S To Check Outstanding Tax

How to check your outstanding property tax:

- Ask Jamie, your virtual assistant.

- Use the ‘Check Property Tax Balance’ digital service without having to log in to mytax.iras.gov.sg.

- Search using your property address and your tax reference number or your property tax reference number.

- Type in the verification code shown in the image.

- Select ‘Search for property’.

Use the property tax reference number to pay your outstanding tax via the various payment options available.

Alternatively, if you wish to check the details of your past payment transactions, you will need to:

31 Jan1 month from the date of notice

Payment Options For Property Taxes

The 2021 property tax statement will be mailed by October 25, 2021.

All property owners receive a tax statement. If you do not receive a tax statement by November 1st, call the tax office at 265-4139.

The Tax Collector accepts Credit, Debit Card, or E-Check online for property tax payments.

Please Note: We are now accepting credit card and debit card payments by phone and in person. To make a payment, please call 541-265-4139. This service is provided by a financial institution charging a service fee to you the taxpayer.

PLEASE NOTE: Currently, there is no legislation to delay the 2021 property tax payments.

Property taxes may be paid in installments using one of the following schedules.

Payment must have a postmark no later than November 15th. If the postmark is later than November 15th, discount is not allowed and interest will accrue on the past due installment. The interest rate is 1.333% per month or fraction of a month until paid.

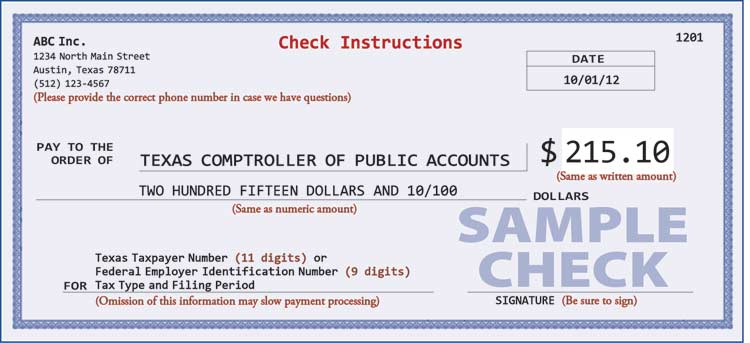

-When paying by mail, make your check or money order payable to Lincoln County Tax Collector.

-Return the lower portion of your tax statement with your check using the enclosed blue envelope. Be sure to write in the amount of your payment on the coupon. The return envelope can be used for the November 15th payment, February 15th and May 16th payment. All payments must be mailed directly to the Lincoln County Tax Office.

-Mail your payment to 225 W Olive Street, Room 205, Newport, OR 97365

The Lincoln County Tax Office is located at:

What Happens If Property Taxes Are Not Paid

Payment of property taxes is a legal obligation of property owners, as taxes are the means by which local residents contribute to the cost of education and local services in their community. Failure to pay taxes result in a loss of revenue, impacting the communitiesâ ability to provide municipal services such as water, sewer, and waste disposal.

In addition, failure to pay outstanding taxes may result in:

- Your property being placed in tax sale

- Further legal action taken by the provincial government

Recommended Reading: Doordash Taxes For Drivers

Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

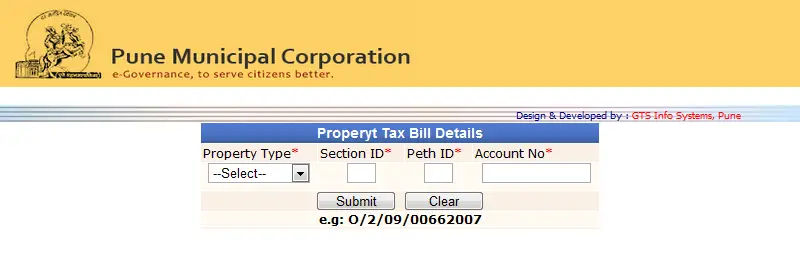

View And Pay Property Taxes Online

This page provides information on how to view and pay your property taxes online, an e-from to submit a change of address with the Assessor’s office, provides links to enroll in email reminders and sign up for e-billing.

