What Qualifies As Business Mileage

First things first. âCommutingâ doesn’t qualify as business miles.

Say you have an office, shop, or other location where you normally conduct your business. In that case, driving from your home to that location is considered commuting and isn’t deductible. It’s no different than if you were a W-2 worker and commuted to an office each day.

Some freelancers have tried to think of workarounds to turn those commuting miles into actual business miles â say, by making business calls while driving.

Unfortunately, that won’t cut it with the IRS. In their eyes, the commuting rule is black and white.â

However, if your office is in your home, then any miles you drive to visit clients or customers does count as business mileage.

Hereâs a cheatsheet to help you figure out whether your miles count:

Log In Or Create An Account

Once you’ve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

The Irs2go Mobile App

You can access the Where’s My Refund? tool from your laptop or desktop computer, or you can use IRS2Go if you prefer to use your mobile device. This app is available as a free download on iTunes, Google Play, and Amazon. You can use it to:

- Check your refund status.

- Make a payment if you owe taxes.

- Get free tax guidance.

- Retrieve security codes for certain online IRS services.

The IRS issued more than 111 million tax refunds in 2019, with the average being $2,869. Overall, more than 150 million individual tax returns were processed.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Tracking Amended Tax Returns

Filing an amended tax return can be a pain. Yet, if you do have to file an amended return for any reason, the good news is you may still be able to track its status online using the Wheres My Amended Return tool. But be patient, as the IRS says an amended return can take three weeks after you mailed it to show up in their system and processing can take up to 16 weeks.

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

You May Like: Can Home Improvement Be Tax Deductible

When Will I Get The Refund

Unemployment tax refunds started landing in bank accounts in May and will run through the summer, as the IRS processes the returns.

The first phase included the simplest returns, made by single taxpayers who didn’t claim for children or any refundable tax credits.

More complicated ones may take longer to process.

In mid-July, the IRS issued 4million refunds, of which those by direct deposit landed in bank accounts from July 14.

Meanwhile, households who receive the cash refund by paper check could expect this from July 16.

Another batch of payments were then sent out at the end of July, with direct deposits on July 28 and paper checks on July 30.

The IRS didn’t announce any payouts for August and is yet to reveal the upcoming refund schedule too.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Read Also: Www.1040paytax.com Official Site

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Tracking Your Tax Refund By Phone

Recommended Reading: Turbo Tax 1099q

Can You Check Your Refund Status Online

If youâre into filing electronically, you can check your tax refund status on the gov.uk website. Youâll find a simple questionnaire designed to assess whether youâve paid too much tax. Among other things, that could be on pay from a current or previous job, pension payments, redundancy payments or a self-assessment tax return.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Can You File Missouri State Taxes Online

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

Wheres My State Tax Refund Ohio

The Department of Taxation for Ohio provides an online form to check your refund status. To see the status, you will need to enter your SSN, date of birth and the type of tax return. You also need to specify if it is an amended return.

According to the Department of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. However, paper returns will take significantly longer. You can expect processing time for a paper return to take eight to 10 weeks. If you are expecting a refund and it doesnt arrive within these time frames, you should use the check status form to make sure there arent any issues.

You May Like: How Much Does H& r Block Charge To Do Taxes

Calculate Your Crypto Gains And Losses

Every time you dispose of your cryptocurrency, youâll incur capital gains or capital losses. These disposal events include, but are not limited to:

- Selling your cryptocurrency for fiat

- Trading your cryptocurrency for another cryptocurrency

- Buying goods and services with cryptocurrency â

To calculate your gain or loss from each transaction, youâll need to track how the price of each one of your assets changed from the time you originally received them.

Hereâs a formula you can use:

Then, your capital gains and losses for your relevant cryptocurrency transactions should be reported on Form 8949.

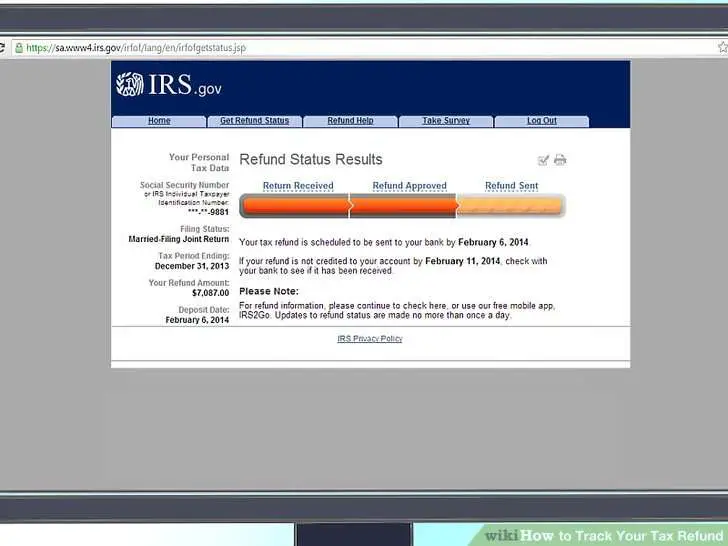

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Recommended Reading: How Can I Make Payments For My Taxes

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity. Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider. Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Also Check: Notice Of Tax Return Change Revised Balance

Tracking Your Tax Refund Online

Reducing Taxable Income With Tax Deductions

This is where your standard or itemized deductions come into play.

There’s a long list of things that you can take as deductions. To claim them, you have to make a list and write totals for each item on the list. That’s called itemizing.

What if you rent or don’t have all those expenses? The US Government decided to simplify things. They decided that there would be a minimum amount you could claim. They also simplified things. This is called the standard deduction. Instead of adding all the other stuff up, you can just say I’ll just take the easy number.

In 2017, the Tax Cuts and Jobs Act blew up the standard deduction to $12,000 for single filers and 24,000 for married . That made it so far more people are claiming the standard deduction than ever before.

Which ever method you decide to use, this is the stage where you reduce your taxable income. Either your standard deduction or your total of itemized deductions are subtracted from your total income. This gives you your taxable income.

There are a few other deductions that can be taken off. In fact, as self-employed individuals, we get a handful of special deductions. You can read more about these four special deductions for independent contractors here.

Also Check: How Much Does H& r Block Charge To Do Taxes

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

How To Track Your $600 California ‘golden State’ Stimulus Check

In February, Governor Gavin Newsom announced that qualifying Californian’s will receive a $600 Golden State stimulus check. The stimulus package was signed by Newsom on February 23, and a total of 5.7 million Californian’s will be eligible according to the governor’s office. $600 payments have started to go out to Californians on April 15th from The California Franchise Tax Board and will be received in the same way you received your tax return. For eligibility on the Golden State Stimulus click here! If eligible, the speed at which you will receive your payment depends on when you filed your taxes. The state must receive your 2020 taxes before the payment is sent and the deadline to send your taxes for the one-time payment is October 15, 2021. If your taxes were filed between January 1st and March 1st you can expect the Golden State Stimulus after April 15th. If you filed after March 2nd it can take up to 45 days to receive payment depending on the method of delivery.

The California Franchise Tax Board has a wait-time availability on their website for the Golden State Stimulus. Eligible residents can contact The California Franchise Tax Board by talking with a representative on their website or by calling 800-852-5711.

Recommended Reading: Form 1040 State Tax Refund

What Edition Of Turbotax Is Right For Me

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

You can always start your return in TurboTax Free, and if you feel the need for additional assistance, you can upgrade to any of our paid editions or get live help from an expert with our Assist & Review or Full Service. But dont worry, while using the online version of the software when you choose to upgrade, your information is instantly carried over so you can pick up right where you left off.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.