Paycheck And Salary Calculators

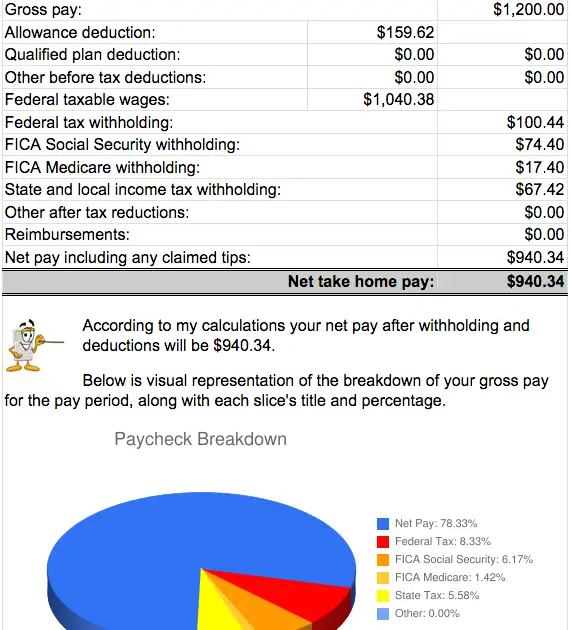

A paycheck calculator lets you know how much money will be in every check that you receive from your employer, and they are available online for free.

Salary calculators can help you determine how much you could be earning, and how much a job offer is worth and how far your paycheck will go in a specific location, based on the cost of living in that area.

If You Owe And Cant Pay

If you cant pay your tax bill by the due date, you may be able to request an installment agreement payment plan to pay it off over time. To qualify, you must:

- Not already have an account in collections with the DRS, or have an account under warrant, bankruptcy, suspense or criminal investigation

- Have filed all your returns

- Owe $10,000 or less

- Be able to pay off the full amount within 12 months

Keep in mind, though, that you may have to pay interest and late-payment penalties until the balance is paid in full.

Connecticut State Department Of Revenue Services

Filing Season – DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. Electronic filing is free, simple, secure, and accessible from the comfort of your own home. for Income tax filing information.

CT-EITC – If you filed 2020 Schedule CT-EITC, Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040, Connecticut Income Tax Return, on or before December 31, 2021, you may be eligible for the 2020 EITC Enhancement Program, for more information.

Also Check: Do I Have To File Taxes For Doordash If I Made Less Than $600

Tracking Your Connecticut Tax Refund

If youre expecting a refund, you can check the status by calling 1-860-297-5962. Or, check your refund status online by visiting the Taxpayer Service Center page and clicking on Check on the Status of Your Refund on the left-hand side of the page.

Youll need to provide your Social Security number or your spouses Social Security number if you filed jointly and their information is first on the return, along with the amount of the refund youre expecting.

To get your refund faster, the DRS recommends you file your state tax return electronically and choose direct deposit instead of getting a paper check.

How Are Pensions Taxed

Pensions are fully taxable at your ordinary tax rate if you didn’t contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

Don’t Miss: Is Donating Plasma Taxable Income

Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.

How Your Connecticut Paycheck Works

Employers in the Nutmeg State withhold federal taxes from each of their employees paychecks. The IRS applies these taxes toward your annual income taxes. Some of it also goes to FICA taxes, which pay for Medicare and Social Security. Your Form W-4 determines how much your employer withholds. You should fill out a new form every time you start a new job or make a life change, like getting married or adopting a child.

Your marital status is a key factor that affects your taxes. How much comes out of your paycheck is determined in part by whether you are single, the head of household, married filing jointly or married filing separately. Connecticut recognizes same-sex marriages for income tax purposes, so keep that in mind when filling out your W-4.

The IRS redesigned some of the Form W-4’s guidelines in recent years. The new version no longer lists allowances, but it asks you to enter dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. The new W-4 also uses a five-step process that asks filers to enter personal information, claim dependents and indicate any additional income or jobs. In most cases, these changes will affect anyone changing jobs or adjusting their withholdings in 2020 and beyond.

Recommended Reading: Look Up Employer Ein

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

What Percentage Of Tax Is Deducted From Salary In Canada

If your taxable income is in the first $45,142 of what you earn, your tax rate will be 05%. The IRS charges 15% of the amount up to $90,287 for a portion of taxable income over $45,142. With respect to portion of taxable income of up to $150,000 taxable income over $90,287 up to 16 percent. A portion of taxable income up to $200,000 faces a tax rate of 16%.

Don’t Miss: Efstatus.taxact.com.

