The Irs Uses Magi To Determine Ira Eligibility And More

The Balance / Bailey Mariner

Your modified adjusted gross income determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account . It also impacts what you can put in a Roth IRA each tax year.

Certain education-related tax benefits and income tax credits are based on MAGI. Under the Affordable Care Act, your household MAGI also impacts whether you can get income-based Medicaid or subsidized health insurance through the Marketplace.

In 2021, the American Rescue Plan allowed more households to access subsidized health insurance through the Marketplace. In tax years 2021 and 2022, you may be eligible for new tax credits that lower the cost of your Marketplace health insurance, even if your MAGI was too high to qualify in previous years. You will still need to file taxes at the end of the year to prove that your income was not too high for the tax credit.

The first thing to know is that your total income, modified adjusted gross income, and adjusted gross income are not the same things. Though they use most of the same base numbers, each is calculated in a slightly different way.

For tax-planning purposes, you will need to learn the differences and when to use each one.

Also Check: How Does Doordash Do Taxes

Does Roth Ira Lower Adjusted Gross Income

Contributions to a regular IRA are the only ones that are ever tax deductible. If youre not married and dont have access to a 401 plan through your work, your contributions are always fully deductible. Only if neither you nor your spouse participates in an employer-sponsored retirement plan are your contributions guaranteed to be deductible, and hence guaranteed to lower your adjusted gross income. Because Roth IRA contributions are made after-tax monies, they will never affect your adjusted gross income.

Calculate Magi For Tax Credits & Deductions

Your eligibility for a handful of tax credits is determined by your modified adjusted gross income. In each case, your MAGI is determined by finding your AGI, which already excludes the value of certain types of income and tax breaks, and then adding some of those values back into your AGI. The process of determining your AGI is always very similar but there may be slight variations depending on the exact tax credit or deduction youâre applying for.

The following tax credits and deductions require your modified adjusted gross income:

-

Student loan interest deduction

Related: 53 tax credit and deductions you can claim in 2021

You May Like: How To File Taxes From Doordash

What Does Agi Include

Adjusted Gross Income is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

Dont Miss: Plasma Donation Taxable Income

How To Make An Estimate Of Your Expected Income

Step 1. Start with your households adjusted gross income from your most recent federal income tax return.

Step 2. Add the following kinds of income, if you have any, to your AGI:

- Tax-exempt foreign income

Step 3. Adjust your estimate for any changes you expect.

Consider things like these for all members of your household:

- Expected raises

- Changes to income from other sources, like Social Security or investments

- Changes in your household, like gaining or losing dependents. Gaining or losing a dependent can have a big impact on your savings.

Now you have an estimate of your expected income.

You May Like: Is A Raffle Ticket Tax Deductible

Adjusted Gross Income Vs Modified Adjusted Gross Income : Whats The Difference

Modified adjusted gross income is slightly different from AGI. Unlike your AGI which is one number, your MAGI may differ depending on the tax credit or deduction for which you claim. But similar to AGI, it can also determine which tax deductions or credits you might qualify for on your tax return.

Typically, your MAGI is your AGI adjusted for certain expenses and income. Generally, your MAGI calculation is your AGI but adding back student loan interest. However, the IRS may calculate your MAGI differently depending on the tax credit or deduction.

Here are a few examples of how MAGI determines certain tax deductions and credits:

Premium Tax Credits: Your MAGI for premium tax credits and other tax savings for is your AGI plus any untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Child Tax Credit: Your MAGI for child tax credit and advance child tax credit payments is your AGI plus some sources of foreign income.

The American Opportunity Tax Credit: Your MAGI for the American Opportunity Tax Credit is your AGI plus some sources of foreign income.

For many taxpayers, their MAGI total is the same or very close to their AGI, since the adjustments that some taxpayers make will only slightly change the final number.

Adjusted Gross Income Vs Modified Adjusted Gross Income

In addition to AGI, some tax calculations and government programs call for using what’s known as your modified adjusted gross income, or MAGI. This figure starts with your AGI then adds back certain items, such as any deductions you take for student loan interest or tuition and fees.

