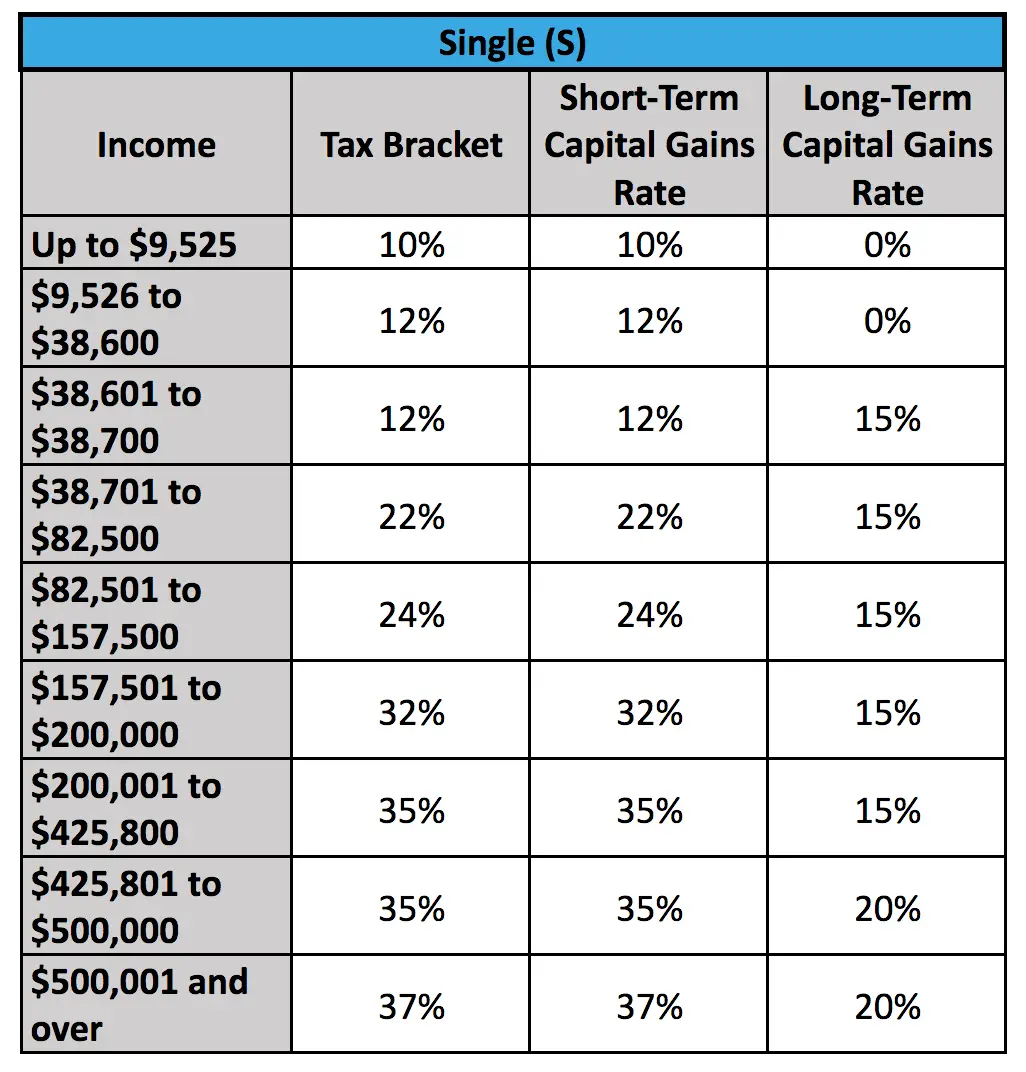

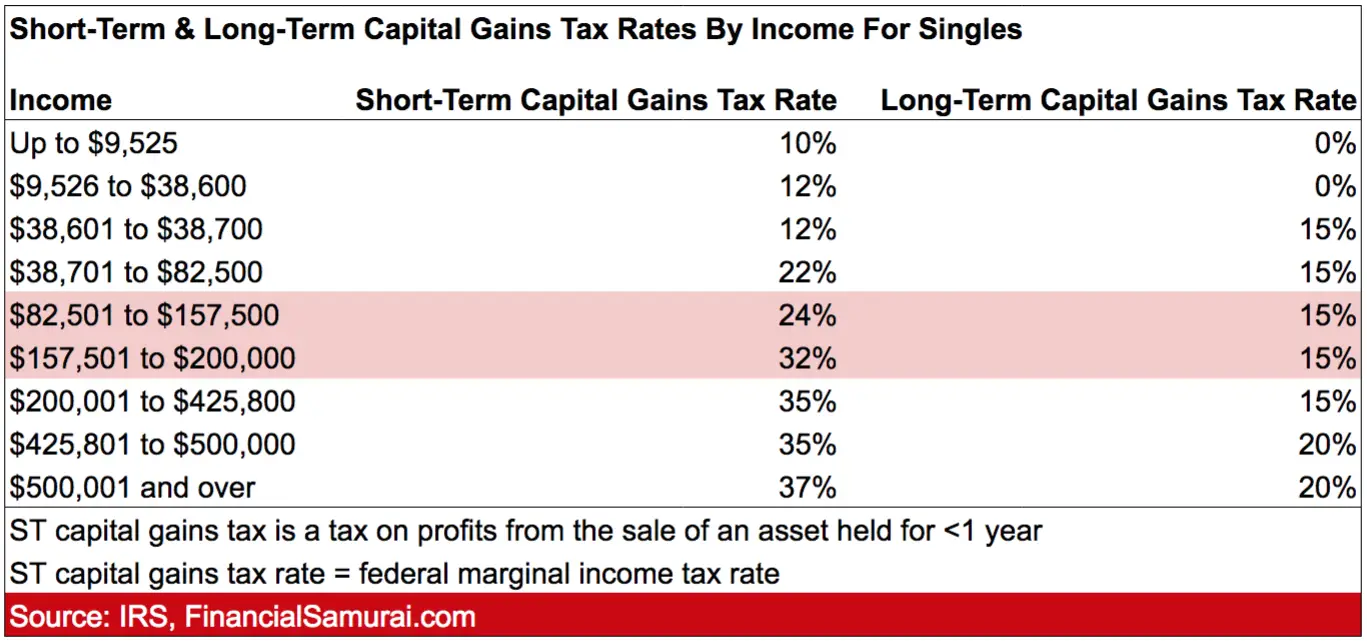

Federal Capital Gains Tax Rates

The tables below show marginal tax rates. This means that different portions of your taxable income may be taxed at different rates.

For example, a single filer who made $10,000 would pay 10% income tax on their first $9,950 and 12% on the remaining $50. That’s a total of $1,001 in tax and an overall tax rate of 10.01%.

Allowable Business Investment Loss

If you had a business investment loss in 2020, you can deduct 1/2 of the loss from income. The amount of the loss you can deduct from your income is called your allowable business investment loss . Complete Chart 6 to determine your ABIL and, if applicable, your business investment loss reduction. Claim the deduction for the ABIL on line 21700 of your income tax and benefit return. Enter the gross business investment loss on line 21699 of your return.

What is a business investment loss?

A business investment loss results from the actual or deemed disposition of certain capital properties. It can happen when you dispose of one of the following to a person you deal with at arm’s length:

- a share of a small business corporation

- a debt owed to you by a small business corporation

For business investment loss purposes, a small business corporation includes a corporation that was a small business corporation at any time during the 12 months before the disposition.

You may also have such a loss if you are deemed to have disposed of, for nil proceeds of disposition, a debt or a share of a small business corporation under any of the following circumstances:

What happens when you incur an ABIL?

