What Documents Do You Need To Deduct Medicare Premiums

Tax Deductions Answer: SSA-1099

Most people have any Medicare Part A and Part B premiums deducted from their Social Security benefit. If you do, you will receive a form each year called SSA-1099. The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes.

In addition, you will receive a form from Medicare called a Medicare Summary Notice. This lists all the services you received, what Medicare paid for them, and the amount billed to you.

Medicare sends you a summary notice every 3 months. If you have a myMedicare account, you can get the same information at any time.

Tips On Saving For Retirement

The earlier you start saving for retirement, the better off youll be because of compounding interest rates. Consider the following tips to boost your savings for retirement:

- Meet your employer’s match:

- Contribute enough of your income to take full advantage of your companys match program.

- Automate your savings:

- Make your retirement contributions automatic each month to increase savings without thinking about it.

- Create a budget:

- Cutting back on your spending can help you save money to contribute more money to your retirement savings.

- Delay Social Security:

- Delay receiving a Social Security payment past the minimum age of 62 this can increase the amount you receive in the future.

- Set a goal:

- Having and meeting saving benchmarks can help you gain satisfaction and encourage you to continue saving for retirement.

What Is A Tax Deduction

According to the IRS, a tax deduction is something you subtract from your income before you figure out the amount of tax you owe. Tax deductions can be work related, itemized, or for education, health care, and investments.

For example, if your income is $40,000 a year and you have $1,000 of deductions, you taxable income may therefore be $39,000. More deductions may mean you owe less in taxes. However, a deduction is not the same as a refund. Having $1,000 in deductions does not mean that you will get a refund for this amount from the IRS.

Recommended Reading: 1040paytax.com Official Site

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

Other Ways To Lower Your Tax Bill

If youre not eligible to deduct your health insurance premiumseither because you dont meet the cost threshold or because you opt to take the standard deduction when you’re filing taxesthere are other ways to reduce your overall medical expenses.

You might consider electing a high-deductible health plan as a type of insurance coverage. HDHPs typically offer lower premiums than other plans. They also offer the unique feature of enabling plan subscribers to open up a Health Savings Account , a tax-advantaged savings account. Money that is contributed to an HSA account can be used to pay for out-of-pocket healthcare expenses. Your contributions to an HSA are tax-deductible and, when used for eligible expenses, your withdrawals are tax-free, too.

Also Check: Do I Have To Report Roth Ira Contributions On My Taxes

Medicare Advantage Or Part C

Medicare Advantage , often referred to as Part C, encompasses Medicare-approved plans provided by private companies. The plans facilitate delivery of Medicare Parts A and B benefits, often include prescription drug coverage, and may have extra benefits such as vision, dental, and hearing services. Youre required to have both Medicare Parts A and B to get a Medicare Advantage plan.

Premium: Some MA plans have premiums you must pay in addition to your Part A and Part B premium. Others charge no premium and may help cover all or part of your Part B premiums.

Deductible: Deductibles vary between plans.

Enrollment period:

- Initial enrollment: This is the seven-month period that starts three months before your 65th birthday month and ends three months after it.

- Special enrollment: If an event happens that leaves you without coverage, such as if you lose other coverage, you may qualify to enroll in a Medicare Advantage plan.

- Open enrollment: If you already have Original Medicare and would like to enroll in a Medicare Advantage plan, you can do so between Oct. 15 and Dec. 7 each year.

- General enrollment: You can enroll during general enrollment from Jan. 1 to Mar. 31 if you have Part A and get Part B for the first time during this period.

Another Alternative: Using Your Hsa Funds To Pay Medicare Premiums

If you have a health savings account , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D . This is an alternative to deducting your premiums on your tax return, since you cant do both. But its something to keep in mind if you would otherwise have to use after-tax money to cover your Medicare premiums.

You cant continue to contribute to your HSA after youre enrolled in Medicare, but you can continue to withdraw funds from your HSA. As long as you use them for a qualified medical expense, which includes premiums for Medicare Parts A, B, C, and D, you dont have to pay taxes on the money.

You May Like: Tax Lien Investing California

Can I Deduct Medicare Part B On My Taxes

If you receive Social Security or railroad retirement benefits and are over age 65, or you qualify for Medicaid Part A due to having a disability, end-stage renal disease or amyotrophic lateral sclerosis, you automatically qualify to receive Medicare Part B medical insurance. Medicare Part B is an insurance plan that helps pay for doctor and medical service in exchange for a monthly premium.

