How Do You Calculate Property Tax

Three main factors play a part in calculating your property tax cost:

The property tax rate is also called a multiplier. This is a percentage used to multiply with the assessed value of your property. The result is your tax bill. If you meet the requirements for a tax exemption, that is also taken into consideration.

States With The Lowest Median Annual Property Tax

The property taxes an average American homeowner spends on the home every year are around $2,200. There is a personal property tax on vehicles in nearly 27 states. Almost in every state, there is one or the other types of property tax. Almost ten states have the lowest property tax ratio and 23 with no personal property tax on vehicles. The states with lower property taxes might have higher taxes on things like income, sales, gas, etc.

Even though you own or rent a home, you will pay property taxes in one way or another. But the fact remains that the property tax burden will vary significantly among different states.

Here is a list of states with the lowest annual property taxes. It is based on the median home value for single family homes across all states.

1) Alabama

Median Annual Property Tax: $558

2) West Virginia

Median Annual Property Tax: $653

3) Arkansas

Median Annual Property Tax: $743

4) Louisiana

Median Annual Property Tax: $795

5) South Carolina

Median Annual Property Tax: $851

6) Mississippi

Median Annual Property Tax: $879

7) Tennessee

Median Annual Property Tax: $1,120

8) Kentucky

Median Annual Property Tax: $1,120

9) Oklahoma

Median Annual Property Tax: $1,129

10) Indiana

Median Annual Property Tax: $1,130

Expert Insights: Moving And Taxes

Making the move to a different state is a big step, and from a tax perspective, it can get complicated. MoneyGeek interviewed several experts to elaborate on the unique tax issues that moving presents and what you may need to take into account if you’re thinking about making a move across state lines. The views expressed are the opinions and insights of the individual contributors.

Senior Manager at Baker Newman Noyes

Recommended Reading: Do You Have To File Taxes With Doordash

Aggregate & Local Property Tax Stats

- 2020: In 2020 the average single-family home in the United States had $3,719 in property taxes, for an effective rate of 1.1%. This raised $323 billion in property taxes across the nation.

- 2019: In 2019 homeowners paid an average of $3,561, raising $306.4 billion.

- Local Data: ATTOM Data Solutions provides a county-level heat map.

Residents Pay The Lowest Property Taxes In These States

Property taxes levied on homeowners rose slightly in 2019 across most of the country.

Getty

If your property taxes for 2019 were not as high as you anticipated, you were not alone. The average property tax bill of $3,561 for a single-family home in 2019 was up only 2% from the average property tax of $3,498 in 2018, based on data from ATTOM Data Solutions.

The property tax analysis for more than 86 million single-family homes in the United States shows that property taxes levied on single family homes in 2019 totaled $306.4 billion, up 1% from $304.6 billion in 2018 and an average tax amount of $3,561 per home, an effective tax rate of 1.14%.

The effective property tax rate is the percentage of a propertys value either its assessed value or in some cases its estimated market value paid in property taxes during a given year.

The report analyzed property tax data collected from county tax assessor offices nationwide at the state, metro and county levels along with estimated market values of single-family homes calculated using an automated valuation model.

Todd Teta, chief product officer for ATTOM Data Solutions, said that although property taxes levied on homeowners rose again in 2019 across most of the country, the nationwide increase was the smallest in the last three years. He called it a sign that cities, towns and counties are taking stronger steps to clamp down on how much they hit up property owners to support schools and local government services.

Getty

You May Like: How Does Taxes Work For Doordash

Property Tax And Other Write

Although most of us dont like to pay tax, the good news for real estate investors is that property tax paid on rental property is a fully deductible expense used to reduce net taxable income.

