Taxable Income Is What Matters

Tax brackets apply only to your taxable incomethat is, your total income minus all your adjustments and deductions.

For example, in 2020, let’s say a married couple files jointly with a combined total income of $80,400. They take the 2020 standard deduction amount of $24,800 and each spouse takes a $5,500 IRA deduction.

- $5,500 + $5,500 + $24,800 = $35,800 deductions

- $80,800 total income – $35,800 deductions = $45,000 taxable income

These deductions could reduce their taxable income by $35,800 and help drop the family into a lower tax bracket.

When Should You Claim Your Rrsp Contributions

One of the great things about contributions to the Registered Retirement Savings Plan is you dont actually have to claim them the year you make them. This means you can put $5,000 in your RRSP right now, but not claim the contribution until 2021 or 2025 or another year in the future!

Why would you want to make RRSP contributions but not claim them? The answer is simple: because you have the money to contribute right now, but you can get a greater tax benefit in the future when your income is higher.

The best part? Your contributions grow tax-deferred inside the RRSP while they wait to be claimed in a future tax year!

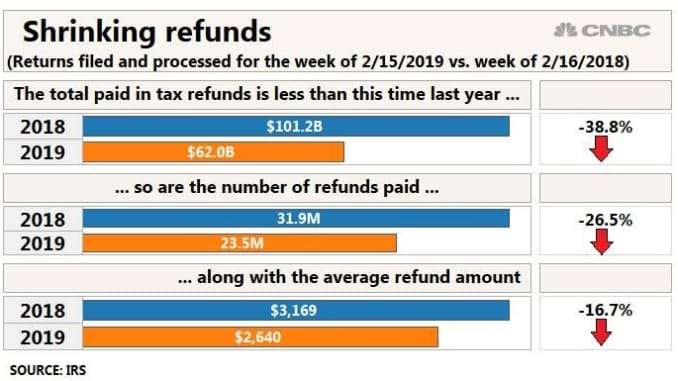

Lower Tax Refunds Can Be A Good Thing

Its nice to see a tax refund show up in your bank account, especially if its a sizable one. But a big refund means you are giving the IRS more money during the year than you have to. And when the IRS sends you a refund, it doesnt come with interest.

On the other hand, if you owe the IRS at tax time, it means youre not having enough taxes withheld from your pay throughout the year. While it may be nice to have the extra money every pay period, youll have to write a check to the IRS after paying employment taxes all year.

Ideally, you want your tax bill to come out to $0, or very close to it. If youre paying the IRS too little or too much throughout the year, adjust your W-4. Use the IRS tax withholding estimator to figure out how many exemptions to claim.

Read Also: How Much Will A Roth Ira Reduce My Taxes

Withholding Tax And Low

Every Canadian taxpayer receives a basic personal income tax credit. In 2018, the amount is $11,809, meaning that you wont pay any federal tax on an income below that amount. Since the RRSP withholding tax is refundable on your tax return, like any other tax paid throughout the year, those with low income can get the withholding tax back.

If you make an RRSP withdrawal during a year when your annual income happens to be very low, you could receive up to the full amount of withholding tax back in the form of an income tax refund.

This might apply if you are a stay-at-home parent not earning income, you suffer a job loss, or are away from work for an extended period, say a personal or maternity leave.

If an RRSP withdrawal is necessary, a year in which youre earning little to no income may provide the best opportunity to do so. As they say, timing is everything.

Calculating Medical Expense Deduction Savings

To figure how much youll save from the amount that you deduct on your taxes for your medical expenses, multiply the amount of your medical expenses deduction by your marginal tax rate. Your marginal tax rate is the tax rate you pay on your last dollar of income. For example, if you can claim a $2,000 deduction for medical expenses, and you fall in the 22 percent tax bracket, you will save an additional $440 on your income tax return.

Read Also: How To Buy Tax Lien Certificates In California

Do Advance Payments Count As Income Do I Need To Report It On My Tax Return

No. Advance payments are not income and do not need to be reported as income on your tax return. These payments are early payments of your 2021 Child Tax Credit, which you would normally claim as part of your tax refund when you file your tax return. Even though the advance payments dont need to be reported on your tax return, in January 2022, the IRS will send you Letter 6419 that tells you the total amount of advance payments sent to you in 2021. Please keep this letter for your tax records. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC.

