Additional Tax Benefits For Businesses And Farms

For businesses, the tax benefits extend beyond the 26% Federal Tax Credit. In the recent Tax Cut and Jobs Act, the law changed to allow 100% bonus depreciation for commercial solar systems. This allows the entire cost basis of a solar system to be depreciated in the year it was placed into service.

For example, if you invest $92,000 in a solar system, your business could receive $48,000 or more of that investment back in year one, depending on your tax bracket. Other equipment investments in this same scenario would cost you $192,000 to match the tax benefits that come with a solar investment. That means you will spend nearly 110% more on most comparable equipment investments in order to receive the same tax benefits.

How Other Solar Incentives Affect How Much You Can Get Back

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other financial incentives may impact your federal tax credit. Here’s what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credits you get for your residential solar system will not decrease federal tax credits. With that said, getting a state tax credit means the taxable income you report on your federal returns will be higher, as you now have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income, but will not reduce your tax credit.

Solar Tax Credit Eligibility

You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1, 2006 and December 31, 2023. Unless Congress renews the ITC, it expires in 2024.

Other requirements include:

- You must own the system outright

- The system must be located in the United States

- The system must be located at your primary or secondary U.S. residence or for an off-site community solar project

Read Also: Appeal Property Tax Cook County

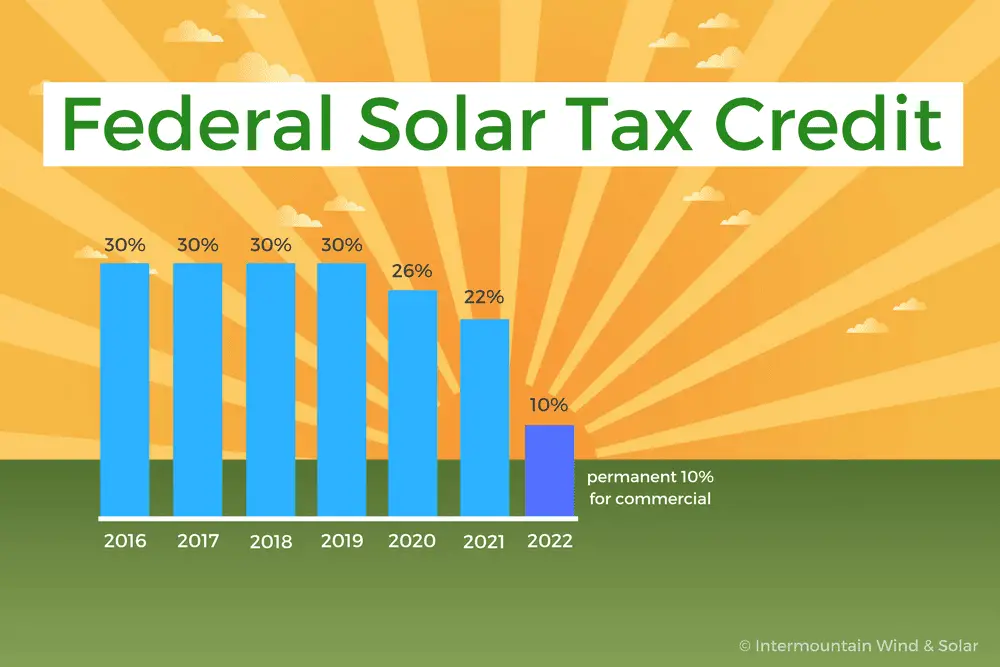

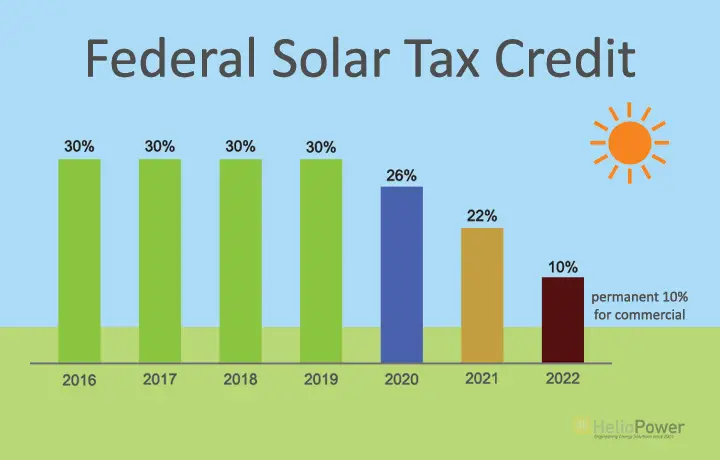

Why Install Before 2022

- 2019: 30% Both commercial and residential customers can claim 30% of their installation costs as a federal tax credit.

