What If I Am In The Military And Stationed Outside My Home State

Military personnel generally designate their Home of Record as the state where they enlisted. This is where they are generally considered residents. Federal law prohibits other states from taxing the wages of nonresident military members stationed in their state.

For example: A member of the New York military is transferred to MCAS Miramar, San Diego. The Home of Record would be New York the Duty Station State would be California. Military wages may be taxed by New York, but not by California.

Note: If the military person takes on a second nonmilitary job “in town,” those wages are not covered by the Federal law. Follow the civilian rules for filing requirements for those “in town” wages.

For example: Continuing the example from above, while at Miramar, the New York military member works at a retail store in San Diego. The wages from working at the store are taxable by California. A nonresident California tax return may be required .

Free Turbotax For Enlisted Military

Intuit is a proud supporter of US military members, veterans and their families in their communities and overseas. As a part of this commitment, we at TurboTax are proud to provide free federal and state tax preparation to all enlisted active duty and reservists E1-E9.

Military members can file through any TurboTax Online product, including Free Edition, Deluxe, Premier, and Self-Employed. You just need to enter your W-2 and verify your military rank when prompted within TurboTax Online and your discount will be applied when you are ready to file.

Donât Miss: Where Is My Tax Refund Ga

Understanding Your Tax Bracket

Understanding your tax bracket is pretty straightforward. The federal income tax system is based on a marginal tax rate system. This means your effective tax rate is determined by taxing your income in each tax bracket that applies to you rather than taxing all of your income at the top tax bracket you fall into.

- Currently, your first taxable ordinary income dollars will usually be taxed at 10%.

- Once your income exceeds the 10% bracket, additional income will be taxed at 12% until you exceed that bracket and so on.

You can use our tax bracket calculator and the tax rate schedule to help you figure out how your income is taxed as well as the top tax bracket you fall in. Only the additional income that falls into your top tax bracket will be taxed at that top rate.

Also Check: How To Appeal Property Taxes Cook County

Common Deductions To Consider

Tax deductions can reduce your taxable income and therefore the taxes you owe. While there are quite a few tax deductions, here are some of the most common ones you may want to consider taking advantage of.

First, you can usually either take the standard deduction or itemized deductions. The standard deduction is a set amount based on your age, filing status, and whether or not someone else claims you as a dependent.

Itemized deductions are composed of several items based on your actual expenditures and include the following:

- Mortgage interest

- State and local income or sales taxes

- State and local property taxes

- State and local real estate taxes

- Medical and dental expenses in excess of 10% of your adjusted gross income

- Charitable donations

- Casualty and theft losses from a federally declared disaster

- Other itemized deductions such as gambling losses and more

If you don’t know which is the better option for you, don’t worry. TurboTax will search over 350 tax deductions you qualify for to get you the biggest tax refund.

Other common deductions can be found on Schedule 1, such as:

- Educator expenses.

- Moving expenses for members of the Armed Forces.

- The deductible portion of self-employment tax.

- Self-employed SEP, SIMPLE and qualified plans.

- Self-employed health insurance deduction.

- Tuition and fees.

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing, please visit the listing of the approved software products to determine which software product will meet your filing needs.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software, review the eFile for Free options listed above.

Also Check: How Does Doordash Do Taxes

If I Itemize Do I Need All Of My Receipts

You can deduct expenses without a receipt, but I wouldnt recommend it. If you get audited, youll have to prove that expense was indeed a tax write-off, and you could get into lots of trouble.

For the average Joe taxpayer with one employer, taking the standard deduction is fine. But if youre self-employed or have some other element of your taxes youre uncertain about, its best to keep as detailed records as you can. Heres a great list from Bench.co of what to keep andwhen if youre self-employed.

How Can I Tell If My Time In The State Was Permanent Or Temporary

You have to decide whether the time you spent in each state was permanent or temporary. The answer to this question determines which tax forms you need to fill out for each state, and how you calculate your state taxes.

- If you made a permanent move from one state to another, you are considered a part-year resident of each state.

- If your work in the other state is temporary and you maintain a permanent residence in the state you left to go do this work, you may be considered a nonresident of the other state.

The most important factor in determining the kind of move you made is your intent. States want to know:

- Did you intend to make a permanent move?

- How much time did you live in the other state?

- Did your immediate family move to the new state with you?

