax form used to report your deductible contributions. HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

Best Tax Software For 2020 Turbotax H R Block Taxslayer And More Bestgamingpro

You May Like: Efstatus.taxact.com

Average Tax Preparation Fees

According to aNational Society of Accountants survey, in 2020 on average you would have paid $323 if you itemize your deductions on your tax return. Before you gulp, you can take some comfort in knowing that this generally includes both your state and federal returns. The average fee dropped to $220 if you didn’t itemize, which tells you something about how complicated and time-consuming the process of itemizing your deductions can be.

Be prepared to pay more if you show up for your appointment with receipts stuffed haphazardly in a cardboard box, or if you’re missing one or more important tax documents like that Form 1099 you received for interest income you earned during the year.

Everything You Need To Grow Your Money

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

Recommended Reading: How To File Uber Taxes On Taxact