For additional ways to pay your taxes, please visit our Paying Your Taxes section.

Property Tax Online Payments

The Auditor-Controller-Treasurer-Tax Collector is pleased to provide you with the capability to obtain property tax information on-line. You may view your tax bill and, if desired, make your property tax payment using a credit card, debit card or E-Check electronic debit from your checking or savings account.

Transaction Fees:

- Debit card payments – 2.34% per transaction

- E-Check payments – FREE

Returned Payment Fees:

- A $30 processing fee will be added to any returned payments. This includes, but is not limited to, incorrect account information submitted during payment, non-sufficient funds and submitting account information for closed accounts.

- If the payment is returned after the due date additional tax penalties may apply.

All transaction fees are payable to the payment processing company. The County of Sonoma does not collect these fees.

PLEASE NOTE: If you do not receive a transaction number at the end of your transaction, your transaction was NOT successful. The payment site is updated in real-time you can always navigate back and confirm the Paid Status is PAID.

Don’t Miss: Do I Have To Claim Plasma Donations On My Taxes

Electronic And Phone Options:

Online with a Debit or Credit Card – Convenience fees apply. American Express not accepted.

Online through your Bank or Credit Union – Check with your bank or credit union to find out if they provide online bill pay services for their customers. Allow adequate processing time for this service set up payment early as it must be received by the due date.

Pay by Phone – 1-833-610-5715 – Point and Pays automated phone system is available 24 hours a day, seven days a week. You can pay with an electronic check, credit and debit card. Convenience fees apply.

Personal Teller Option – Call 1-877-495-2729 to use Point and Pay’s Personal Teller Option and make your payment with a live teller. Personal Tellers are available from 8 am to 11 pm EST, Monday through Friday. A $5.00 convenience fee will be charged in addition to the payment fee.

Note: Electronic and phone payments must be electronically delivered by 11:59 pm on the due date to be considered timely.

How Is Property Tax Calculated

To determine your tax bill, the tax office multiples your propertys assessed value . For example, if your home is assessed at $200,000, and the local tax rate is 1%, your tax bill would be $2,000. Of course, the higher the assessed value, the higher the tax bill.

Some local governments apply the tax rate to just a portion of the assessed value. This is known as the assessment ratio. If your home is assessed at $200,000, and your county has an assessment ratio of 80% and a tax rate of 1%, your tax bill would be $1,600 .

Read Also: Do You Get A 1099 From Doordash

Electronic Property Tax Bills

Enjoy convenience and go green by choosing e-PT bills. You will be notified via SMS and/ or email when your e-PT Bill is ready. You may view your bill via our ‘View Property Tax Notices’ digital service.

Benefits of e-PT Bills

No more lost mails! You may access your e-PT Bills with your Singpass.

You may view up to 3 years of e-PT Bills anytime, anywhere.

Receive SMS and/ or email notifications on how much to pay and by when.

Improved property tax digital billing experience

We have launched a new initiative to improve the annual property tax digital billing experience for owners who own more than 1 property.

From Dec 2020, property owners who have opted for the consolidated electronic property tax bill will receive a single notification, instead of separate notifications, once their digital bills are ready for viewing at mytax.iras.gov.sg.

Our new and improved property dashboard allows you to get an overview of your portfolio of properties and print a consolidated summary statement.

Corporate owners are able to download essential property tax information to suit your companys needs.

Interactive property tax bill

View and pay your property tax bills on your mobile phones or laptops through i-Bill.

Every December, IRAS will send a unique link via SMS and/ or email to selected residential property owners to view their bill on an interactive platform. The last 4-digits of the owners ID will be required for verification purpose.

I Paid My Property Tax Bill But I Have Not Received My Receipt

Effective August 2020, tax receipts will be provided only for in-person payments . We will no longer be providing tax receipts for other types of payments . For these payments, please keep your banking confirmation number for records, as that will be your proof of payment. If you require a receipt for a specific purpose , please contact our office by toll free number at 1-888-677-6621 or email .