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Recommended Reading: Reverse Tax Id Lookup

Best Free Paycheck And Salary Calculators

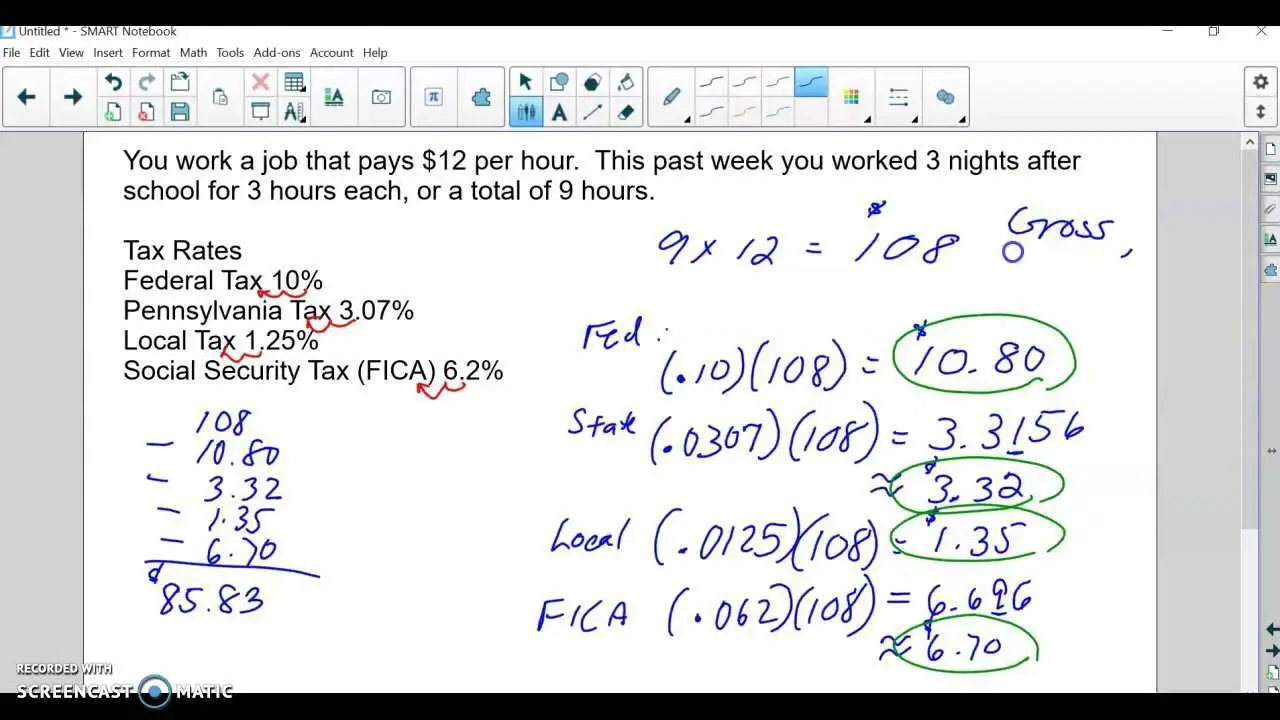

If youve ever had a job before, you know that your gross pay is significantly more than your net pay, the number you deposit in your bank account. So, how can you figure out how much money you’ll take home when you get paid? What will you net after taxes and other deductions are taken out of your paycheck?

Determining The Amount Of Taxes You Should Withhold

If you are newly retired, it can be difficult to figure out how much in taxes to withhold from your pension as your tax rate depends on your household sources of income and deductions.

When you add up all of your sources of income and subtract your deductions, you get your taxable income, which determines your tax bracket. You can use this tax bracket to estimate how much to withhold. When you look at a chart of tax rates, you can see that higher amounts of income will be taxed at higher rates.

Tax planning can help you figure out the right amount to withhold. With tax planning, you put together a “pretend” tax return, called a “tax projection.” As you transition into retirement, you might want to work with a CPA, tax professional, or retirement planner to help you with this.

If you prefer to do it yourself, you can plug numbers into an online 1040 tax calculator to get a rough estimate, or you can fill out your federal tax form as if you were filing taxes. Follow the instructions to see where each source of income goes. Calculate the tax you think you will owe. Divide that by your total income. Use the answer to see what percentage to withhold.

Also Check: Plasma Donation Earnings

What Is The Difference Between Income Tax Withholding And Payroll Tax Withholding

Both income taxes and payroll taxes are assessed on the wages you earn. These taxes are both withheld from your wages as you earn them. However, there are two very important distinctions between these two types of taxes Who pays the tax and what does the tax pay for?

Income taxes are withheld from your wages to pay for your own personal income tax liability for the year based on your total taxable income. You, as the employee, are 100% responsible for paying income taxes. Payroll taxes are often referred to as FICA, FUTA or Social Security taxes. Payroll taxes are contributions that employees AND employers are required to make to fund Federal programs for Social Security, Medicare and Unemployment insurance. Employees are required to contribute an amount equal to 6.2% of their wages to the Social Security Fund and 1.45% of their wages to the Medicare Fund. Employees pay their allocable share of payroll taxes by having it withheld from their wages and their employer then remits the contributions to the federal government on their behalf.

Employers must make a matching contribution equal to 6.2% of the employees wages to the Social Security Fund wages and 1.45% of the employees wages to the Medicare Fund. Therefore, employers and employees are both responsible for payroll taxes on employee wages.

