Understanding Schedule D: Capital Gains And Losses

Investments or assets that are sold must be recorded for tax purposes. This includes realized capital losses, which can be deducted from your income tax bill if the shares sold were owned for investment purposes. Capital gains or losses are broken down into either short-term capital gains/losses or long-term capital gains/losses . Long-term capital gains tax is often more favorable than short-term gains that are taxed as ordinary income.

All prior versions of Schedule D are available on the IRS website.

Schedule D has instructions that help you collect information about the current year capital asset sales and prior year capital loss carry-forwards. Depending on your tax situation, Schedule D may instruct you to prepare and bring over information from other tax forms.

- Form 8949 if you sell investments or your home

- Form 4797 if you sell a business property

- Form 6252 if you have installment sale income

- Form 4684 if you have a casualty or theft loss

- Form 8824 if you made a like-kind exchange

Ultimately, the capital gain or loss you compute on Schedule D is combined with your other income and loss to figure your tax on Form 1040. Schedule D and Form 8949 are included with Form 1040 when you file your federal tax return.

Claiming Capital Loss From A Delisted Stock

With Nortel becoming delisted, there are thousands of investors out there still holding the delisted stock. So what happens next? How do you claim the capital loss?

As Im not a tax expert, I contacted Tax Guy to help me out with that question. Here is what he came back with.

If you own shares of a company that are worthless because the company is bankrupt or is being wound up , you can elect to have a deemed disposition and re-acquisition at nil value .

Even if the company has not officially declared bankruptcy you can still make the election if:

- The company is insolvent

- It has ceased operating

- The shares have a nil market value or

- It is reasonable to expect that the corporation will be dissolved or wound up and will not carry on business in the future

Any of these conditions allow you to claim a capital loss. If the shares ever regain value again, the adjusted cost base is $0 and you will have a capital gain when you actually sell them.

A note about de-listing: Just because a stock has ceased trading or has been de-listed from a stock exchange does not itself mean that a deemed disposition can be claimed. It is possible to de-list or cease trading and continue operations.

Donate Assets To Charity

When you make a donation to a registered charitable institution, you receive a tax receipt which allows you to deduct a portion of your donation from income tax owing. Instead of making a donation in cash, you can transfer ownership of stocks to the registered charity. . It’s a way of rebalancing your portfolio without triggering a capital gain because you are not selling the stock, you are simply transferring ownership. You will receive a tax receipt for the current fair market value . Consult a tax professional before you do this so you follow the correct procedure.

Read Also: Do You Have To Do Taxes For Doordash

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Considerations In Deducting Stock Losses

Always attempt to take your tax-deductible stock losses in the most tax-efficient way possible to get the maximum tax benefit. To do so, think about the tax implications of various losses you might be able to deduct. As with all deductions, it’s important to be familiar with any laws or regulations that might exempt you from being eligible to use that deduction, as well as any loopholes that could benefit you.

Since long-term capital losses are figured at the same lower tax rate as long-term capital gains, you get a larger net deduction for taking short-term capital losses. Therefore, if you have two stock investments showing roughly equal losses, one you have owned for several years and one you have owned for less than a year, you can choose to take both losses.

However, if you want to realize only one of the losses, selling the stock you’ve owned for under a year is more advantageous, since the capital loss is figured at the higher short-term capital gains tax rate.

It is generally better to take any capital losses in the year for which you are tax-liable for short-term gains, or a year in which you have zero capital gains because that results in savings on your total ordinary income tax rate. Do not try selling a stock right at the end of the year to get a tax deduction, and then buy it right back in the new year.

Read Also: Tsc-ind

Can You Claim A Capital Loss If You Havent Sold Your Crypto

Remember, you need to actually realize your loss for it to count as a capital loss that can be written off on your taxes. To realize a loss, you must incur a taxable eventâin other words, you need to actually dispose of your crypto to realize the loss.

Examples of disposals include the following:

- Trading or selling crypto for fiat currency

- Trading one crypto for another cryptocurrency

- Spending crypto to buy a good or serviceâ

That means that if youâre simply holding your cryptocurrency, you will not be able to deduct any losses. You will only be able to report your losses once a taxable event occurs.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Where Can I File An Amended Tax Return For Free

Issues To Consider Before Utilizing Tax

As with any tax-related topic, there are rules and limitations:

- Tax-loss harvesting isnt useful in retirement accounts, such as a 401 or an IRA, because you cant deduct the losses generated in a tax-deferred account.