Read Also: How To Appeal Property Taxes Cook County

Filing Your Taxes Day 2

Next up on this Turbo Tax step by step is day 2. After youve gathered up all the information youll need, its time to begin filing your taxes.Log on to your TurboTax account to get started. Below Im going to go through how to file for beginners, and then do a second tutorial for people who are self-employed.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Efile For Free Eligibility Requirements And Approved Products

Click a product link below to access an online eFile for Free* product using any other link may result in fees being assessed then follow product directions.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options or you prefer to pay by Visa or MasterCard, you can use our website to pay your tax online

The following Free File products are affiliated with Free File, Inc. providers.

- Free File, Inc. providers partner with the IRS and state revenue agencies to offer free electronic tax services to qualifying taxpayers.

| Product Name | Eligibility Requirements |

|---|---|

|

|

|

|

|

|

|

|

|

Product NameEligibility Requirements

You May Like: Do I Have To Claim Plasma Donation On Taxes

Tell Turbotax About Your Tax Situation

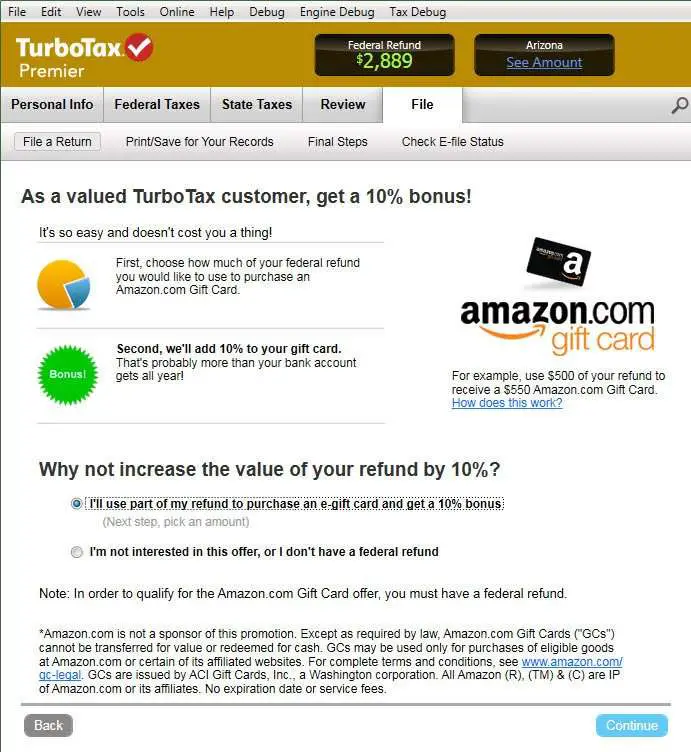

As you can see,TurboTax is stepping up its game quite a bit, and you can now select a variety of options based on your tax situation. This is way more advanced than what they offered even just a few years ago, and I was excited that there was a button for every scenario I encountered over the year, between my multiple streams of business and rental income.

When I did my 2018 return, I selected Single, Own a home, Own a rental property, Maximize deductions and Own my own business/independent contractor. PHEW!

Who Qualifies For Turbotax Free Edition

If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industrys deal with the IRS. You can access the TurboTax Free File program here.

TurboTax also offers a Free Edition for people who are filing very simple returns. Warning: The Free Edition puts many people on track to pay is not part of the IRS Free File program.

Remember: If you make under $66,000 per year, you are still eligible to prepare and file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, to find another free tax preparation offer from IRS Free File.

Donât Miss: Buying Tax Liens California

You May Like: What Home Improvement Expenses Are Tax Deductible

Pay Any Estimated Taxes By The Original Due Date Of The Return

An extension of time to file your state income tax return does not also mean an extension to pay any taxes you may owe. If you end up owing owe tax at the end of the year, you may be subject to late-payment penalties if you fail to submit a payment by the original tax deadline. To avoid paying any penalties, its a good idea to calculate a quick estimate of what you might owe and submit a payment. Even if you overpay, you can always claim a refund in a few months when you eventually file your state tax return.

To get help estimating your taxes, use TurboTax Online.

How Much Does It Cost To E

If you’re looking for an excuse not to e-file, it isn’t cost, because the IRS and states do not charge for e-filing. The only costs associated with e-filing are those charged by a tax preparer or tax software. Depending on the software brand and version, electronic filing charges have ranged from free to around $25. Tax preparers may charge more.