- 2020: 26% Both commercial and residential customers can claim 26% of their installation costs as a federal tax credit.

- 2021: 22% Both commercial and residential customers can claim 22% of their installation costs as a federal tax credit.

- 2022: 0% can be claimed by residential customers 10% of installation costs will be available for commercial installs

How Does The Federal Solar Tax Credit Work Get Solar Asap

In 2005, United States lawmakers passed the Energy Policy Act, which grants a tax credit to homeowners and businesses that purchased solar power systems. For many, the Investment Tax Credit is a huge motivator for going solar. With utility companies raising electricity ratesand shifting customers to time-of-use pricingits easy to see why many are switching to solar energy, a more affordable way to power homes and businesses.

While the ITC is great news for those looking to install solar now, things will look different in just a few years when the ITC is phased out and the up-front cost of installing solar goes up.

Also Check: How To Correct State Tax Return

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

What Are The Itc Deadlines For Commercial Solar Energy Systems

The amount of credit your organization may be eligible for is generally equal to a percentage of the solar energy systems cost:

- 30% credit for solar projects that began construction before 2020 and are placed in service before 2026

- 26% credit for solar projects that begin construction in 2020, 2021, or 2022 and are placed in service before 2026

- 22% credit for solar projects that begin construction in 2023 and are placed in service before 2026

- 10% credit for solar projects that begin construction after 2023 or which begin construction earlier but are not placed in service before 2026

Please keep in mind that a solar energy system is generally considered as placed in service once:

Also, the start of construction is established by either:

- Beginning physical work of a significant nature on the project or

- Incurring at least 5% of the solar energy systems total qualified cost

However, to address delays related to the COVID-19 pandemic, the IRS extended the four-year period to six years for projects that started construction in 2016-2019 and five years for projects that started construction in 2020.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

The Tax Credit Percentage

The credit amount that you receive for solar installation wont always be the same especially as solar energy becomes the norm. At the moment, homeowners are receiving an incentive for their efforts to conserve energy.

But as the years go by, the tax credit will decrease. The 26% credit is expected to only last until the end of 2022. And by 2023, the credit amount will decline to 22%, and its expected to completely expire in 2024. However, you never know what changes could occur to extend the tax credit.

Recommended Reading: How To Buy Tax Lien Properties In California

Solar Tax Credit For : What You Need To Know

When the solar tax credit was passed in 2005, it was initially set to expire within two years by the end of 2007. The program had enjoyed a considerable measure of success, though, so lawmakers granted a series of extensions that promised to keep the program alive until the end of 2016.

As it turns out, they were right: The U.S. solar industry has grown by more than 8,600% since the ITC emerged in 2006.

When lawmakers passed the 2016 federal spending bill, they took the existing solar tax credit and extended it for five years to 2021. This effort made solar power more affordable for Americans who wanted to install residential or commercial systems.

Solar Tax Credit Extension

The ITC has since been revisited several times, most recently in December of 2020, when Congress extended the ITC at the rate of26% through the end of 2022. It was originally set to decrease to 22% in 2021.

Under the most recent extension, rates will decrease to 22% in 2023. In 2024, benefits will end for residential properties, and drop to 10% for commercial properties.

If youre interested in reading the solar tax credit extension bill in its entirety, you can find it here. You can also view updated information regarding the current status of the ITC in the Database of State Incentives for Renewables and Efficiency.

Its also important to note that the ITC reflects the date when your system goes into service, not when you purchase it.

How Do I Submit An Application For The Solar Tax Credit

Solar tax credits are available if you purchase a solar energy system for your business or residence. When you file your annual federal income tax return, you can claim the solar tax credit.

Notify your accountant if you installed solar panels within the last year. If you are self-employed, you will simply utilize tax form 5695.

IS THE SOLAR TAX CREDIT SUBJECT TO AN INCOME LIMIT?

If youre concerned about income restrictions, there is no upper income limit for ITC eligibility. However, you must have a sufficient tax liability charge to obtain the full credit.

IS THE FEDERAL SOLAR TAX CREDIT TRANSFERABLE?

If you do not have enough tax liabilities to claim the entire solar tax credit in a given year, any residual credits will transfer over to subsequent years as long as the tax credit remains in place.

IS THE TAX CREDIT FOR SOLAR ENERGY REFUNDABLE?

The ITC is not refundable. However, under Internal Revenue Code Section 48, the credit may be carried back one year or carried forward for the next 20 years.