How To File Your Connecticut State Tax

You can e-file your state tax return for free through the Taxpayer Service Center, or via paid or free tax software programs. You can also use ®, which is always free, to file both your federal and Connecticut state tax returns.

If youd prefer to file a paper return, you can and print your tax forms including Form CT-1040 from the DRS website and fill them out with a pen. Mail your CT-1040 return to:

If you expect a refund:

Department of Revenue Services

If you include a payment with your return:

Department of Revenue Services

P.O. Box 2977

Hartford, CT 06104-2977

To get free state tax preparation help from the DRS, call 1-860-297-5962 from 8:30 a.m. to 4:30 p.m. Eastern time Monday through Friday, or go in person to one of its field offices after checking what documents you need to bring. This assistance is only for Connecticut taxes, not for federal tax returns

If you still have lingering concerns, the department offers help through its Problem Resolution/Taxpayer Advocate office.

You May Like: Does Doordash Take Out Taxes For Drivers

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

What Are Federal Taxes

Federal taxes are the taxes that are withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld, however, FUTA is paid solely by employers.

For employees, there, unfortunately, isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck. The amount withheld depends on several factors. However, working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

Don’t Miss: What Is The Sales Tax In Philadelphia

What Are Some Qualifying Events

- Caring for a new child by birth, adoption or fostering.

- If you or a family member is dealing with a serious health condition.

- Those serving as an organ or bone marrow donor.

- Victims of family violence are eligible for up to 12 days of paid benefits to seek medical or psychological care, to relocate or to participate in civil or criminal proceedings.

- Caring for a family member who was injured on active duty in the armed forces.

How Much Will I Get Paid If I Take Leave

Employees earning less than or equal to the state’s minimum wage multiplied by 40 will get 95 percent of their average weekly wage. That is a maximum of $494 weekly in 2022.

Employees whose wages exceed that amount will get the $494 weekly benefit plus 60 percent of their average weekly wage up to 60 times the state’s minimum wage.

The maximum benefit in 2022 will be $780 weekly.

However, those benefit rates can be reduced if there isn’t enough revenue in the program to cover them.

There is also a wage threshold to qualify. From the state’s paid leave website:

“Covered employees in Connecticut are eligible for benefits under the PFMLA if they have earned wages of at least $2,325 in the highest quarter of the first four of the five most recently completed quarters and are currently employed, or have been employed within the last 12 weeks, or are self-employed, a sole proprietor and a Connecticut resident enrolled in the program.”Wages may include salary or hourly pay, vacation pay, holiday pay, tips, commissions, severance pay and the cash value of any “in-kind” payments.

Recommended Reading: How To Buy Tax Lien Certificates In California

Ct Tax Exemptions For Pensions Clarified

Over the past few months, you may have seen some news about the income tax exemption for Social Security, pension, and annuity incomes. I have received many questions, and wanted to clarify that the exemption stands.

Beginning on January 1, 2019, Connecticut stopped collecting income taxes on Social Security for individuals having less than $75,000 in annual income and couples having less than $100,000 in annual income. Any amount over the $75,000 or $100,000 in income will be taxed.

Beginning on January 1 of this year, Connecticut stopped collecting income taxes on 14% of pension and annuity incomes using the same income limits as above. This percentage will increase by 14% per year until 2025, when all pension and annuity income will be exempt from state income taxation for those people under the income limits. The Governor proposed repealing this exemption, but I fought for Meriden and Berlin seniors, and the exemption remains. I believe this will make a great difference for our seniors, and make Connecticut an even better state for retirees.

Also, I am happy to announce that the Governor will sign Public Act 19-49, which ensures people with autism receive transitional services at an earlier age. This was a major priority of mine as Chair of the Human Services Committee. I am looking forward to the formal bill signing event!

For more of my weekly update, .

Running Payroll In Connecticutstep

Step 1: Set up your business as an employer. At the federal level, you need your Employer Identification Number and an account in the Electronic Federal Tax Payment System .

Step 2: Register with the State of Connecticut. In Connecticut, you will need to register with the Connecticut Department of Revenue Services. To register, you will need to complete the Business Taxes Registration Application online using the Taxpayer Service Center. This will allow you to register for various taxes including withholding tax, sales and use tax, and business entity tax. If you need assistance, the Connecticut Department of Revenue Services provides a FAQ section to assist businesses.

Please Note: Beginning in September 2021, myconneCT will be the new portal website for Connecticut Department of Revenue Services.

Step 3. Set up your payroll process. Youll need to set up systems to support your payroll process this includes selecting a pay schedule and deciding how youll pay employees, how youll process taxes and deductions, etc.

Step 4: Collect employee payroll forms. The best time to collect payroll forms is during onboarding. Payroll forms include W-4, I-9, and direct deposit authorization information. Connecticut requires you to submit form CT-W4 as well.

Step 8. Document and store your payroll records. It is important to retain records for all employees for several years , including those who are no longer with your company.

Don’t Miss: Does Doordash Take Taxes Out

What Are The Canadian Tax Brackets For 2021