The Internal Revenue Service allows you to deduct your Medicare Part B premiums if you choose to itemize your deductions. Keep in mind, however, that in order to claim your medical expenses your total bill must be valued at more than 7.5 percent of your adjusted gross income.

D Late Enrollment Penalty 2022

The late enrollment penalty is a figure added to your Medicare Part D monthly premium if you go without Part D coverage or Medicare Advantage for 63 or more continuous days.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. For each month you go without Medicare Part D coverage, 1% of the national base beneficiary premium is rounded to the nearest $.10 and added to your monthly premium.

Also Check: How To Buy Tax Liens In California

Are Medicare Premiums Tax Deductible

Many health insurance premiums are tax deductible, including the ones you pay for Medicare.

But unlike premiums for insurance plans you get through an employer, Medicare premiums are generally not considered pretax. Pretax deductions are those taken out of your wages before its taxed.

For example, if you have a plan through your employer that costs $85 per paycheck, that $85 is taken out of your total pay before taxes are. So, if your total check was $785, youd have $85 taken out for insurance. Then, youd pay taxes on the remaining $700.

Your Medicare premiums, however, wont be taken out pretax. Youll need to deduct them when you file your taxes instead. This is the case even if you pay your premiums by having the money deducted from your Social Security retirement benefits check.

The rules for deduction depend on your specific circumstances, including your income and employment status. Your income and circumstances can also affect which Medicare premiums youre able to deduct.

In general, you can deduct:

Is My Medicare Advantage Premium Tax Deductible

According to the IRS, if you itemize your deductions, you may be able to deduct medical and dental expenses for yourself, your spouse, and your dependents. However, you may only deduct the amount of your medical expenses that exceed 7.5% of your adjusted gross income.

The IRS specifically states that deductible medical expenses include payments for insurance premiums for policies that cover

- Medical care

- Qualified long-term care

People who are employees generally cant include premiums they pay under an employer-sponsored policy. Since Medicare Advantage plans monthly premiums cover medical care and are not employer-sponsored, they generally would qualify for a tax deduction.

Read Also: Can You File Missouri State Taxes Online

Is Social Security Taxed Before Or After The Medicare Deduction

You may not pay federal income taxes on Social Security benefits if you have low-income. But for most, your Social Security benefits are taxable. That means youll pay taxes before Medicare premiums are deducted.

Why does the system work this way? To prevent tax-deduction double-dipping.

Lets say your Social Security benefits are taxed after deducting Medicare premiums. Then you also deduct your Medicare premiums as an itemized deduction. Youd be getting the tax deduction on your premiums twice.

Ready to Save on Medicare?

100% Free

Can I Get A Deduction For My Medicare Advantage Plans Premium If I Dont Itemize My Deductions

You can only get a tax deduction for your Medicare Advantage plans premium if you itemize deductions. According to the IRS, most taxpayers claim the standard deduction when they file their federal tax return and dont itemize deductions.

In 2019 the standard deduction for married couples filing jointly is $24,400.

In 2019 the standard deduction for single taxpayers and married individuals filing separately is $12,200.

Lets say for example, that you pay $98 a month for your Medicare Advantage plan or $1,176 a year. If this is your only deduction, you may be able to claim a much higher deduction by opting for the standard deduction and not itemizing.

To find out more about Medicare Advantage plans, enter your zip code on this page.

This article should not be relied on for tax advice. Please consult a tax advisor who understands your particular circumstances in order to see what, if any, part of your medical expenses may be tax deductible. This article is for general information and might not be updated after publication.

* This report reviews costs and trends among people who purchased Medicare insurance products through eHealth during January 1 through March 31, 2018 and the same period in 2019.

NEW TO MEDICARE?

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Can I Deduct My Medicare Premiums On My Tax Return

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums from their federal taxes, including Medicare premiums for their spouses. | Image: Shutterstock

Reviewed by our health policy panel.

More than 63 million Americans are enrolled in Medicare. And although most of the cost of the program is covered by payroll taxes and general revenue, enrollees cover about 15% of the cost of Medicare with the premiums they pay each month. Those premiums can certainly add up over time. But unlike the employer-sponsored coverage that most Americans have during their working years, Medicare premiums are not typically paid with pre-tax dollars.

What Medicare Premiums Do I Have To Pay

There are four parts to the Medicare program:

- Part A, which is your inpatient hospital, hospice, and skilled nursing facility insurance

- Part B, which covers doctor visits, diagnostic tests, durable medical equipment, and most outpatient services

- Part C, which is the Medicare Advantage program

- Part D, which is Medicares prescription drug program

If you sign up for Original Medicare and want protection against out-of-pocket costs, you may also have Medicare premiums for a Medicare Supplement insurance plan.