Normal deductible expenses

Tax write-offs that real estate investor use include:

- Mortgage interest

- Business credit card interest paid when making purchases for the property

- Hazard and business insurance

- Professional fees such as property management or leasing fees

- Legal and tax preparation fees

- Property taxes

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue. Alaska only levies a paltry 1.76% sales tax rate.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including sales-tax-free Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- Alaska 1.76%

- New Hampshire 0%

You May Like: Tax Preparer License Requirements

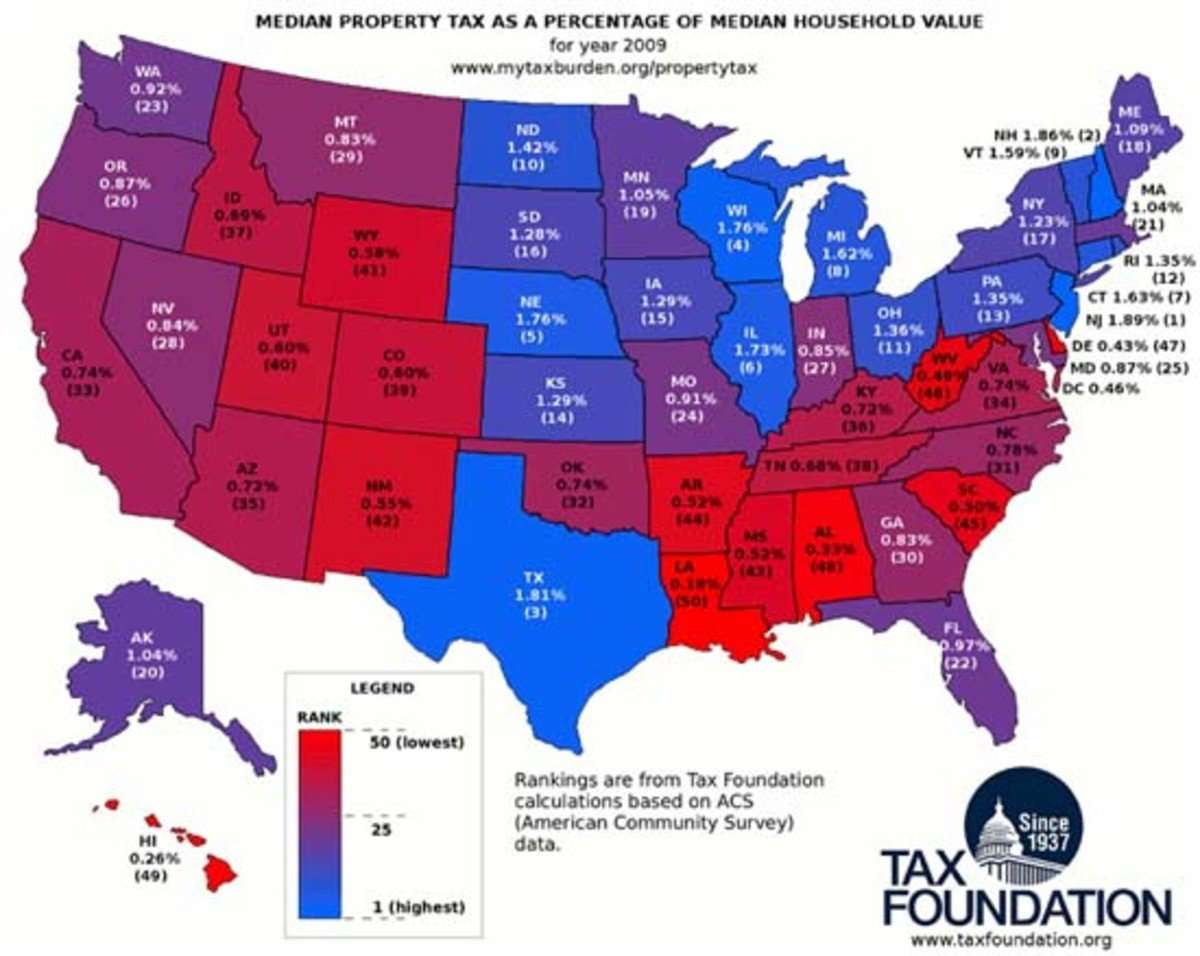

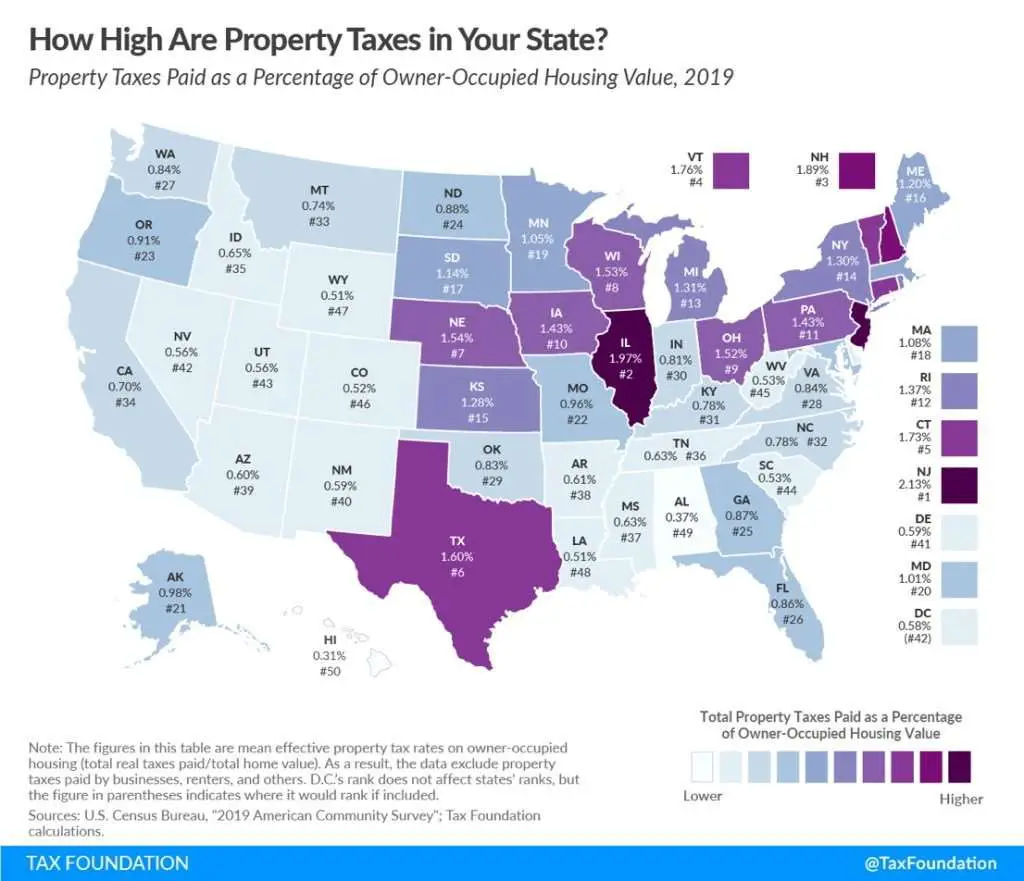

How High Are Property Taxes In Your State

Todays map takes another look at property taxes, this time focusing on states effective tax rates on owner-occupied housing. This is the average amount of residential property taxes actually paid, expressed as a percentage of home value.

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account in order to give a broader perspective for property tax comparison.

States tax real property in a variety of ways: some impose a rate or a millagethe amount of tax per thousand dollars of valueon the fair market value of the property, while others impose it on some percentage of the market value. While values are often determined by comparable sales, jurisdictions also vary in how they calculate assessed values.

Some states have equalization requirements, ensuring uniformity across the state. Sometimes property tax limitations exist which restrict the degree to which ones property taxes can rise in a given year, and sometimes rate adjustments are mandated after assessments to ensure uniformity or maintenance of revenues. Abatements are often available to certain taxpayers, like veterans or senior citizens. And of course, property tax rates are set by political subdivisions at a variety of levels: not only by cities and counties, but often also by school boards, fire departments, and utility commissions.

Property Taxes By State

Although there is some variance in the actual property tax rates within and across the different states, we can compare each states property taxes by looking at the effective property tax rate.

This rate is calculated by looking at the amount of a states property taxes paid every year as a percentage of the total value of occupied homes within each state.

Lets look at a list of all states and their effective property tax rates and average annual amounts, from the lowest to the highest.

#1: Hawaii has the lowest effective property tax rate at 0.27%. Homes are expensive in Hawaii, however, so the low property tax rate balances it out. The median home price in Hawaii is $587,700. Each year, Hawaiian residents might pay around $1,586 in property taxes, even with the very low effective tax rate.

#2: Alabama also boasts a meager property tax rate. Coupled with the low median home prices in the state , Alabama is a very affordable place to own a home residents of a median home may only owe $564 in taxes annually.