- There are restrictions on using specific types of losses to offset certain gains. A long-term loss would first be applied to a long-term gain, and a short-term loss would be applied to a short-term gain. If there are excess losses in one category, these can then be applied to gains of either type.

- When conducting these types of transactions, you should also be aware of the wash-sale rule, which states that if you sell a security at a loss and buy the same or a substantially identical security within 30 days before or after the sale, the loss is typically disallowed for current income tax purposes.

All About The Capital Loss Tax Deduction

When it comes to investing, you can expect to experience both gains and losses. You might even incur a capital loss on purpose to get rid of an investment thats making your portfolio look bad. And while selling an asset at a loss may not seem ideal, it can benefit you at tax time. Besides lowering your taxable income, a capital loss may also help you snag a deduction.

Check out our capital gains tax calculator.

Also Check: Www..1040paytax.com

Get Ready For A Brighter Future

Tax loss harvesting works magic on your tax return, but it should never stand in the way of your investing goals. Don’t become overzealous and divorce great stocks just to take advantage of the tax perks this year it’s always best to invest for the long-term and give your portfolio a chance to keep growing.

Tax loss harvesting makes the most sense when you are in a higher tax bracket and have investments in your portfolio that have lost their sparkle. You can sell the investments at a loss, save money on taxes, and reallocate that money in places where your portfolio has a chance to grow even more. But fair warning — don’t attempt to buy the same or substantially identical stock within 30 days of taking the loss. That would be in violation of the IRS’ wash-sale rules, and it’s one of the exceptions that will disqualify you from taking advantage of the amazing tax benefits that a stock loss presents.

Tax loss harvesting is the mental breakthrough that you’ve been searching for this year — you can still hold your head up high knowing you will receive incredible tax savings and have additional funds available to sprinkle some more attractive stocks throughout your portfolio.

Are You A Trader In Stock Market Remember To Report Losses While Filing Tax Return

Most people know how sale of listed equity shares is taxed. Short-term gains are taxed at 15%, while long-term gains are exempt. But the tricky part is how to report intra-day stock trading? Some taxpayers do not report to these transactions in their tax return, especially when they have losses. What is the tax treatment, lets find out.

Your investments or activity in the stock market may involve various forms. As a first step, it is important to classify your activity in to various buckets. Consider these:

* Intra-day stock trading activity

* Investments in equity shares or mutual fund investments

* Futures and options transactions

All of these have different tax treatment. Investments held for the longer term are treated as capital assets and capital gains tax rules apply. But the Income-tax Act treats intra-day trades and F& O activity as a business. Even when you are a salaried employee, any gains from these must be reported as a business in your tax return. This puts off a lot of taxpayers.

Reporting intra-day trades as a business

Reporting your stock trading as a business lets you claim expenses from your receipts. Put together all the expenses that have been spent to earn this business income. It may include, brokers commission, a portion of your phone bills, internet cost, demat account charges. If you have employed a person to help you, you can deduct his/her salary. Or if you are using a consultant, or attending investor workshops those can be claimed too.

Don’t Miss: Www.1040paytax.com.

How To Report Losses On Tax Return

To deduct your stock market losses, you have to fill out Form 8949 and Schedule D for your tax return. If you own stock that has become worthless because the company went bankrupt and was liquidated, then you can take a total capital loss on the stock.

- Use IRS Form 461 to calculate limitations on business losses and report them on your personal tax return. This form gathers information on your total income or loss for the year from all sources. You subtract out the business loss and compare it to the excess loss limits to see if your losses will be limited.

How Can My Stock Losses Be Used To Lower Taxes

By Evelyn Jacks on September 17, 2017

And what tax forms should be used?

Q. I just received a report from my brokerage noting the value of one of my investments was cut in half. Can this loss report be used to lower taxes and how does that work? I understand there is also a specific form used for Canada Revenue, but Im not sure which ones I need. Thanks, Leslie

A. The loss on stocks is a capital loss. Capital losses may be used to reduce capital gains in the year of sale, any of the immediate three years, or any future year. Capital losses cannot decrease your income from any other source, except in the year that you die.

