Double Check Your Tax Return Before You File

Double checking your tax return prior to submission can ensure your tax refund is processed quickly. Failure to do so may cause the IRS to delay the processing of your tax refund.

Here is a list of questions to review prior to filing your tax return to ensure the IRS processes your tax refund as quickly as possible.

- Did I review my identifying numbers for myself, spouse and dependents?

- Did I ensure the names on my tax return are spelled correctly?

- Did I review my dependents information?

- Have I reviewed my banks routing and account numbers for accuracy?

- Did I include the correct date of birth for myself and dependents

- Did I electronically sign my tax return ?

Applying For Tax Amnesty Or Pardon

The CRAs policy is to encourage tax laggards to come clean through tax amnesty. The VDP is designed to encourage both individuals and corporations to come forward and disclose material they didnt previously report, possibly avoiding penalties or prosecution.

The application must be voluntary, and the CRA must not have initiated an enforcement action, including sending out an audit letter. This criterion makes it harder for those who intentionally avoid paying their taxes to benefit from the program.

Taxpayers with extraordinary circumstances, like financial hardships, may have further options for relief from their tax obligations.

Don’t Fail To File Because You Don’t Have The Funds

Many people don’t file a tax return because they say they don’t have the money to pay the tax they owe. That’s a major mistake that can cost you a lot of money. The penalty for failing to file a return is 5% of the unpaid taxes for each month that your return is late, up to 25% of your unpaid taxes.

And, if you fail to pay the tax you owe by the April deadline, you’ll have to pay 0.5% of the unpaid taxes for each month that the return is late, up to 25% of your unpaid taxes.

So, pay what you think you’ll owe by April 18. If you’re afraid of receiving a tax bill you know you can’t afford right now, consider applying for a payment plan. And if you don’t think you can finish your return in time, request an extension by April 18 and you won’t have to submit your return for six months or until Oct. 17.

Read Also: What Tax Form Does Doordash Use

Placing A Federal Tax Lien On Your Property

Placing a federal tax lien on your property is one of the most troublesome actions the IRS may take against a delinquent taxpayer. Once a federal tax lien is placed on your business property, the IRS will have an interest in all property owned by your business from real estate to financial assets. Depending on the formation of your business, a tax lien could extend to your personal property as well.

A federal tax lien is typically placed on a taxpayers property after the IRS assesses the taxpayers liability and sends the taxpayer a demand for payment. If the taxpayer ignores the IRS request for payment or the taxpayer does not pay the debt on time, the IRS may then levy all property they have claimed with the tax lien. A tax levy of property could cripple a business and cause various other issues for a taxpayer.

These are not the only options that the IRS has to pursue back taxes from a business owner. If you have unfiled back taxes, it is wise to settle this issue with the IRS before they discover it themselves. As mentioned, the IRS would prefer to recover delinquent tax payments before turning to criminal proceedings. As a result, you may be able to make an arrangement with the IRS to handle your back taxes or to request a tax penalty abatement.

The worst thing you can do as a business owner is to avoid communicating with the IRS, especially if you owe back taxes.

What Money Will Be Included In My Tax Refund This Year

There are several things that could be tacked on to your tax refund this year. As usual, if you overpaid your taxes in 2021, you’ll receive that money back. However, if you’re a parent, you could also expect to receive the rest of your child tax credit money, as well as a reimbursement for money you spent on child care related expenses last year.

Also, if you’re still missing your third stimulus payment, you might receive that when you get your tax refund.