You could have carried a non-capital loss arising in tax years ending after March 22, 2004 through December 31, 2005, back 3 years and forward 10 years.

Note

Any ABIL that you claim for 2020 will reduce the capital gains deduction you can claim in 2020 and in future years.

Which Tax Rate Applies To Your Long

The federal income tax rate that applies to gains from the sale of stocks, mutual funds or other capital assets depends on how long you held the asset and your taxable income. Gains from the sale of capital assets that you held for at least one year, which are considered long-term capital gains, are taxed at either a 0%, 15% or 20% rate.

However, which one of those long-term capital gains rates 0%, 15% or 20% applies to you depends on your taxable income. The higher your income, the higher the rate. If you’re working on your 2021 tax return, here are the capital gains taxable income thresholds for the 2021 tax year:

You May Like: Doordash How Much To Save For Taxes

Investment Tax Planning Strategies

Two Things To Keep An Eye Out For

Following is a table of the income levels that might potentially expose investors to this additional tax.

- $200,000 for a single person or as the head of a household.

- $250,000 if you are marital and jointly file

- $125,000 if youre separated and married.

Read Also: How Do I Get My Pin For My Taxes

Exemption On Capital Gains

Example:Manya bought a house in July 2004 for Rs 50 lakh, and the full value of consideration received in FY 2016-17 is Rs 1.8 crore. Since this property has been held for over 3 years, this would be a long-term capital asset. The cost price is adjusted for inflation and indexed cost of acquisition is taken.

Using the indexed cost of acquisition formula, the adjusted cost of the house is Rs 1.17 crore. The net capital gain is Rs 63, 00,000. Long-term capital gains are taxed at 20%. For a net capital gain of Rs 63, 00,000, the total tax outgo will be Rs 12,97,800.

This is a significant amount of money to be paid out in taxes. This can be lowered by taking benefit of exemptions provided by the Income Tax Act on capital gains when profit from the sale is reinvested into buying another asset.

What Is The Dividend Tax Rate

The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. The tax rate on nonqualified dividends is the same as your regular income tax bracket. In both cases, people in higher tax brackets pay a higher dividend tax rate.

» MORE:See which tax bracket you’re in

Read Also: Efstatus Taxactcom

How Much Is Capital Gains Tax On The Sale Of A Home

When selling your primary home, you can make up to $250,000 in profit or double that if you are married, and you wont owe anything for capital gains. The only time you will have to pay capital gains tax on a home sale is if you are over the limit.

Many sellers are surprised that this is true, especially if they live in their homes for years. This is because, before 1997, the only way you could avoid paying taxes on the profits from a home sale was to use it to purchase an even more expensive house within two years.

Taxpayers over 55 had other options. They could take a once-in-a-lifetime tax exemption of up to $125,000 in profits. This required Form 2119 to be filed too.

Thankfully, in 1997, the Taxpayers Relief Act was introduced, and millions of residential taxpayers had the burden lifted. The lifetime option was replaced with the current sale of home exclusion amounts. This change makes it easier for homeowners to sell their current residence if they want to.

Convert Rental Property To Primary Residence

The IRS grants better tax benefits to those who sell a primary residence than investors who sell rental properties. Its becoming commonplace for rental property owners to convert their investments into primary residences before carrying out the subject propertys sale. That way, theyll be able to offset some of the capital gains taxes levied in their direction.

To make the deduction, homeowners must meet specific criteria set forth by the IRS. Namely, they must have owned the home for at least five years. Additionally, the homeowner must have lived in the subject property for two of the five years leading up to the sale. Thats an important distinction to make, as the amount of time the investor lives in the home will help determine the amount allowed to be deducted.

Recommended Reading: How To Keep Track Of Taxes For Doordash

Calculate Long Term Capital Gains

The procedure to calculate long term Capital Gains is mentioned below:

- First, the individual must consider the full value of the asset.