So, if you experience a capital loss in the current tax year, first you use the loss to reduce any capital gains reported in the year. The reporting is done on Schedule 3 of your tax return.

Then, you may carry unabsorbed losses back to any of the previous three years to reduce capital gains reported in those years. Use form T1A Loss Carry Back to do so.

If the prior year gains are not sufficient to absorb the loss, any left-over amount can be carried forward indefinitely and applied to any capital gain reported in those years.

But if you pass away before you use up all your capital losses, they may be applied against any type of income in the year of death. If that income is not sufficient to absorb all the losses, the leftover capital losses may be applied to the year immediately before death.

Read Also: Do You Have To Do Taxes For Doordash

Why Reporting Capital Losses Is Difficult

If you have been trading frequently, calculating your losses for each of your cryptocurrency trades and reporting them on your taxes can be quite tedious.

After all, crypto exchanges like Coinbase and Binance have trouble providing gains and losses reports to customers. This problem occurs due to the technical nature of cryptocurrencies and their interoperability. When a customer transfers crypto from one wallet to another, exchanges wonât necessarily know the customers original cost basis for the coin that was transferred in.

As a result, itâs very difficult for exchanges to accurately calculate capital gains and losses. Thatâs why investors are increasingly turning to crypto tax software to aggregate complete transaction history from all platforms.

Additional Rules And Changes

These gain and loss rules apply primarily to publicly traded investments, such as stocks, bonds, mutual funds, and, in some cases, real estate holdings.

There are additional rules that apply when you realize both short- and long-term gains, and to whether deductions can be used to offset state income, how real estate gains are treated when you must recapture depreciation, and how you account for passive losses and gains.

Don’t Miss: How Does Doordash Do Taxes

Dividend Income Taxed At A Special Rate

When you own stock, you own part of a company and are entitled to receive part of the profits. The corporation has already paid tax on the income, however. Thats why you, as a shareholder, get a reduced rate when the corporation passes on profits to you in the form of qualified dividends.

For most taxpayers, the tax rate on dividends is 15 percent. The maximum rates on dividends are the same as those for net capital gain.

Are You A Day Trader Or Investor

First, you need to determine if youre a day trader or investor. It all comes down to how often you trade, how long you hold the equities, and the amount of time you spend trading.

If you buy and sell equities as an investment, youre an investor and should report any profits or losses on a capital account.

If, on the other hand, you day trade like a securities dealer and buy and sell on a daily basis with the aim of making a short-term profit on small price fluctuations, any gains should be reported as business income.