#3: Louisiana has the third-lowest property tax rate in the United States and has a low median home price of $147,600. An annual property tax bill on a median home here would be $767.

#4: Colorado has a property tax rate not much higher than Louisianas, but the median home prices are much higher at $381,300. This makes the median property tax amount $2,097 annually.

Also Check: How Do I Get My Pin For My Taxes

Is There A Homestead Exemption In Washington State

Washington state automatically exempts you from bankruptcy when you are eligible for the homestead exemption. If you owe more than $10,000 on your home, you must file a homestead declaration with the recorders office. The homestead exemption for the property claimed during bankruptcy must be listed on Schedule C: The Property You Claim Exempt.

Take Advantage Of Tax

Retirement accounts like a 401 or IRA are great ways to defer taxes to a later date, while also growing your net worth. In 2022, you can contribute up to $20,500 in pre-tax income to your employer sponsored 401, and defer paying them until you’re ready to start withdrawing the money in retirement. If you’re employer doesn’t offer a 401, it’s easy to open an IRA through a financial company like like Wealthfront or Fidelity.

Additionally, if you have a high deductible health plan , you can contribute to a Health Savings Account if your employer offers one. If they don’t, you can contribute with post-tax money, and you will earn a tax write-off for your contribution.

Don’t Miss: How Much Is Sales Tax On A Car In Nc

States That Doesnt Tax State Sales

Do you know what sales tax is? It is defined by the U.S. Department of the Treasury as a tax charged on the sale of goods and services. Sales tax is in three form, which include vendor tax, the consumer tax, as well as vendor-consumer tax. Only five states in the country dont have a sales tax.

These states are:

Even though Alaska dont charge state sales tax, the state, however, allows local counties to tax local sales on residents. While majority of states indeed charge state sales tax, most of these tax rates are low.

The data from The Tax Foundation shows that states that charge low state sales tax are:

- Colorado

- Oklahoma

- North Carolina

Certainly, when looking into sales tax, you importantly need to remember local sales tax rates too. Together with the state sales tax, these rates can amount to huge sum really quick. Data from The Tax Foundation shows that only five states charge highest median combined state and local sales taxes.

They are:

States that charge the lowest average combined rates include:

- Alaska

- Maine .

Key Facts About Taxes

For a typical middle-class family, the difference between living in the highest-tax state in our rankings Illinois and the lowest Wyoming is nearly $10,000 a year. A breakdown of the state-by-state tax picture reveals:

- Illinois imposes the highest tax burden. A hypothetical middle-income family would pay $13,894 a year in state and local income, sales and property taxes.

- Wyoming collects the least. The same family with the same financial picture would spend just $3,279.

- Mississippi is in the middle of the pack. A typical family would pay $8,025 a year in state and local taxes.

Youre probably not going to pick up and move simply to avoid state and local taxes. There are simpler ways to cut your tax bill, like saving for retirement, calculating business expenses and taking advantage of education credits and deductions. But if youre pondering a relocation for professional or personal reasons, taking tax implications into consideration could help you choose your next move.

Read Also: How Does Doordash Do Taxes

States Without Property Tax In 2022 Ranking Lowest/highest

The average homeowner in the U.S. pays nearly $2,400 in property taxes each year, according to Business Insider. However, thats an average number.

The fact is that property taxes vary significantly from place to place and can have a negative effect on cash flow if a real estate investor isnt careful.

In this article well look at the states with highest and lowest property tax rates, discuss how property taxes work, and offer some tips on keeping property taxes as low as legally possible.

States With The Highest And Lowest Property Taxes

Property tax falls under local, not state, jurisdiction. Median household property tax payments from analysis performed by the Tax Foundation as a percentage of median household income from the Census Bureau’s 2018 American Community Survey cites these as the counties with the most expensive property tax:

- Essex County, New Jersey 16.86%

- Passaic County, New Jersey 14.62%

- Union County, New Jersey 12.70%

These Louisiana parishes hold the least expensive spots for property tax as a percent of income:

- Assumption Parish 0%

- Vernon Parish 0.45%

- Grant Parish 0.68%

Louisiana carries some of the lowest property tax rates as a percentage of earned income because it offers a homestead exemption. This law allows the first $7,500 of assessed property values to forego having property taxes levied against them.

