Is It Easy To File A Tax Extension

Yes, securing an extension is a fairly straightforward process. All you need to do is get Form 4868, fill it out, and then send it off to the IRS, either electronically or by post, before the deadline. The form itself isn’t very long, although coming up with an estimate of your total tax liability in the tax year can sometimes be tricky.

Youll Get Six Extra Months To File Your Taxes But No Extra Time To Pay Your Bill

If you need more time to file your taxes either because you had a family emergency, couldnt get your papers together in time or were just too busy you have options when it comes to filing a tax extension.

But contrary to popular belief, a tax extension doesnt give you extra time to pay your taxes: It only buys you extra time to file. Heres a step-by-step guide on how to do it.

How Do I Know My Tax Extension Request Has Been Approved

If you sent Form 4868 electronically to the IRS, you should receive an email within 24 hours confirming that it has been received. For mail applications, you wont receive an email and will most likely need to call the IRS for confirmation that your request is in the right hands.

Silence is normally a good sign. The IRS won’t contact you following the filing of a tax extension unless there is an issue with it. That doesn’t happen too often, although there are occasions when a tax extension request may be denied.

Don’t Miss: Do You Get Taxed On Plasma Donations

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify forGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Why File A Business Tax Extension

There are a lot of reasons why your business may need to file for a tax extension. The IRS understands that not everything always goes as planned, and sometimes you just need a little extra time to get it right. Some reasons you might need an extension include:

- You need more time to file your business return accurately

- Youre making contributions to a Simplified Employee Pension Plan IRA and wont have them completed by the initial tax deadline

- Some of the tax filing documents you need are missing or incorrect, and youre waiting to receive the correct documents

But filing for an extension wont help you out if you cant make your business tax payment by the deadline. The extension is only a deadline for filing your taxes, not for paying them. Youll need to pay any taxes due by the original deadline, or you will be charged interest and fees. All of which will affect your tax refund.

Recommended Reading: Doordash Taxes Percentage

Using Turbotax Easy Extension To File A Tax Extension

TurboTax EasyExtension is a simple, online tool that allows you to file a tax extension in minutes. Try it here.

Heads up – filing Form 4868 only provides you with an extension of time to file. You must still pay 100% of the tax you owe by the original filing deadline to avoid interest and late-payment penalties.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

How Do I Get A Tax Extension

First, you’ll have to request an extension by April 18 or you could face a “failure to file” penalty, the IRS said. The good news is that the extension is automatic, but you’ll still need to take the first step of filing some paperwork with the IRS.

To ask for an extension, you’ll need to fill out Form 4868. This is a one-page form that asks for basic information such as your name, address and Social Security number. It also asks you to estimate how much you owe in taxes.

This form can also be used through the IRS’ Free File service, and can be used regardless of income. Typically, only people with adjusted gross income below $73,000 can use the Free File service, but anyone can use it to ask for an extension, the IRS said.

Also Check: Does Doordash Take Taxes Out For You

We Follow Irs Rules For Extensions Of Time For Filing A Return

If you have obtained a Federal Automatic Extension, you do not need to submit an Application for Extension of Time to File. It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows.

An extension of time to file your return does NOT extend the time to pay. If tax is due, interest accrues from the original due date of the tax. If you expect to owe tax when you file your return, the best policy is to make a payment. For income taxes use an extension payment voucher.