Also Check: Is Past Year Tax Legit

Facing Hefty Capital Gains Here’s A Potential Solution

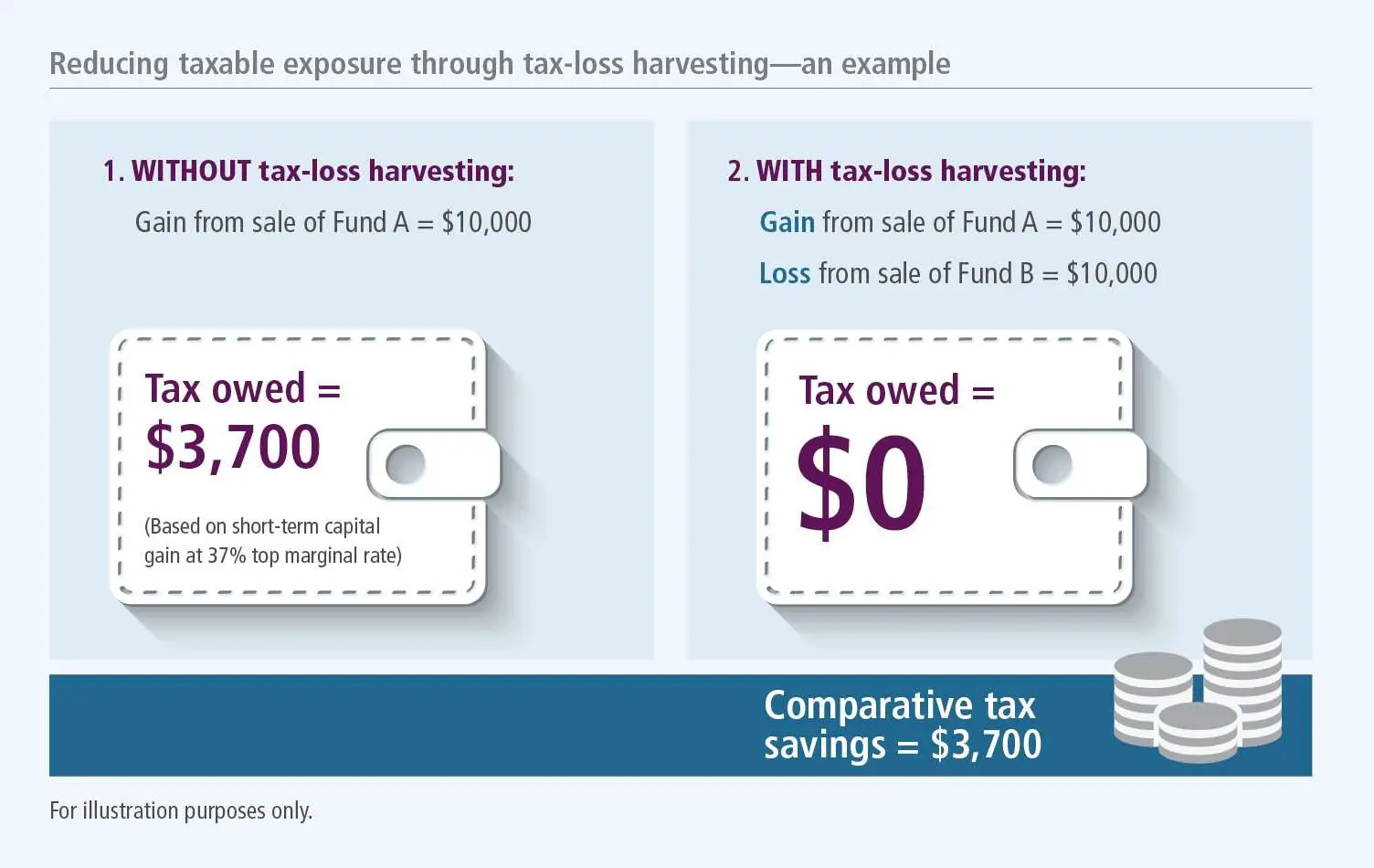

When you pay taxes on your realizedcapital gains for the year, you’ll only consider your netgainsthe amount you gained minus any investment losses you realized.

This means that if you know you’re going to have some realized gains, it’s a good idea to see whether you have any opportunities to realize losses to offset them.

For instance, if you need to rebalance your accounts, you could choose to sell of funds or stocks that have lost value since you purchased them.

This method of intentionally selling investments at a loss in order to lower taxes is known as “tax-loss harvesting.”*

If your losses are greater than your gains

A year when your realized losses outweigh your gains is never fun, but you’ll make up for a little of the pain at tax time. Up to $3,000 in net losses can be used to offset your ordinary income .

Note that you can also “carry forward” losses to future tax years.

Do Capital Losses Offset Short

In the United States, cryptocurrency is taxed at a lower rate when it is sold after a holding period of 12 months.

Itâs important to remember that short-term capital losses first offset short-term capital gains, and long-term capital losses first offset long-term capital gains. If you have any net capital losses remaining, it can then be used to offset capital gains of the other type.

You May Like: How Does Doordash Do Taxes

Harvest Losses To Maximize Your Tax Savings

When looking for tax-loss selling candidates, consider investments that no longer fit your strategy, have poor prospects for future growth, or can be easily replaced by other investments that fill a similar role in your portfolio.

When you’re looking for tax losses, focusing on short-term losses provides the greatest benefit because they are first used to offset short-term gainsand short-term gains are taxed at a higher marginal rate.

According to the tax code, short- and long-term losses must be used first to offset gains of the same type. But if your losses of one type exceed your gains of the same type, then you can apply the excess to the other type. For example, if you were to sell a long-term investment at a $15,000 loss but had only $5,000 in long-term gains for the year, you could apply the remaining $10,000 excess to any short-term gains.

If you have harvested short-term losses but have only unrealized long-term gains, you may want to consider realizing those gains in the future. The least effective use of harvested short-term losses would be to apply them to long-term capital gains. But, depending on the circumstances, that may still be preferable to paying the long-term capital gains tax.

If you still have capital losses after applying them first to capital gains and then to ordinary income, you can carry them forward for use in future years.