For reference, assessed home values represent 1/10 of the home’s actual value. For example, a $100,000 home would have a $10,000 assessed value. Therefore, Louisiana’s homestead exemption allows the first $75,000 of home value not to count toward calculating your property tax bill, which goes a long way toward lowering the percentage of income that goes toward these taxes.

You May Like: Are You Self Employed With Doordash

New Report Finds That New Jersey Again Ranked No 1 In 2020 While Hawaii Had The Lowest Rates

Newsletter Sign-up

Delivers the most important property news around the world to your inbox each weekday

Every week, Mansion Global poses a tax question to real estate tax attorneys. Here is this weeks question.

Q. What states have the highest and lowest property taxes?

A. New Jersey had the highest property taxes in the U.S. again in 2020, according to a report this week from WalletHub.

The state has a 2.49% effective tax rate, and the median home value is $335,600, according to the report. That means homeowners there pay about $8,362 on a property valued at that amount.

Connecticut paid the second-highest amount, $5,898, and had a 2.14% effective tax rate, the report found. There, the median home value was $275,400. New Hampshire had the third-most expensive property taxes, with homeowners seeing a $5,701 bill on a property with a median price of $261,700. The effective tax rate there was 2.18%.

New York, Illinois and California are also in the top 10 states with the highest property taxes in 2020, with homeowners paying $5,407, $4,419 and $3,818, respectively.

Nationally, property taxes are fairly high overall, said WalletHub analyst Jill Gonzalez.

More: Whats the Latest on New Yorks Proposed Pied-a-Terre Tax?

The average American household spends $2,471 in property taxes, she said in an email. Even though no one is exempt from paying property taxes, location is very important in determining how big your burden will be.”

Raise Issues With The Tax Assessor

Your property tax bill is based on the assessed value of your property, any exemptions for which you qualify and the property tax rate for where you live. Factors such as your property’s size, construction type, age and location can affect your tax bill.

You can request a property tax card from your local town hall that serves as a record of all the information the town has gathered about your property over the years. This card will include specific details about your home such as room size and the number of fixtures.

After reviewing the card, make a note of any inconsistencies. Take those issues to your local tax assessor. They will either make a correction or conduct a re-evaluation. This can sometimes mean a lower property tax assessment that can translate to less money you owe in property taxes.

While property taxes can be just one more expense to think about as youre buying a home, the money raised from these taxes goes toward public services that greatly improve the quality of life for residents such as by creating new parks, improving roads and funding schools.

Understanding how property taxes work will help you become a more informed homeowner and it may open your eyes to exemptions that are waiting to be taken advantage of.

Don’t Miss: How To Pay Doordash Tax

Raise Concerns With The Tax Assessor

A tax assessor is the person in charge of appraising properties and gathering information to establish the property taxes. The assessment relies on the property age, lot size, location, and features of the house. Homeowners interested in learning more about their property assessment can request further information from the county clerk. They should be able to provide assessment material from years prior as well. If you notice any inconsistencies, be sure to alert the county assessor. In most cases they will be able to conduct a new assessment and fix any areas if there are any. When successful, this can result in a lower property tax bill.

States With Lowest Property Tax

When it comes to the opposite end of the spectrum, Hawaii offers the lowest effective property tax rates in the country at 0.31%. While that low rate may have you excitedly looking up beachfront properties, its equally important to note that Hawaii residents paid more than double the national average in-state taxes in 2020. This is a good example of some states offering lower property tax rates in return for higher rates in other major tax categories.

Additionally, Alabama proves to be a very affordable state for homeowners. Not only does the state boast the second-lowest property tax rates, but Alabama also has the seventh-lowest cost of living. And if youre looking for a state that offers a light tax burden, Wyoming has the fourth-lowest effective property tax rate and no state income tax.

Again, these are high-level assumptions using effective property tax rates and a national median home price. To find a more complete estimate, verify with your county websites online tax estimator using a specific homes value.

- Hawaii

- Alabama

- Louisiana

- Wyoming

- Colorado

- West Virginia

- South Carolina

- Utah

- Nevada

- Delaware

You May Like: How To Get 1099 From Doordash