Read Also: How To Keep Track Of Taxes For Doordash

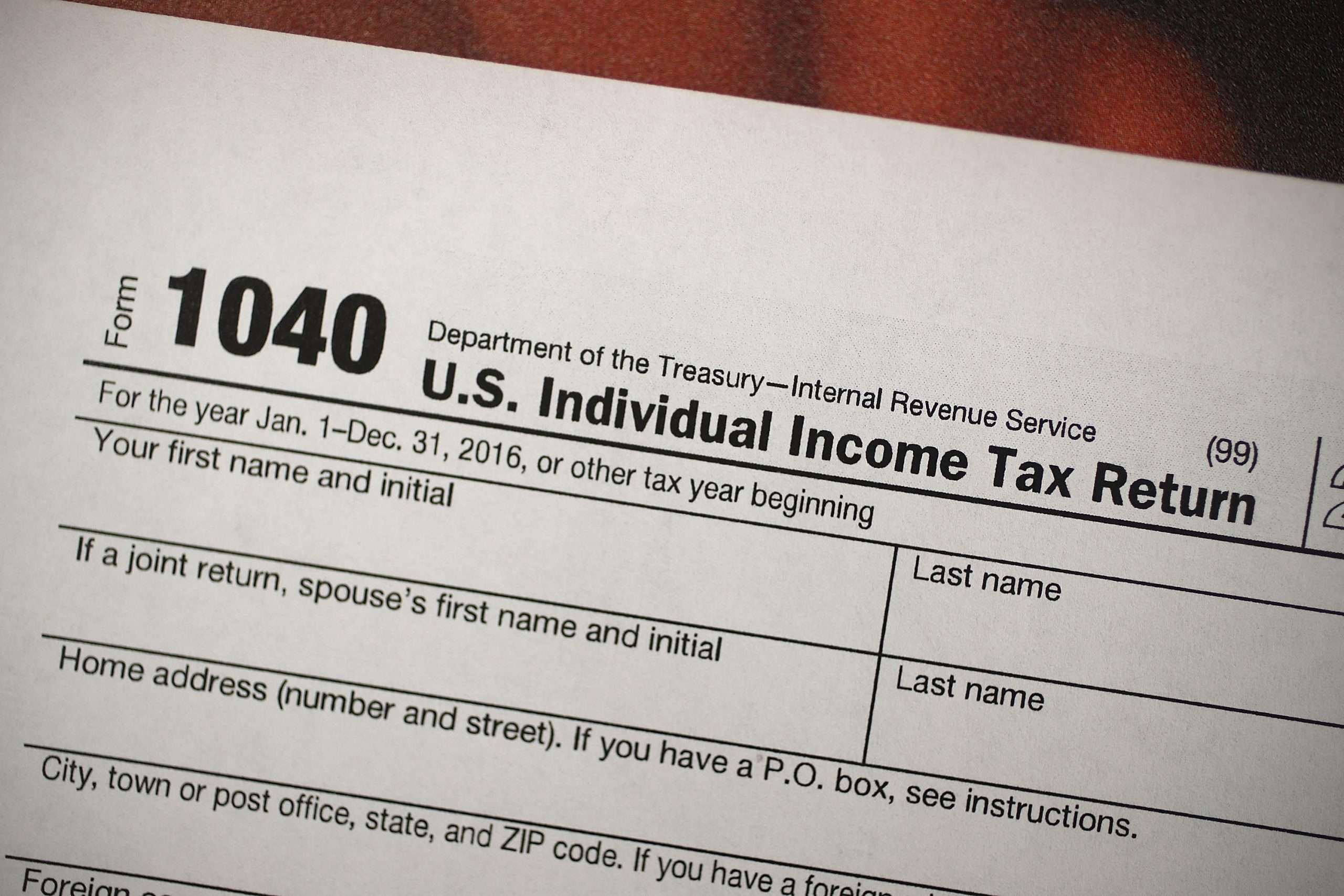

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

The Repercussions Of Cheating

Many otherwise honest people fail to report all their income, either inadvertently thanks to the complexities of the tax rules or because theyre actually trying to hide something.

For those who get caught fiddling with their books, the penalties can be severe. Cheating on taxes is a criminal offence punishable by fines equal to several times the amount of tax owing, plus the tax, plus the interest, and possibly even prison time.

And, contrary to popular belief, theres no time limit for the CRA to prosecute you for cheating or filing late. Its never too late to be brought up on tax charges from years ago.

Furthermore, waiting until youre caught, or until an investigation on your return has begun, means your bargaining power is reduced. If youve made a mistake, finance professionals advise that its better to fess up as soon as possible and then look into the possibility of amnesty or reprieve.

You May Like: Doordash How Much Should I Set Aside For Taxes

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Better To File Late Than Never

Some people may neglect to file one year and then freeze when it comes to the following years tax return because of prior mistakes.

If you owe the government money, this type of procrastination can hurt you financially. The Canada Revenue Agency will monitor your financial behaviour over time, using identifiers like your SIN and your date of birth to access data from your bank accounts or credit card transactions. When the CRA notices your absent tax return, you may end up owing penalties and interest.

If you notice your mistake before they do, its best to contact the CRA to find out any penalties you may have incurred, as well as the best way to file and pay off your outstanding balance. In some cases, the CRA will waive the penalties if the taxpayer comes forward and submits an application through the Voluntary Disclosures Program . This form gives taxpayers a second chance to make corrections or file returns that were missed.