Your MAGI is used to determine how much, if anything, you can contribute to a Roth IRA in any given year. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act .

Many people with relatively uncomplicated financial lives find that their AGI and MAGI are the same number or very close.

If you file your taxes electronically, the IRS form will ask you for your previous year’s AGI as a way of verifying your identity.

You May Like: Efstatus.taxact.xom

How Do I Lower My Adjusted Gross Income

Your adjusted gross income can be lowered by calculating “above the line” deductions. Ultimately, if your goal is to reduce your taxes, you have to reduce your income. One way to do that is by contributing to a 401 plan.

Other ways to lower your taxable income include:

-

Buying or selling a house

-

Having children

How Is Adjusted Gross Income Determined

To calculate your adjusted gross income, you first need to determine your total gross income. Your gross income may include wages, dividends, alimony, capital gains, interest income, royalties, rental income, retirement distributions, and any other income thats not reported elsewhere on your tax return.

Once you have this number, you can subtract any Adjustments to Incomealso known as above-the-line deductionsthat apply to your situation. In order to claim an above-the-line deduction, you simply need to complete your tax return, says banking and tax expert Amanda Dixon, in an article for SmartAsset. Above-the-line deductions are easy to spot. You can find them above the line where youre required to enter your adjusted gross income.

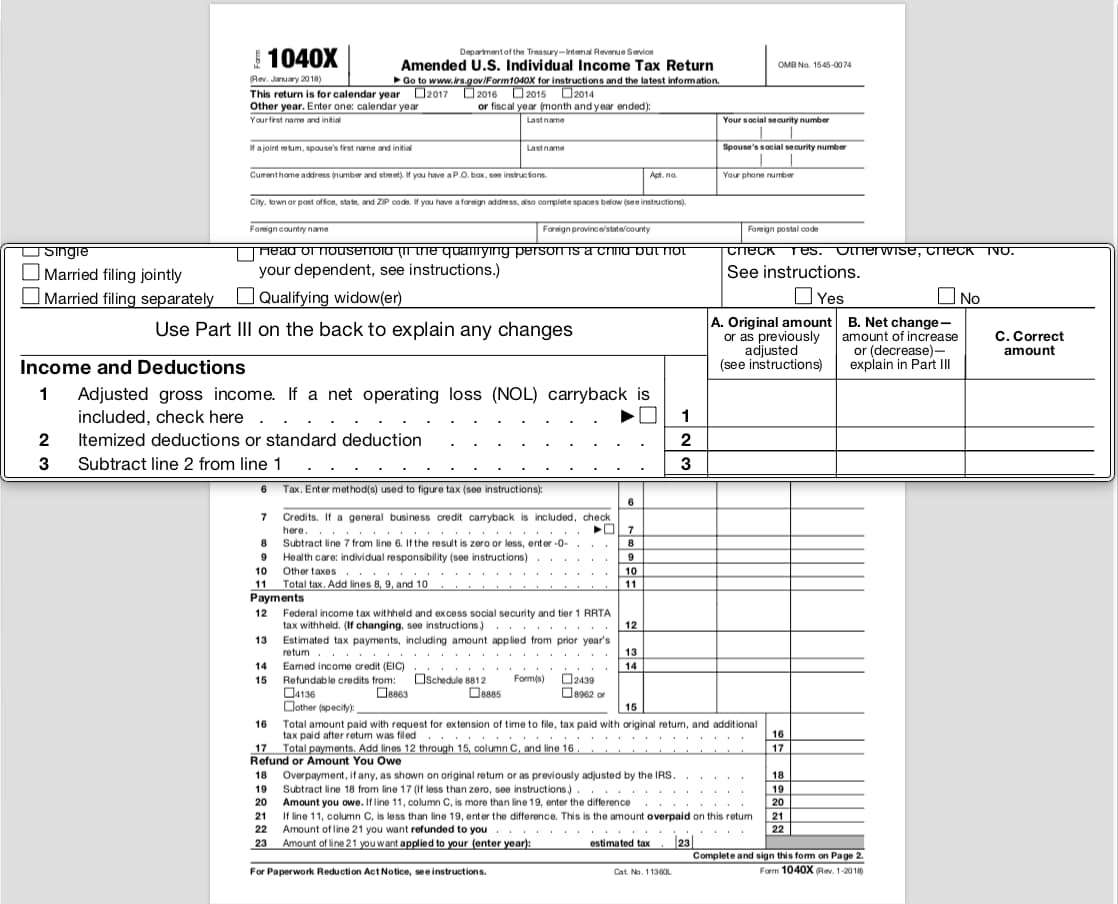

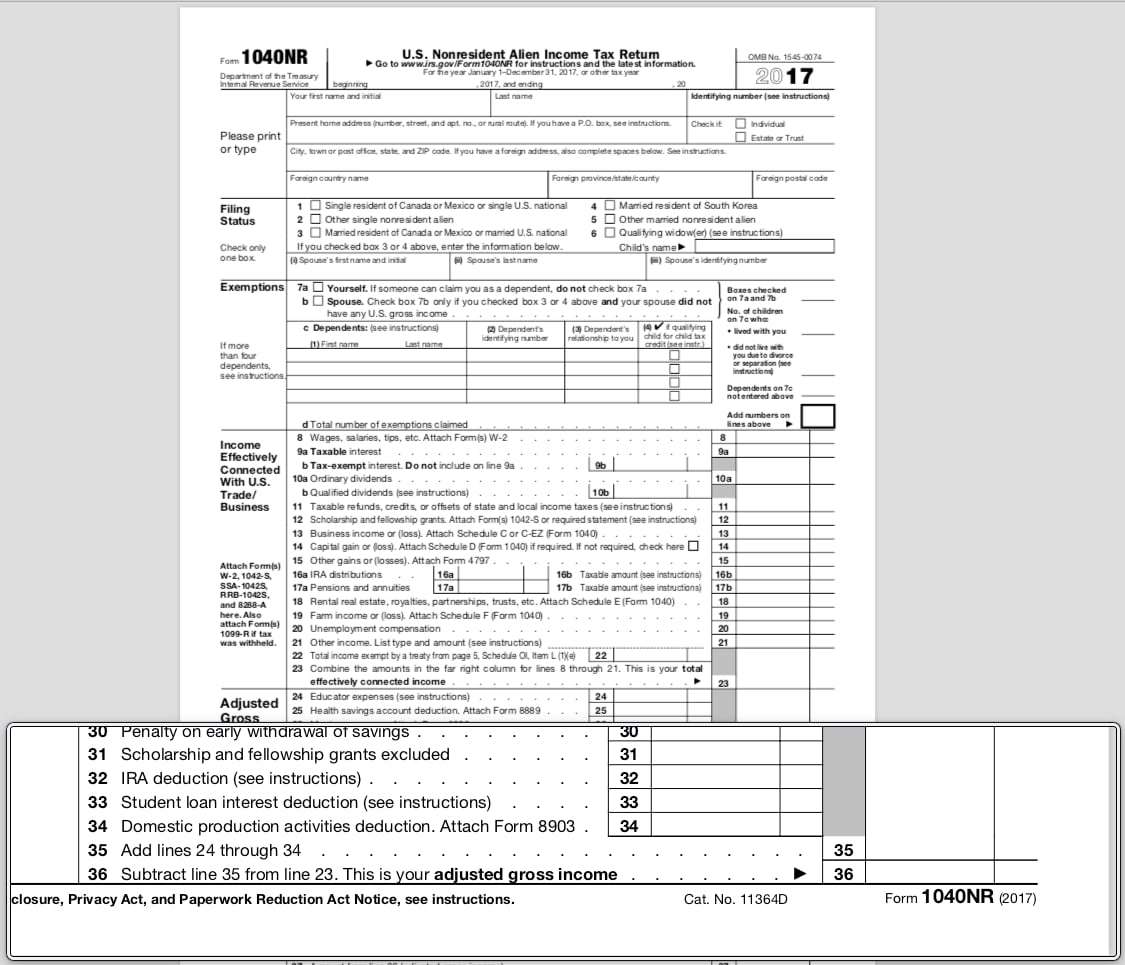

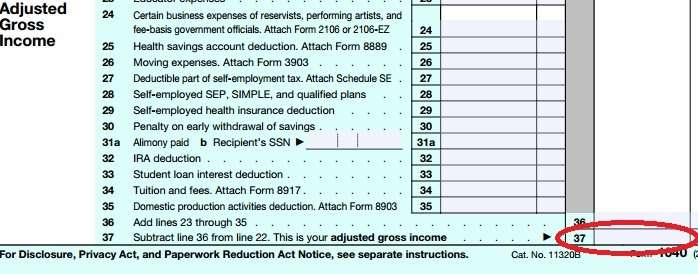

Here are the eligible above-the-line deductions for the 2018 tax year, found on Schedule 1 of the 1040 form :

As you can see above, some common adjustments include contributions to certain business expenses, classroom-related expenses, and any student loan interest youve paid.