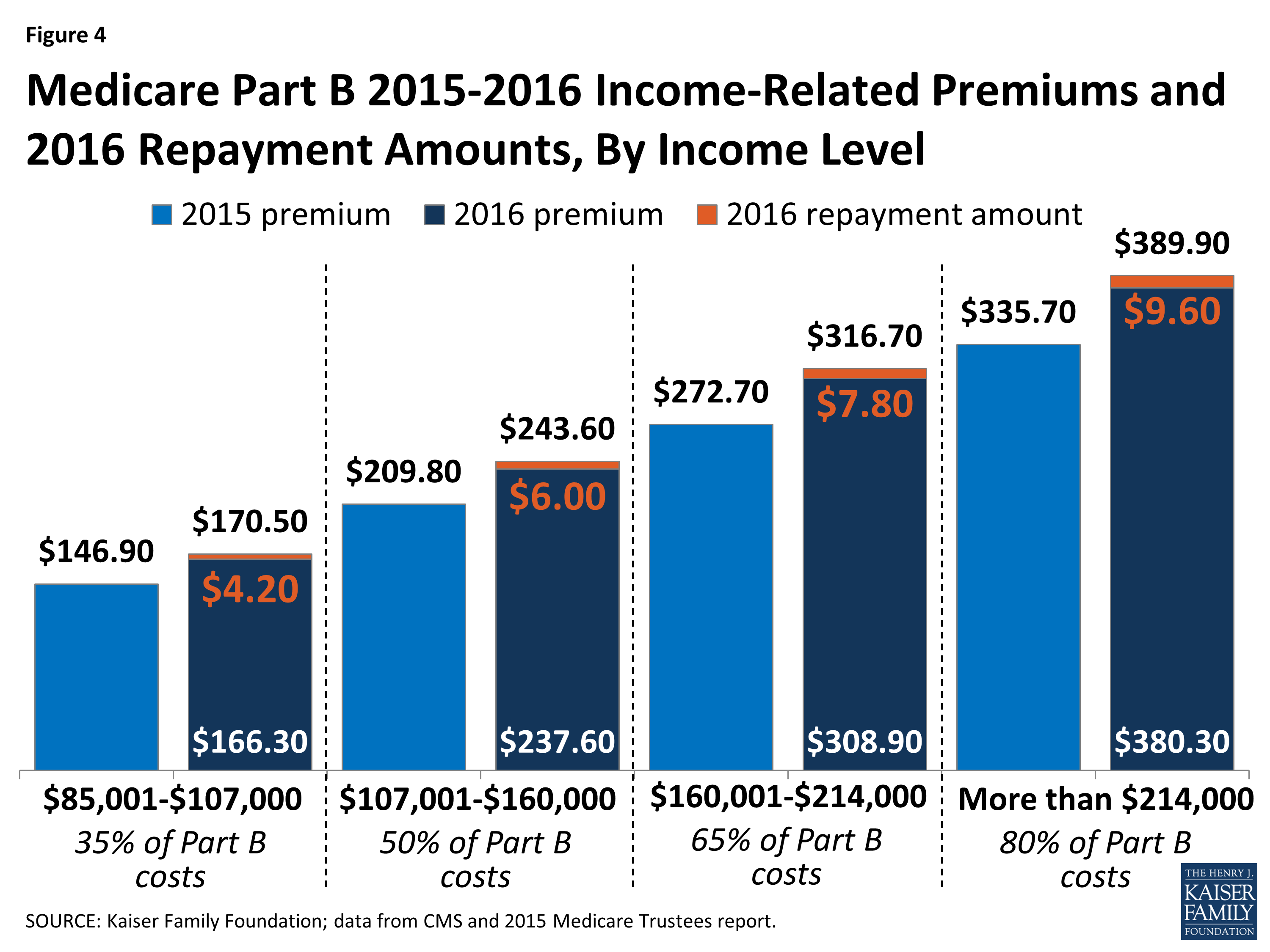

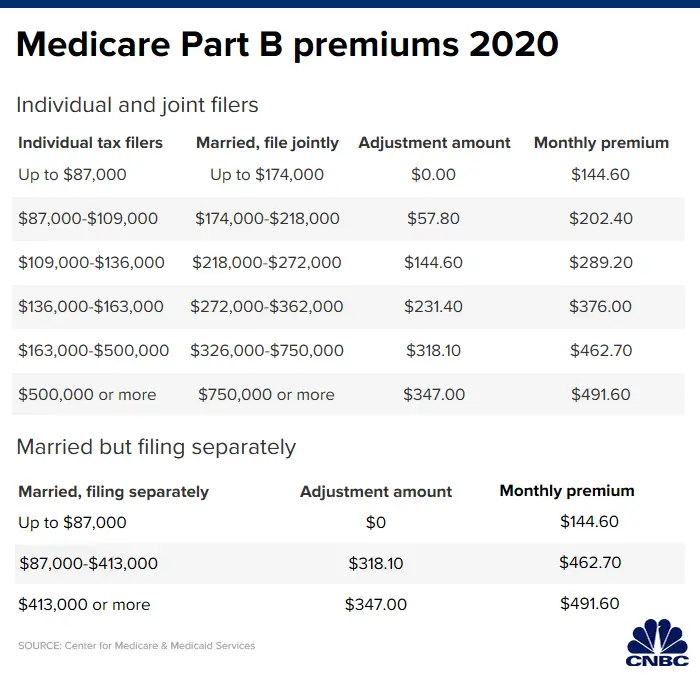

Medicare premiums for Part A are based on your work history most people qualify for premium-free Part A. Everyone generally pays the base Part B premium, even if you enroll in a Medicare Advantage plan, although some low-income individuals qualify for additional help with Medicare premiums for Part B. Those with higher incomes may pay a high-income adjustment along with the standard Part B Medicare premiums.

If you enroll in Part C, or Medicare Advantage, plan, you pay your Part B Medicare premium plus any additional premium charged by your plan.

You May Like: Can You Change Your Taxes After Filing

Maybeif Your Healthcare Costs Are High Enough

For some Americans, health insurance is one of their largest monthly expenses, leading them to wonder what medical expenses are tax-deductible to reduce their bill. As the price of healthcare rises, some consumers are seeking out ways to reduce their costs through tax breaks on their monthly health insurance premiums.

If you are enrolled in an employer-sponsored health insurance plan, your premiums may already be tax-free. If your premiums are made through a payroll deduction plan, they are likely made with pre-tax dollars, so you would not be allowed to claim a year-end tax deduction.

However, you may still be able to claim a deduction if your total healthcare costs for the year are high enough. Self-employed individuals may be qualified to write off their health insurance premiums, but only if they meet certain criteria. This article will explore tax-deductible medical expenses, including the criteria for eligibility.

Are Social Security Benefits Taxed

A person may have to pay income taxes on their Social Security benefits.

This usually only applies to people who have considerable additional sources of income, such as dividends from investments or earnings from self-employment.

A person who files taxes as an individual may have to pay income tax on up to 50% of their Social Security benefits if their total income is between $25,000 and $34,000.

