How Long Does It Take To Get Amended Tax Return Back

Update: One of our readers,Pete Lytle, mentioned that The IRS did not start processing amended returns until August 1st due to COVID-19. They received mine on March 16th. They said that the 16 week count down starts on August 1st. Which means I may have to wait until around Thanksgiving. Although the rep stated since mine was received in March, it should only take a few weeks. Now its near mid September and nothing. And my car has now been repossessed. Thanks IRS. Interesting note: during the shut down, the IRS collections department was open. I am hurt, pissed off and sad.

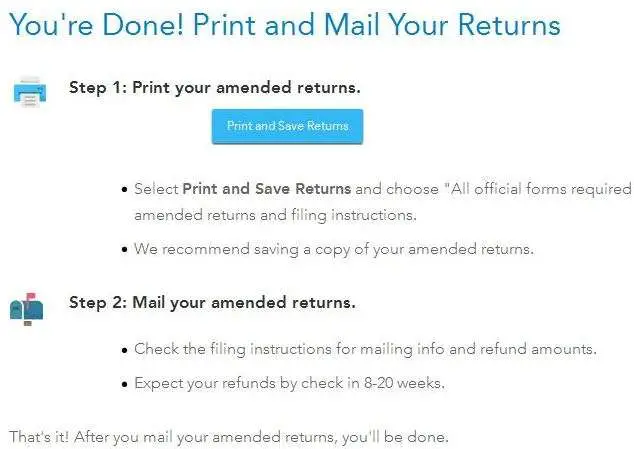

Recently, I filed my 1040X and I used TurboTax Online. I have to say, amending a tax return with TurboTax is really as easy as 1, 2, 3. I just logged into my account and clicked on Amend Your Tax Return for 2014 and it guided me through the process. My case was easy. My son was born in December of 2014. Because he was born overseas, it took a couple of months for him to receive his Social Security card. When I filed my tax return, I still hadnt receive his Social Security card, so I had to file it without adding him as my dependent. We finally received his card and I updated the 1040X form immediately, and I realized I can get about $1,500 dollars back because I am eligible for the Child Tax Credit, which is $1,000.

Receiving your amended tax returns back takes a long time. Usually, it takes about 3 weeks from the date you mailed the amended return for it to show up in the IRS system.

Filing Back Tax Returns

You may be able to fill out past-due tax returns through online software or with an accountant, but youll need to print the forms and mail them to the IRS.

Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them. It takes about six weeks for the IRS to process accurately completed back tax returns.

Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

How Can I Track My Tax Refund

The IRS maintains a variety of systems to help you track your refund. For each of them, you’ll need to supply your social security number, the exact amount of your tax refund and your tax filing status. Generally, you’ll get a faster response using an online tool than using the phone.

- Where’s My Refund: This web-based tool managed by the IRS allows you to check your status 24 hours after your return is filed electronically — or four weeks after mailing it.

- IRS2Go: This is the mobile app version, available for Android and iOS devices.

- IRS TeleTax: You can call the IRS at 1-800-829-4477. Be prepared for a long wait.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How To Track Your Federal Tax Refund If It Hasn’t Arrived Yet

If you just filed recently, you should know your federal tax refund check could take up to 120 days to arrive. Here’s what else we found.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

Whether you’ve already filed your taxes or you’re planning to do so by the final due date — that’s Oct. 15 if you file a tax extension — you’ll need to know how to track your refund. Be aware that the IRS is still facing a backlog of unprocessed individual returns, 2020 returns with errors and amended returns that require corrections or special handling. And while refunds typically take around 21 days to process, the IRS says delays could be up to 120 days.

The tax agency is also juggling stimulus checks, child tax credit payment problems and refunds for tax overpayment on unemployment benefits. The money could give families some financial relief but an overdue tax refund could also be a big help. If you don’t file your 2020 tax return soon, you’ll likely owe late fees or more interest — and you could be missing out on your tax refund, stimulus checks or child tax credit payments, which you may only be eligible for with your 2020 tax return.

Common Reasons For A Tax Refund Delay

While its your tax agents job to help you check, maximise and lodge your tax return to the ATO in a timely manner, there are some reasons out of our control that may cause a delay in your tax refund.

For example, if you:

- didnt add all your income sources,

- added unusual deductions for someone in your industry,

- have an insolvency account and owe money,

- owe money to child support or another government agency,

- have an outstanding ATO debt,

- were just unlucky and the ATO decided to audit returns in your industry or with your type of deductions. .

Note: Tax returns are only ever held up by the Australian Tax Office, not your tax agent. At Etax we want you to get your tax refund as quick as possible so its never in our interest to slow things down. Rather, its our job to work with you to overcome any delays caused by the ATO and get your tax refund back and into your bank account.

Read Also: Www Aztaxes Net

How Should I Contact The Irs For More Help

The IRS received 167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited right now because the IRS says it’s working hard to get through the backlog. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.

How Can I Check The Status Of My Tax Return

After your return has been accepted, you are on the IRS payment timetable.

The average American tax refund is nearly $3,000 and that tax refund might be the biggest check you get all year. Many Americans will be counting down the day to get that money in their hands after hitting the e-file button.