You May Like: What Tax Form Does Doordash Use

How Do I Find Out Who Owns A Property In New York

Search for the Propertys Owner on NYCityMap The NYCityMap page can give you information on most properties in New York City. You just need to enter the propertys address in the search bar. If the address exists, the map will show you the buildings location and information, including the real estates: Owner.

My Husband And I Are Co

Property tax is a tax levied on property ownership. The payment arrangement on the property tax payable is a private matter to be settled among the property owners. If one of the owners has made payment, the co-owner is not required to make another payment for the same property.Both owners will be able to view the same amount in myTax Portal as it is tied to the same property.

Read Also: What Does It Mean To Grieve Taxes

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

How Is My Property Tax Calculated

Property tax is based on the assessed value of your property. Manitoba Municipal Relations, Assessment Services branch assesses each property for both the land and the buildings of that property by comparing lot sizes, location, local improvements, building age, size, condition and the quality of the construction.

Property taxes that are collected are provided to school divisions for school taxes and the northern affairs communities to cover the cost of municipal service provided to property owners.

Recommended Reading: Doordash Paying Taxes

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

Last Year’s Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

Recommended Reading: How Much Do You Pay In Taxes For Doordash

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Assessment Procedures Manual Revisions

An overview of the Arizona property tax assessment system including property classification and assessment ratios, appeals, standard appraisal methods, statutory valuation procedures, exemptions and a discussion of full cash and limited property value. In 2018, the manuals team deployed a major update project comprising all manuals and guidelines produced by the Local Jurisdictions District. The following definitions are being incorporated as intrinsic project elements:

- Review: Manual conforms to standard style and formatting. Legislative and other citations have been verified. No changes to content, methodology, policy or practice.

- Revision: Includes all review processes manual is a newly edited version. Manuals are also considered revised when conforming to a non-substantive legislative change. Information that does not alter valuation methodology may have been added or deleted.

- Rewrite: Includes all review processes major substantive changes have been made to any combination of content, valuation methodology, policy or practice.

The Updated Assessment Procedures Manual material available on the website supersedes prior electronic and/or hardcopy versions of these chapters, guidelines, memoranda or directives which may conflict with the updated material.

Recommended Reading: Cook County Appeal Property Tax

Bank Or Financial Institution

You can pay your property taxes through the bank, credit union or other financial institution you have an account with. When you use your bank or financial institution, we recommend that you always confirm when your payment will be processed by your bank to avoid late payment penalties. For example, banks will often process payments received in the afternoon with the date of the next business day.

There are three ways you can pay your property taxes through your bank or financial institution:

Note: You can no longer make a payment at a financial institution you dont have an account with.

Bill payment service

Most banks and financial institutions offer bill payment services for their clients. Bill payment services can generally be accessed through your online banking account, an automated teller machine , telephone banking or in person with a teller at the financial institution that you bank with.

Note: When you pay in person, you need to set up a bill payment service for Rural Property Taxation before you pay with a teller.

To pay your property taxes using a bill payment service you’ll need to add a payee for Rural Property Taxation to your bank account. To add a new payee to your bank account you need to know our payee name and your folio number.

- Our payee name is PROV BC – RURAL PROPERTY TAX

- Your folio number is listed on your Rural Property Tax Notice. It must be entered without spaces or decimals. For example, 012 34567.890 must be entered as 01234567890

Wire transfer

Property Tax Digital Services

You can access digital services at mytax.iras.gov.sg to:

- Manage your preference for electronic or paper notices

- View your account summary

- View your property dashboard

- View a copy of your notices/bills and correspondence

- Apply for owner-occupier tax rates

Find out more information on our digital services.

You May Like: Door Dash Taxes

Effective Date Of Payment

Property tax payments can be made through most chartered banks, trust companies, credit unions, and Alberta Treasury Branches. Know your bank’s policies regarding the effective date of payment. Its important to pay at least three business days prior to the property tax payment due date to meet the payment deadline and avoid a late payment penalty. Please keep in mind that most bank transactions are based on Eastern Standard Time.

What State Has The Highest Property Tax

Also Check: How To File Taxes For Doordash