They may have to pay income tax on up to 85% of their benefits if their total income is higher than $34,000.

Individuals who file a joint return with their spouse may have to pay income tax on up to 50% of their benefits if they have a combined income of $32,000 to $44,000.

If income is higher than $44,000, individuals completing a joint tax return may have to pay income tax on up to 85% of their benefits.

Read Also: How Much Does H& r Block Charge To Do Taxes

Limitations Of An Hdhp

While an HDHP can offer some tax benefits, they arent necessarily an appropriate healthcare solution for everyone. If you have a pre-existing medical condition or expect to incur significant healthcare expenses in the year ahead, you may want to select a plan that offers more comprehensive coverage.

Because of the features of an HDHP, they are typically only recommended for individuals who dont expect to need healthcare coverage except in the face of a serious health emergency. You should carefully weigh your options during the open enrollment period in order to find the plan that best meets your needs.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

You May Like: Do You Have To Report Roth Ira On Taxes

What Expenses Are Not Eligible For A Medicare Tax Deduction

The IRS provides an exhaustive list of medical expenses that are considered tax deductible. However, you should be aware of costs that don’t fit the bill. For example, Medicare expenses that are reimbursable are not eligible for a tax deduction.

Late penalties on Part B or Part D premiums are not eligible to be deducted. Generally, you can’t deduct prescription drugs purchased abroad unless it’s legal in the other country and the U.S. Nonprescription drugs like supplements or vitamins are not usually considered allowable unless specifically recommended to you by your doctor to treat a particular medical condition.

Other expenses that are not considered allowable for tax deduction:

-

Babysitting or childcare

-

Veterinary fees