- Next, the individual must make the below-mentioned deductions:

- The costs that have been incurred due to the transfer.

- The amount of money that is spent on the acquisition.

- The amount of money that is spent on improvement.

- From the number that has been calculated by following the above steps, the individual must subtract any exemptions that are provided under Section 54B, Section 54F, Section 54EC, and Section 54.

Do Home Improvements Reduce Tax On Capital Gains

You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements youve made. You can add the amount of money you spent on any home improvementssuch as replacing the roof, building a deck, replacing the flooring, or finishing a basementto the initial price of your home to give you the adjusted cost basis. The higher your adjusted cost basis, the lower your capital gain when you sell the home.

For example: if you purchased your home for $200,000 in 1990 and sold it for $550,000, but over the past three decades have spent $100,000 on home improvements. That $100,000 would be subtracted from the sales price of your home this year. Instead of owing capital gains taxes on the $350,000 profit from the sale, you would owe taxes on $250,000. In that case, youd meet the requirements for a capital gains tax exclusion and owe nothing.

Take-home lesson: Make sure to save receipts of any renovations, since they can help reduce your taxable income when you sell your home. However, keep in mind that these must be home improvements. You cant take a deduction from income for ordinary repairs and maintenance on your house.

You May Like: How Do I Pay Taxes For Doordash

Exempt Capital Gains Balance

When you filed Form T664 for your shares of, or interest in, a flow-through entity, the elected capital gain you reported created an exempt capital gains balance for that entity.

Note

Generally, your ECGB expired after 2004. If you did not use all of your ECGB by the end of 2004, you can add the unused balance to the adjusted cost base of your shares of, or interest in, the flow-through entity.

For 2004 and previous tax years, if you received property from a trust in satisfaction of all or a part of your interest in the trust , you could elect to use the ECGB for the entity to increase the cost of property you received from the trust. For 2005 and future years, the election is no longer necessary because any unused ECGB can only be added to the cost of your interest in the flow-through entity.

Example

Andrew filed Form T664 for his 800 units in a mutual fund trust with his 1994 income tax and benefit return. He designated the fair market value of the units at the end of February 22, 1994, as his proceeds of disposition. Andrew claimed capital gains reductions of $500 in 1997 and $600 in 1998. At the end of 2003, his exempt capital gains balance was $2,250. In 2004, he had a $935 capital gain from the sale of 300 units. This left him with an unused balance of $1,315 at the end of 2004. In 2005 and future years, he can only add the unused ECGB to the cost of any remaining units:

1. ECGB carryforward to 2004

6. Unused ECGB at the end of 2004

6

Capital Gains Inclusion Rate

Thecapital gains inclusion rateof 50% determines how much of your total capital gains that will be subject to tax. Investments in registered plans such as aRegistered Retirement Savings Plan , Registered Retirement Plan , or Tax-Free Savings Account are considered tax-sheltered and capital gains tax will not be charged on investments while they are held in these accounts. The disadvantage with a registered investment account is that you will also not be able to carry forward any capital losses. For more information on registered and non registered investment accounts, seeCapital Gains on Investment Accounts.

Read Also: Do I Have To File Taxes For Doordash If I Made Less Than $600

Do Trust Beneficiaries Pay Tax On Capital Gains

A tax deduction is made for income that is distributed to beneficiaries. Capital gains from this amount may be taxable to either the trust or the beneficiary. All the amounts distributed to and for the benefit of the beneficiary are taxable to them to the extent of the distribution deduction of the trust.

Chapter 2 Completing Schedule 3

This chapter gives you information about how and where you should report some of the more common capital transactions on Schedule 3, Capital Gains in 2020. Schedule 3 is included in the Income Tax Package.

Schedule 3 has five numbered columns and is divided into several sections for reporting the disposition of different types of properties. Report each disposition in the appropriate section and make sure you provide the information requested in all columns. Complete the bottom portion of the schedule to determine your taxable capital gain or your net capital loss. If you have a taxable capital gain, transfer the amount to line 12700 of your income tax and benefit return. If you have a net capital loss, see Chapter 5 for information on how you can apply the loss.