After you add lines 23 through 35, youll enter your adjusted gross income on line 36. Back on your 1040 form, youd then subtract the adjusted gross income you just arrived at on Schedule 1 from line 6 to get your new total for line 7.

Don’t Miss: Ein Number Lookup Irs

What Is Adjusted Gross Income And How Do You Calculate It

Adjusted gross income, or AGI, is extremely important for filing your annual income taxes. More specifically, it appears on your Form 1040 and helps determine which deductions and credits you are eligible for. Based on the amount of your AGI, you can then figure out how much youll owe in income taxes. For tax year 2020, yo can find your AGI on page 1, line 11 of the IRS Form 1040.

As you take care of your taxes, make sure you have an adequate financial plan in place. Talk to a financial advisor today.

Qualified Performing Artists And Other Professions

You can adjust your income if you are a qualified artist, as well as a reservist and some fee-basis government officials.

In addition to these deductions, there are also deductions for charitable contributions and contributions to Health Savings Accounts .

For moving expensesprovided you are in the armed forcesthere are various costs related to self-employment, early withdrawal penalty amounts, and student loan interest.

Be careful when figuring the amounts for these categories, as special requirements must be met for each.

Also Check: Doordash Tax Tips

What Is Adjusted Gross Income

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Calculate Magi For The Net Investment Income Tax

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”>

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”> If you have capital gains income above a certain amount, itâs subject to an additional 3.8% tax called the net investment income tax . The exact income threshold for paying NIIT depends on your filing status and your modified AGI. Your MAGI for net investment income tax is your AGI plus income you excluded under section 911, plus adjustments for people who owned stock in certain controlled foreign corporations or passive foreign investment companies .