If you e-filed your taxes online, you have the option of getting your refund deposited directly into your account. This is the fastest way to get your federal tax refund. 9 out of 10 e-filed tax returns with direct deposit will be processed within 21 days of IRS e-file acceptance.

If you filed your tax return on paper through the mail, you can expect a process time of 6 to 8 weeks from the date the IRS received your tax return documents.

Heres the process in which the IRS processes your tax return:

RELATED ARTICLES

Don’t Miss: Michigan.gov/collectionseservice

Get A Withholding Certificate From The Irs:

Learning how to get FIRPTA withholding back is simple enough. Just begin by filling the application soon after the transaction has taken place or a day after the transaction has closed in full and receive the Withholding Certificate. The application for FIRPTA Withholding Certificates can be found on the official website of the IRS. The foreigner will have to fill form 8288-B. This would be the Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests to apply for a withholding certificate. It is imperative that this application form must be filed within days of the transaction. The form requires information on the seller as well as information of the buyer, which means eventually the buyer also gets to learn that the application for the withheld amount has been sent to the IRS. The IRS, upon receiving the application, goes through the document of the foreigner along with checking theory tax return and payments and then, after giving a green light, the closing agent who is responsible for keeping the withheld amount hands it back to the foreigner. The application process however, requires some preparations and makes the attachments of the following information necessary:

How Far Back Can I Amend A Tax Return

The IRS allows you to correct the mistakes you made in your tax returns. However, the time to correct these mistakes has a deadline attached to it.

You are able to file for amended returns three years from the date that the original tax return was due. When you get your new Form 1040X, you need to indicate the year of the tax return that you are amending at the top of your form. According to the IRS, your amendment must come within three years of your original return. For instance, if the due date of the return was February 26, 2013, the IRS will give you until February 26, 2016 to file a Form 1040X for 2012. In the case where you made the tax payment after you filed the return, the IRS will set your deadline for two years from the date of your payment, assuming that would be later.

Read Also: What Does H& r Block Charge

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

You May Like: Tax Lien Investing California

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more aboutidentity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

Why Choose Us Tax Recovery

Canadian/US tax professionals | GuaranteedWe dont get paid until you get paidCertified IRS Acceptance Agent | Over 15 years of experience

US Tax Recovery is a withholding tax recovery service that specializes in casino tax recovery on behalf of Canadians and other non-US citizens. Each year, millions of visitors to the United States win money in legal casinos, and find themselves having to pay a 30% withholding tax on these winnings. US. Tax Recovery will determine your eligibility for a full or partial US tax refund, and will assist you in recovering the taxes paid from the IRS up to three years after your winnings were originally taxed. We help Canadians and other International visitors to the United States claim their casino tax refund on the 30% gambling winnings tax US casinos and other gaming venues are required to withhold.

Recommended Reading: Efstatus Taxact Com Login

How Long Will I Have To Wait For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

How To Prevent Refund Delays Next Year

The key to getting your refund as quickly as possible is filing online if possible. Avoid filing a paper return by mail as these generally take longer to process.

If you qualify, or if you feel confident manually filing your taxes, consider filing online either through the IRS Free File or Free File Fillable Forms. When you file online, you will receive a quick confirmation that your return was either accepted or rejected. The email confirmation often occurs in just a few minutes. You can also enter your bank account information to receive a direct deposit of your refund or make a payment online.

When you file your return, avoid guessing on amounts reported by third parties such as banks, stock accounts, health insurance payments or mortgage interest, Peeler says. Instead, obtain the exact amounts by checking your account online or from the paperwork sent by these companies. For instance, mortgage lenders send out statements giving the exact amount of interest you paid on your loan.

Having mismatched amounts will cause a delay in your refund even if you understated the amount of a deduction.

These mismatches can trigger CP2000 letters or requests for more information on letter 2626C, Peeler says. If you miss these letters and dont provide the additional information, your return could be shelved until they get a response.

Recommended Reading: What Does Locality Mean On Taxes

How Long Does It Take To Get My Tax Return Done At Etax

You can finish your tax return easily online in just minutes at Etax.com.au. With no appointments or waiting, you can join tens of thousands of Australians by using our number one online tax return service anywhere, any time. And, youll have year-round access to qualified Etax accountant advice online using Live Chat, My Messages, or friendly help by phone.

Wheres My Tax Refund How To Check Your Refund Status

The average direct deposit tax refund was close to $3,000 last tax season, and with tax season well underway, its no surprise that the most common tax season-related question were now hearing is: Wheres my refund?

The time it takes the IRS to process your tax refund is based on how you chose to file your tax return either e-file or by mail.

- E-filed tax returns with direct deposit: E-file with direct deposit is the fastest way to get your federal tax refund. Typically, the IRS expects to issue nine out of 10 tax refunds within 21 days after acceptance. However, we are seeing delays from this normal timing.

- Mailed paper returns: Due to COVID-19, the IRS expects delays for paper returns. Usually the IRS says to allow 4 weeks before checking the status of your refund, and that refund processing can take 6 to 8 weeks from the date the IRS receives your return.

If your 2020 tax return includes one of the credits below, you could experience delays in receiving your tax refund.

Read Also: Buying Tax Liens California