What If I Didnt File A 2019 Or 2020 Tax Return And I Didnt Use The 2020 Irs Non

If you arent normally required to file taxes, use the new IRS Non-filer Portal. This tool allows you to sign up for the CTC advance payments and claim any missed stimulus checks. You will be asked to provide your information, including the number and ages of your qualifying children.

If you have a filing requirement or are eligible for other tax credits, you will need to file a 2020 tax return to get the CTC advance payments.

You May Like: Turbo Tax 1099q

How To Maximize Your Tax Refund

Many taxpayers deliberately have more tax withheld from their paychecks than is necessary in order to get a large refund each spring. However, overpaying on your taxes as a small-business owner reduces the working capital needed to run your business day-to-day. There are better ways to ensure you get a nice refund each spring. Here are a few suggestions:

Save For Retirement While Reducing Your Taxable Net Income

By contributing to your Registered Retirement Savings Plans , you are taking a step toward financial stability in your future. Who doesnt want to have a comfortable lifestyle once theyve left the workforce?

- Investing in RRSPs is an excellent way to plan for your retirement years.

- An RRSP is a retirement savings plan that is registered with CRA, and to which you or your spouse or common-law partner contribute.

- RRSPs can be self-directed plans or group plans.

Read Also: Protesting Property Taxes In Harris County

Deduct Child Care Expenses

Childcare has quickly become one of the largest household expenses for young families. Thankfully, the CRA allows you to claim these expenses as a tax deduction on your tax return.

In most cases, childcare expenses must be claimed by the parent with the lower net income.

Basic limit for childcare expenses

- Eligible children born in 2012 or later = $8,000

- Number of eligible children born in 2002 to 2011 = $5,000

Pro tip: In addition to the usual fees from daycares or in-home providers, most overnight camps and summer day camps are also eligible for the childcare deduction.

Tax Rates And Brackets

| Tax rate |

|---|

| $311,026 and more |

Federal income tax is progressive, so your taxable income can fall into more than one tax bracket. The highest tax bracket that applies to your income determines your marginal tax rate. For each tax bracket and filing status, calculating federal tax means applying the tax rate for that bracket to the portion of your taxable income that falls within the bracket thresholds, plus any additional amount of tax associated with that bracket.

Heres an example of how federal income tax calculation works.

If youre a single filer with taxable income of $9,000, your marginal tax rate is the lowest 10% because your total taxable income falls within the threshold for the lowest tax bracket.

But what if youre a single filer earning taxable income of more than $518,401? Your marginal tax rate is the highest , because $518,401 is the lowest threshold amount for that tax bracket, which is the final one your income falls into. But only the portion of your income that exceeds $518,400 will be taxed at 37%. All the lower tax brackets also apply to the portions of your income that fall within those brackets – the 10% rate applies to the first $9,875 of your taxable income, 12% to the next $30,249 and so on.

Also Check: Reverse Ein Lookup Irs

Withholding Tax On Rrsp Withdrawals: What You Need To Know

One of the benefits of an RRSP is having the flexibility to withdraw some of the money before retirement. However, even though you can withdraw money from your RRSP prior to retirement, it doesnt mean that you should. The action comes with a cost. That cost is a withholding tax.

RRSP withholding tax is the amount that the bank is required to submit to the CRA on your behalf. When you withdraw money from your RRSP, you are required to pay taxes, so the bank holds back a portion of your withdrawal and forwards it on.

Since withdrawn RRSPs are considered income in that year, the withholding tax is similar to your employer withholding a portion of your income to submit for your tax obligations.

Working Out Your Paye Take

When you pay your tax through the Pay As You Earn system, HMRC takes a bite out of your money before you even get it. The cash the taxman grabs this way goes toward your , pension contributions and any Student Loan repayments your making. What you actually take home after all that is based on your tax-free Personal Allowance.