What About State Returns

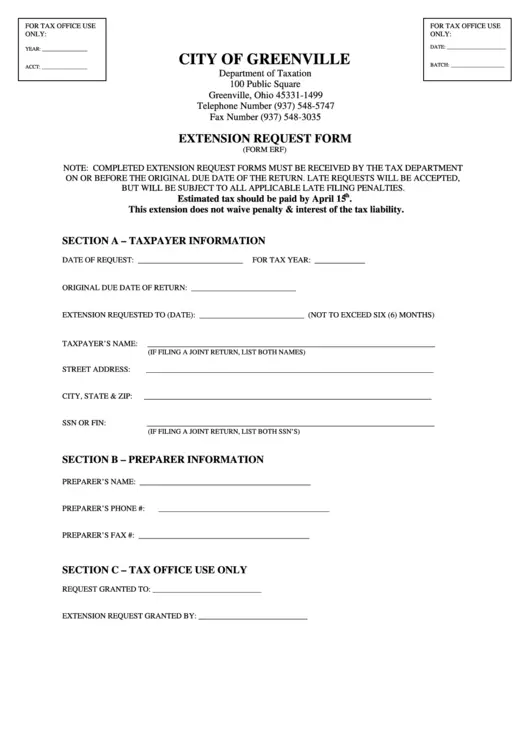

It is possible to file a tax extension for most state tax returns. But to do so, you will need to follow the specific requirements set by your state.

This will differ from one agency to the next. It is a good idea to contact your states taxing authority and to request this information.

Most of the time, you can file this request online. You may be able to print forms as well.

Mailing them in is also done according to the directions provided.

Don’t Miss: Doordash Driver Tax Calculator

Do I Have To File An Extension With My State

That depends. Once you’ve requested an extension from the feds, check if you’ll need to do so for your state. According to the IRS, “State filing and payment deadlines vary and are not always the same as the Federal filing and payment deadline.”

Some states will automatically give you an extension on your state taxes if you receive a federal extension. In other states, you’ll need to request an extension separately. The Federation of Tax Administrators offers a rundown of how to check for tax information for the state you live in.

If you live in one of the nine states without personal income tax, you’re likely in the clear. However, two of those states New Hampshire and Tennessee still tax investment income, so, if you have earnings from dividends, stock sales or other investments, you may still have to file a state tax return in those states.

How To Receive A Tax Extension

The deadline for filing and paying your 2021 income taxes is April 18, 2022. If youre worried you wont have enough time to submit your federal tax return before its due, you can request an extension from the IRS. Doing so will give you until Oct. 15, 2022 to file a return an additional six months.

Why might you need a tax extension?

Most people file their tax returns before Tax Day, but not everyone is able to meet that deadline. According to Turbo Tax, the most common reasons why people request extensions include a delay in receiving the tax documentation you need from other entities, unexpected life events or natural disasters that inhibit you from filing on time, and simply not managing their time well.

How can you request a tax extension from the IRS?

As with any procedure involving the IRS, you have to fill out and submit the proper form to receive a tax extension. In this case, its a Form 4868.

As Amanda Dixon of SmartAsset explains, Form 4868 is known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Anyone can qualify for an automatic federal tax extension. The government wont even ask why you need extra time to file.

Other special circumstances require different IRS forms to request an extension, such as a Form 7004 for certain business income taxes, a Form 2350 if youre a U.S. citizen living abroad, or a Form 4768 to pay U.S. Estate tax.

An alternate method to receive an extension

Read Also: Employer Tax Id Lookup

Is There Such A Thing As A Free Tax Extension

Yes, there is. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS’ free fillable forms, assuming they are comfortable handling their taxes. If that’s not the case, there are several tax-software companies that offer free filing under certain conditions.

Serving In A Combat Zone

The deadline for filing your tax return and paying your tax is automatically extended if you serve in a combat zone. There’s a two-step process for figuring the length of this type of tax extension. First, your deadline is extended for 180 days after the last day you’re in a combat zone, have qualifying service outside of the combat zone, or serve in a contingency operation, or the last day of any continuous hospitalization for an injury from service in the combat zone. Use whichever of these two dates is the latest.

Second, your deadline also is extended beyond 180 days by the number of days you had left to take action with the IRS when you entered the combat zone. For example, this year you have 4½ months to file your tax return. Any days left in this period when you entered the combat zone are added to the 180 days.

This tax extension isn’t just for military personnel, either. It can be claimed by merchant marines on ships under the Department of Defense’s control, Red Cross personnel, war correspondents and civilians supporting the military.