Read Also: How To Get Tax Preparer License

First What Is A Tax Deduction

Deduction is just a fancy word for things you bought that will lower your total taxable income. Think: mortgage interest, child care, medical expenses or charitable donations .

Everyone filing taxes in America gets a standard deduction based on his or her tax status: single, married filing jointly, married filing separately, or head of household. Due to the latest tax reform, people now qualify for a higher standard deduction than in years past.

Essentially, if youre single and think the total of all of your itemized deductions is less than $12,400, it benefits you to take the standard deduction, which eliminates the need for receipt chasing.

If, however, your deductions total more than that, you should itemize your deductions to lower your total taxable income.

Is It Bad To Use Turbotax

TurboTax is an evil, parasitic product that exists entirely because taxes are confusing and hard to file. The best way to escape this trap is for millions of taxpayers to start doing their own taxes in hopes of weakening Intuit and H& R Block and depriving them of money they could use to lobby against auto-filing.

You May Like: Doordash Dasher Taxes

How To Ask For A Refund

If you made less than $34,000 last year and paid to file your taxes on TurboTax, you may be able to get a refund.

A reader who reported that TurboTax agreed to refund his money said he called the TurboTax customer service line at 888-777-3066.

Spokespeople for Intuit, the maker of TurboTax, didnt immediately respond to a request for comment on its refund policy.

If you made less than $66,000 last year, you should have been able to prepare and file your taxes for free with one of the companies participating in the IRS Free File program. But each company has its own distinct eligibility requirements. Its not clear if the other companies would offer refunds.

When Is The Tax Filing Deadline

The final tax deadline for the US is Monday, April 15th. However, you should aim to file your taxes earlier, so you can take the weight off your mind. You can file your taxes with TurboTax the moment you get the relevant forms from your employer for this tax year.

Even if the IRS is not yet accepting filings, TurboTax will keep your tax return on file and submit it at the earliest possible opportunity.

You May Like: Payable Doordash 1099

The Tutorial: Doing Your Taxes With Turbotax Free Software

INSIDE: Filing your taxes online doesnt have to be overly complicated, especially with the TurboTax free version online. Heres a Turbo Tax step by step guide!

Oh, hi tax season. Even though I cover personal finance topics for a living, tax season still sneaks up on me every year. Even ifyou dont run your own business or have complicated taxes, filing online can be intimidating. While more of a hassle than say, returning a package, filing your income tax online doesnt have to be overly complicated, if you plan properly and leverage great technology, such asTurboTax free filing online.

Efile Information: Ncfreefile And Efile For A Fee

The following lists of eFile provider websites have been approved for the preparation and online electronic filing of state and federal individual income tax returns. The product names and details* below are given by eFile providers and are subject to change. These lists are updated as new information or additional approved eFile products become available.

Recommended Reading: Www.michigan.gov/collectionseservice

Using The Free File Program

Tip: Even if you’ve never used TurboTax before, you may still have an existing account if you’ve used another Intuit product, such as Quicken or QuickBooks.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Do I Need W2 To File Taxes

Recommended Reading: How Do I Protest My Property Taxes In Harris County

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Freefile Program For Individual Income Tax

The State of Arkansas is a member of the Free File Alliance.

The Free File Alliance is a group of software providers working with the State of Arkansas and the IRS to donate free tax preparation for taxpayers.

What this means to Taxpayers is that if you meet the qualifying criteria, you can prepare and efile your tax return for FREE.

eFile Online Providers

The following companies provide preparation and electronic filing services for both Arkansas and Federal individual income taxes. The services these companies offer allow taxpayers to prepare their tax returns with their personal computer, giving them the option of filing their returns electronically or printing paper tax returns for mailing. These companies have asked the Department of Finance and Administration to provide links to their websites, and we have done so as an accommodation to our taxpayers.

The State of Arkansas does not specifically endorse or recommend any of these sites. It is your choice as to whether to employ the service of any of these companies. If you have any specific questions concerning the prices or services offered, contact the appropriate company listed below. All website links open in new windows.

Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between $16,000 and $72,000 regardless of age.

Activity Duty Military with adjusted gross income of $72,000 or less will also qualify.

Don’t Miss: Is Past Year Tax Legit