Therefore, if you do not have a tax liability this year but did last year, you can still claim your credit or if you do not have a tax liability this year but will in the next two decades, you can still claim your credit.

Read Also: How Much Does H& r Block Charge To Do Taxes

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2020 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to tax year 2021.

- If you failed to claim the credit in a previous year, you can file an amended return.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premieris designed for you. Increase your tax knowledge and understanding all while doing your taxes.

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of this year.

- Your system must be installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must either be brand new or have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment.

Recommended Reading: Is Plasma Donation Taxable Income

Solar Panel Tax Credit Faqs

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg as 2022 is the last year to claim the 26% solar federal tax credit. The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

|

Year |

Have more questions about the federal solar tax credit? Check out our TOP 10 FREQUENTLY ASKED QUESTIONS ABOUT THE FEDERAL SOLAR TAX CREDIT blog for additional information!

MORE QUESTIONS

Internal Revenue Service, located at 1111 Constitution Avenue, N.W., Washington, DC 20224, and phone at 829-1040.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts at Sunpro Solar today!

How Is The Solar Itc Calculated

The solar ITC is generally calculated by multiplying the applicable ITC percent by the cost of your organizations solar energy system, including equipment such as:

- Solar PV panels, inverters, racking and balance-of-system equipment

- Step-up transformers, circuit breakers and surge arrestors

- Storage devices

Use the calculator above to estimate your hypothetical solar ITC amount.

You May Like: How To Get Tax Preparer License

How Does The Solar Tax Credit Work

Like all tax credits, the solar tax credit provides a dollar-for-dollar reduction in the amount of income taxes you would otherwise pay. For example, if you claim a $5,000 federal tax credit, you reduce your federal income taxes due by $5,000.

Heres a real-world example: if you spend $20,000 on your solar panel systems installation, then you could be eligible for a credit of 26%, or $5,200. Since the credit applies to your total tax liability, youd subtract that $5,200 from whatever you owed at the end of the year and pay the remainder.

Everything You Need To Know About The Solar Tax Credit

The Federal Investment Tax Credit, also known as the Solar Tax Credit, is a tax credit that allows you to deduct up to 26% of the cost of your solar energy system from your federal taxes. By helping to offset the cost of purchasing residential solar, the tax credit is designed to get more homeowners to install solar, stimulate investment in the solar industry, and accelerate the pace of solar investment and innovation.

You May Like: Have My Taxes Been Accepted

Energy Storage And The Federal Solar Tax Credit

The primary requirement is that you own your home solar system. When homeowners add a home battery, it must be charged at your home by an on-site renewable energy system like solar . This is necessary for the home battery to be considered renewable, and for its cost to be eligible for the tax credit.

So, for your battery cost to be included in the tax credit, you must show that its only charged by renewable energy. To earn the tax credit for your battery cost, Sunruns solar guides can easily help you document how your home battery is charged solar.

Interested In Installing Solar Technology

EnergyLink is the expert in energy project financing along with designing and building. Our team knows how to get the best financial setup for your organization by taking advantage of financial incentives like the solar tax credit and handling the tedious parts that bring your energy project to life. With the value of the solar tax credit decreasing in 2023, now is the perfect time to get started on a solar project. If you are interested in installing solar technology click the link below to learn more or speak to a team member at 218-0830.

Recommended Reading: Turbo Tax 1099q

Form 5695 Line 14 Worksheet Reducing The Credit

Line 14 is where it gets tricky. The thing about the solar tax credit is it isnt fully refundable, meaning you can only take a credit for what you would have owed in taxes. This is different from other, fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit.

Thats why you use the worksheet below. You enter the total tax you owe before credits in line 1 of the worksheet, and the amounts of any fully refundable credits on the lines within step 2, adding them all on the final line.

Then, subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. This is the total amount you can claim for the solar tax credit.

Heres what the line 14 worksheet looks like for Mr. Exampleson, who has an initial tax liability of $3,820 this year, and can claim no other tax credits:

Because Mr. Exampleson only owes $3,820 in taxes this year, thats all the credit he can take now. He enters that number on lines 14 and 15 of Form 5695, and then enters $210, which is the difference between his total credit and the credit he can take this year , onto line 16.

Finally, he enters the amount from line 15 on Form 5695 into the box on line 5 of Schedule 3.

Thats it! Mr Exampleson owes $0 taxes this year, and will get a further credit of $210 on his 2021 tax return. He may also qualify for refundable tax credits on the second part of Schedule 3.

Now, check out the tax credit FAQ below.