Don’t Miss: Do Tax Preparers Have To Be Licensed

Publicly Traded Shares Mutual Fund Units Deferral Of Eligible Small Business Corporation Shares And Other Shares

Use this section to report a capital gain or loss when you sell shares or securities that are not described in any other section of Schedule 3. These include:

- units in a mutual fund trust

- publicly traded shares

Report dispositions of units or shares on lines 13199 and 13200 of Schedule 3.

You should also use this section if you donate any of the following properties:

- units in a mutual fund trust

- interest in a related segregated fund trust

If you donated any of these properties to a qualified donee, use Form T1170, Capital Gains on Gifts of Certain Capital Property, to calculate the capital gain to report on Schedule 3.

For more information, see Pamphlet P113, Gifts and Income Tax.

If you sold any of the shares or units listed above in 2020, you will receive a T5008 slip, Statement of Securities Transactions, or an account statement.

You may buy and sell the same type of property over a period of time. If so, you have to calculate the average cost of each property in the group at the time of each purchase to determine the adjusted cost base .

For more information, see Adjusted cost base .

If you report a capital gain from the disposition of shares or other securities for which you filed Form T664,Election to Report a Capital Gain on Property Owned at the End of February 22, 1994, see Chapter 4.

Note

If you own shares or units of a mutual fund, you may have to report the following capital gains :

Employee security options

Note

Employee security option cash-out rights

Capital Gains On Sale Of Second Home

If you own multiple homes, it may not be as easy to shelter sale profits as it was in the past.

The Housing Assistance Act of 2008 was designed to provide relief for homeowners on the edge of foreclosure, yet it could cost the owners when they decide to sell.

You used to be able to move into the second property, make it your primary residence, live there for two years, and profit from the gains.

Even when your second piece of real estate is converted into your primary home, you will be taxed on part of the gains based on how long the home was used as a second home and not the primary residence.

You May Like: Tax Lien Investing California

Saving Tax On Sale Of Agricultural Land

In some cases, capital gains made from the sale of agricultural land may be entirely exempt from income tax or it may not be taxed under the head capital gains.

a. Agricultural land in a rural area in India is not considered a capital asset and therefore any gains from its sale are not chargeable to tax. For details on what defines an agricultural land in a rural area, see above.

b. Do you hold agricultural land as stock-in-trade? If you are into buying and selling land regularly or in the course of your business, in such a case, any gains from its sale are taxable under the head Business and Profession.

c. Capital gains on compensation received for compulsory acquisition of urban agricultural land are tax exempt under Section 10 of the Income Tax Act.

If your agricultural land wasnt sold in any of these cases, you can seek exemption under Section 54B.

Capital Gains Tax Rate 2021

If you are filing your taxes as a single person, your capital gains tax rates in 2021 are as follows:

-

If your income was between $0 and $40,400: 0%

-

If your income was between $40,001 and $445,850: 15%

-

If your income was $445,850 or more: 20%

If you are filing your taxes as married, filing jointly, your capital gains tax rates are as follows:

-

If your income was between $0 and $80,800: 0%

-

If your income was between $80,801 and $501,600: 15%

-

If your income was $501,600 or more: 20%

If you are filing your taxes as the head of household, your capital gains tax rates are as follows:

-

If your income was between $0 and $54,100: 0%

-

If your income was between $54,100 and $473,750: 15%

-

If your income was $473,750 or more: 20%

Last but not least, if you are filing your taxes as married, but filing separately, then your capital gains tax rates are as follows:

-

If your income was between $0 and $40,000: 0%

-

If your income was between $40,400 and $250,800: 15%

-

If your income was $250,801 or more: 20%

Don’t Miss: Appeal Cook County Taxes