To find your exact NIIT liability, use the worksheets and instructions for IRS Form 8960.

Read Also: How To Find Employer Ein Without W2

Also Check: Filing Taxes With Doordash

What Is Taxable Income

Taxable income is the portion of your AGI that you pay taxes on to the government after final adjustments take effect. The typical adjustment is the standard deduction which is based on filing status and the number of dependents you have. Some people are better off itemizing their deductions in the case where they have enough special deductions that add up to more than the standard deduction.

Taxable income is calculated by deducting your allowable standard deductions from adjusted gross income . Your taxable income will be less than your AGI due to the deductions.

How Do I Find My Adjusted Gross Income Without A W

If you want to find out your adjusted gross income but you have not received the W-2 form, do not worry. You can use other means such as your last paystub to calculate your adjusted gross income as well.

It is not much different from calculating AGI with the help of a W-2 form.

- You can find your annual income from the paystub. Add your other sources of income into it.

- Now add up all of your deductions like you did in the above steps.

- Subtract deductions from the annual income. This value will be your adjusted gross income.

Don’t Miss: Tax Preparation License

The Bottom Line: Get To Know Your Adjusted Gross Income

Understanding adjusted gross income will help you develop a stronger purchase strategy for your lifestyle. Knowing how it is calculated allows you to better position yourself in the home buying process because your AGI impacts your loan eligibility and the types of credits and deductions you qualify for.