Read Also: Do You Pay Taxes On Donating Plasma

Tax Credits For Education Expenses

Two types of tax credits, a Lifetime Learning Credit and the American Opportunity Tax Credit, provide tax benefits for qualified educational expenses for post-secondary education. The rules for these credits differ. The IRS provides a comparison chart online. It also provides an extensive list of FAQs to help you determine which credit to claim.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Also Check: How Taxes Work With Doordash

What Happens If I Miss The Tax Deadline

If you are getting a refund, there is no penalty, according to H& R Block. Then again, not getting your money from the IRS might be punishment enough.

If you owe the IRS, the penalties kick in. TurboTax says penalties can reach 5% of the amount owed for each month you are late. The maximum amount taxpayers can be penalized is 25% of the amount due, according to TurboTax.

Follow Brett Molina on Twitter: .

When Did I Last File My Taxes

By Top Tax Staff | May 23, 2018 8:00:00 AM | Tax Tips and Help

The IRS expects most taxpayers to file their returns on time every year. When the tax season starts in January, you have close to four months to file and submit your returns well before the April 15 deadline.

However, when you failed to file your taxes for the last several years, you might wonder how much trouble you could possibly be in with the IRS and what it will take to remedy the situation. You can start by determining when you last filed your taxes and by manually filing late returns.