Also Check: Doordash Dasher Taxes

Brighttax Is Here To Help

Taxes can be complicated particularly when living abroad. And if you arent aware of all of the credits and deductions you may be eligible for, you could end up paying more than you owe . Bright!Tax CPA can help you file an extension, answer any of your tax questions, and help you file your return when youre ready.

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

Also Check: 1040paytax Irs

How Do I File A Tax Extension

When you seek a tax extension deadline, the rules require you to first take a few preliminary steps. The general process to request a tax deadline extension is the same whether you file taxes online or by mail. The tax extension deadline for 2021 returns is the same date as the regular tax deadline: To qualify for a federal tax extension, you must file the appropriate forms by the standard tax filing deadline of April 18, 2022.

File Form 4868 Or Pay Your Tax Electronically

There are two ways to request an automatic three-month extension: File Form 4868 or make an electronic tax payment. Either way, you need to act by the midnight deadline.

You can file Form 4868 by mail or electronically. If you mail a paper version of the form to the IRS, it must be postmarked by May 17, 2021. If you’re mailing a payment, you have to use the U.S. Postal Service to mail the form, since it must be delivered to a P.O. box . If you’re not making a payment, you can use certain private delivery services to mail the form. If you submit the form electronically either on your own computer or through a tax professional have a copy of your 2019 tax return handy, since you’ll be asked to provide information from that return to verify your identity. If you want to save a few bucks, use the IRS Free File or Free File Fillable Forms to prepare and e-file the form at no cost. Both are available on the IRS website.

The other way to get an automatic tax extension is by making an electronic tax payment by today’s midnight deadline. Simply pay all or part of your estimated income tax due using the IRS Direct Pay service , the Electronic Federal Tax Payment System, or by using a credit or debit card . You’ll also need to indicate that the payment is for a tax extension. Make sure you keep the confirmation number for your payment, too. Start at the IRS’s “Paying Your Taxes” webpage to make an electronic federal tax payment.

You May Like: Csl Plasma Taxes

Extensions For Expatriates Explained

A tax extension can be filed with the IRS to offer you more time to file your tax return. This allows for more flexibility to gather your W-2s or 1099s, and review any available tax deductions.

Technically, every American expat already receives an initial automatic extension every year. While taxes are due mid-April for citizens living in America, expats living abroad receive a two-month extension, without having to file to obtain it.

With the June 15 deadline just around the corner, if you need a little more time to get your documents in order, you can request a tax-filing extension with the IRS.

File A Tax Extension Request By Mail

It’s also possible to file Form 4868 in paper form. You can download the form from the IRS website or request to have a paper form mailed to you by filling out an order form on the IRS website. Alternatively, you can call the IRS at 829-3676 to order a form.

Notably, if you are a fiscal year taxpayer, youll have to file a paper Form 4868.

If you recognize ahead of time that youll need an extension, dont wait until the last minute to submit Form 4868. The earlier you get it in, the more time youll have to fix any potential errors that may come up before the deadline passes and the extension door closes.

Also Check: How To Get Pin To File Taxes

New 2020 Deadline To File And Pay Taxes

The IRS has moved the deadline for filing and paying 2019 income taxes to July 15, 2020. The deadline for extensions is also July 15. If you need extra time to file your tax return after July 15, you can file an extension application. You must still pay your taxes by July 15, even if you file an extension.

Extension Of Time To File

An extension of time to file a return may be requested on or before the due date of the return. The extension is limited to six months. You may receive another 6-month extension if you are living or traveling outside the U.S. You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.

Extensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Complete the Military Combat Zone on your Extension of Time to File, FR-127.

Note: Copies of a federal request for extension of time to file are not acceptable.The extension of time to file is not an extension of time to pay. Full payment of any tax liability, less credits, is due with the extension request. If the tax liability is not paid in full with the extension, the request for an extension will not be accepted, and the taxpayer will be subject to a failure-to-pay penalty and interest on any tax due.

Don’t Miss: Dasher Tax Form