Pretty much everyone qualifies for some kind of Personal Allowance. Your allowance shows up in your tax code and determines how much you can earn before the taxman gets his cut. For the 2020/21 tax year, for example, the standard Personal Allowance is £12,500. Anything you earn up to that threshold is tax-free.

After youve used up your Personal Allowance, you move into the basic rate Income Tax bracket. If your earnings are high enough, the top end of them might push into the higher rate, meaning even more tax comes gets taken. Looking again at the 2020/21 tax year, the tax bands look like this:

- Up to £12,500: 0%

- £12,501 to £50,000: 20%

- £50,001 to £150,000: 40%

- £150,001 or more: 45%

With your Income Tax out of the way, you’ve got National Insurance Contributions to consider. Your NICs go toward things like keeping up your State Pension eligibility, and the 2020/21 thresholds looks like this:

- Earnings under £9,500 a year: 0%

- Earnings between £9,500 and £50,000 a year: 12%

- Anything over £50,000 a year: 2%

Tax Refund Calculations

You May Like: Www.1040paytax.com

Who Is Eligible For Income Tax Refund

There are many cases wherein you will be eligible for a refund. Some of them are:

- If the tax youve paid in advance on the basis of self-assessment is more than the tax payable on the basis of regular assessment.

- If your TDS from salary, interest on securities or debentures, dividends, etc. is higher than the tax payable on the basis of regular assessment.

- If the tax charged, based on regular assessments, gets reduced because an error in the assessment process was resolved.

- The same income is taxed in a foreign country and in India as well.

- If you have investments which offer tax benefits and deductions that you have not declared.

- If you find, after considering the taxes youve paid and the deductions you are allowed, that the tax paid amount is in the negative.

Ato’s Tax Help Program

If you earn $60,000 or less you may be eligible for the ATO’s Tax Help program. Tax Help is a free and confidential service that runs from July to October each year. The ATO’s trained volunteers help people lodge their tax returns online, by phone or in person from Tax Help centres located around Australia.

If you are not eligible for Tax Help, the National Tax Clinic program may be able to help you instead.

You can also ask general questions about tax through the ATO Community.

See Tax time essentials on the ATO website for information about preparing your annual return.

Read Also: 1040paytax.com Safe

Child Tax Credit Payments End This Month But You Could Still Get An Extra $1800 Per Kid

After the last advance payment this December, more money awaits you in 2022. Here’s what you need to know.

In just under two weeks, the final advance child tax credit check will be disbursed to millions of families. And if you’ve received all the payments since July, the December check will be the last you’ll get until you file your tax return in 2022. Your last payment should arrive on Dec. 15 if you’re enrolled in direct deposit — otherwise, expect your check to arrive in the mail by the end of the month.

Now that the advance payments are coming to an end, you’re likely wondering what comes next. We’ll explain the latest on whether the government plans to extend the enhanced child tax credit payments beyond 2022. We’ll also tell you what to expect when you file your taxes next year. This story will be updated regularly.

Should You Rush Out And Start Spending

The higher your taxable income, the more the ATO will shelter the cost. But for those with lower taxable incomes, you should only ever spend what you need to regardless of what portion of that spend is tax deductible.

Your tax-paying entity or company will also have an impact on your tax saving.

For example, a company with turnover less than $50 million is taxed at 26 cents in the dollar , while a self-managed superannuation fund is generally taxed at 15 cents in the dollar assuming it is in accumulation phase.

So, a dollar spent on a tax-deductible expense in a company or SMSF will cost the company 74 cents after tax and the SMSF a significant 85 cents after tax.

Which begs the question why negative gearing into property in an SMSF is considered so attractive when you realise that, for every dollar lost after rental income, the tax man only pays 15 cents?

The SMSF funds every dollar lost to the tune of 85 cents. The investment had better be a good one, if its to recover the after-tax losses over the period of ownership and still provide the SMSF with a solid capital gain.

Dont forget there are other tax concessions available that will impact your decision on whether you incur a cost or not.

Obtaining a tax deduction in June 2021 will mean that you will receive the tax credit for that cost in your 2021 income tax return, and you will receive the refund for the expense when you lodge your 2021 tax return.