Also Check: Efstatus Taxact 2015

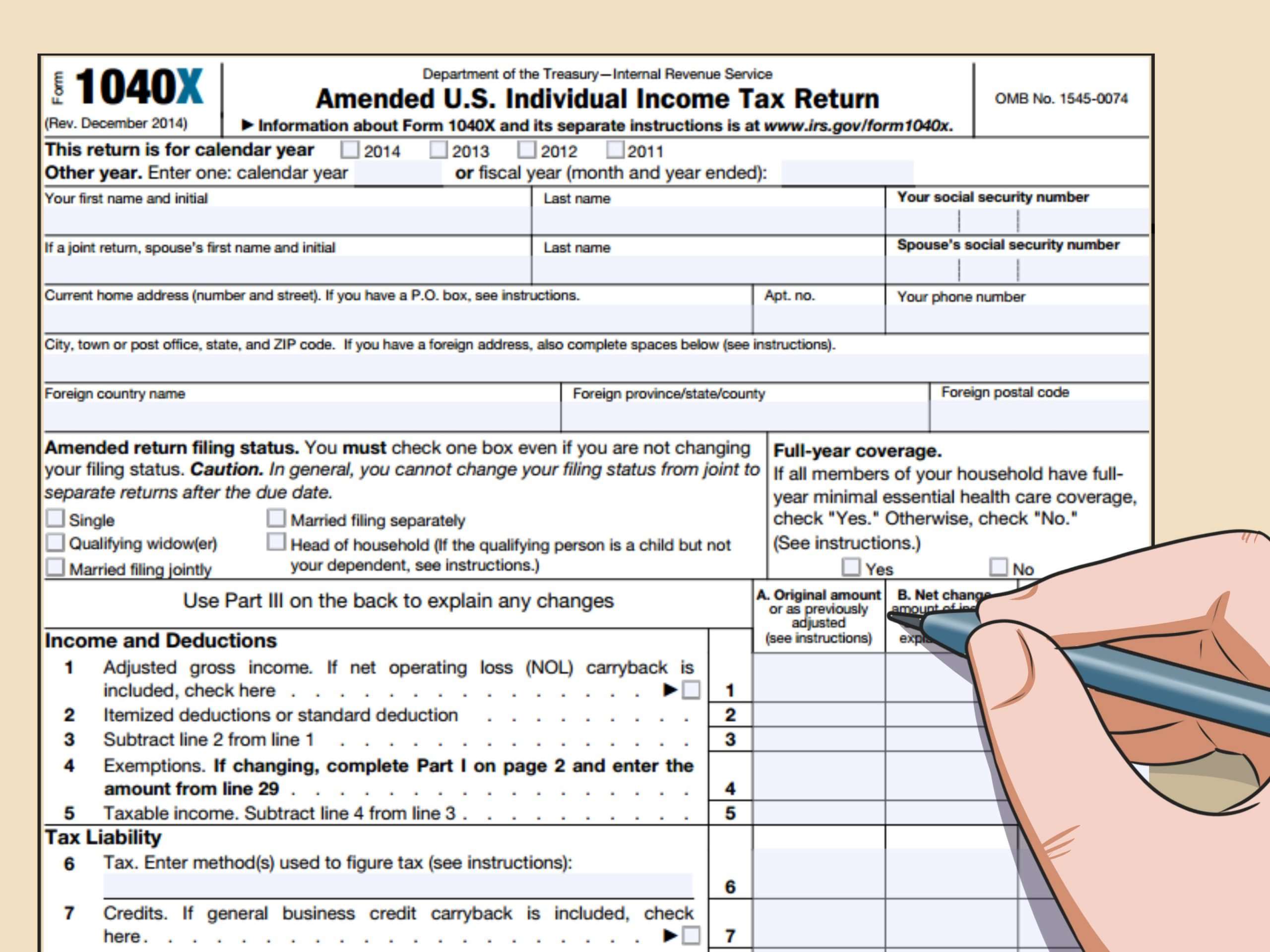

Completing Your Tax Return

On page 1 of your tax return, in the “Information about your residence” area:

- On the first line, enter the province or territory where you lived or were considered to be a factual resident on December 31, 2021

- On the second line, enter the province or territory where you live now, if it is different from your mailing address. The CRA needs this information to calculate provincial or territorial credits and benefits you may be entitled to receive

- On the third line, if you were self-employedin 2021, enter the province or territory where you had a permanent business establishment

- On the last line, if you became or ceased to be a resident of Canada for income tax purposesduring 2021, indicate your date of entry or departure

Where To File Your Taxes

Now you know that doing your taxes boils down to adding up your income and deductions and hoping the latter will overweigh the former so that the government pays you . Its time to filethis year, you have till May 17. If youre a Texas resident, youll have until June 15.

But what exactly is the process of filing your taxes? There are a few options.

Don’t Miss: Stripe Doordash 1099

Do I Have To Itemize Deductions To Deduct Student Loan Interest Paid In 2021

No. You can deduct interest paid on a student loan in 2021 without itemizing your deductions. You can deduct such interest and still claim the standard deduction. Remember that this deduction is limited to necessary educational expenses for tuition and fees, room and board, and required books it is subject to a maximum of $2,500 per student and phases out at higher income levels. If you are married, you must file a joint return to claim the credit and you and/or your spouse cannot be claimed as a dependent on someone elses return.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: Plasma Donation Taxes

Filing Prior Years’ Tax Returns

The IRS encourages most taxpayers to file their returns electronically each year. Electronic filing is secure, fast, and reduces the likelihood of fraud.

However, if you plan to file missing returns from the last few years, you may not be able to use electronic filing. Instead, you may have to file them manually simply because the forms you need will no longer be available electronically.

Estimated Irs Refund Tax Schedule For 2020 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate when you might expect to receive your tax refund based on previous years.

Date IRS Accepts Your Return |

Expected Direct Deposit Refund Date |

Expected Mailed Check Refund Date |

Read Also: How To Get A 1099 From Doordash

How To Track Your Tax Refund Status With The Irs

If you expect a tax refund this year, you can track your tax refund status with the IRS Wheres My Refund online tool or the IRS2Go mobile app.

You will need to input your Social Security number, filing status and your expected refund amount. The IRS updates your tax refund information within 24 hours after e-filing and updates the tool daily. If you filed your tax return by mail, expect longer processing times and delays.

If you do not have access to online tools, you can also contact the IRS by phone, at 829-1040 to obtain the status of your refund. Wait times average 15 minutes or longer during the peak of tax season.

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

You May Like: Tax Preparer License Requirements

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Filing With A Tax Pro

For the last couple of years, my taxes have been more complicated than Id like them to be. I moved states, switched jobs, changed my filing status, didnt receive my first stimulus check and so on.

I took a stab at filing online for free but ended up with many questions and a migraine. So, I just let someone who knows what theyre doing handle it for me I made an appointment with a tax professional.

Theres nothing wrong with having a specialist do your taxes if your tax situation is a bit more complex. Of course, youll have to pay a fee, which varies by the tax preparer and complexity of your taxes. It can be a certified public accountant, attorney or enrolled agentjust make sure the person is qualified by checking their credentials. Many people also use H& R Block for filing with a tax professional.

Prices typically range between $100 and $300. If youre looking for an affordable option, look into your local credit unions which may offer low-cost tax preparation services.

If youre still a student, theres another great option for you.

Many college and university campuses will provide tax preparation services for students with the assistance of other students who may be looking to gain experience working under a qualified supervisor in a tax lab, says Jeffrey Wood, CPA and partner at Lift Financial. These labs are usually located in the business departments, may be free depending on your institution, and may be worth looking into for tax filing assistance.

You May Like: Doordash Stripe 1099