Consult a tax professional with any concerns or questions about your adjusted gross income and your financial strategy. A professional can save you a lot of time, headaches and cash. Learn more about buying a home in ourLearning Center.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Where Do I Find My Last Years Agi

For tax years 2020 and 2021, your AGI is calculated on page 1, line 11 of your Form 1040 or 1040-SR. Your AGI for tax year 2019 is on Line 8b.

Simply look at the printed copy of last years return to find your adjusted gross income. If you filed with TaxSlayer, you can also log in to My Account to view this info on your prior year return.

When you return to TaxSlayer to file your tax return each year, your AGI is pulled forward and entered into your current tax form.

Don’t Miss: Doordash Driver Tax Calculator

Understanding Adjusted Gross Income

As prescribed in the United States tax code, AGI is a modification of gross income. Gross income is simply the sum of all the money you earned in a year, which may include wages, dividends, capital gains, interest income, royalties, rental income, alimony, and retirement distributions, before tax or other deductions. AGI makes certain adjustments to your gross income to reach the figure on which your tax liability will be calculated.

Many states in the U.S. also use the AGI from federal returns to calculate how much individuals owe in state income taxes. States may modify this number further with state-specific deductions and .

The items subtracted from your gross income to calculate your AGI are referred to as adjustments to income, and you report them on Schedule 1 of your tax return when you file your annual tax return. Some of the most common adjustments are listed here, along with the separate tax forms on which a few of them are calculated:

- Self-employment tax

- Student loan interest deduction

What Is Agi And How Can You Reduce It By Years End

3 min read

Its the holiday season While your mind might be on buying presents and enjoying festive events, you may want to consider adding something else to your to-do list: finding an answer to what is AGI? and discovering ways to reduce it.

Even this late in the year, its not too late to lower your tax bill for the upcoming tax season. In fact, there are several actions you can take in a relatively short amount of time and improve your tax situation, many of which involve looking into eligibility for additional tax deductions.

Here is a little more information about AGI, and why its important to consider reducing it before Dec. 31, 2017:

Don’t Miss: Harris County Property Tax Protest Services

What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

Thats why its so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

You May Like: How To Figure Out Taxes Out Of Paycheck

You Dont Have To Pay Taxes On All Of Your Possibly Taxable Income

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

A Tea Reader: Living Life One Cup at a Time

Recommended Reading: How To Protest Property Taxes Harris County

You May Like: Tax Lien Investing California

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What If You Cant Find Your Previous Federal Tax Returns

If you just cant find your tax return, you can find your AGI in two ways:

Method 1:Go to the IRSGet Transcript portal and choose Get Transcript Online. Youll need your Social Security number, date of birth, filing status and mailing address from your latest tax return. Youll also need access to your email your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan and a mobile phone with your name on the account. Once your identity is verified, select the Tax Return Transcript and use only the Adjusted Gross Income line entry. Youll be able to view or print your information here.

Method 2: If you dont have internet access or the necessary identity verification documents, you can use the Get Transcript portal and choose Get Transcript by Mail, or call 1-800-908-9946 to request a Tax Return Transcript. It takes about five to 10 days to be delivered to you.

Recommended Reading: 1099 For Doordash

Gross Income Vs Adjusted Gross Income

When tax time comes around, Americans are often required to become better acquainted with certain tax terms even if they are not accountants. Thankfully, most of us leave the majority of the tax prep work to the tax experts. However, when it comes to the different ways in which your taxable income can be described, things can get confusing. For this reason, its a good idea to get to a better understanding of the difference between your gross income and adjusted gross income and how it impacts your personal financial planning.

Are Roth Ira Contributions Based On Gross Or Net Income

Contributing to a Roth IRA is also contingent on your entire income. The IRS imposes income limits on high-earners. Your modified adjusted gross income and tax-filing status determine the restrictions. MAGI is computed by subtracting deductions for things like student loan interest, self-employment taxes, and higher education expenses from your adjusted gross income .

If you are single and your MAGI is less than $125,000 , you can contribute the full amount in 2021. If you earn more, your maximum contribution will decrease as your MAGI rises. You wont be able to contribute anything if your MAGI is more than $140,000 .

Read Also: How To Do Your Taxes For Doordash