You May Like: Buying Tax Liens In California

Review Personal Bank And Credit Card Statements

Although you should never mix business and personal finances, you may have used your personal bank account or credit card to make a business-related purchase throughout the year. Review your personal bank and credit card statements for business expenses you may have otherwise missed. Your business accountant should know how to record these expenses in your books so that they can be reflected on your tax return as a business expense.

State And Local Exemptions

State, county and municipal governments also provide tax exemptions to businesses to stimulate the local economy. For example, a business may be exempt from paying local property taxes if it moves its operations to a particular geographic area. In Massachusetts, the state provides many telecommunication companies that provide cable television, Internet access and public broadcasts of radio and television an exemption from sales tax. Many cities and states also offer sales tax holidays where consumers can purchase goods without paying state or local sales taxes.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

You May Like: How Can I Make Payments For My Taxes

What You Need To Know About The New Additional Dependent Credit

The TCJA also brought in the Additional Dependent Credit, which is worth $500 and isnt refundable. This is aimed at taxpayers who have other dependents, such as aging parents and grandparents.

You can claim this credit if you provide at least half of the financial support of anyone who lives in your home for the entire year.

The dependent in question cant earn more than $4,150, according to 2018 tax standards.

The Additional Dependent Credit also applies to dependent children who are 17 or over at the end of the tax year.

Like with most credits, the dependent needs to be a US citizen, national, or resident alien to qualify. You can calculate the Additional Dependent Credit along with the Child Tax Credit using the online tax credit calculator.

The phaseout limits are the same as stated above for the Child Tax Credit.

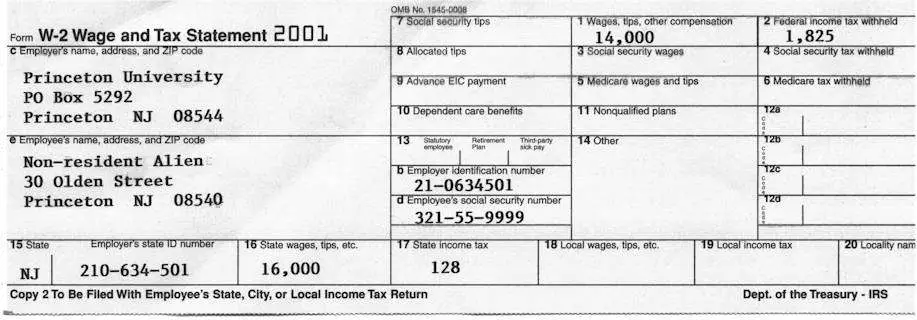

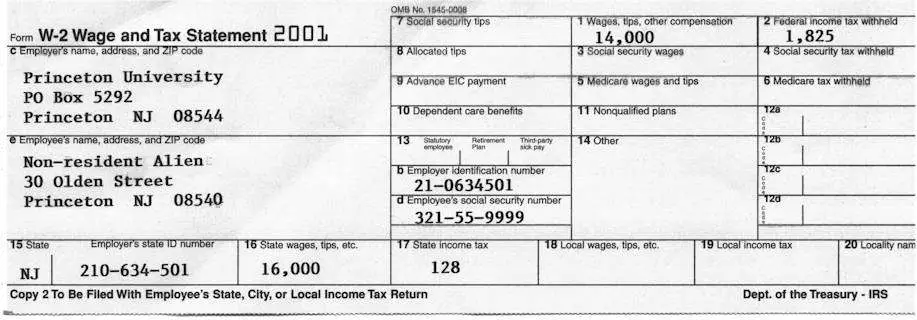

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

Read Also: Efstatus Taxactcom

Three Easy Ways To Get A Bigger Tax Refund

When you do your tax return each year, do you get the full tax refund youre entitled to? Are you looking for a bigger tax refund, but dont know where to start and dont want to get in trouble with the ATO?

In Australia, millions of people miss legitimate tax deductions. That means people dont get the tax refund they deserve. Is that you?

Australias complicated taxation system includes lots of rules about what you can and cant claim. Getting tax deductions right isnt simple, but there are ways to get help and get it right.

Here are some easy ways you can get more dollars in your pocket at tax time.